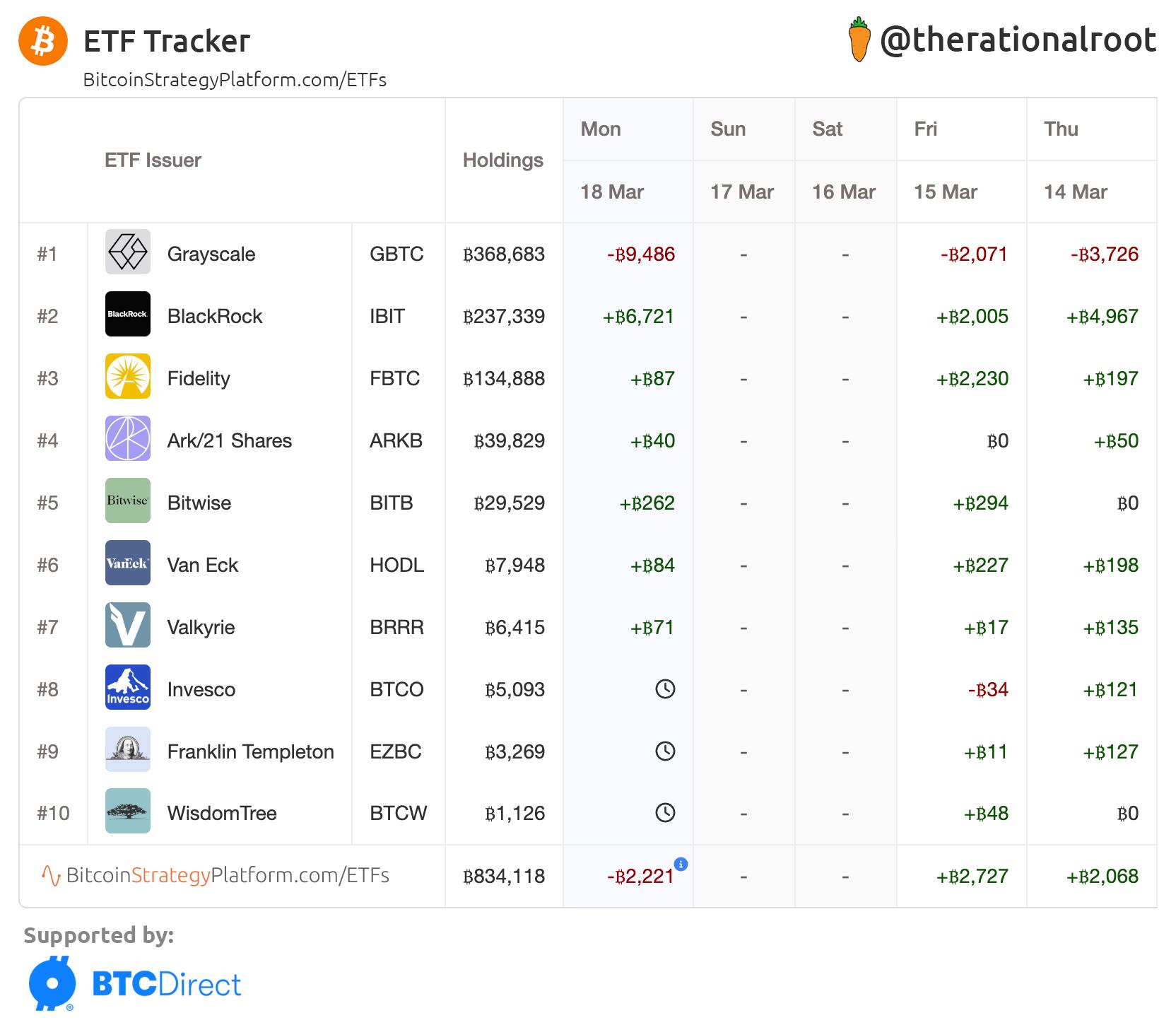

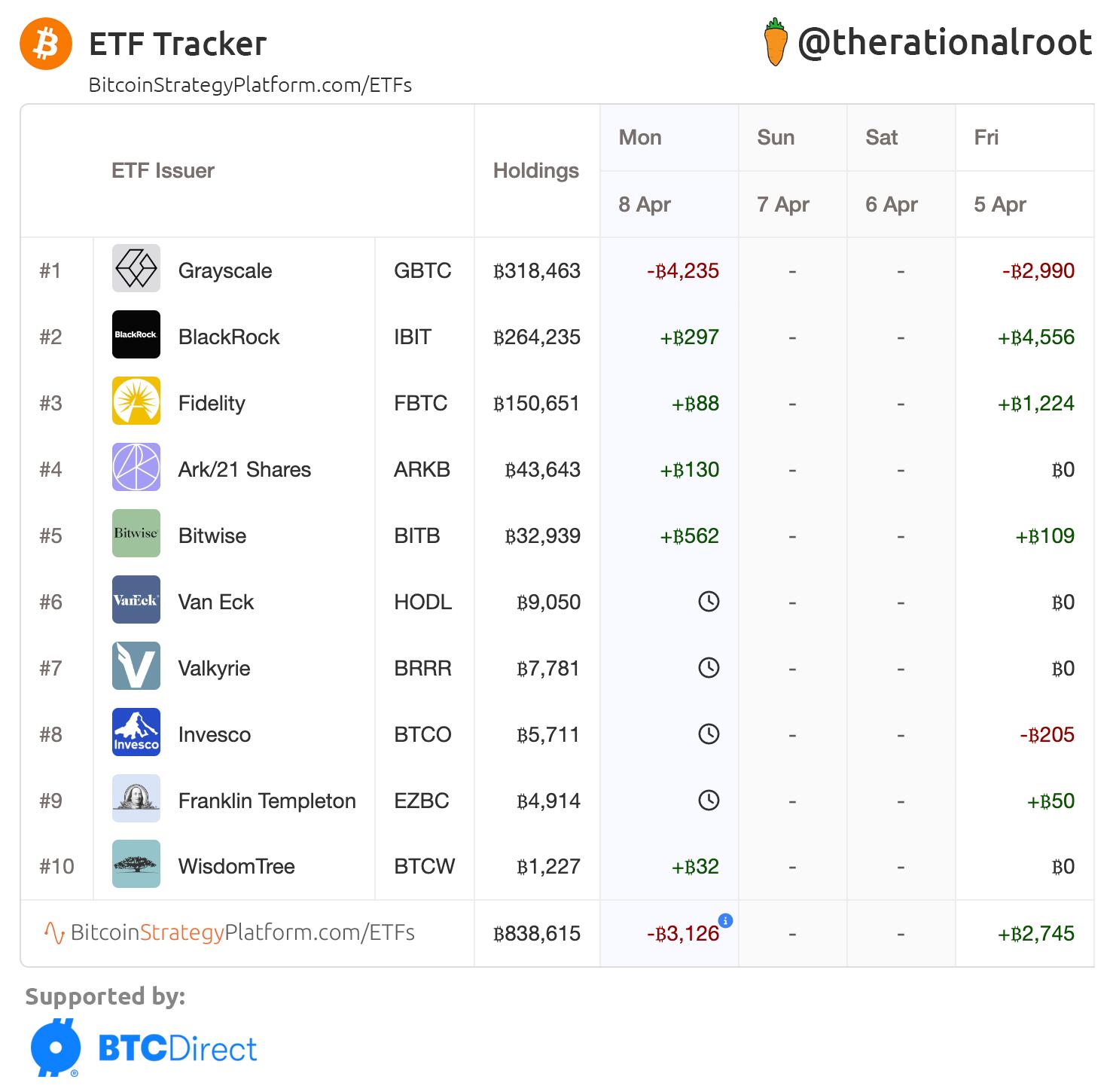

