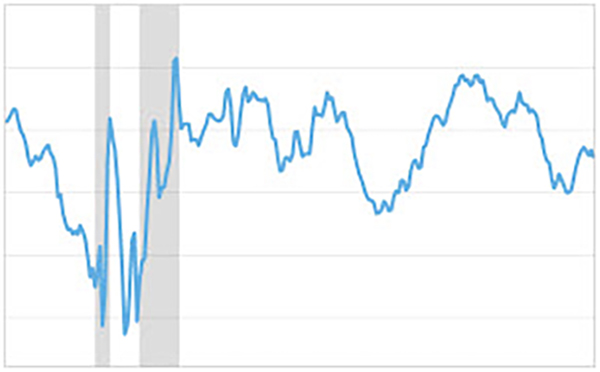

⚠️ The #HYG / #TLT (adjusted) ratio just printed a gravestone doji on the 4-month chart. All oscillators on this timeframe are as over-extended as they've ever been. A reversal is likely coming in 2024.

This is a major #recession warning. This ratio tops in the lead up to an economic recession, and it bottoms near business cycle lows. This chart is warning that we're likely near a major market top.

#Bonds / #Treasury / #Fed / #FOMC / #InterestRates / #AAPL / #TSLA / #MSFT / #NVDA / #Recession / #Stagflation / #Bitcoin / #Trading / #Investing / #Gold / #Nostr

#Bonds / #Treasury / #Fed / #FOMC / #InterestRates / #AAPL / #TSLA / #MSFT / #NVDA / #Recession / #Stagflation / #Bitcoin / #Trading / #Investing / #Gold / #Nostr

#Bonds / #Treasury / #Fed / #FOMC / #InterestRates / #AAPL / #TSLA / #MSFT / #NVDA / #Recession / #Stagflation / #Bitcoin / #Trading / #Investing / #Gold / #Nostr

#Bonds / #Treasury / #Fed / #FOMC / #InterestRates / #AAPL / #TSLA / #MSFT / #NVDA / #Recession / #Stagflation / #Bitcoin / #Trading / #Investing / #Gold / #Nostr

#Commodities / #Gold / #Bitcoin / #Inflation

#Commodities / #Gold / #Bitcoin / #Inflation #Commodity / #Inflation / #Recession / #Stagflation / #Trading / #Investing

#Commodity / #Inflation / #Recession / #Stagflation / #Trading / #Investing #SPY / #SPX / #SP500 / #Trading

#SPY / #SPX / #SP500 / #Trading

#Bitcoin / #BTC / #Stack / #Sats

#Bitcoin / #BTC / #Stack / #Sats The #Fed has been using the #CPI to paint a much better picture of inflation than is actually occurring. The problem for the Fed is that even though it can try to downplay the real rate of #inflation, consumers are sensing that inflation is much worse than is being reported and this is being reflected in sentiment data.

With that said, if you think things are bad now, currency inflation is poised to get far worse in the years ahead as the ratio of interest on public debt to #GDP spirals higher...

Note: To illustrate the dilution of purchasing power I used the formula: 1/(WALCL-RRPONTTLD-WTREGEN). This formula represents the value of one U.S. dollar relative to the total monetary base. The expression #WALCL-#RRPONTTLD-#WTREGEN reflects the assets on the Fed's balance sheet that determine the monetary base.

The #Fed has been using the #CPI to paint a much better picture of inflation than is actually occurring. The problem for the Fed is that even though it can try to downplay the real rate of #inflation, consumers are sensing that inflation is much worse than is being reported and this is being reflected in sentiment data.

With that said, if you think things are bad now, currency inflation is poised to get far worse in the years ahead as the ratio of interest on public debt to #GDP spirals higher...

Note: To illustrate the dilution of purchasing power I used the formula: 1/(WALCL-RRPONTTLD-WTREGEN). This formula represents the value of one U.S. dollar relative to the total monetary base. The expression #WALCL-#RRPONTTLD-#WTREGEN reflects the assets on the Fed's balance sheet that determine the monetary base. #ETHUSD / #Ethereum / #ETHUSDT / #ERC20

#ETHUSD / #Ethereum / #ETHUSDT / #ERC20

Bearish divergences are also occurring on the monthly, quarterly, and even yearly charts.

#SPX / #SP500

Bearish divergences are also occurring on the monthly, quarterly, and even yearly charts.

#SPX / #SP500

See more here:

See more here: