People ask how many bitcoins I have. My answer is always the same:

How dare you speak to me?

Andrew M. Bailey

resistancemoney@resistance.money

npub1yezu...awc7

I’m here to chew bubblegum and talk about bitcoin and I’m all out of bitcoin

What is the optimal portfolio of group chats? Some principles:

- Experiment (join many)

- Diversify (cross ideological divides)

- Manage risk with sizing (allocate attention sparingly)

- Let winners ride (engage good ones more)

- Cut losses (mute/exit, if a chat isn't useful)

When you use bitcoin, you're not just empowering yourself. You're joining a network, and empowering others who use it too. All this without the permission or cooperation of authorities.

(excerpt from ‘Resistance Money’, p. 274)

Many recommend it as an investment. But is bitcoin actually good for the world? What are its costs or benefits? How should we evaluate them? This presentation addresses such questions through the main findings of 'Resistance Money', a recent academic book.

Free Ross

Day One

I have three shirts that display this message. They're in my rotation — 3 out of 7 times you'll see me in a week, I'm in a Free Ross shirt.

Some day, I hope to wear a Free Ross shirt and shake the hand of a free Ross. I would tell him that he was never forgotten.

I'm planning my Spring 2025 travel calendar — January through May. What are some bitcoin events in Europe or North America I should think about attending?

This podcast was special — both because I consider the Crypto Critics Corner fellas friends, and because we were able to dig into a few points of substantive disagreement.

That said three of my mistakes require correction:

1. Sliding between which kind of miracle bitcoin's origin is alleged to exemplify (virgin birth and immaculate conception)

2. Failing to be precise about soft vs. hard forks

3. Wrong date on Patrick McKenzie interview with Tyler Cowen

I’m still mulling over whether the house flipping analogy works in the case of speculators and bitcoin.

Episode:

Video:

Episode 156 – Is Bitcoin good for the world? (feat. Andrew Bailey) – Crypto Critics' Corner