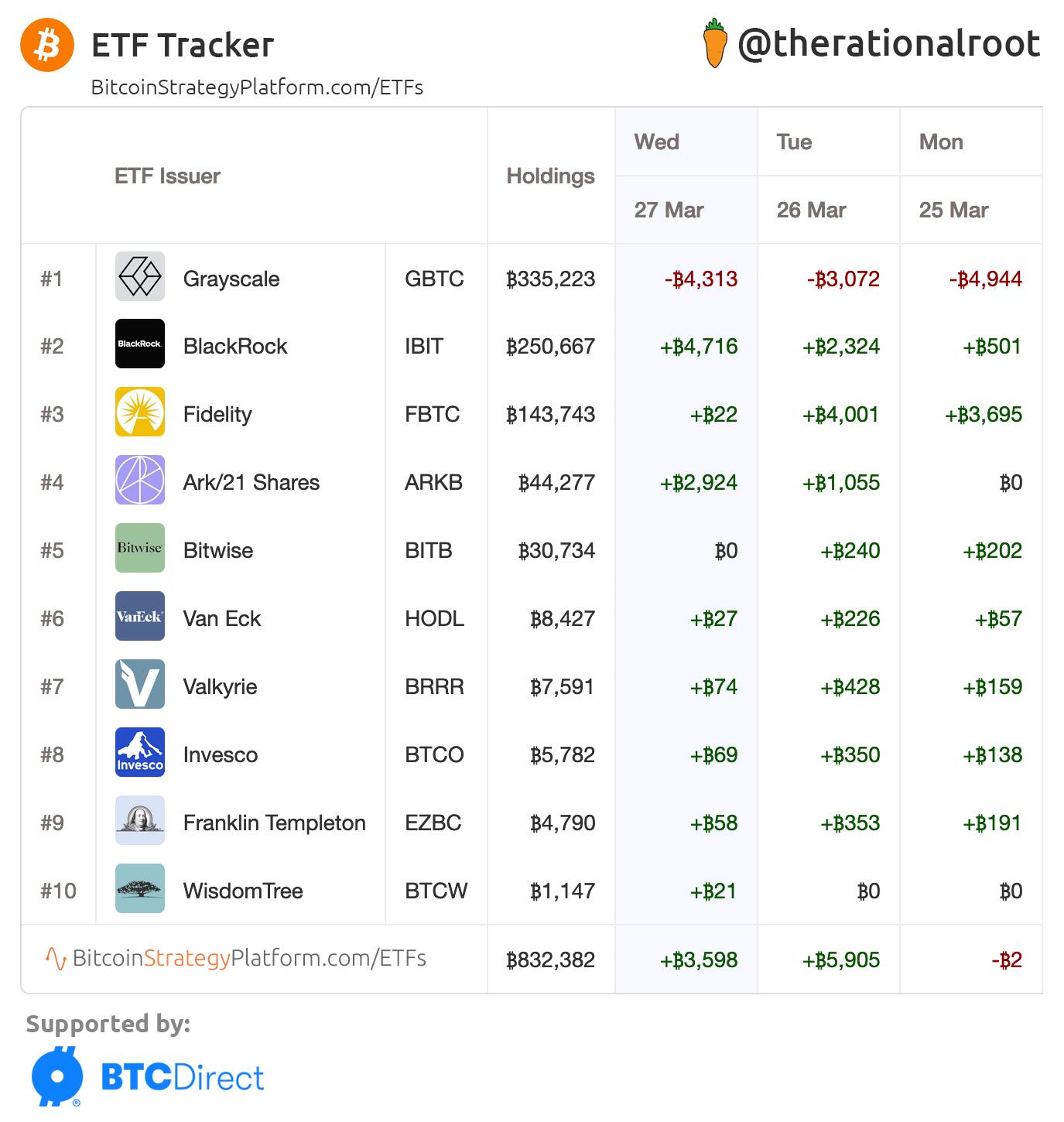

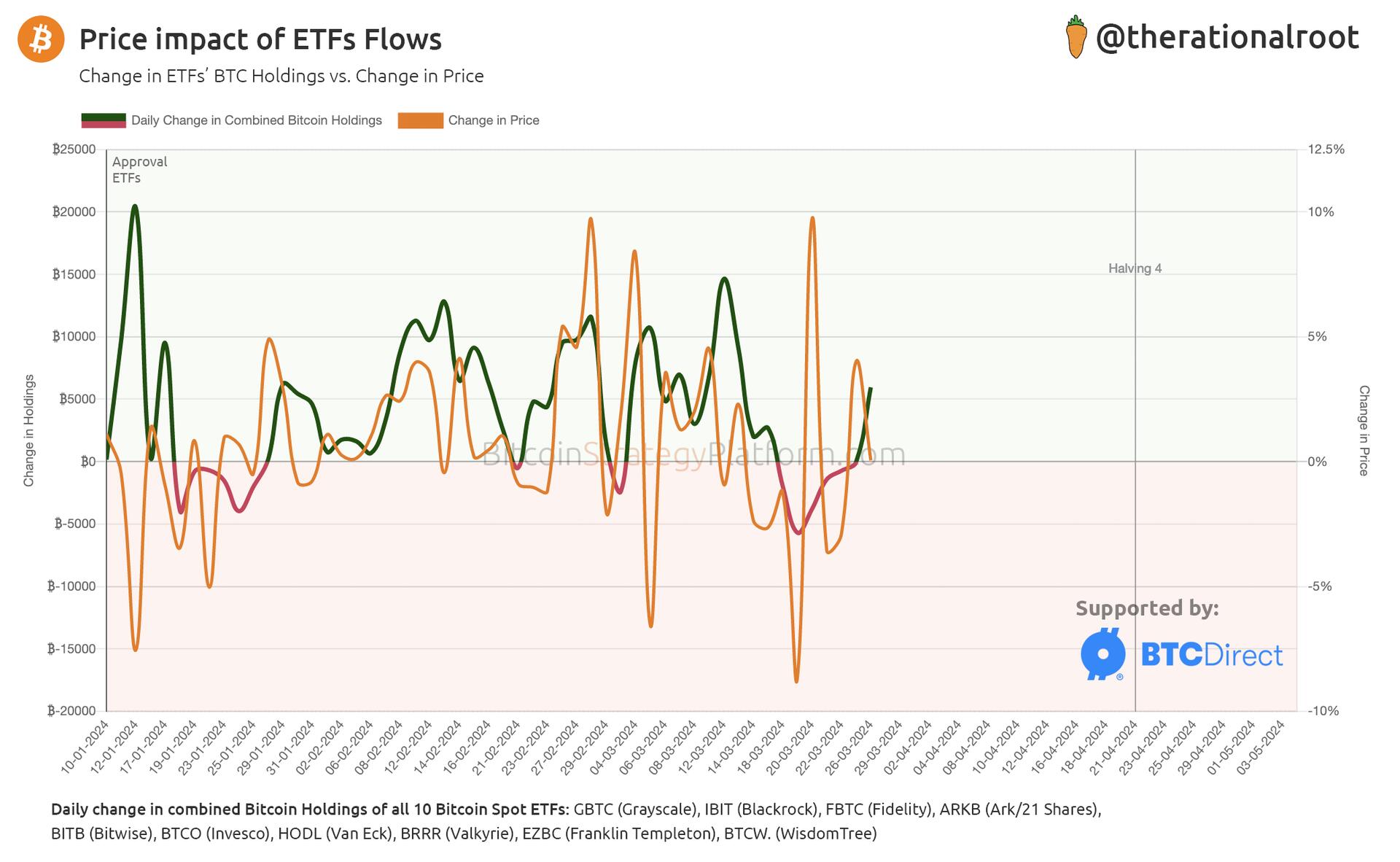

