ᶠᶸᶜᵏᵧₒᵤ!🫵🏼

frontrunbitcoin@satoshivibes.com

npub199sa...9mfd

☕️ #coffeechain ⚡️bitchat geohash 👉🏼 #21m

#mempool junkie Buy me a beer @ 1nostr5HAT9JLjNQDJGgNhJDjo1df9j2d

History in the making #sbr

#plebchain

We’re so back

In his 1796 Farewell Address, George Washington emphasized the importance of national unity and prudent foreign policy. Key points regarding European entanglements and foreign adventurism include:

1. Neutrality and Avoidance of Permanent Alliances**: Washington urged the U.S. to steer clear of permanent alliances with European nations, arguing that such entanglements could draw the young republic into unnecessary conflicts. He favored temporary alliances for emergencies but stressed that long-term commitments risked compromising American interests.

2. Non-Intervention in European Conflicts**: He advised strict neutrality in European wars and political disputes, believing that the U.S., geographically distant and politically distinct, should avoid becoming a pawn in Old World rivalries.

3. Focus on Trade and Commercial Relations**: While advocating for economic engagement with other nations, he cautioned against letting trade relationships evolve into political or military obligations that might undermine sovereignty.

4. Prioritizing National Unity and Independence**: Washington warned that foreign alliances could exacerbate domestic divisions and distract from nation-building. He emphasized self-reliance, urging the U.S. to cultivate its own strength and avoid dependence on external powers.

Overall, Washington’s counsel sought to insulate the U.S. from external conflicts, preserve its autonomy, and prioritize domestic prosperity and unity over foreign adventurism. His ideas shaped early American isolationist tendencies and a cautious approach to international relations.

