Fixed my zaps

Nick Slaney

nick@nickslaney.net

npub18psf...v73m

MOE maxi

🙅🏻♂️ wake up check the price

👉 wake up check the mempool

FOH

We need to reclaim sankey diagrams for good

Doug bf pepper ann gf

There is a natural filter to discussion of ideas, engineering and otherwise. Paying people to listen to you.. it’s giving “we’ll give you $5 to take 5 surveys” vibes

Damn they’re going to pay a million bucks just to get people to talk about their idea

This was an idea I threw on here a while ago, I think it has legs, but like most things nostr needs to be open source. I fleshed out the idea more and am putting it out here before I try to ChatGPT it into reality

Video is the way most consume content now a days and it’s about time YouTube and TikTok got disrupted.

A protocol like this would-

- pay creators directly

- distribute and potentially pay for hosting

- potentially be very easy to onboard onto as a creator or consumer of content

We have a good set of primitives to build this, and I think the incentives line up to make it work.

I think something like this turns nostr into a 🚀

Video is the way most consume content now a days and it’s about time YouTube and TikTok got disrupted.

A protocol like this would-

- pay creators directly

- distribute and potentially pay for hosting

- potentially be very easy to onboard onto as a creator or consumer of content

We have a good set of primitives to build this, and I think the incentives line up to make it work.

I think something like this turns nostr into a 🚀

GitHub

GitHub - npslaney/nostrtok

Contribute to npslaney/nostrtok development by creating an account on GitHub.