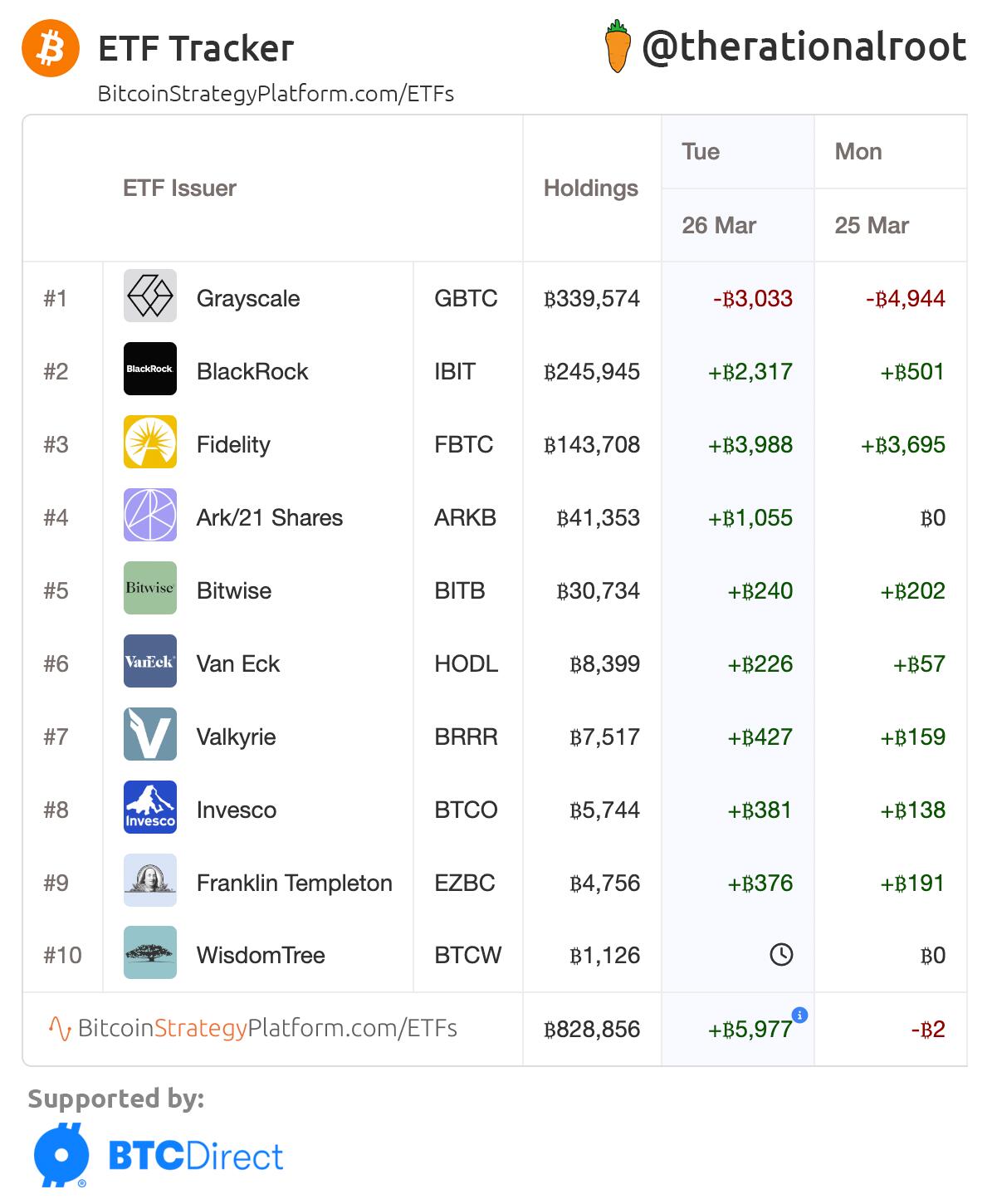

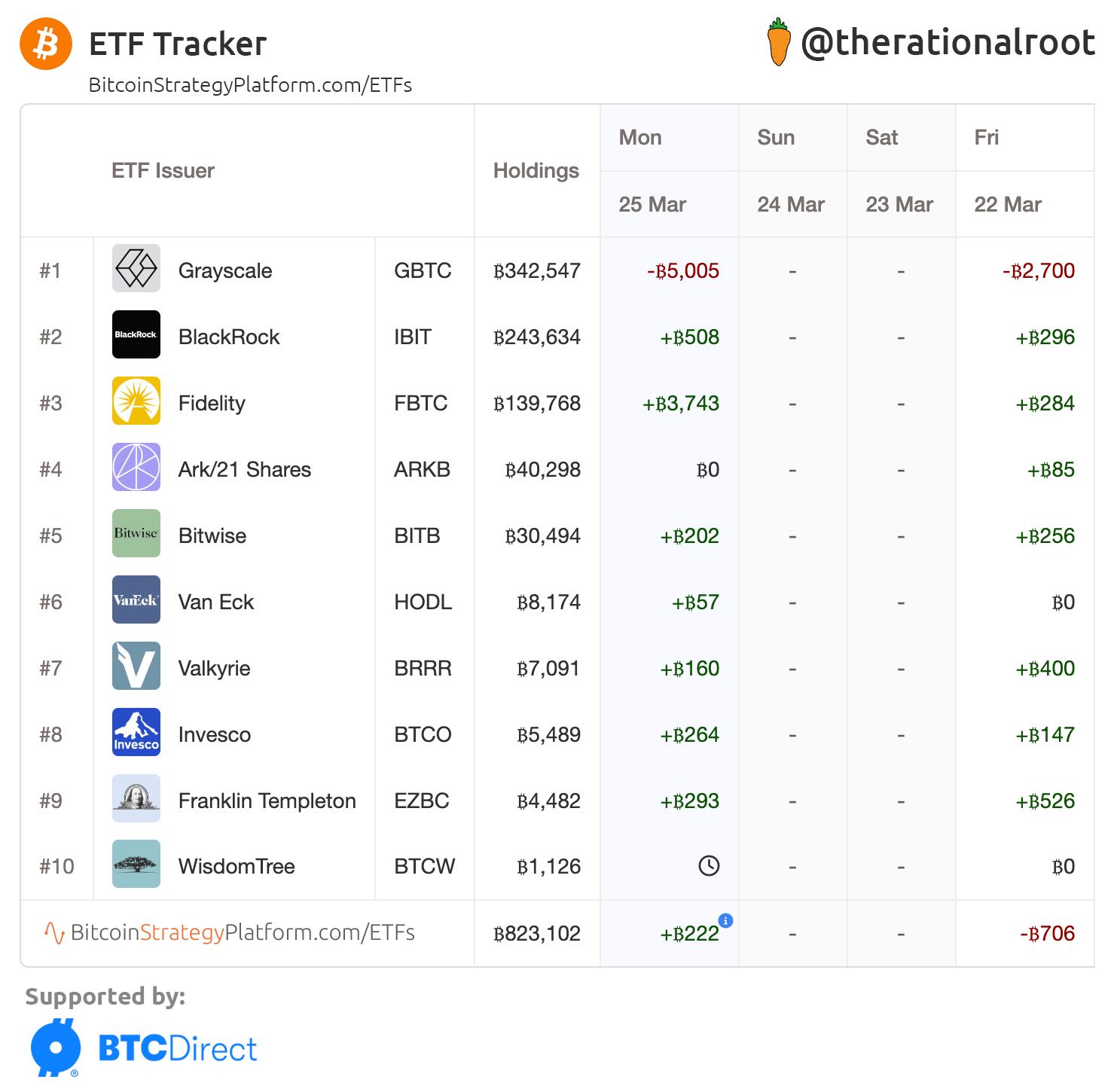

