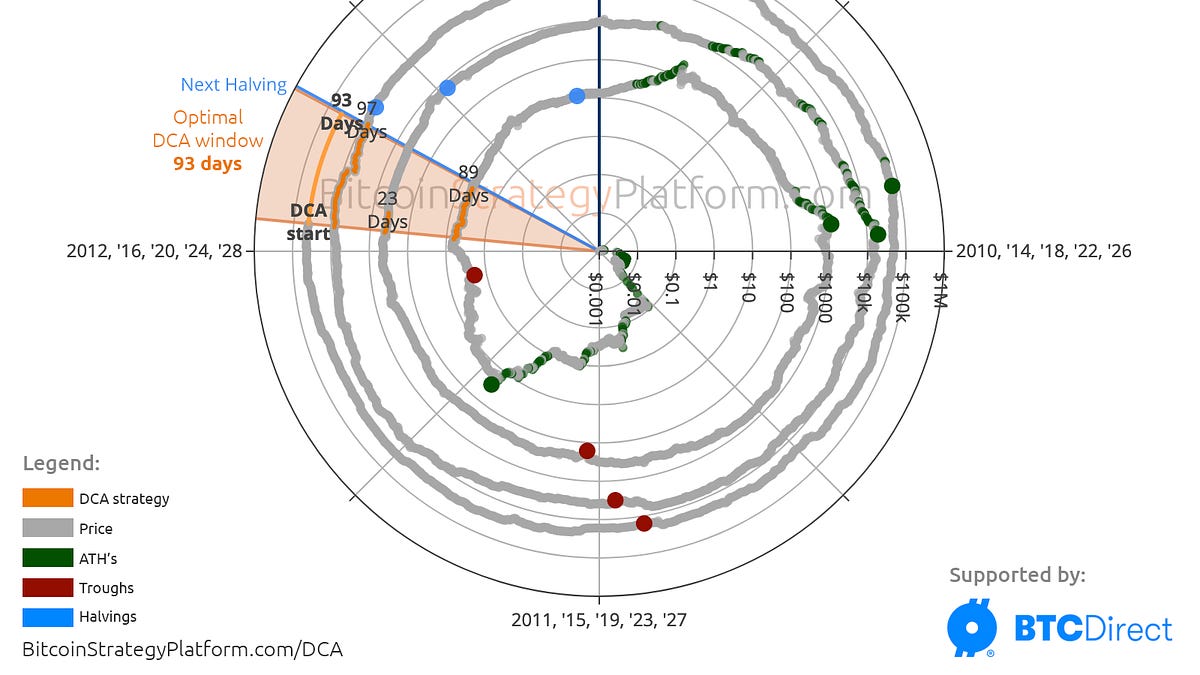

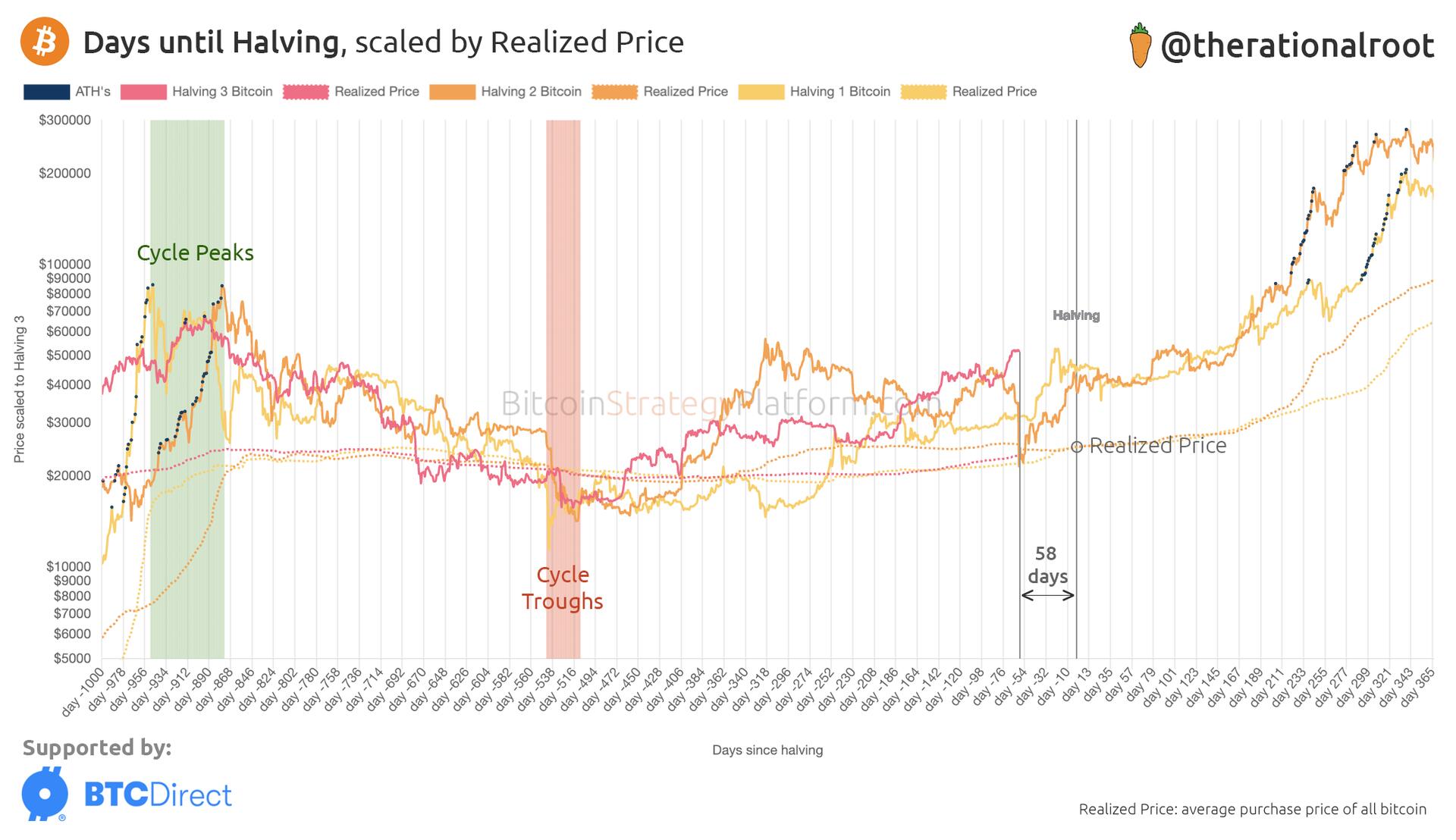

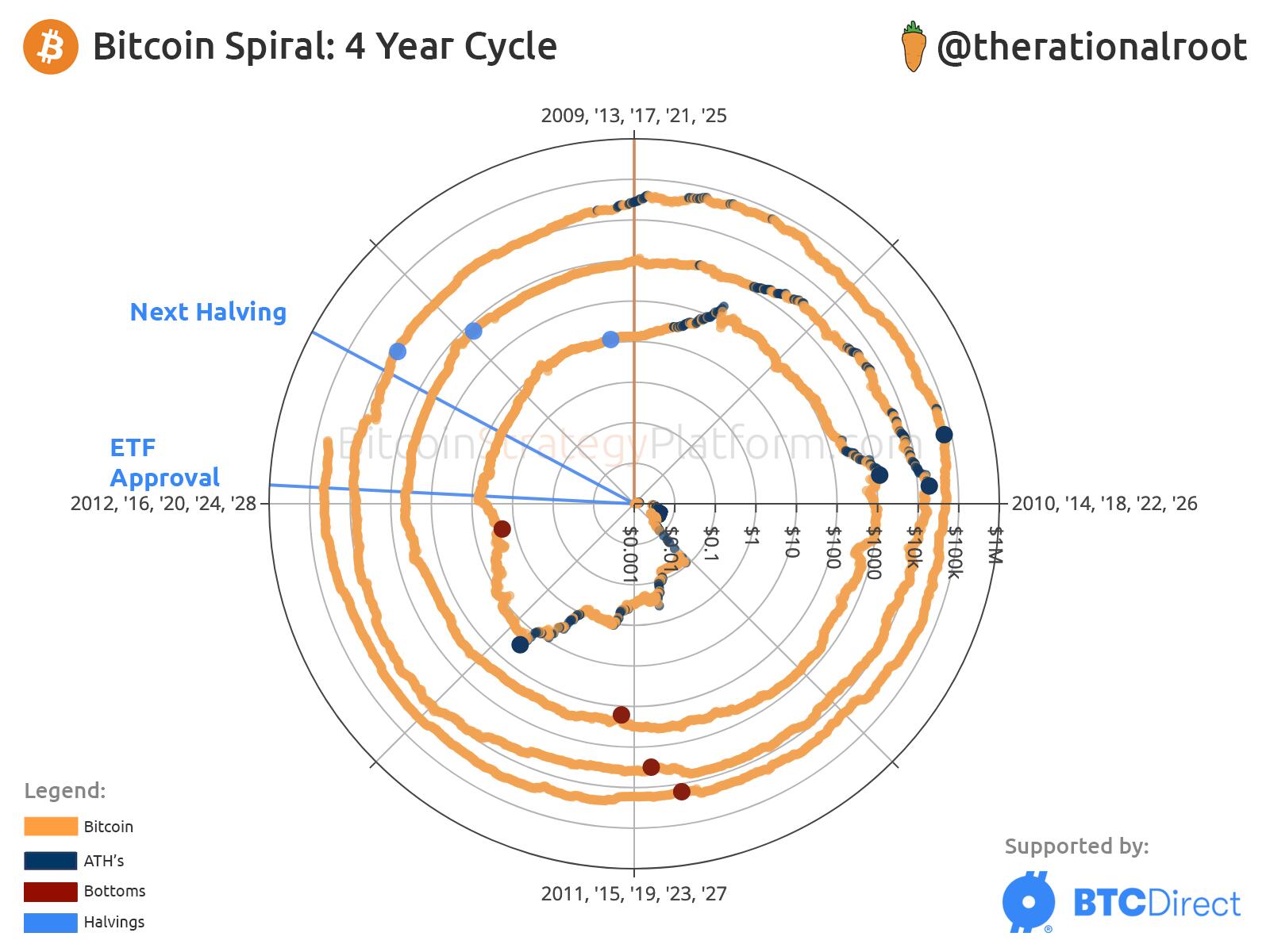

