USE #nostr. Study #bitcoin. 🧡

“Whoever loses their account forfeits their economic freedom. And their voice. Without procedure, without the possibility of objection, without transparency.

This thought may seem exaggerated, but it describes a reality in which financial institutions are increasingly becoming bearers of political power.

Censorship has expanded from the digital realm into the economic sphere—and now affects the foundation of individual freedom.

YouTube, Twitter, or others can block content, demonetize, or restrict accounts, often without clear justification.

I myself have experienced as a YouTuber that free speech has its price.

A historical black-and-white photo of Josephine Baker, who danced topless in Berlin 100 years ago, or a critical analysis of geopolitical topics can result in a loss of reach, visibility, or monetization.

Platforms act according to their own rules, while users have few options to defend themselves.

While social media visibly censor, the same thing happens quietly and unobtrusively in the financial sector. Banks can close your account, block your payments, or exclude platforms from payment systems.

Based solely on political beliefs. Access to money thus becomes a tool of control, and financial power a means of censorship.

John Kiriakou, former CIA whistleblower and co-founder of Panquake, sums it up succinctly: “Financial institutions are increasingly deciding who can speak—and who can survive economically.”

Panquake, an Icelandic tech startup specializing in data privacy and powered by geothermal energy, became the victim of a controversial bank access. The company's accounts were frozen without warning or legal procedure.

The suspicion: politically motivated debanking, as Panquake supports whistleblowers like Julian Assange and Edward Snowden. The goal seemed clear: to threaten the company's existence.

The company fought together with lawyers from WikiLeaks, but Iceland does not have a discovery process like the USA, making internal bank communication difficult to access.

Eventually, the funds were released, but the conflict concerns the principle: banks should not engage in political discrimination.