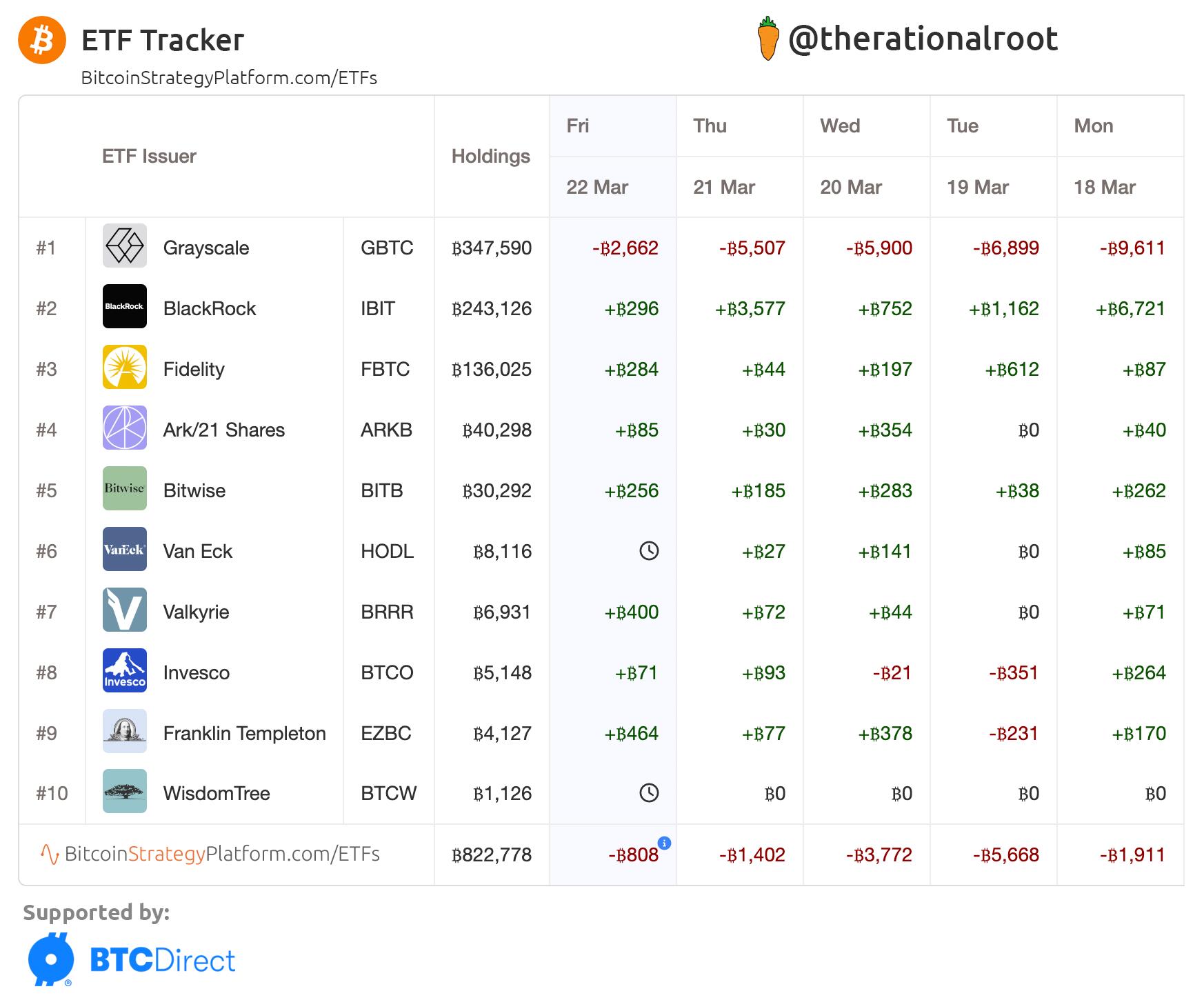

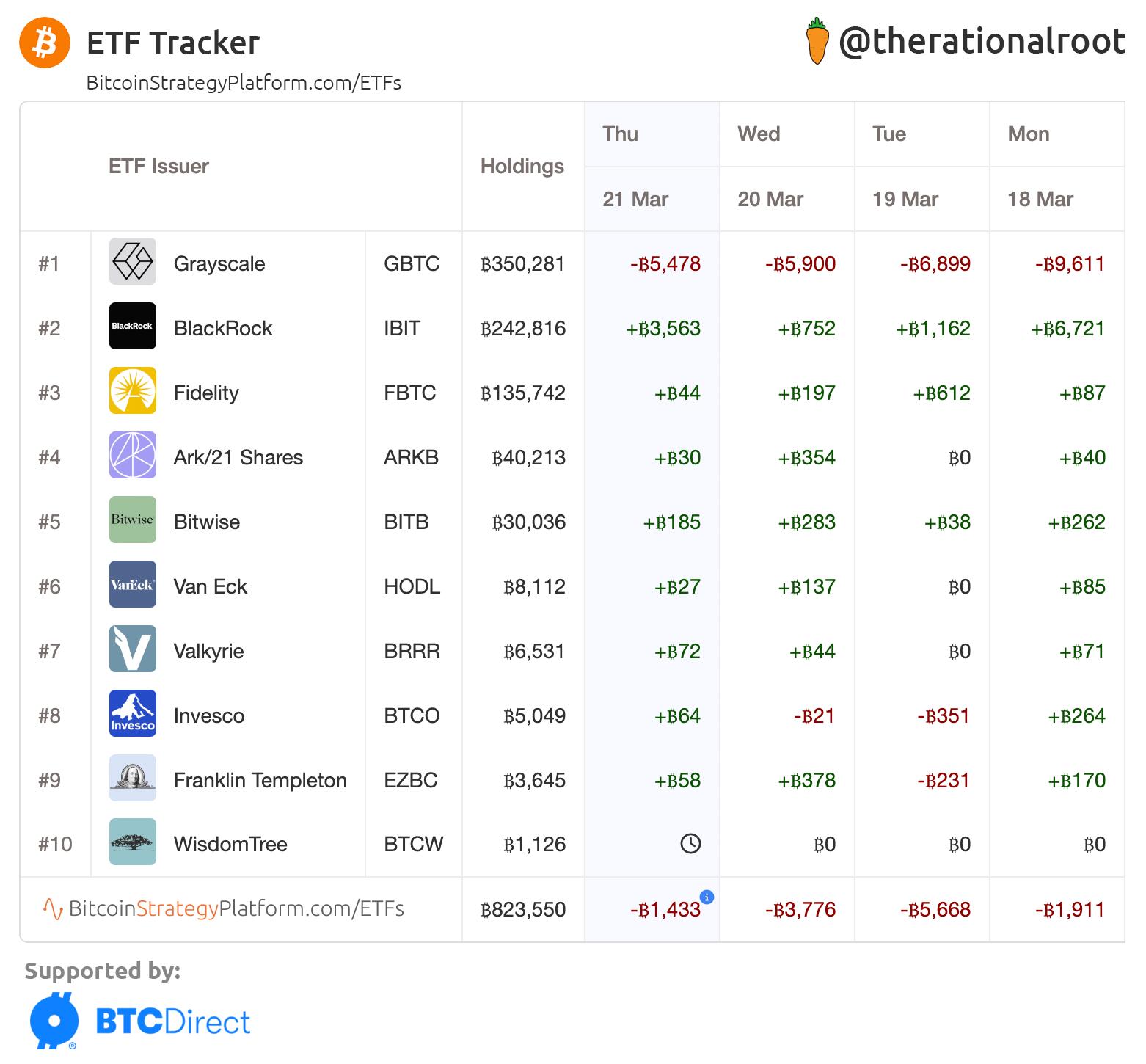

