𝐓𝐡𝐞 𝐏𝐚𝐲𝐝𝐚𝐲 𝐋𝐨𝐚𝐧 𝐓𝐫𝐚𝐩 & 𝐇𝐨𝐰 𝐁𝐢𝐭𝐜𝐨𝐢𝐧 𝐅𝐢𝐱𝐞𝐬 𝐈𝐭 🌍

Around the world, millions turn to payday loans when they’re short on cash.

But what seems like a quick fix often becomes a trap that’s hard to escape.

Here’s how payday loans work, and why Bitcoin can help:

𝐖𝐡𝐚𝐭 𝐚𝐫𝐞 𝐩𝐚𝐲𝐝𝐚𝐲 𝐥𝐨𝐚𝐧𝐬?

Payday loans are short-term, high-interest loans meant to help people until their next paycheck.

With interest rates skyrocketing to 300%-500% APR, these loans often do far more damage than relief, trapping borrowers in cycles of relentless debt.

𝐓𝐡𝐞 𝐭𝐫𝐚𝐩:

Borrowers often struggle to repay the loan in full, leading to rollovers with additional fees. This creates a debt spiral that’s nearly impossible to escape.

𝐖𝐡𝐨’𝐬 𝐚𝐟𝐟𝐞𝐜𝐭𝐞𝐝?

Payday loans disproportionately impact:

• Low-income individuals

• Those without access to traditional credit

• People facing emergencies

These loans often prey on those who need financial help the most, pushing them deeper into debt.

𝐓𝐡𝐞 𝐫𝐨𝐥𝐞 𝐨𝐟 𝐁𝐢𝐭𝐜𝐨𝐢𝐧

Bitcoin is changing the game by offering a decentralized, permissionless financial system.