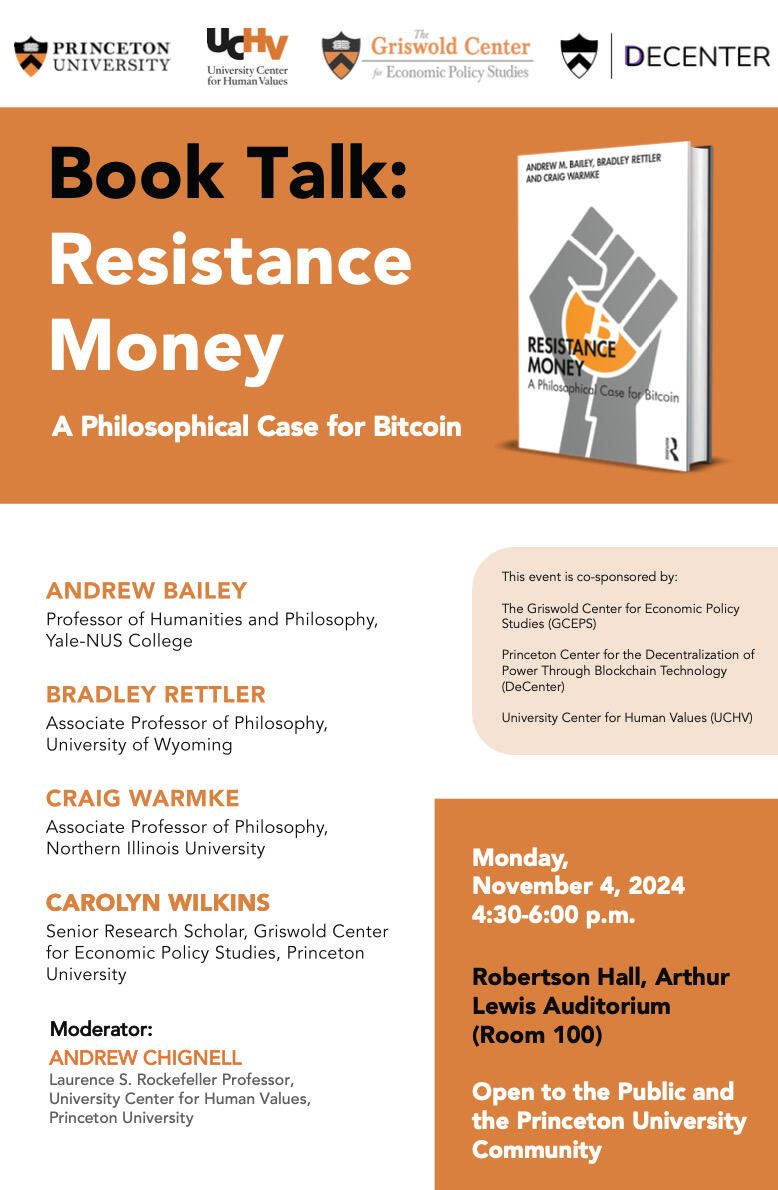

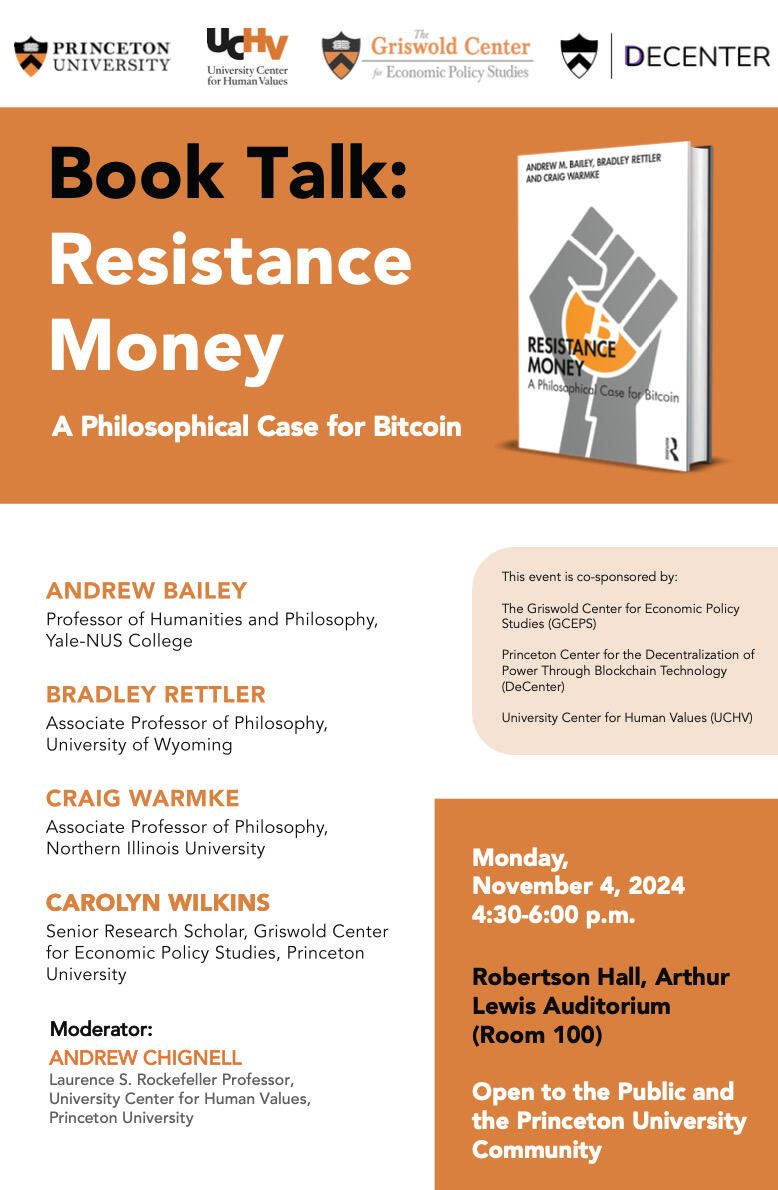

Join us at Princeton University for a discussion of ‘Resistance Money’, on November 4, 4:30-6:30pm. @Bradley Rettler, @Craig Warmke, and I will be there. Will you?

For too long, academia has polluted journalism and policy with misinformation about bitcoin. Thanks to the Bitcoin Amsterdam organizers, for having @Bradley Rettler, @Craig Warmke and me on stage to talk about how to fix this problem!