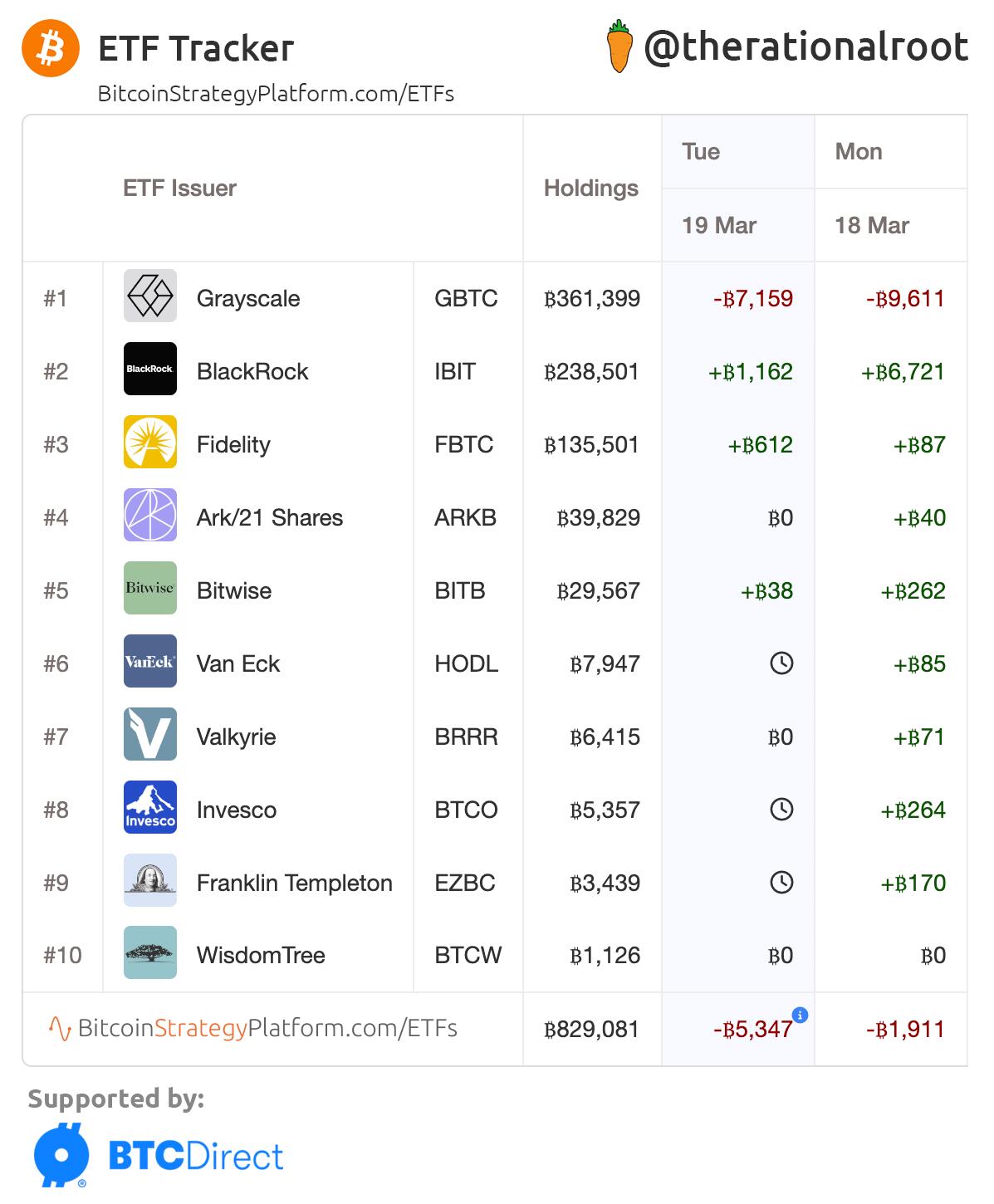

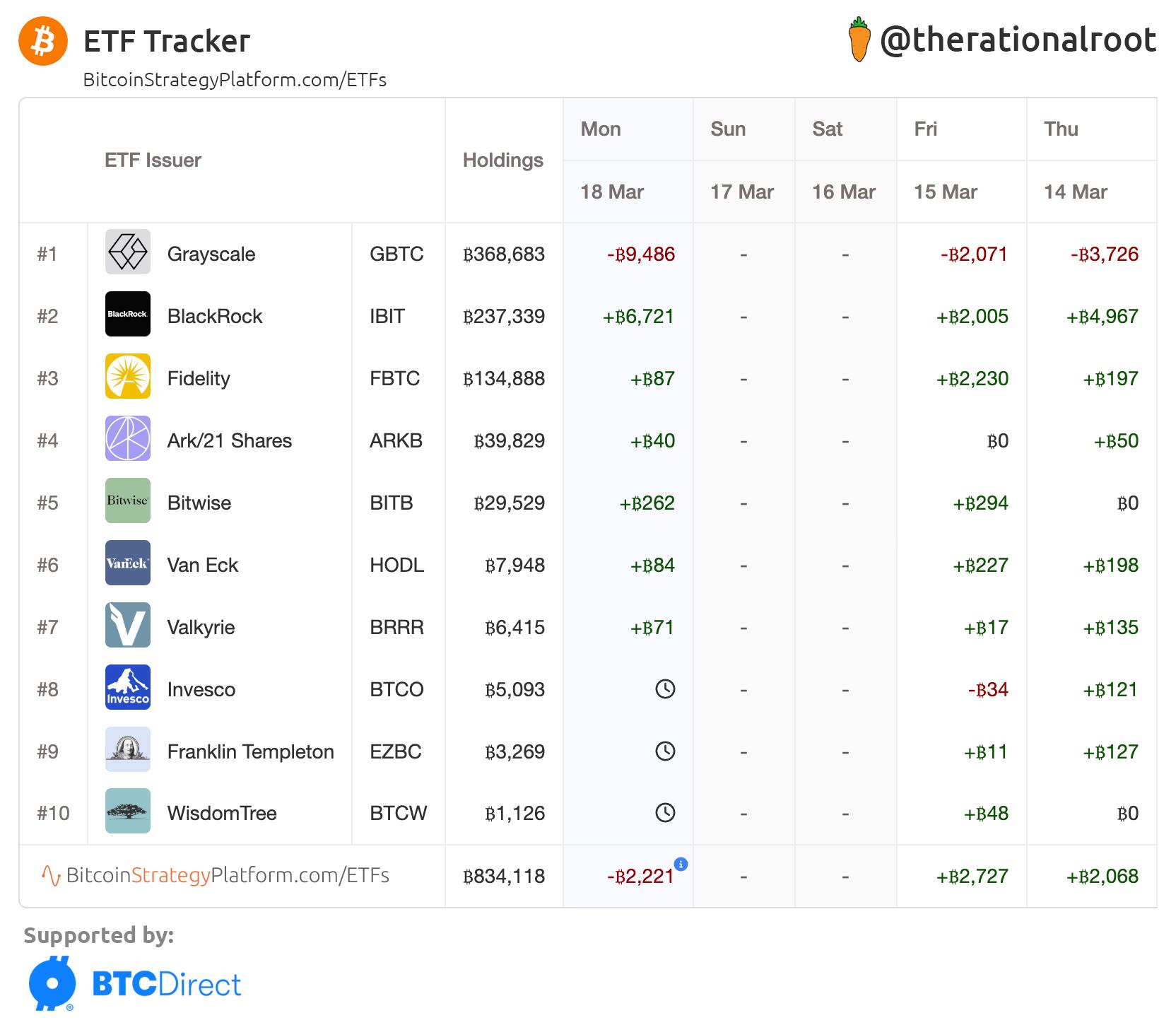