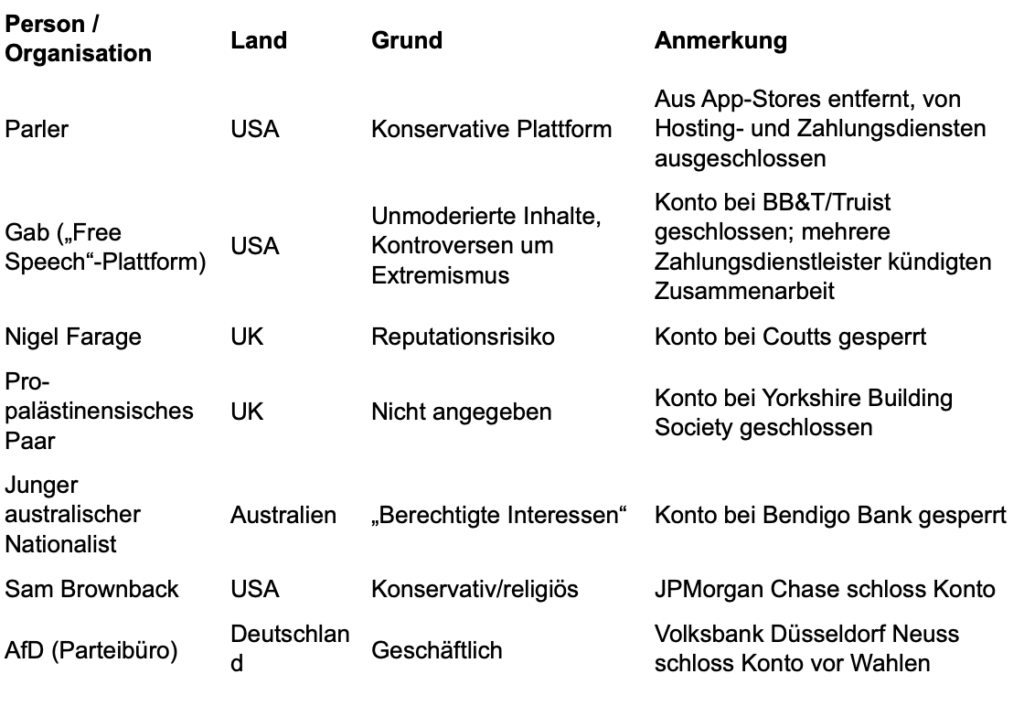

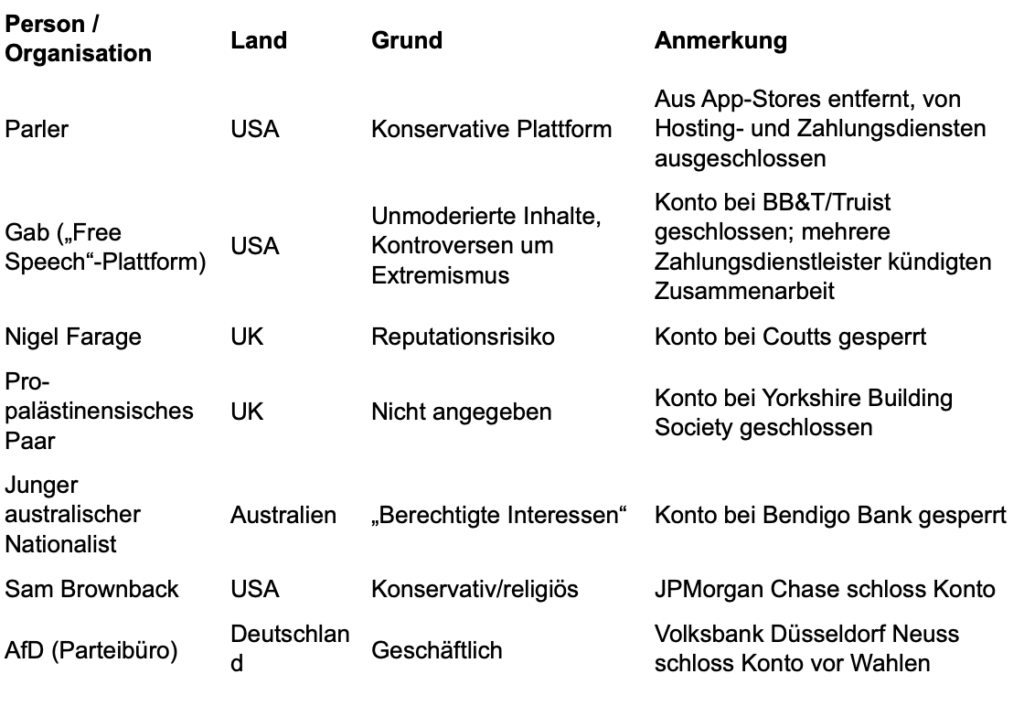

Further examples illustrate the extent:

Switzerland also provides an alarming example. Decades of trust in its banks were destroyed overnight with a stroke of a pen.

Numerous Swiss citizens abroad—including myself—watched as long-standing accounts were closed without warning. Not due to fraud, not due to misconduct, but due to US tax regulations like FATCA.

These force banks to denounce customers. Out of fear of sanctions, essential banking services were simply cut, and expats had to desperately fight for access to their own money.

On February 18, 2019, the Tages-Anzeiger headline read: “As an emigrant suddenly without an account.” A spotlight on the fragile foundations of trust and security—even in one of the supposedly most stable financial systems in the world.

A particularly stark case illustrates the interplay of political pressure, censorship, and banks.

The former EU lobbyist Frédéric Baldan exercised his legal right to challenge the possible corruption of EU Commission President Ursula von der Leyen.

And was shortly thereafter confronted with blocked accounts. This incident is an indication that banks are no longer just financial service providers.

But that they can act as tools of political power when they restrict economic freedom of action and suppress critical voices.

That the Berliner Zeitung was the only medium in Germany to report on this shows how quietly and effectively this form of censorship works today.

A citizen who exercised his right to take action against the possibly corrupt commission president was suddenly economically blocked—above screenshot of the Berliner Zeitung illustrates this process.

Debanking is not a coincidence, but a structural problem.

Account closures often occur under neutrally sounding pretexts such as “compliance risk,” “reputation protection,” or “business decision”—with clear effect:

Voices are economically excluded, freedom is restricted.

Payment service providers like Stripe, PayPal, or Amazon Web Services can financially paralyze platforms, as the cases of Gab or Parler show.

Whoever loses the economic infrastructure quickly loses the ability to act independently or to publicly express their opinion.

Debanking is thus a quiet but powerful front in the struggle for free speech and economic self-determination.

Financial power is increasingly being used as a weapon to suppress dissent.

The protection of financial inclusion—regardless of political beliefs—is crucial, because if access to money is denied, freedom itself becomes a privilege, not a right.

Euphemisms like “compliance risk,” “reputation risk,” or “commercial decision” obscure political motives.

KYC requirements (“Know Your Customer”) are increasingly being used as political instruments, although they were originally intended to prevent money laundering and human trafficking.

John Kiriakou puts it succinctly: “Apple refused to unlock the phone of a terrorist. Principles must also apply in extreme cases.”

If these principles are abandoned, the door is open for questionable surveillance and abuse.

Financial inclusion must be guaranteed regardless of political or moral beliefs, so that freedom is no longer a privilege but an inalienable right”

Debanking, die neue Zensur

Immer häufiger entscheiden nicht Betrug oder Gesetzesverstösse über den Zugang zu Geld, sondern die eigenen Überzeugungen.