One of the best effects of the current American administration is to remind people that some laws are bad, and that some crime is good.

I fear they will forget the lesson very quickly, upon taking back power. But it is a good lesson!

Andrew M. Bailey

resistancemoney@resistance.money

npub1yezu...awc7

I’m here to chew bubblegum and talk about bitcoin and I’m all out of bitcoin

bitcoin is for criminals

Source: HRF's Financial Freedom newsletter: https://mailchi.mp/hrf.org/financial-freedom-newsletter

A big part of my job is career coaching: asking young adults what they want out of work life and how they'll get it. I get all sorts of answers. But never once has a student shared a dream of buying U.S. Treasuries.

I am officially neutral or slightly skeptical about a Strategic Bitcoin Reserve. But here's an argument I'd like to develop and evaluate:

Our world is increasingly multi-polar, with realignments of who knows what kind on the horizon. Borders will change. Cross-border payment systems will realign too. It seems useful to have on hand a way to transfer value across those new and shifting borders, without the cooperation of intermediaries. Bitcoin, unlike other digital monies, can do this.

So the reason to stockpile some bitcoin isn't merely that it is likely to become more valuable. It's that it is uniquely useful, and it is wise to stockpile useful tools you might need.

Objection: if the USFG really needs to pay mercenaries or buy munitions or spy software or whatnot, and doesn't have a way to wire dollars to sellers, it can just buy bitcoin at the very moment of need — no need to buy it now.

Reply: the objection only works if we assume that bitcoin's value will remain flat or decline. Otherwise, the counter is: acquiring some bitcoin now will allow the USFG to benefit from appreciation, and make any future purchases using bitcoin cheaper.

Another reason I prefer this style of argument over the proposal that the USFG should buy bitcoin now, merely for the reason that it will likely rise in value, is that it is explicitly framed around bitcoin's unique point of usefulness. The fundamental reason to buy bitcoin isn't that Number Go Up, it's that bitcoin can do things other tools cannot. This also supplies us with a plausible answer to the question: why bitcoin? why not TSLA? Or NVDA? Because bitcoin can do things these other assets cannot. Its value lies, not merely in expectation of future appreciation, but in utility.

Objection: acquiring bitcoin, in the hopes to someday use it for cross-border payments, is best done in secret. A Strategic Bitcoin Reserve is most useful when covert.

Reply: that's probably correct. But there are limits to what a democratic government can do, covertly. And acquiring bitcoin in public enhances any Number Go Up effect, by providing a clear and widely-known signal of bitcoin's value.

hey I know that guy

Meet the Fellows: Andrew Bailey | Bitcoin Policy Institute

Philosophers: "that noble tradition of thinkers who were so annoying that their countrymen would either execute them (Socrates), banish them (Aristotle), excommunicate them (Spinoza), or not have sex with them (Kant)."

From Robert Gressis' memoire, "The Most Awkward Man in Japan: Dispatches from a Philosopher Abroad" (2024)

(It's good, and much funnier than one might guess, given that it's written by a philosophy professor!)