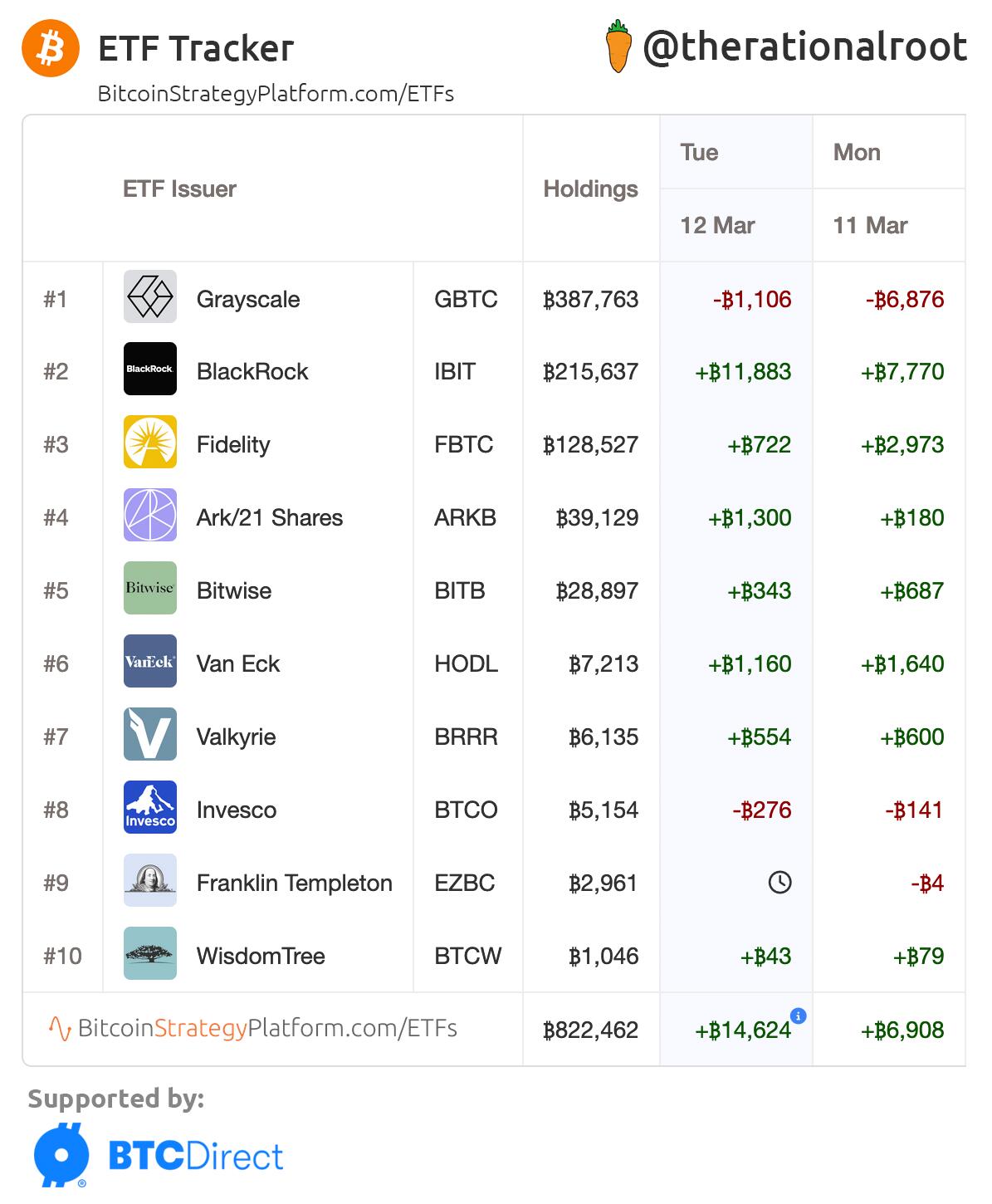

Giant GBTC outflows, 9.5k #BTC.

