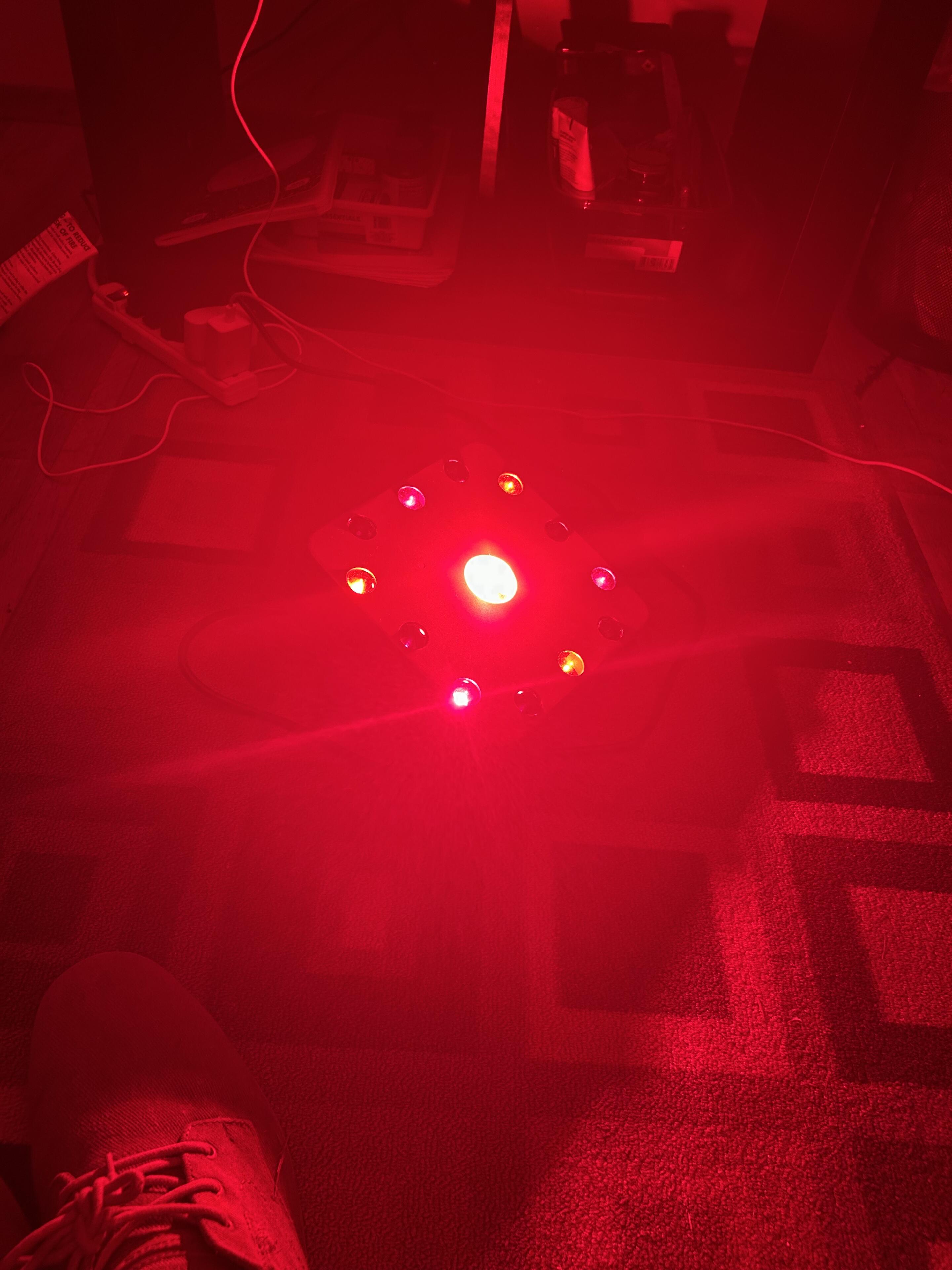

In the last few months or so I’ve started researching Biohacking and alternative health practices, mainly to heal some health issues I’ve had for a while. One of these is a stomach issue and the other is a mild stigmatism in my right eye that makes reading a little blurry.

Red light therapy , specifically at 660 nm and 850 nm has been shown to have many beneficial properties, specifically:

660nm: This wavelength is known to stimulate cell repair and collagen production, contributing to skin health and wound healing.

850nm Near-Infrared: It penetrates deeper into the tissues, promoting blood flow and potentially aiding in muscle recovery and deep tissue repair.

Both of these wavelengths are present in the device I bought.

There’s a great podcast with @thegarybrecka on @joerogan where he dives deep into the bio physics of the human body and the benefits of practices like red light therapy:

open.spotify.com/episode/3IPGys…

Red light therapy basically boosts mitochondria by directly hitting a key enzyme inside your cells called cytochrome c oxidase.

When red or near-infrared light penetrates your tissue, it gets absorbed by this enzyme, which frees up electron flow inside the mitochondria.

Normally, under stress, nitric oxide clogs up the enzyme and slows down your cell’s energy production.

Red light kicks the nitric oxide off, allowing your mitochondria to breathe and make ATP again — basically recharging your cells from the inside out.

Anecdotally I have seen a massive improvement in my vision after just two or three weeks of usage of the red light device and I have felt significantly more energy during the day when I use the device in the morning..

the one downside is that the slightly sped up metabolism makes me hungrier and burns a few more calories passively since my energy is higher.

My bathroom at night now has a red light and I also have the aforementioned device in my bedroom which I shine on my torso with my shirt off before bed.

Our modern hyper digitized world is awash in exclusively blue light, which is completely unnatural (and unhealthy) for both the human body and the human eyes. The red light simply brings you back into balance.