👀

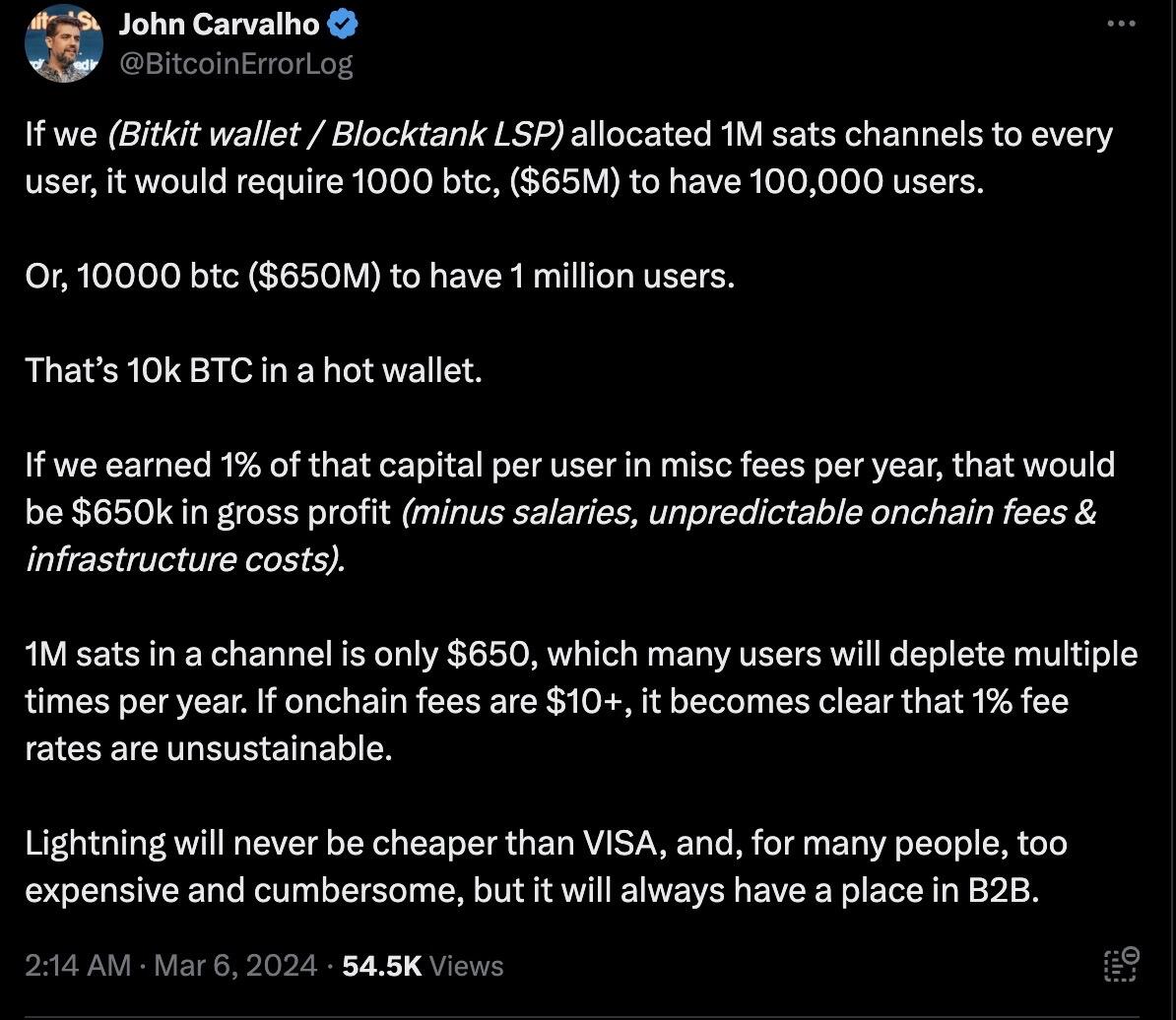