#gm #nostr #plebchain #coffeechain #bitcoin

#gm #nostr #plebchain #coffeechain #bitcoinMy #nerdminer predicts price 🤣

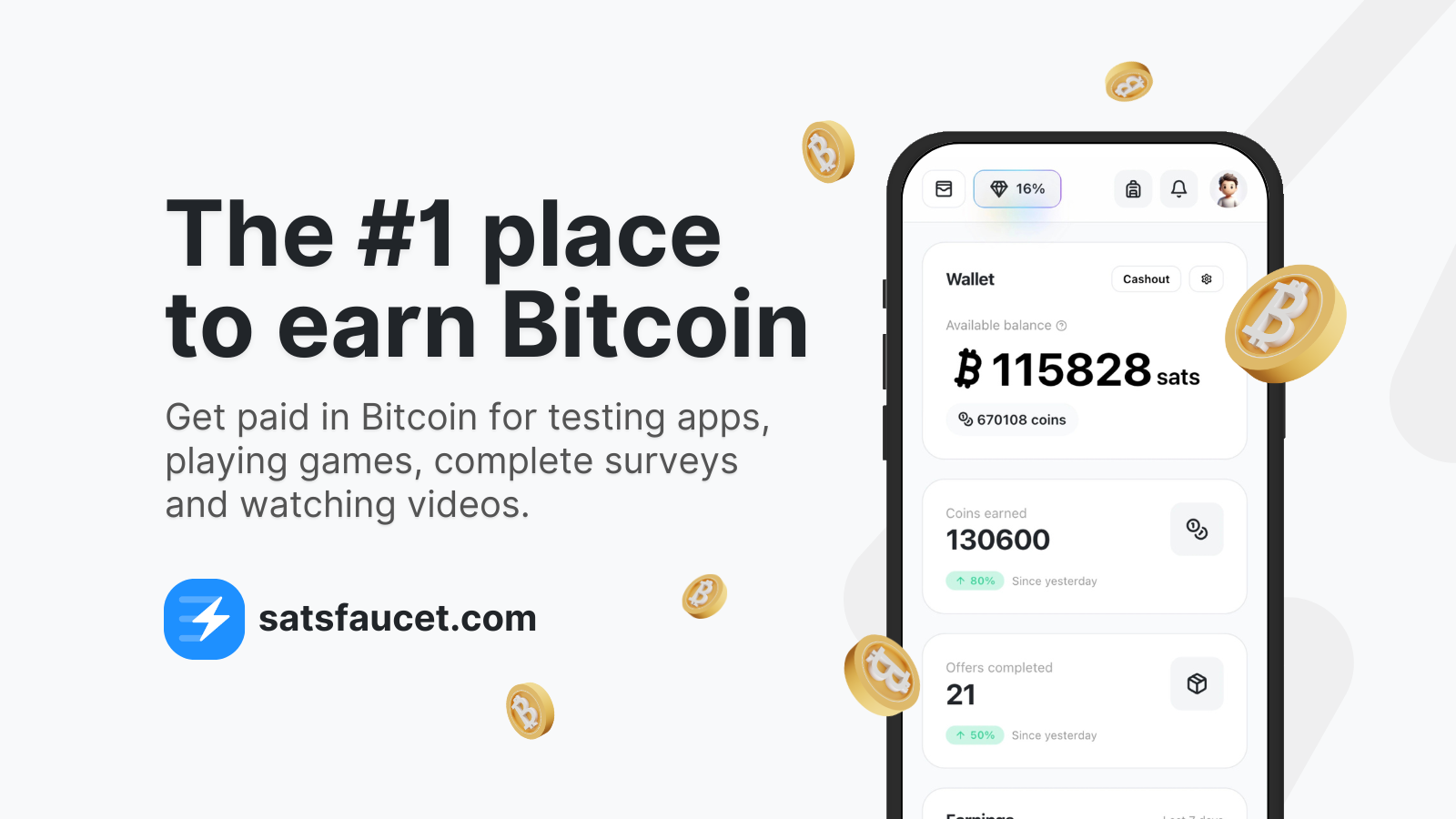

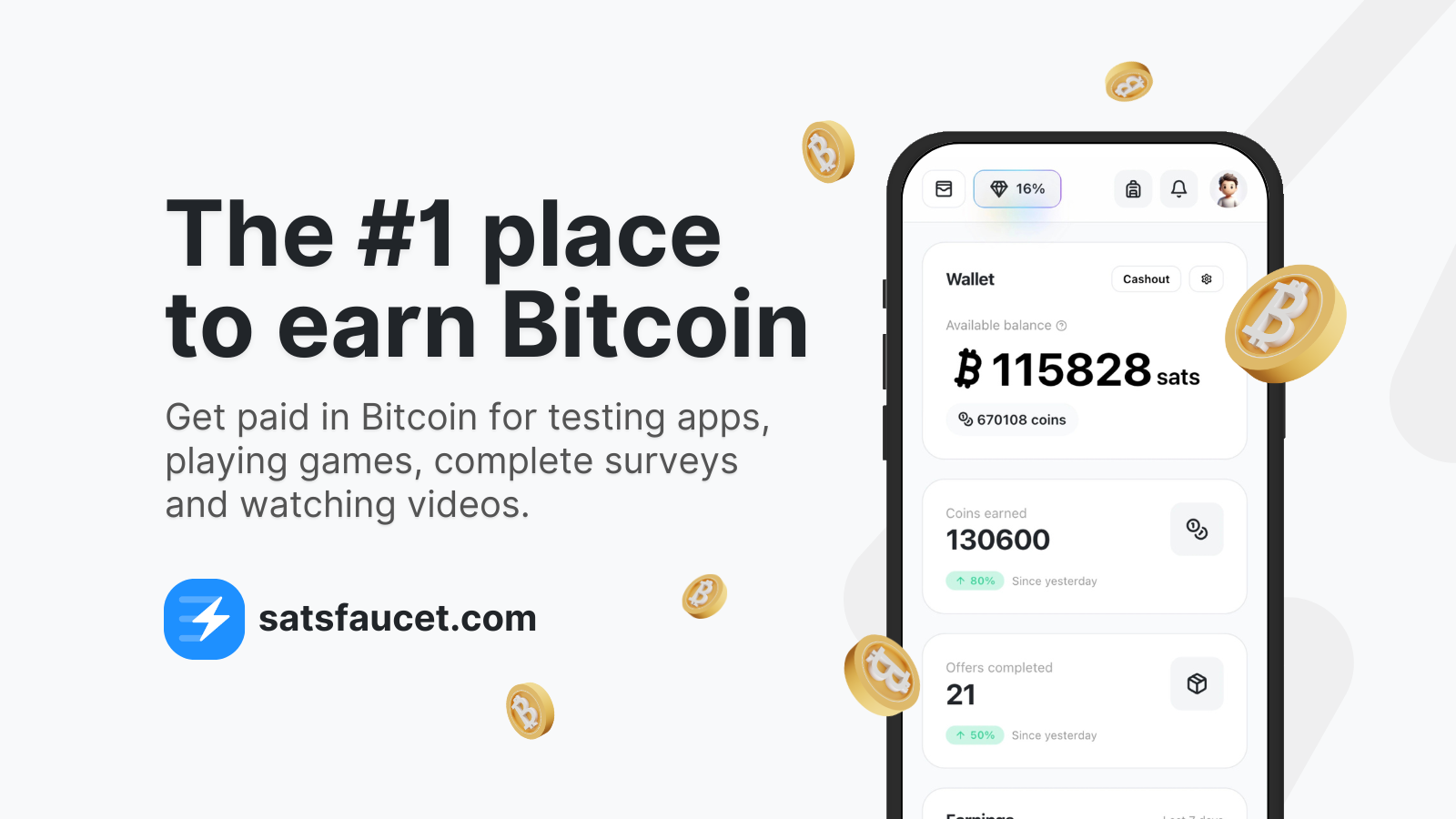

I earned 7969 sats on @SatsFaucet! Withdrawed instantly to my #LightningNetwork wallet!

👉  #SatsFaucet #StackSats #EarnSats #EarnBitcoin #BitcoinFaucet #LightningNetwork

#SatsFaucet #StackSats #EarnSats #EarnBitcoin #BitcoinFaucet #LightningNetwork

SatsFaucet - The #1 Place to Earn Bitcoin

Get paid in bitcoin for playing games, testings apps, giving your opinion, watching videos and more. Instant withdraw to your favorite Lightning Ne...

The bullish case for Bitcoin ETF options is based on several factors that could drive significant growth and further adoption:

Institutional Adoption and Liquidity: The approval of Bitcoin ETF options could greatly increase institutional participation. Institutional investors, who were previously hesitant due to lack of regulation or custody concerns, will now have a more accessible, regulated vehicle to gain exposure to Bitcoin. This could lead to a massive inflow of capital into the Bitcoin market, increasing its liquidity and stabilizing its price over the long term.

Leverage Increases Returns: The introduction of leverage through ETFs allows traders and investors to amplify their potential returns on Bitcoin. While this can increase risk, it also opens the door for investors to capture greater upside without the need for constantly rolling over options or using complex trading strategies. Over time, this could drive more sustained demand for Bitcoin, especially during bullish market conditions.

