#amen

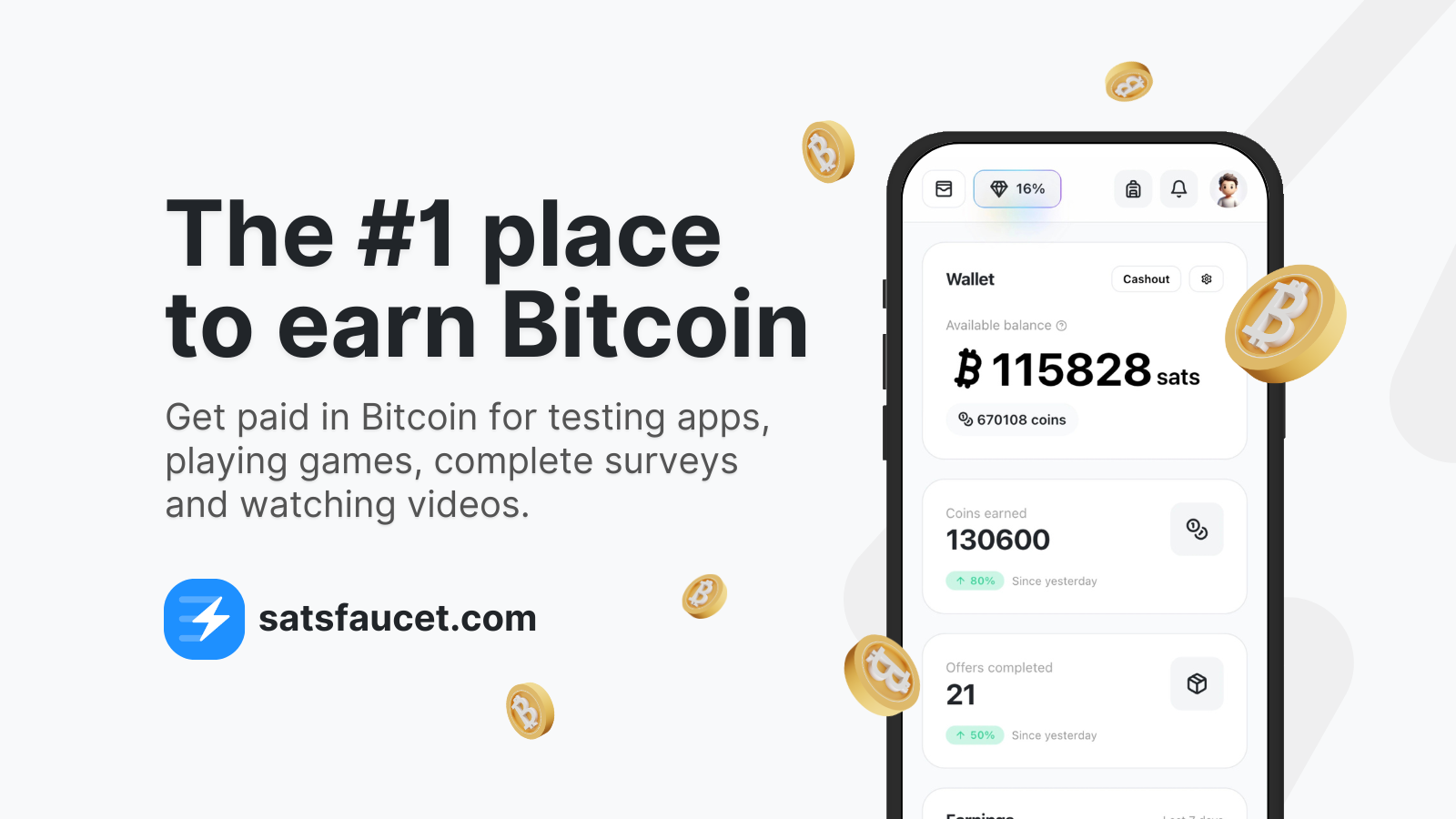

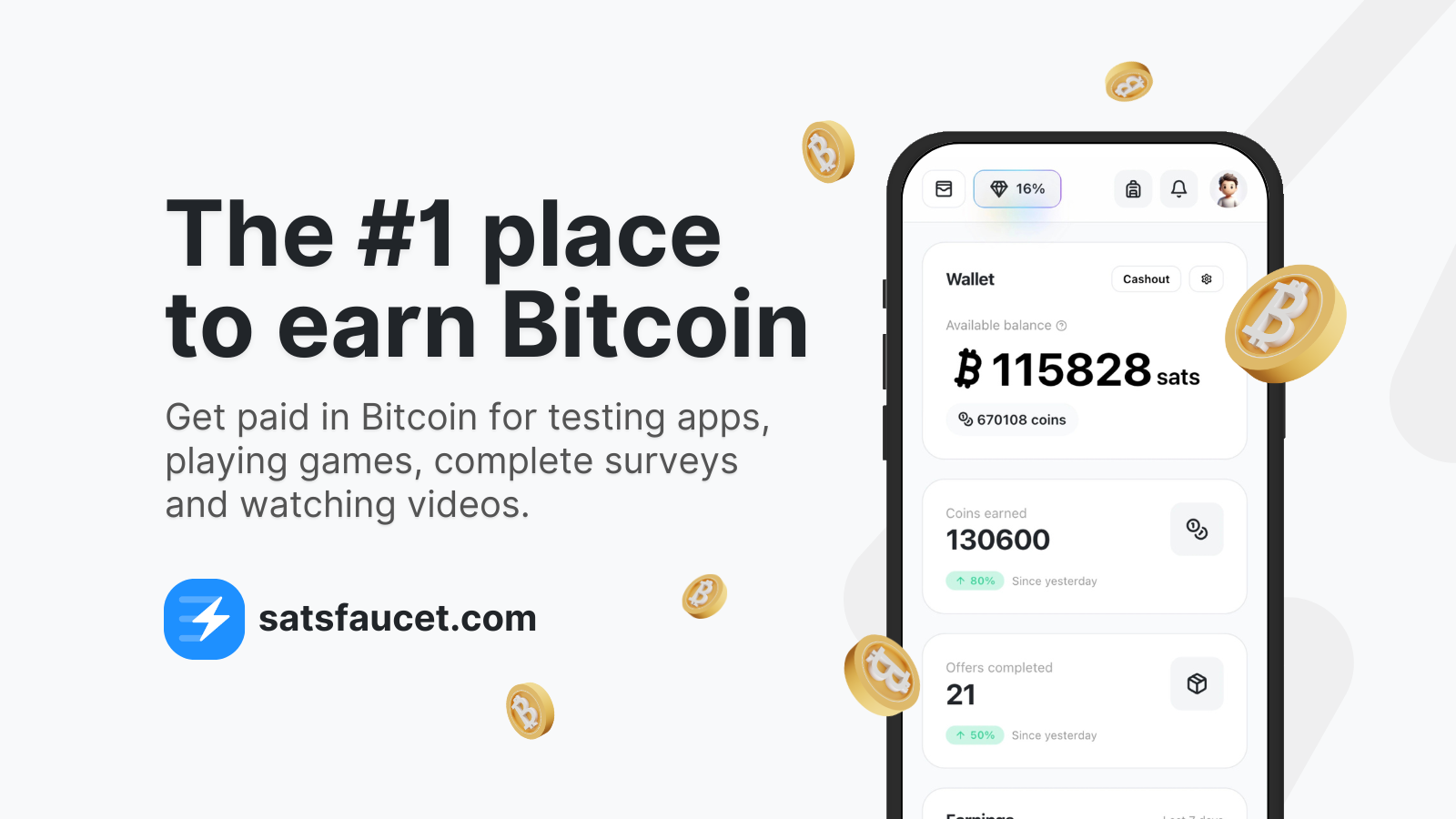

#stacksats #plebchain

I seriously did not think I would see this ever again #plebchain

Wall Street: “Markets are too volatile… halt trading!”