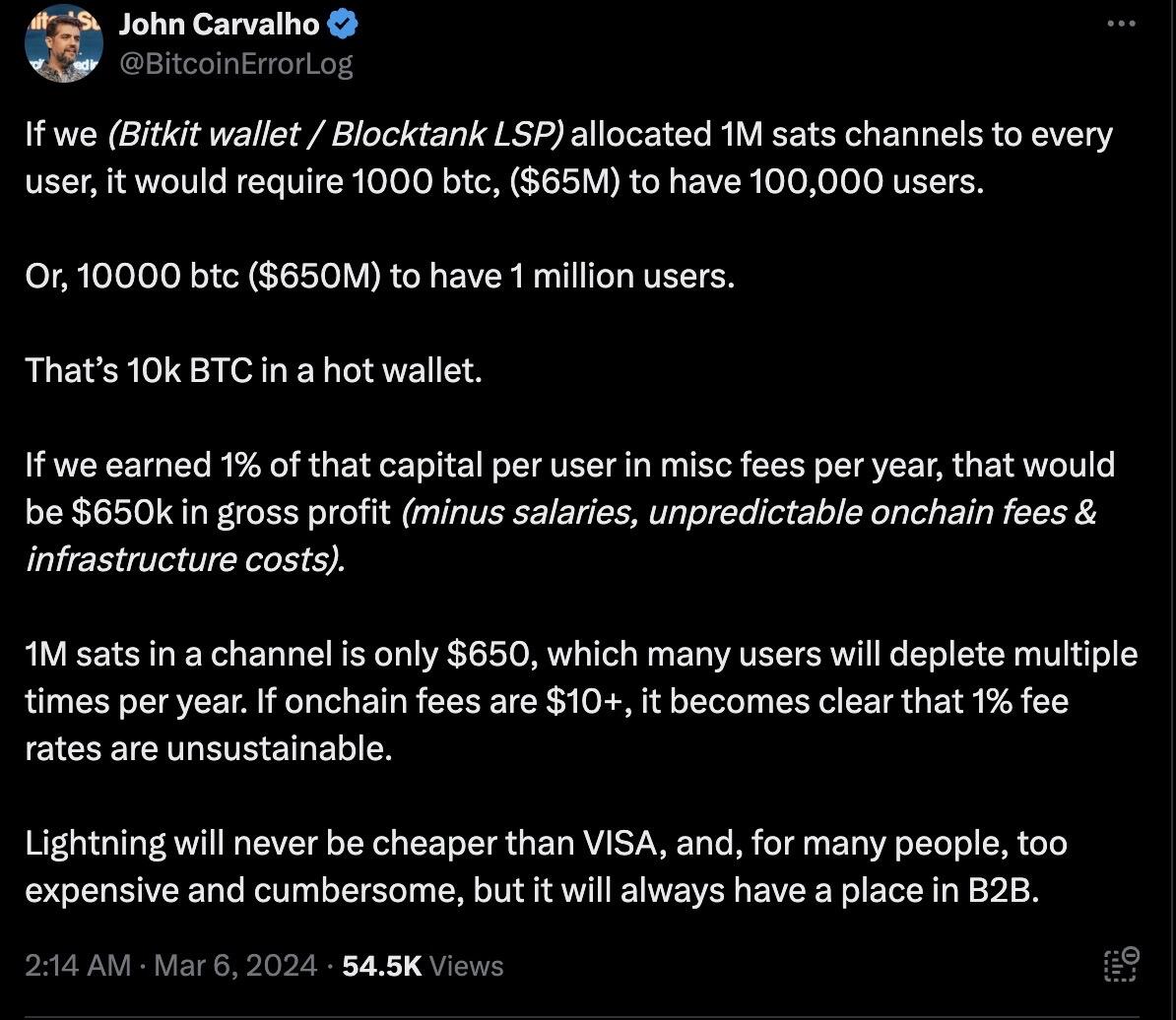

Why is this so wrong?