Unlocking Synthetic Exposure: Fractionalized banking with ETF options allows for greater financial innovation. Investors can now gain exposure to Bitcoin’s price movements without directly holding the asset, reducing friction for participation. This makes Bitcoin more accessible to a broader audience, from retail to large-scale funds, and enhances its integration into traditional financial systems. This synthetic exposure could lead to exponential growth in trading volume and demand for Bitcoin.

Volatility Can Fuel Demand: Bitcoin's inherent volatility, combined with leveraged ETFs, could actually drive more speculative interest. Traders love volatility because it provides opportunities to profit from both upward and downward price movements. With Bitcoin's known upside potential, leveraged ETFs offer high-reward opportunities, which will likely attract more capital to the market, leading to even larger price moves on the upside.

Scarcity and Inability to Dilute: Unlike stocks or other commodities, Bitcoin has a fixed supply, which cannot be diluted or increased by any central authority. As demand grows due to ETF adoption, the capped supply of Bitcoin could result in price surges. The scarcity dynamic will likely continue to drive Bitcoin’s value, especially in a world where fiat currency is often subject to inflation and money printing.

Institutional Maturity and Risk Management: With the involvement of regulated entities and financial products like ETFs, the market will likely mature, attracting higher-quality participants. This could reduce some of the wild price swings seen in the unregulated crypto market while allowing for greater market efficiency. Institutional hedging tools will allow investors to manage risk better, making Bitcoin a more attractive asset for large portfolios.