Bitcoin: “lol, cope.”

🚫 No circuit breakers

🚫 No bailouts

🚫 No counterparty risk

Just 24/7 open-source monetary policy and relentless price discovery.

Stay fiat if you like permissions.

Stay Bitcoin if you like freedom.

#plebchain

Female bots love me on the x bird 🤣

hey normies

#Bitcoin sits on throne,

#tariffs scramble global trade—

old guards just scoff, snide.

#plebchain #gm #nostr

Sorry guys, I’m out too #cumberland #otc#gm #nostr #plebchain

A Counter-Case: Reframing the Debate on Rule of Law and Legal Activism

1. The Rule of Law Is Not Above Accountability

While the letter defends legal professionals against government criticism, it omits the possibility that lawyers and firms, like all actors in a democracy, are subject to scrutiny and public accountability. The notion that criticism constitutes retribution assumes a chilling effect that may not be universally valid. If law firms engage in advocacy—especially politically charged or high-profile cases—they inevitably enter the public arena and must accept a level of transparency and consequence.

2. Public Confidence in Legal Neutrality Matters

The legal profession enjoys broad autonomy, but when law schools or firms appear to align with specific political or ideological movements, they risk eroding public trust in legal impartiality. Government leaders—and citizens—may reasonably question whether such institutions are truly upholding the law, or selectively interpreting it to advance an agenda. This is not an attack on the rule of law, but a demand for its consistent application.

3. Free Speech Is Not Freedom from Consequences

The letter criticizes the punishment of individuals for speaking out on matters of public concern. Yet it conflates lawful expression with immunity from consequences—social, professional, or even legal. Speech that incites, misinforms, or undermines democratic institutions may cross into harmful territory. Dissent should be protected, but not all speech is equally constructive or protected, especially in a professional or legal setting where trust, decorum, and ethics matter.

4. International Students and Activism: A Complex Legal Landscape

The letter expresses concern over international students fearing deportation for political activism. But non-citizens, by legal definition, have limited residency rights and are subject to immigration law, which may restrict certain forms of political engagement. This isn’t necessarily a violation of constitutional rights but a reflection of the legal distinction between citizens and non-citizens, which is standard in most nations.

5. Rule of Law Also Requires Institutional Restraint

Ironically, by taking a broad ideological stance, the law school risks weakening the very impartiality it seeks to defend. If legal institutions openly align with a specific narrative, it may invite political counter-pressure. The long-term survival of the rule of law depends not just on defending free speech, but on the restraint and neutrality of those who interpret and enforce the law.

⸻

Conclusion

The Harvard Law letter raises valid concerns—but it does so from a position that may blur the line between legal advocacy and political activism. The counter-case asserts that accountability, balance, and humility are just as essential to the rule of law as defending it from external threats.

Would you like this adapted into a debate format, op-ed, or point-by-point rebuttal for presentation?

Assuming the current downward trend continues, Bitcoin's 50-day moving average would cross below the 200-day moving average (forming a "death cross") around May 9, 2025, approximately 42 days from today.

This estimation is based on simplified linear trends, and actual market behavior may vary significantly. #llm #timedelta

My #nerdminer predicts price 🤣

The bullish case for Bitcoin ETF options is based on several factors that could drive significant growth and further adoption:

Institutional Adoption and Liquidity: The approval of Bitcoin ETF options could greatly increase institutional participation. Institutional investors, who were previously hesitant due to lack of regulation or custody concerns, will now have a more accessible, regulated vehicle to gain exposure to Bitcoin. This could lead to a massive inflow of capital into the Bitcoin market, increasing its liquidity and stabilizing its price over the long term.