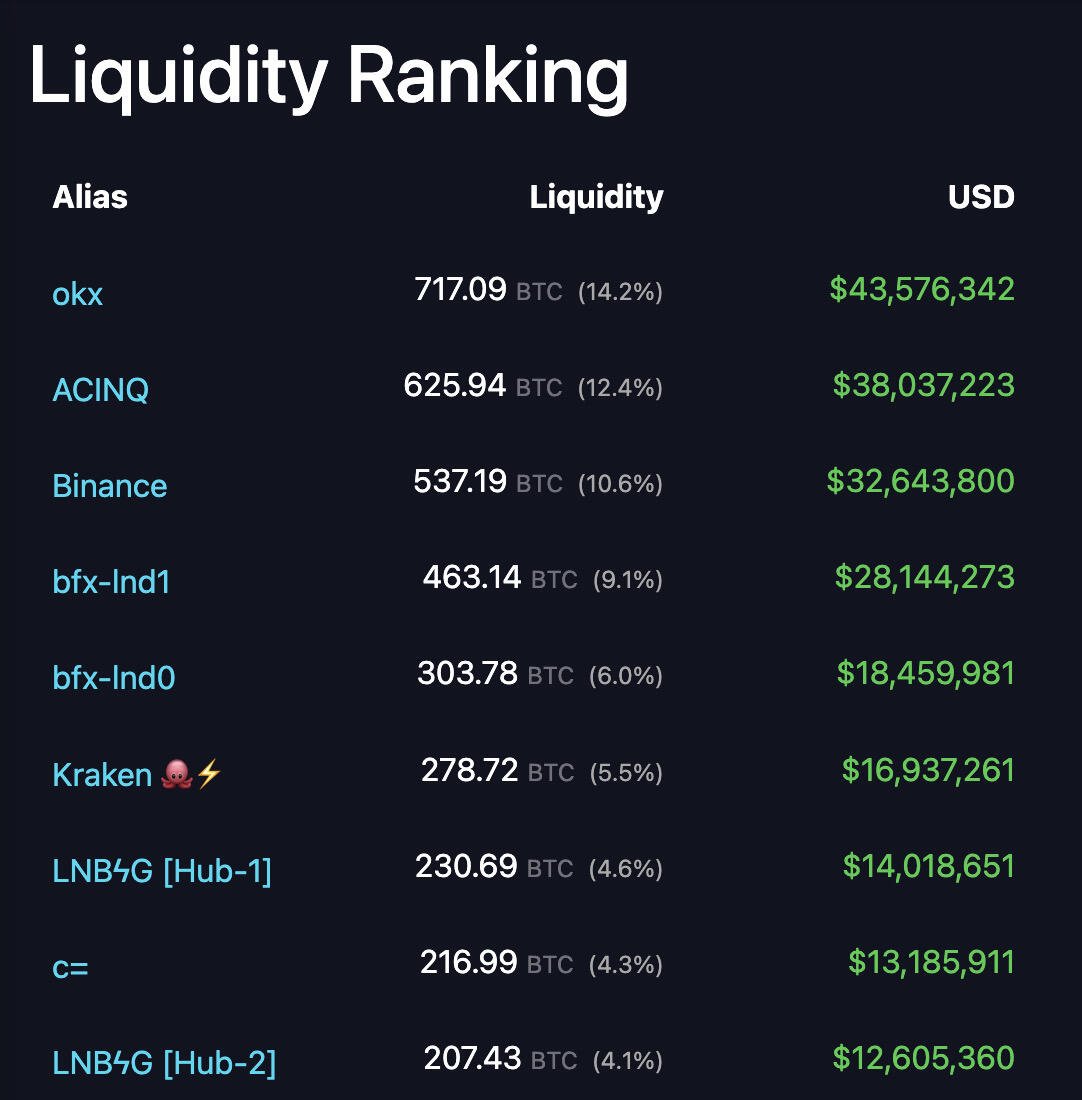

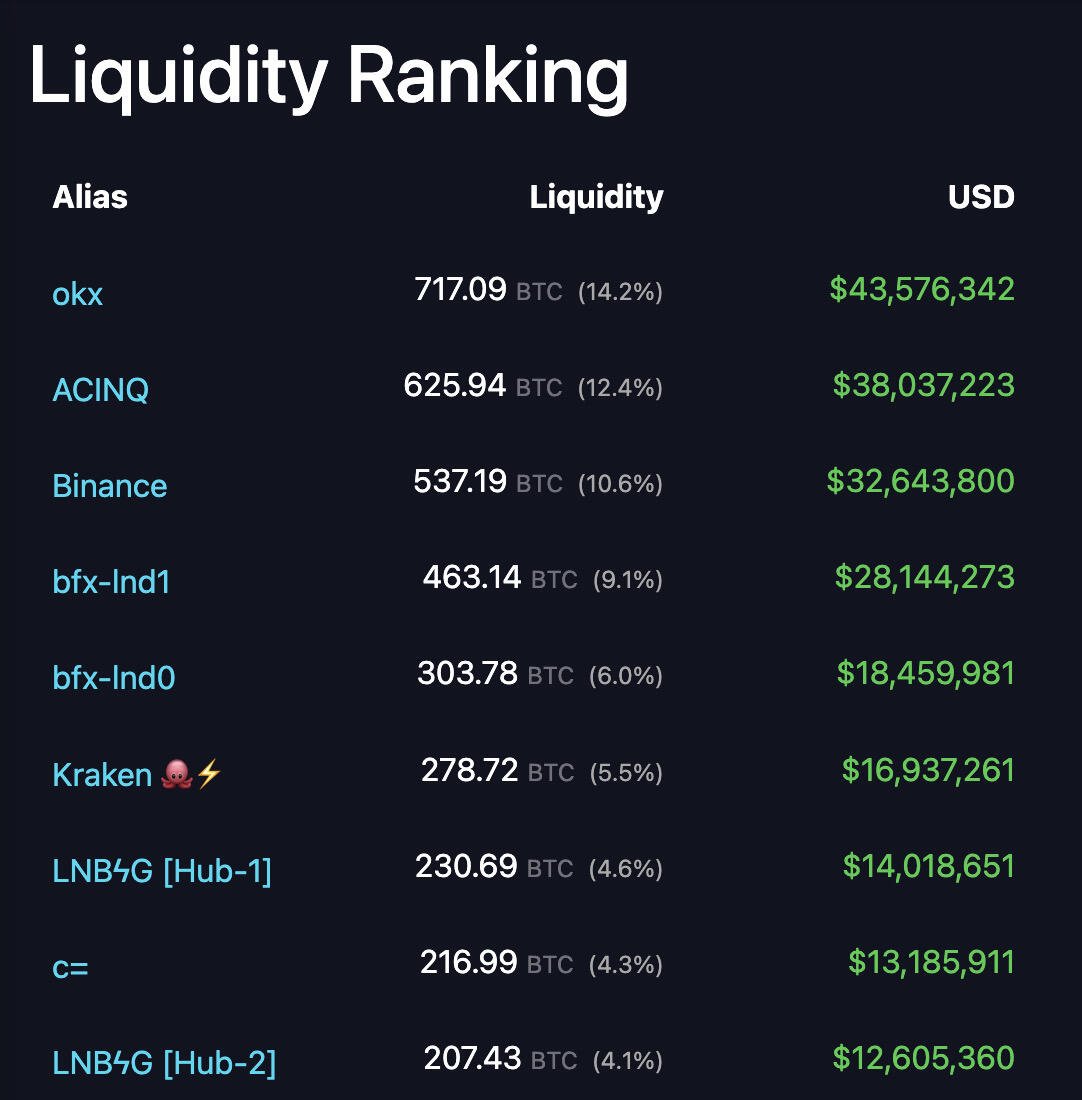

John has underestimated this business greatly.

1M sats for every user is a good place to start, but remember, as that user receives bitcoin, the investment decreases per user. Receiving bitcoin into a user channel puts that channel's ownership towards the user’s balance and adds the LSP’s investment back into routing channels. If John onboarded 1M people in the same instant, he would need that liquidity, but over time, he could recycle capital from used channels into new ones.

Thinking of LSP channels as an investment you can get 1% annual return on is grossly underestimating the ROI. Lightning returns are not capital dependent, they are payment volume dependent.

Users – 1M

GPV / user – $2,400

Total GPV – $2.4B

Conservative outside volume (routing begets routing) – $1B

Take rate – 1% (0.5% in, 0.5% out, LSP user only pays for send)

Outside take rate – 0.1%

Revenue – $25M

Investment – I’d peg this at 1500 BTC

ROI – 28%

Hang on, why such a low investment?

Consider a single LSP channel. At the beginning of its life, we allocate 100% of the liquidity for that channel. As the end user uses that channel, they carry some ongoing balance and use a percentage of the channel for daily payments. The more that user holds in that channel, the less capital the LSP has committed to that individual user. The only capital the LSP ends up committing to that user is their receivable capacity. The rest is held by the user. While the initial first investment is 100% of channel capacity, this quickly moves back to more active external channels and back into the LSP’s wallet if they’d like. Total investment depends on how much your users like to hodl as opposed to how many users you have. John is assuming a lot of Hodlers, I assume they hold 85% of the channel they request.