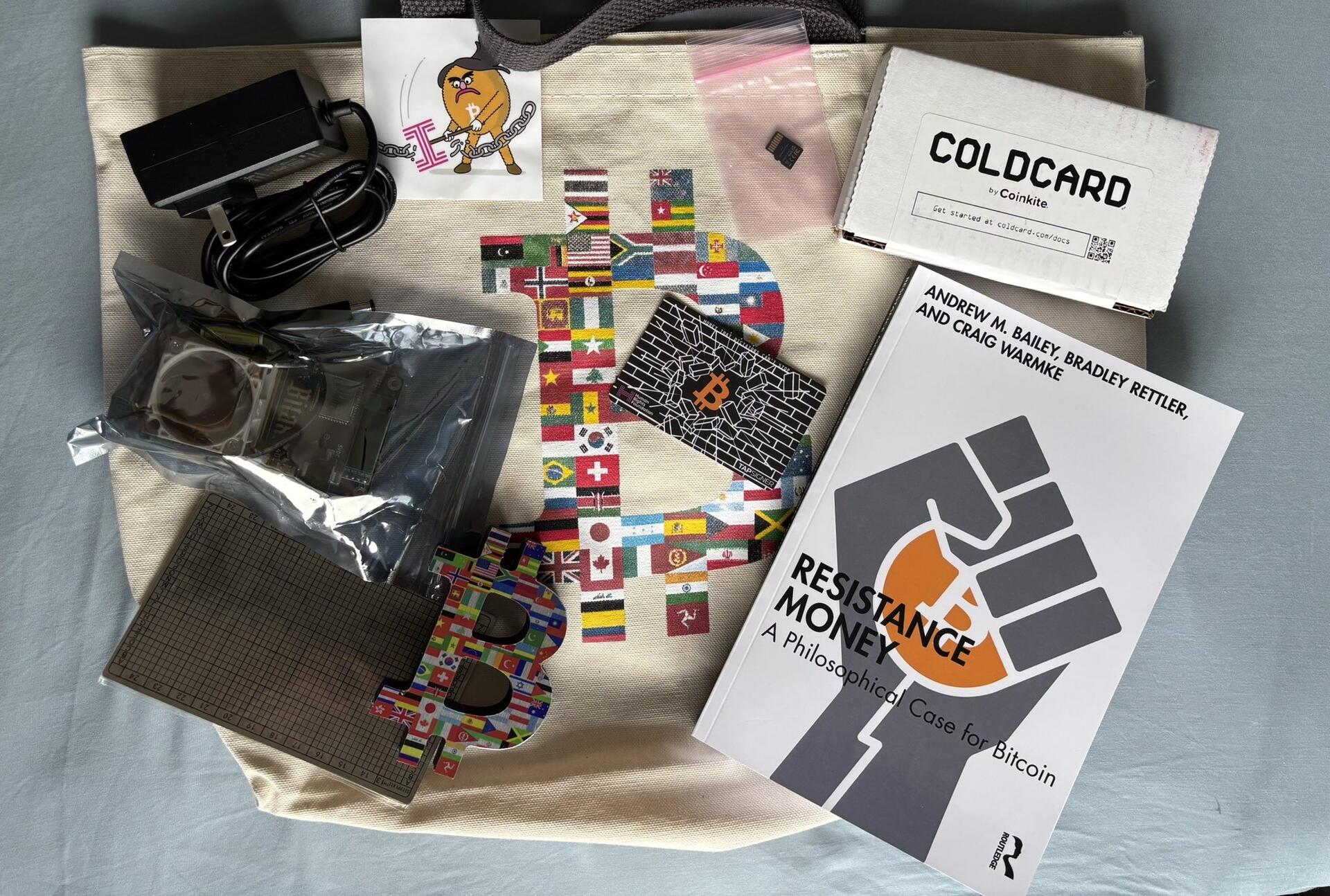

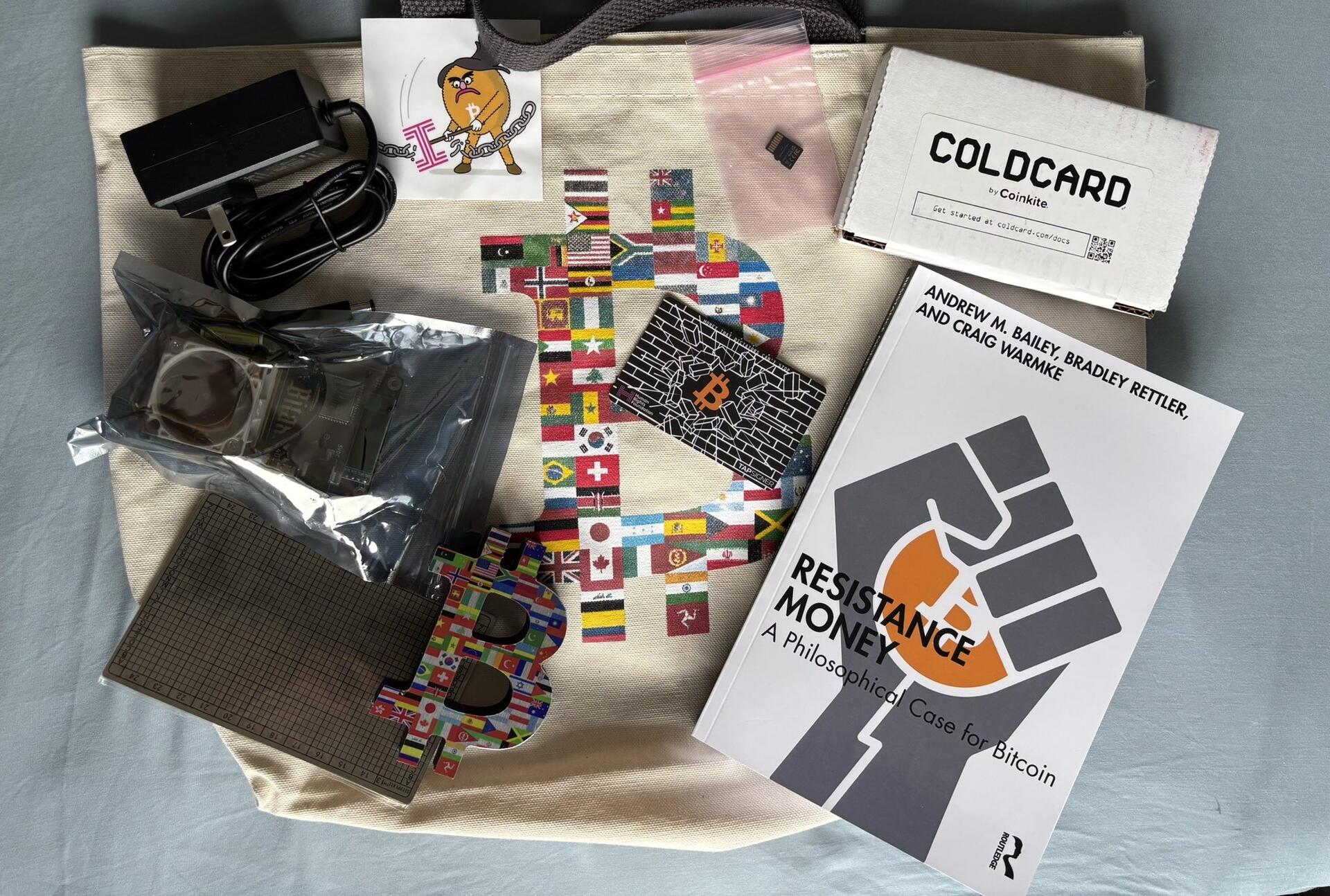

Best conference swag bag.

As for the Global Bitcoin Summit itself, I can scarcely put into words what I felt there. Not the fear and greed one often finds at such events, but instead: faith, hope, and love.

Onwards.

not a pyramid scheme

Arch-conservatives and utopian socialists make the same mistake. They have a vision for society; people are tools for carrying it out. There are exactly three known cures: (i) suffering under the boot, (ii) Hayek '45 — and (iii) this curious little poem by D. Friedman.

my Twitter feed tonight

Cash is good. Bring back supernotes, and in bigger denominations — $500, $1,000, even $10,000. But for better financial privacy, we need supercoins too, without serial numbers. This is perhaps my most unusual money policy stance: the US should mint $100 and $1,000 coins.

The latest review of Resistance Money is out — this time in The Spectator:

The Spectator

Does bitcoin fit the definition of good money?

Three philosophers walk into a crypto-currency. Resistance Money: A Philosophical Case for Bitcoin, I’d argue, is a slightly inaccurate title. Me...

immediately implementing a jubilee: closing all browser tabs, marking all messages as read, restarting laptop

It is good to be free.

There are some very bad objections to the idea of a strategic bitcoin reserve on the part of the US Federal Government. For example:

1. Bitcoin is bad for the world (false; our best science shows that, on net, bitcoin is good)