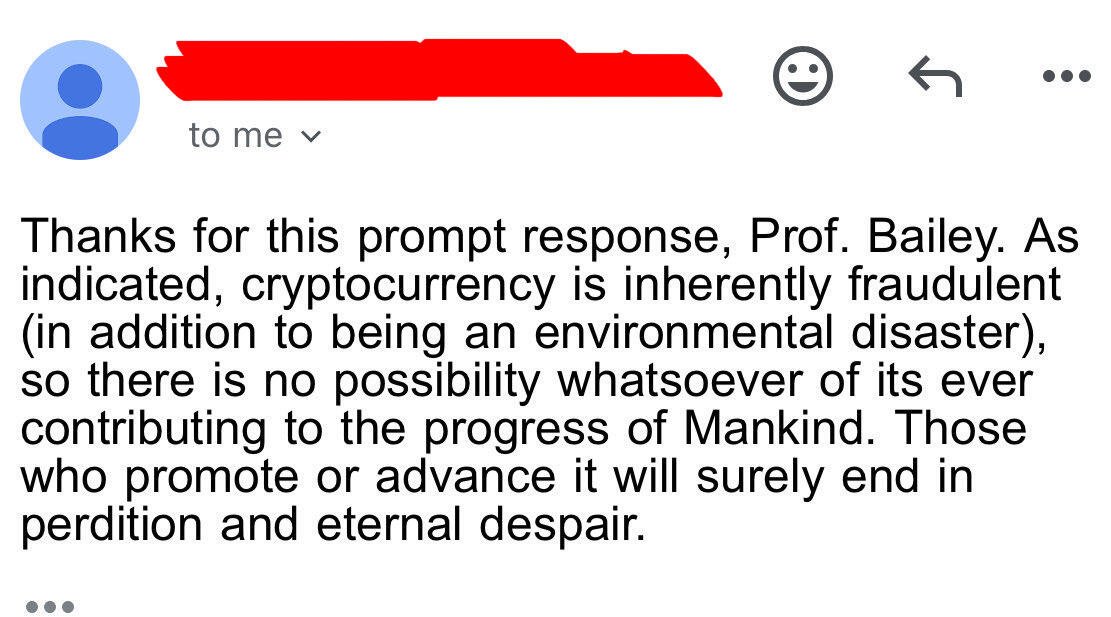

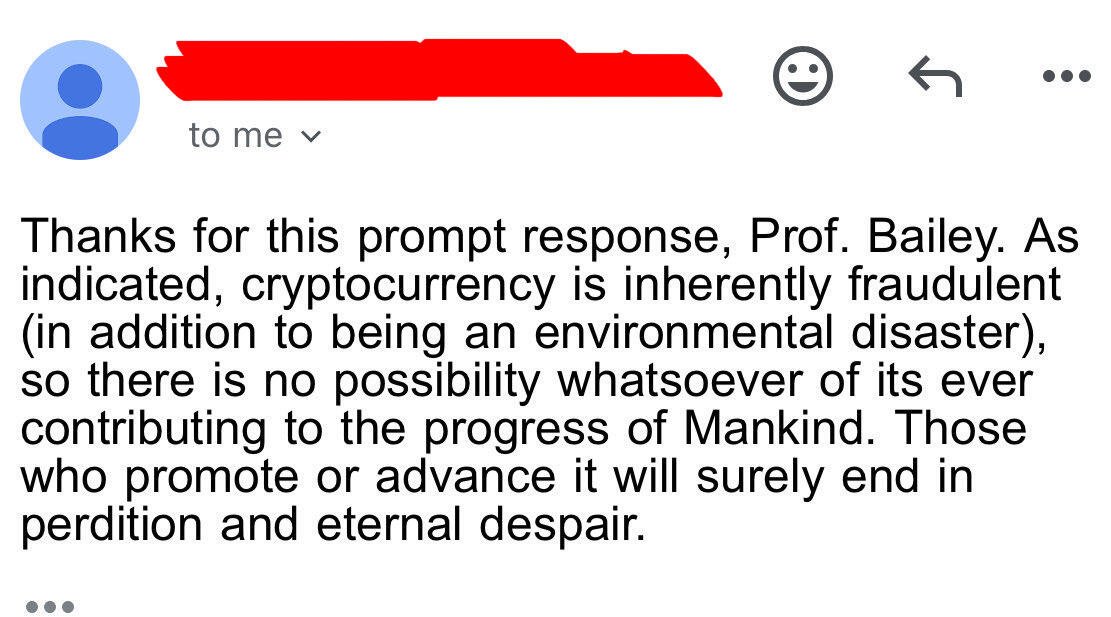

I get the most interesting emails!

- Will autocrats attempt to expand their power over payments?

- Will central banks continue to print, and sometimes go belly up?

- Will other cryptos prove to be fraud and delusion?

If you say “yes” to these questions, congratulations: you understand the case for bitcoin.

Nihilism — the view that nothing could really matter — is both false and mischievous. False: some things do matter, regardless of our attitudes. Mischievous: if you believe it, your life will become less meaningful and good.

Nihilism is, then, rather dangerous. It'd be good to have an antidote. There are many, in fact:

1. Love: giving and receiving

2. Old Books: they remind us of what matters by taking us far away

3. Long Walks: we are animals, not spirits, and animals live best when animated

Some people have repugnant views and act on them. When censors block your access to those views, they block your ability to understand the world, to predict how it will unfold, and to act on the basis of evidence.

2025 draws nigh. What advice do you have for me, for the coming new year?