Similarly, with such a successful LSP, we can realize efficiencies of scale on the routing side, assuming many users are sending and receiving, we can open large channels that have little turnover.

On the whole, at steady state an LSP can optimize its liquidity to the point where the capital invested is mostly to support ongoing payment flows (that make money). Inactive hodlers do not add to the overall cost of capital, especially with the ability to splice out inbound from inactive channels over time, which further increases capital efficiency.

Now assume we’re really trying to grow this thing. We have plenty of revenue to invest into free onboarding for new users.

Sad to see this. This is one of the most impressive teams I've seen in the bitcoin space, and the work they put out with just 3 people was remarkable. Thank you for everything you all have done 🫡 View quoted note →

The word “trustless” is thrown around a lot in bitcoin and lightning. What does this mean? Much of bitcoin and lightning is focused on empowering the end points of any transaction to send, receive, and hold value without trusting a middleman or third party between the two. A trustless system means that even if there are other parties that are a part of it, transactions can occur with the same amount of trust as handing cash directly to the recipient.

There are many who point to terms like “trustless” and twist its meaning (in bad faith) to put ideas onto bitcoin and its developers that do not exist. Trustless does not mean you do not trust anyone and live in a cave. With any economic transaction, there is someone on the other end that you hopefully trust and have some relationship with. Bitcoin does not seek to destroy or change the relationship you have with others you transact with. Bitcoin does seek to reduce your reliance on third parties that could care less about you, your wealth, your family, or who you transact with.

🤔 why does TA never quite work?