2. Bitcoin isn't valuable (false; bitcoin is precious, and useful)

3. Buying or holding bitcoin undermines American values and empowers foreign adversaries (false; bitcoin embodies American values, and a huge chunk of bitcoin is held by Americans)

4. Buying or holding bitcoin weakens the American dollar (this one is complicated, and depends on what it means to 'weaken' the dollar, and how the reserve strategy is actually implemented)

5. People only like the strategic reserve idea because it pumps their bitcoin bags (this one is very psychologically important -- but irrelevant to the merits of the policy as such)

Following are some other objections that strike me as more sensible. What do you think? What are the best replies to these objections? Are there other sensible objections I'm missing?

6. A bitcoin-stockpiling strategy gives the state more incentive to seize bitcoin

7. The state should be neutral between asset classes and assets within them; to hold or buy bitcoin is to pick a winner

8. Massive state holdings confer powers in contentious fork wars that the state shouldn't have (e.g., to massively sell off the more freedom- or privacy-oriented side of a hard fork, and thus move markets in that direction)

9. A sovereign wealth fund should aim at yield-bearing assets to displace taxes or debt, but bitcoin doesn't offer any yield

10. Policy should be neutral about a 'number go up' thesis; but stockpiling bitcoin is pretty plainly a bet on that thesis

11. Impoverished and indebted governments should pay down debts rather than acquire assets