Mainstream Legitimacy: The approval of Bitcoin ETFs by regulatory bodies like the SEC is a huge step in legitimizing Bitcoin as a mainstream asset. This move could pave the way for further financial products, like Bitcoin pension funds or more advanced derivatives, further embedding Bitcoin in the global financial system and expanding its user base. As Bitcoin becomes more recognized, its value as a store of wealth could increase, similar to gold.

Gateway to Broader Crypto Adoption: Bitcoin’s entrance into the regulated financial system through ETFs could serve as a gateway for the broader cryptocurrency market. As Bitcoin ETFs gain acceptance and perform well, other cryptocurrencies could follow a similar path, leading to increased interest and investment in the overall digital asset space.

In conclusion, the bullish case for Bitcoin ETF options lies in increased institutional adoption, accessibility for retail investors, leveraged growth potential, and Bitcoin’s scarcity. The approval of these ETFs represents a significant leap toward Bitcoin’s integration into traditional financial systems, potentially driving its price higher and solidifying its role as a major financial asset.

#plebchain #nostr

Satoshi vs. MilliSatoshi (mSats)

Satoshi and milliSatoshi (mSats) are both units of measurement used in the Bitcoin network. They represent smaller divisions of a Bitcoin, which is the primary unit of currency.

Satoshi: This is the smallest unit of Bitcoin. There are 100 million satoshis in one Bitcoin. Think of it like a penny to a dollar.

MilliSatoshi (mSats): As the name suggests, a milliSatoshi is one-thousandth of a Satoshi. It's a much smaller unit, often used in microtransactions or when dealing with very small amounts of Bitcoin.

To summarize:

* 1 Bitcoin = 100 million satoshis

* 1 Satoshi = 1,000 milliSatoshis

Why use mSats?

Micro-transactions: mSats allow for very small transactions, which are essential for certain use cases like paying for small items or services.

Lightning Network: The Lightning Network, a layer-2 scaling solution for Bitcoin, often uses mSats to facilitate fast and low-cost transactions.

In essence, satoshis and mSats provide flexibility in representing different values of Bitcoin, allowing for both large and small transactions within the network.

#ask #nostr #plebchain #learnstr

Decentralization of Power and Money: A Comparison

Decentralization is a concept that involves distributing #power or control away from a central authority. This idea has been applied to various aspects of society, including government and finance. The decentralization of power through arms and the #decentralization of #money through Bitcoin share some intriguing parallels:

Decentralization of Power through Arms

Individual agency: Citizens armed with #firearms have the potential to exercise individual agency and resist #government #overreach.

Check on authority: A dispersed ownership of weapons can serve as a check on the power of governments, preventing them from becoming overly centralized or oppressive.

Historical precedent: The American Revolution is often cited as an example of how an armed citizenry can overthrow a tyrannical government.

Decentralization of Money through Bitcoin

Individual agency: Bitcoin users have control over their own finances, without relying on intermediaries like banks.

Resistance to censorship: Bitcoin transactions are difficult to censor or control, making it resistant to government interference.

Global reach: Bitcoin operates on a global network, making it difficult for any single entity to dominate or control.

Key Parallels:

Empowerment of individuals: Both concepts empower individuals by giving them more control over their lives.

Resistance to centralized authority: Both decentralization of power and money aim to limit the concentration of authority in the hands of a few.

Historical significance: The idea of an armed citizenry has deep historical roots, while Bitcoin represents a more recent innovation.

Differences:

Nature of power: The decentralization of power through arms is primarily about political authority, while the decentralization of money is primarily about economic authority.

Technology: Bitcoin proof of work blockchain technology, while the decentralization of power through arms is not tied to a specific technology.

Risk: The decentralization of power through arms can potentially lead to violence or instability, while the decentralization of money is generally seen as a positive development.

In conclusion, while the decentralization of power through arms and the decentralization of money through Bitcoin share some similarities, they are distinct concepts with different implications and risks. Both ideas have the potential to empower individuals and limit the concentration of power, but they also raise important questions about governance, security, and societal stability.

Put heels 👠 on the girls #bitaxe #nerdaxe #plebchain #solominer #overclock