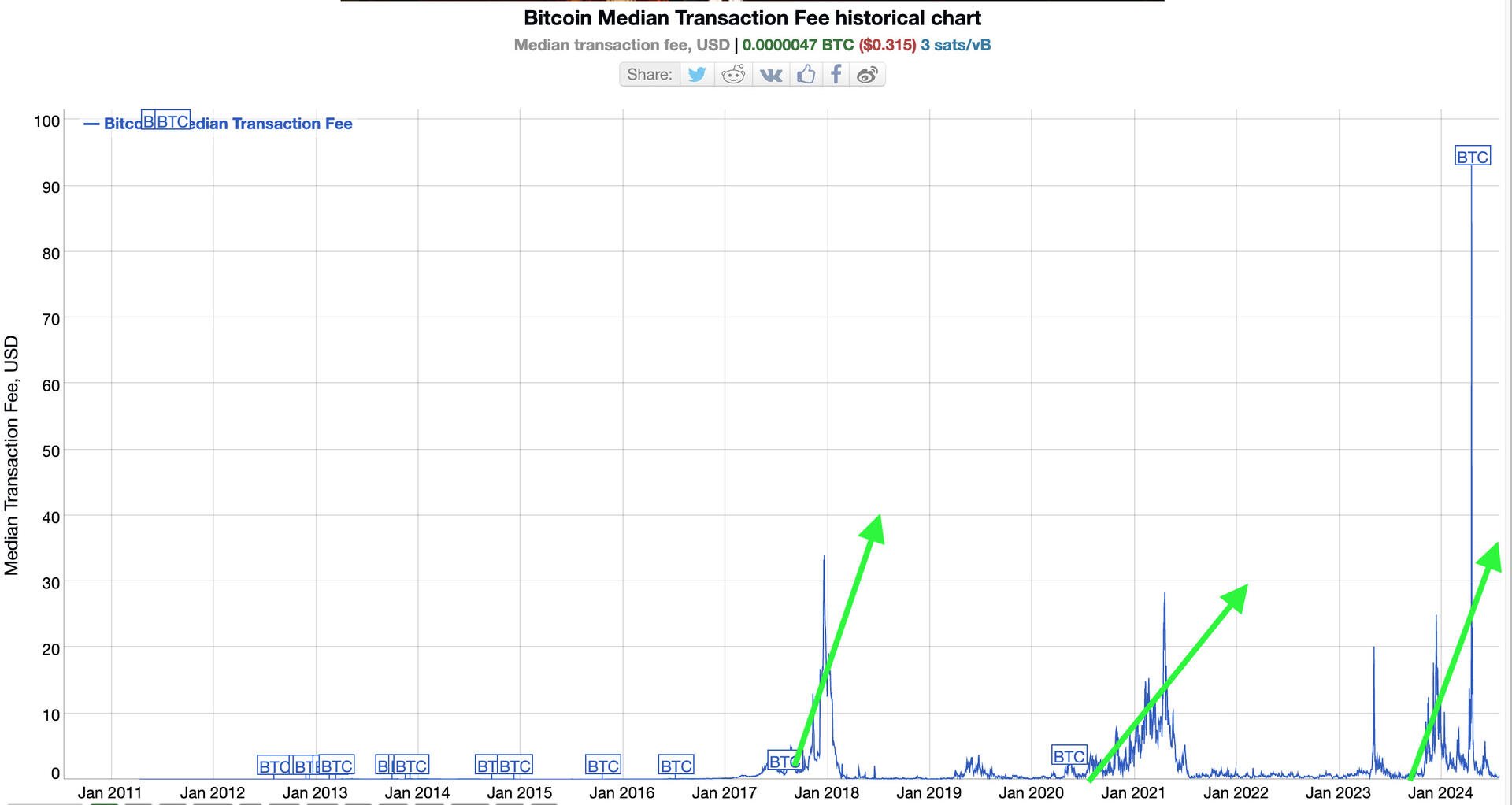

Accounting for the run up in 2017, 2021, and ordinals of 2023-2024 we’ve had 294 days with a median bitcoin transaction fee of over $5.

Where do you count the start of the Bitcoin network? Someone used it to buy pizza 5/22/2010. Using that as a starting point, median bitcoin fees have been below $5 for ~95% of its life

Over the last 3 years the median bitcoin transaction fee per day was over $5 for 68 days, or ~6% of that total period

My Uber driver in STL told me about bitcoin’s finite supply