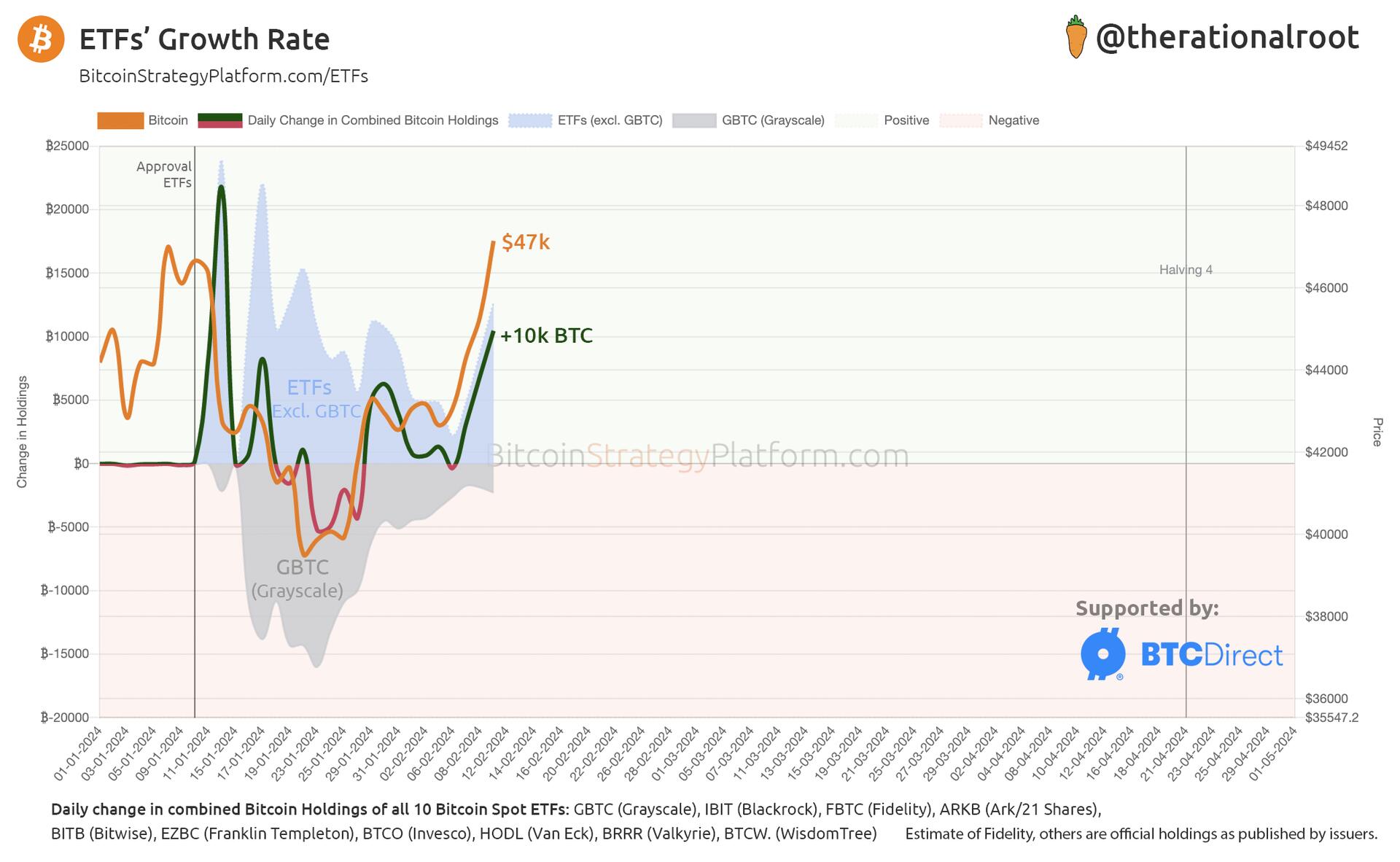

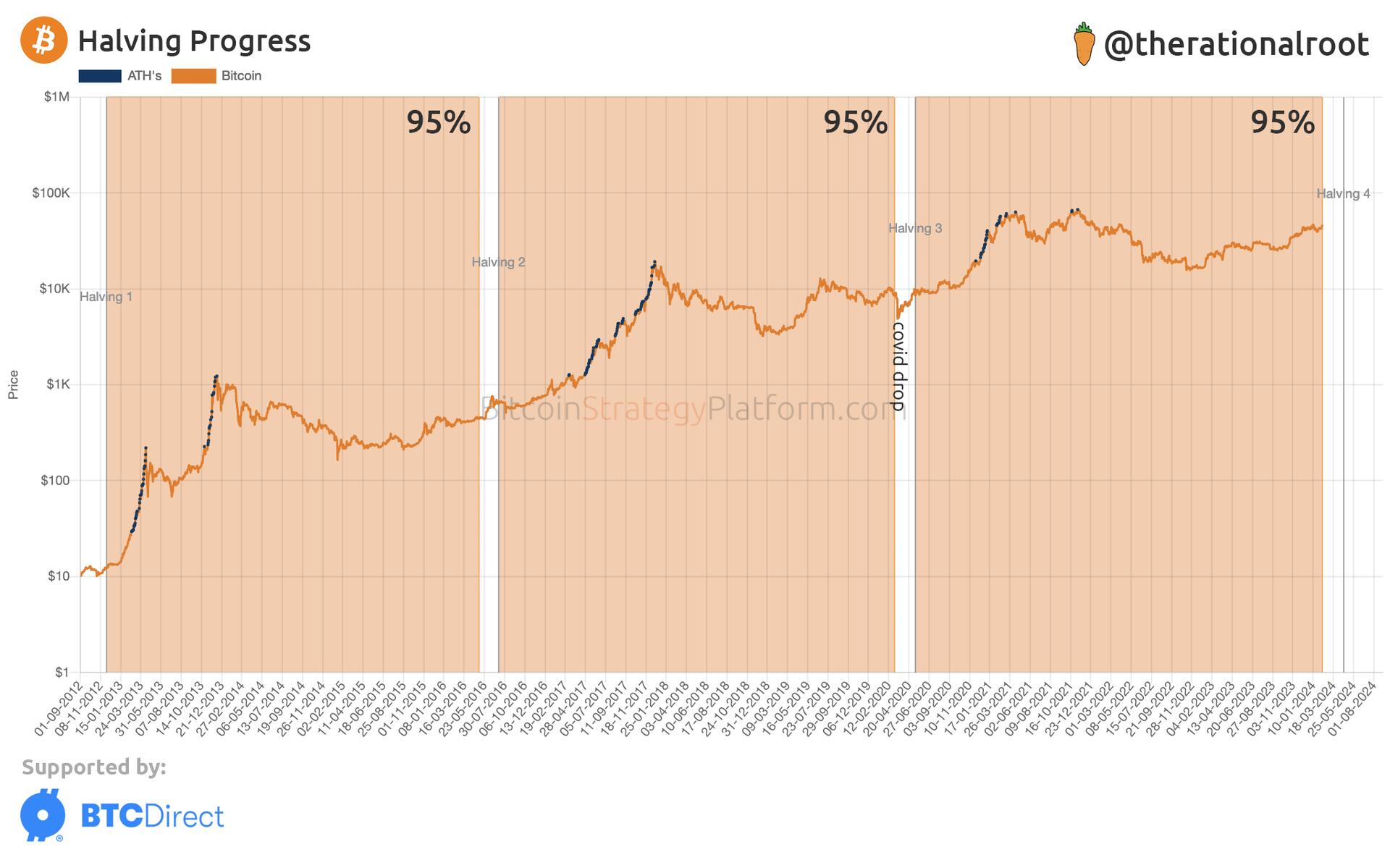

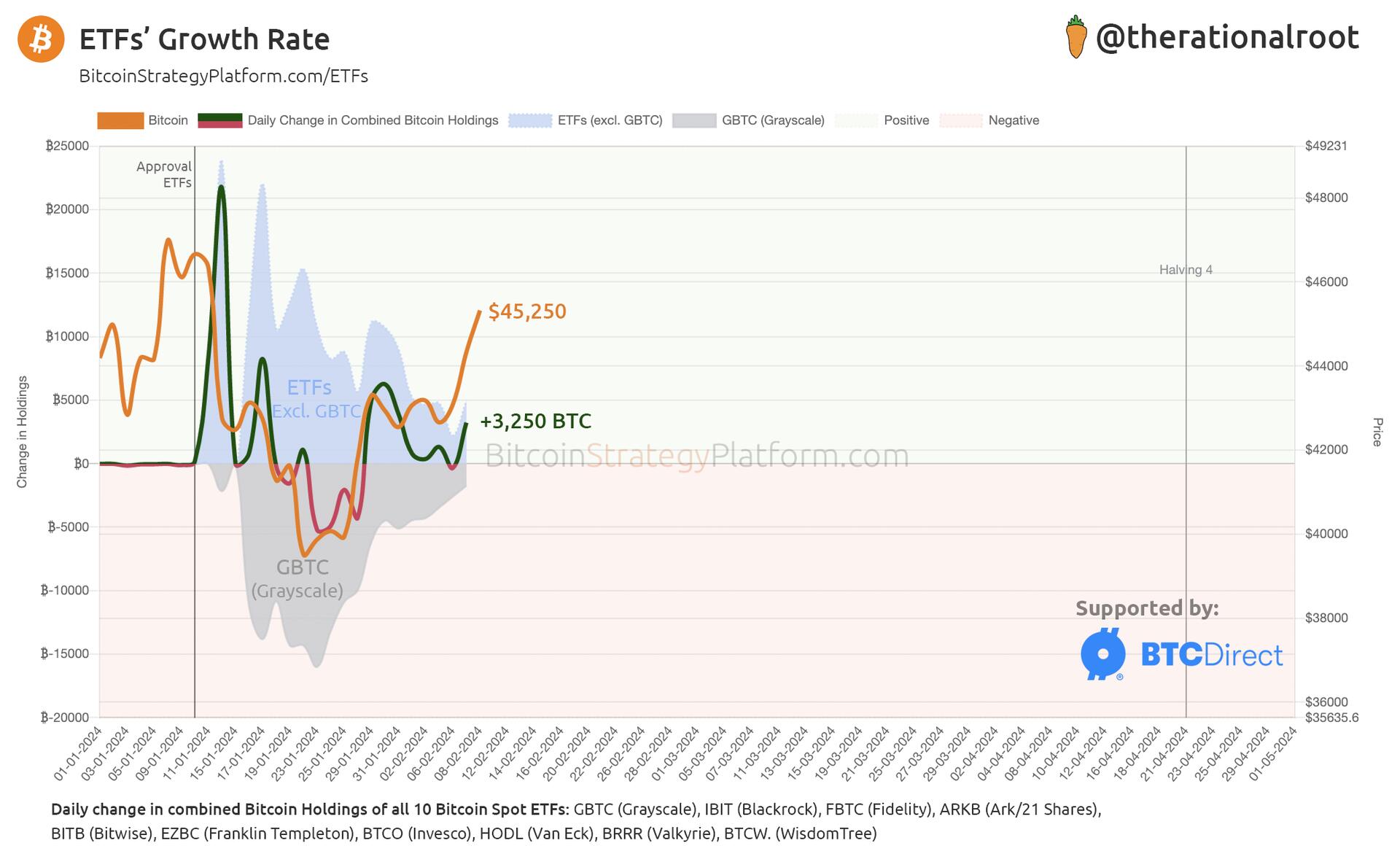

For today's investors, the optimal DCA time frame is 89 days — aimed to minimize risk and maximize profit, based on the current position in the 4-year cycle. Those adopting an 89-day DCA, even at the least opportune moment, were in profit within 3 years! #Bitcoin

Disclaimer: historical performance doesn't assure future results.

cc:

@preston

cc: @preston

cc: @preston