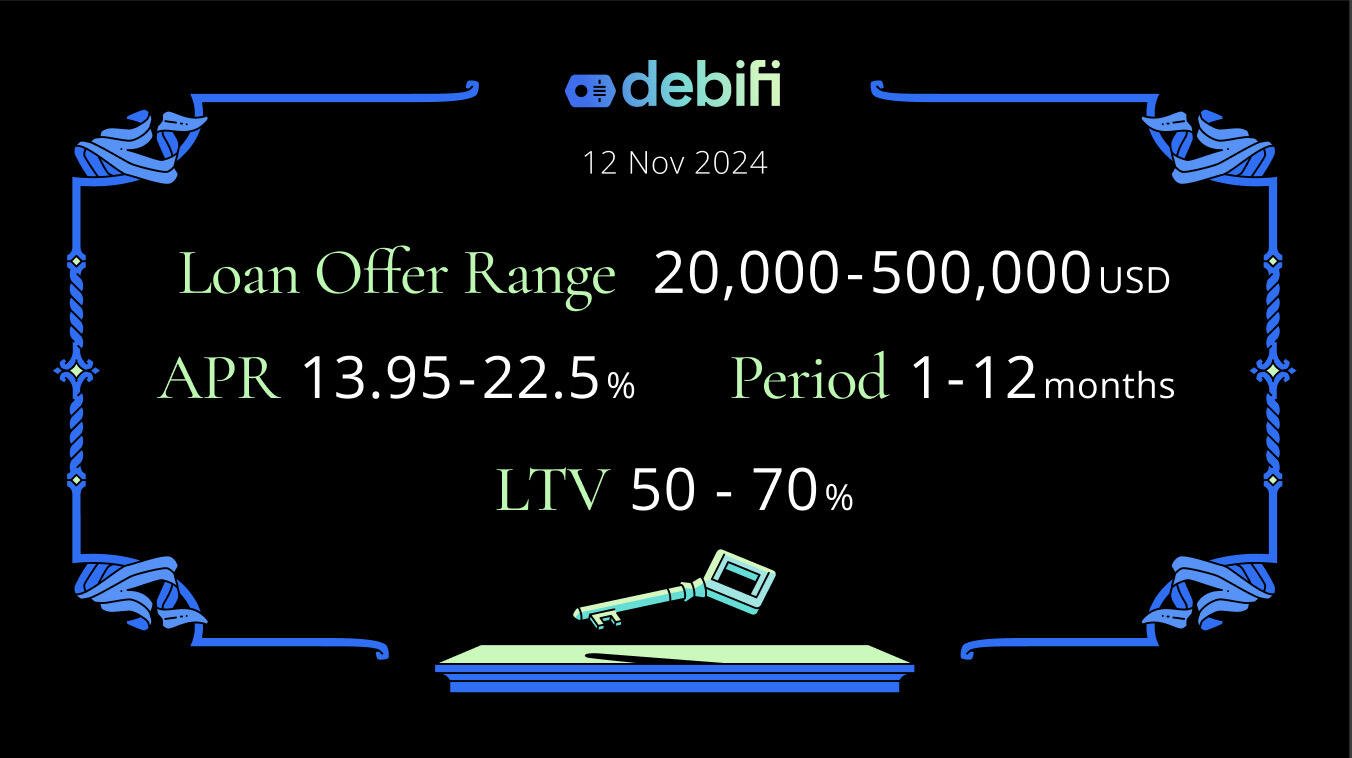

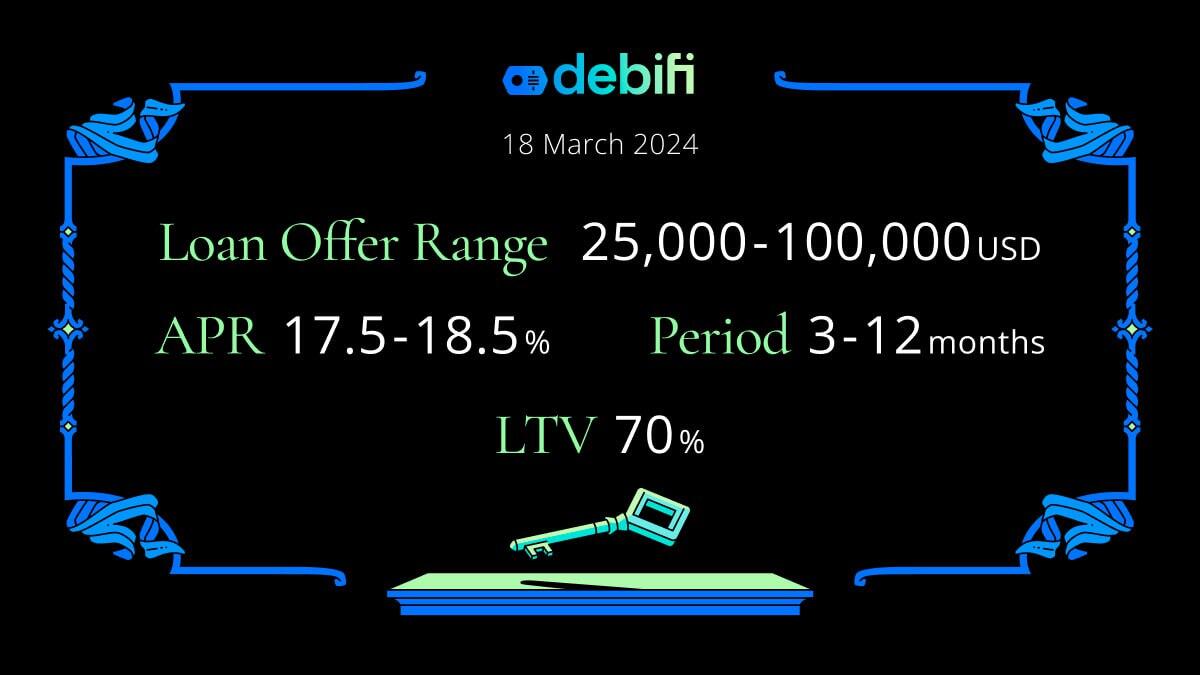

Instead of predatory practices, Bitcoin-backed loans provide:

• Low-cost loan alternatives

• No credit checks

• The ability to maintain your wealth

By using #Bitcoin as collateral, individuals excluded from the traditional banking system can access the funds they need without falling victim to predatory practices.

Bitcoin empowers individuals to break free from predatory financial systems, creating new opportunities for financial freedom.