Leverage Increases Returns: The introduction of leverage through ETFs allows traders and investors to amplify their potential returns on Bitcoin. While this can increase risk, it also opens the door for investors to capture greater upside without the need for constantly rolling over options or using complex trading strategies. Over time, this could drive more sustained demand for Bitcoin, especially during bullish market conditions.

Unlocking Synthetic Exposure: Fractionalized banking with ETF options allows for greater financial innovation. Investors can now gain exposure to Bitcoin’s price movements without directly holding the asset, reducing friction for participation. This makes Bitcoin more accessible to a broader audience, from retail to large-scale funds, and enhances its integration into traditional financial systems. This synthetic exposure could lead to exponential growth in trading volume and demand for Bitcoin.

Volatility Can Fuel Demand: Bitcoin's inherent volatility, combined with leveraged ETFs, could actually drive more speculative interest. Traders love volatility because it provides opportunities to profit from both upward and downward price movements. With Bitcoin's known upside potential, leveraged ETFs offer high-reward opportunities, which will likely attract more capital to the market, leading to even larger price moves on the upside.

Scarcity and Inability to Dilute: Unlike stocks or other commodities, Bitcoin has a fixed supply, which cannot be diluted or increased by any central authority. As demand grows due to ETF adoption, the capped supply of Bitcoin could result in price surges. The scarcity dynamic will likely continue to drive Bitcoin’s value, especially in a world where fiat currency is often subject to inflation and money printing.

Institutional Maturity and Risk Management: With the involvement of regulated entities and financial products like ETFs, the market will likely mature, attracting higher-quality participants. This could reduce some of the wild price swings seen in the unregulated crypto market while allowing for greater market efficiency. Institutional hedging tools will allow investors to manage risk better, making Bitcoin a more attractive asset for large portfolios.

Mainstream Legitimacy: The approval of Bitcoin ETFs by regulatory bodies like the SEC is a huge step in legitimizing Bitcoin as a mainstream asset. This move could pave the way for further financial products, like Bitcoin pension funds or more advanced derivatives, further embedding Bitcoin in the global financial system and expanding its user base. As Bitcoin becomes more recognized, its value as a store of wealth could increase, similar to gold.

Gateway to Broader Crypto Adoption: Bitcoin’s entrance into the regulated financial system through ETFs could serve as a gateway for the broader cryptocurrency market. As Bitcoin ETFs gain acceptance and perform well, other cryptocurrencies could follow a similar path, leading to increased interest and investment in the overall digital asset space.

In conclusion, the bullish case for Bitcoin ETF options lies in increased institutional adoption, accessibility for retail investors, leveraged growth potential, and Bitcoin’s scarcity. The approval of these ETFs represents a significant leap toward Bitcoin’s integration into traditional financial systems, potentially driving its price higher and solidifying its role as a major financial asset.

#plebchain #nostr

Satoshi vs. MilliSatoshi (mSats)

Satoshi and milliSatoshi (mSats) are both units of measurement used in the Bitcoin network. They represent smaller divisions of a Bitcoin, which is the primary unit of currency.

Satoshi: This is the smallest unit of Bitcoin. There are 100 million satoshis in one Bitcoin. Think of it like a penny to a dollar.

MilliSatoshi (mSats): As the name suggests, a milliSatoshi is one-thousandth of a Satoshi. It's a much smaller unit, often used in microtransactions or when dealing with very small amounts of Bitcoin.

To summarize:

* 1 Bitcoin = 100 million satoshis

* 1 Satoshi = 1,000 milliSatoshis

Why use mSats?

Micro-transactions: mSats allow for very small transactions, which are essential for certain use cases like paying for small items or services.

Lightning Network: The Lightning Network, a layer-2 scaling solution for Bitcoin, often uses mSats to facilitate fast and low-cost transactions.

In essence, satoshis and mSats provide flexibility in representing different values of Bitcoin, allowing for both large and small transactions within the network.

#ask #nostr #plebchain #learnstr

#amen

#amen

#amen

#amen