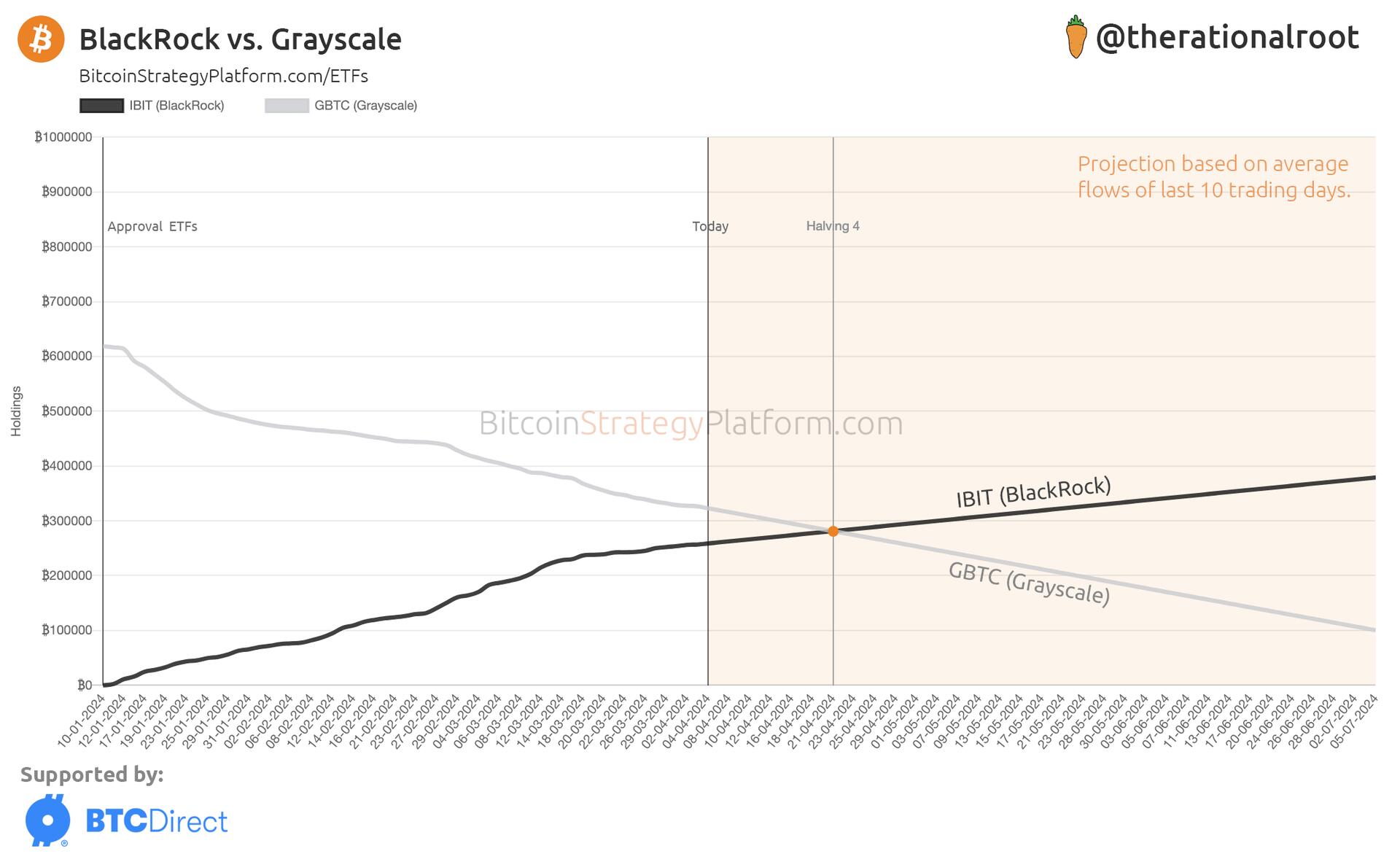

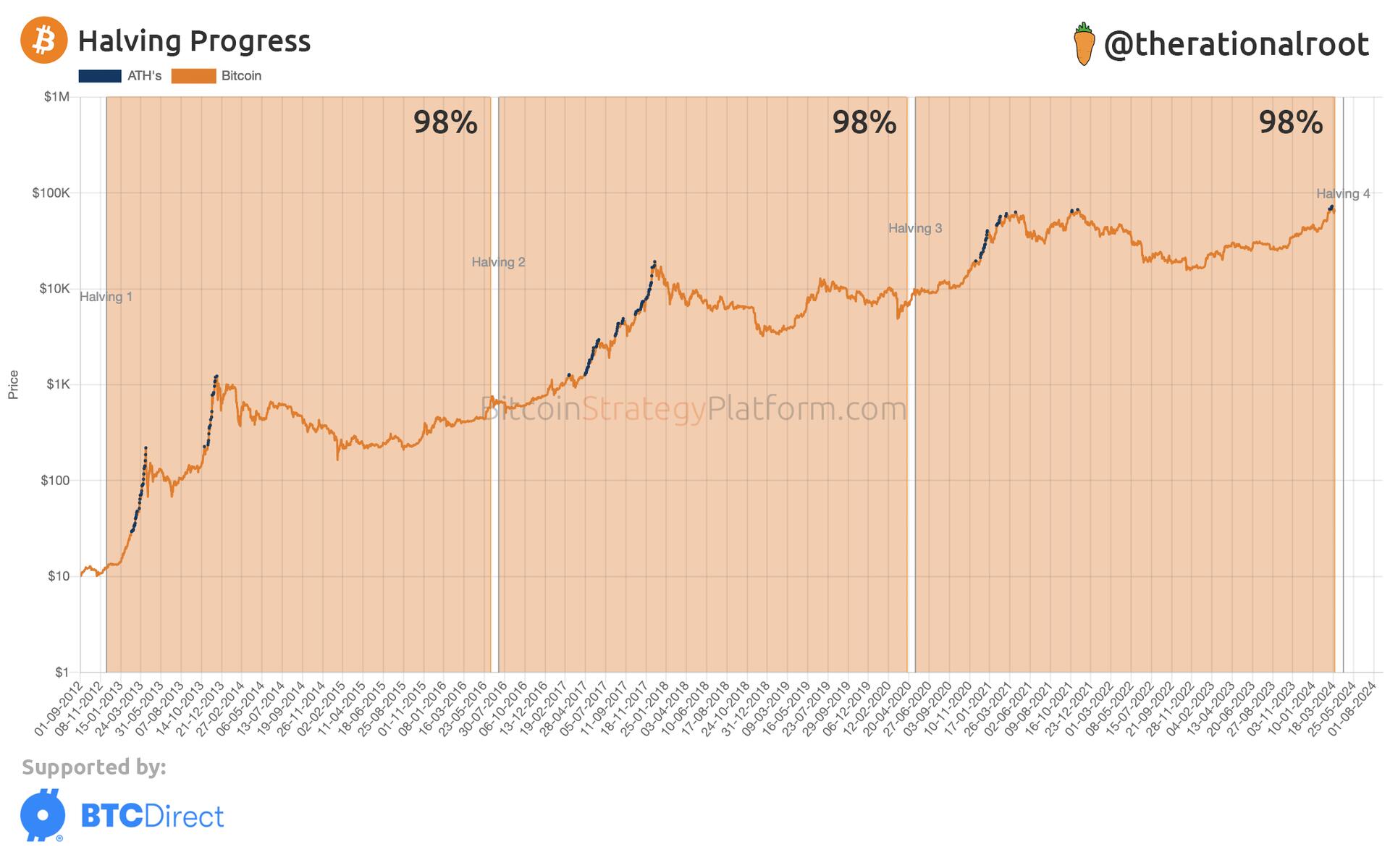

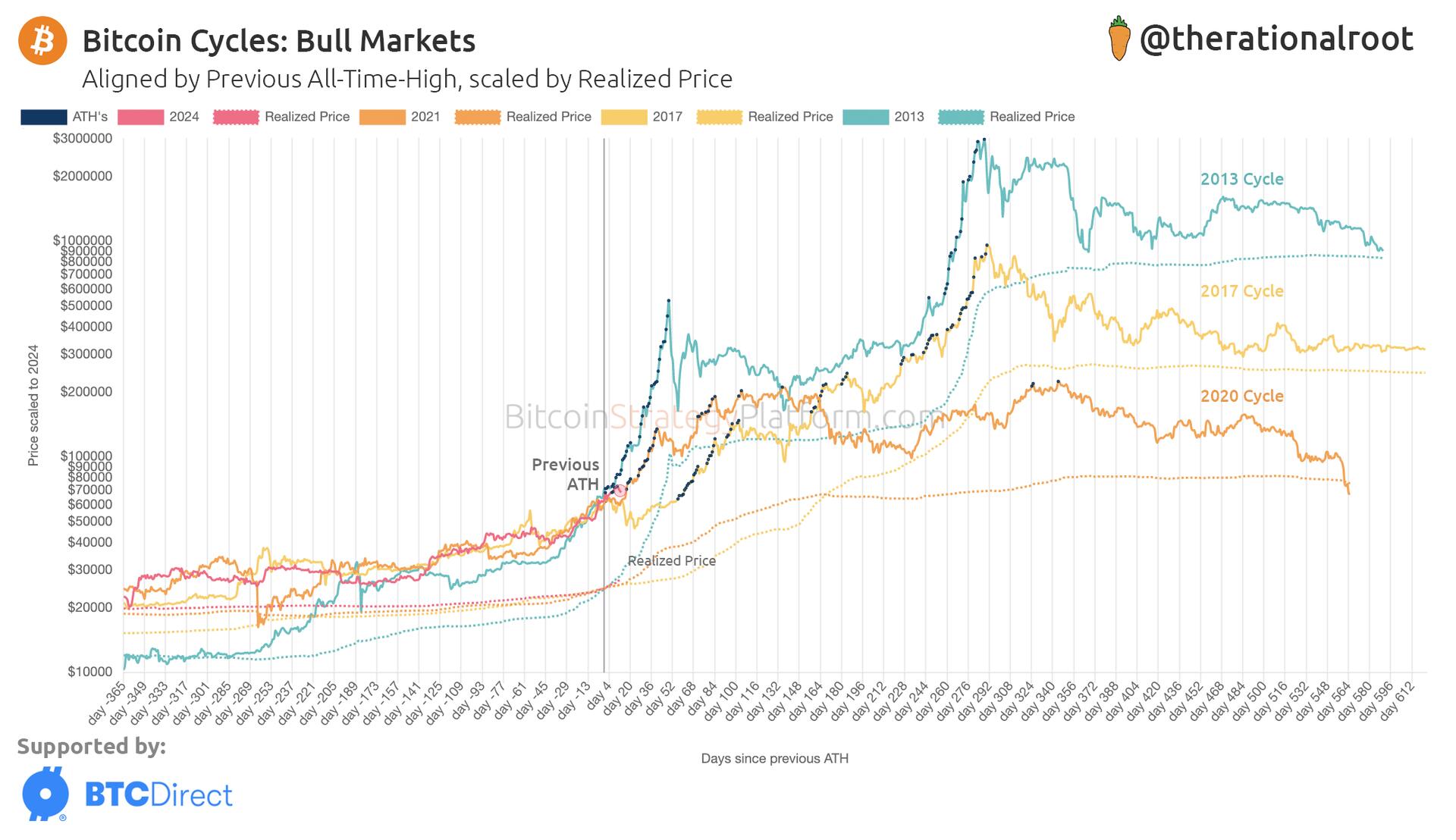

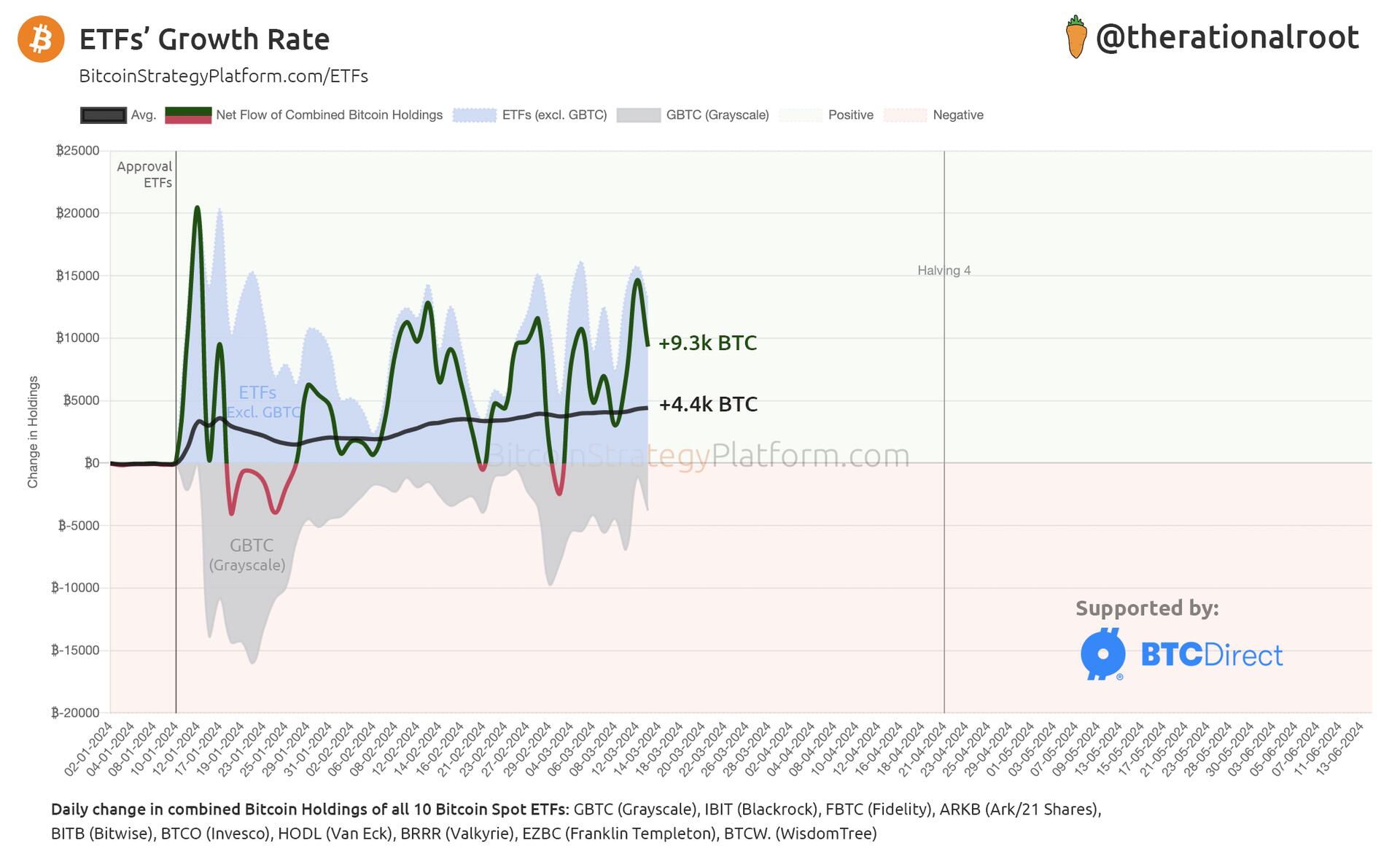

Since ETF approval, 250,000 BTC have flowed out of Grayscale. This substantial sell pressure was mostly offset by other ETFs' inflows. We were overdue for a pullback, and yesterday, and likely today, outflows are in charge.

Nonetheless, large inflows to BlackRock!