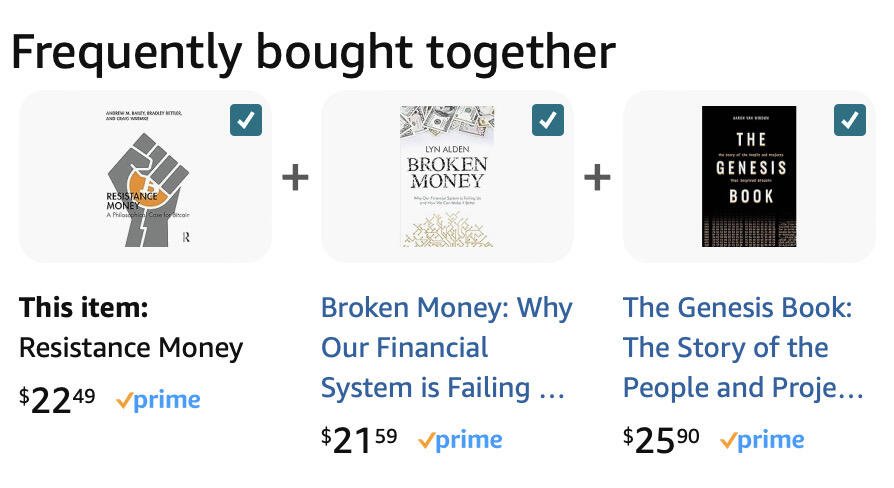

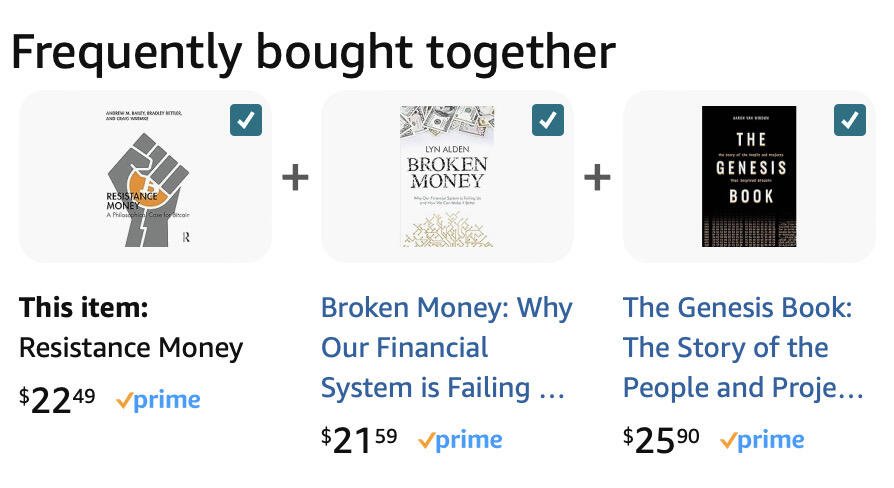

Every few months I post this, in the hopes that we’ll find a taker. Any book sellers out there interested in stocking ‘Resistance Money’ and selling it for bitcoin? We can get you copies from the press at a steep discount. No author kickbacks or royalties or funny business: we just want people to be able to buy the book for bitcoin!

Hard to think of a better holiday bundle tbh

1. If they do Free Ross on Day One, we're going apeshit.

2. If they don't Free Ross on Day One, we're going apeshit.

3. Therefore, we're going apeshit (from premises 1-2)

Pretty convincing argument tbh

Thank you, eggyolk! The two features this review identifies — writing to clarify rather than to wow, offering understanding rather than polemics — were top of mind for us as we wrote the book.

Many such cases. View quoted note →

10 THESES ON DEBANKING

1. Debanking, in the target sense, is when lawful payments or enterprises are blocked from banking services, because they are, to use a nice phrase from Nick Carter: "politically disfavored".

2. Debanking can occur at the explicit and written direction of regulators, or through more hidden means, as with off-the-record phone calls or vague gestures at limiting 'risky' activity so as to avoid costly audits — or worse.

3. Off-the-record governance of this kind undermines the rule of law, trust in institutions, and innovation. It's hard to build a law-abiding business when you don't know if you'll get kicked out of the system, for secret reasons you can't even share in public.

4. Some recent cases of debanking involve lawful but, to many, distasteful enterprises – crypto token pump shops, for example. Others involve family and friends of unpopular politicians. Yet other examples are more sympathetic: human rights activists, independent journalists, or whistle-blowers.

5. Since these examples run the ideological and moral gamut, it's probably most useful to keep 'debanking' as a purely descriptive term, rather than to gatekeep its application to, say, just the sympathetic cases.

6. Debanking in the modern era began with Operation Chokepoint, under the Obama administration. Though the first Trump administration ended that program, it implemented debanking structures of its own, including the campaign against Libra/Diem in 2019. The pattern continued under the Biden administration with the inauguration of Chokepoint 2.0. There is, by now, little doubt that politicized debanking happens.

What's at issue now is what to do about it.

7. Modern banking systems are neither entirely public nor entirely private. They are, instead, a curious hybrid. This hybrid character undermines arguments like 'it's a free world, and payment rails are privately owned, so financial services should be able to block customers they find risky'.

8. There is something of a paradox, then, at the heart of the issue. Here's how Justin Slaughter puts it:

- No individual bank should be required to bank any particular customer

- No industry that is not clearly prohibited by law should be refused a bank account

It is by no means obvious how to design a system that respects both constraints.

9. There is no purely political or policy solution to this paradox. Congress, the Fed, Article 3 courts, the Executive, CFPB, FDIC — any of these institutions *could in theory* be used to untangle the mess. But in truth, empowering them further is unlikely to have that effect, since they are themselves political institutions.

10. The way forward lies, instead, in developing and using payment and banking rails that are genuinely open for all — beyond the easy capture of regulators or corporate structures alike. Thus David Marcus: “you have to build it on the most neutral, decentralized, unassailable network and asset..."

“The ratio of Blackberries to iPhones used to be 100:1, so we are due for a correction and return to the mean.”

— Person who draws lines on charts

A friend was planning a trip to Japan to celebrate some recent wins. The application was complicated, and took significant work.

Visa denied; no reason given.

He'll have to wait six more months before he can apply again. Damn.

Check your passport privilege all.

Why share? Does it connect to my family's troubles with American immigration? Sure. But it's something I care about independently too. My developed world friends are often wildly unaware of how hard it is to travel without a fancy passport. Which is frustrating for everyone else!

People ask how many bitcoins I have. My answer is always the same:

How dare you speak to me?