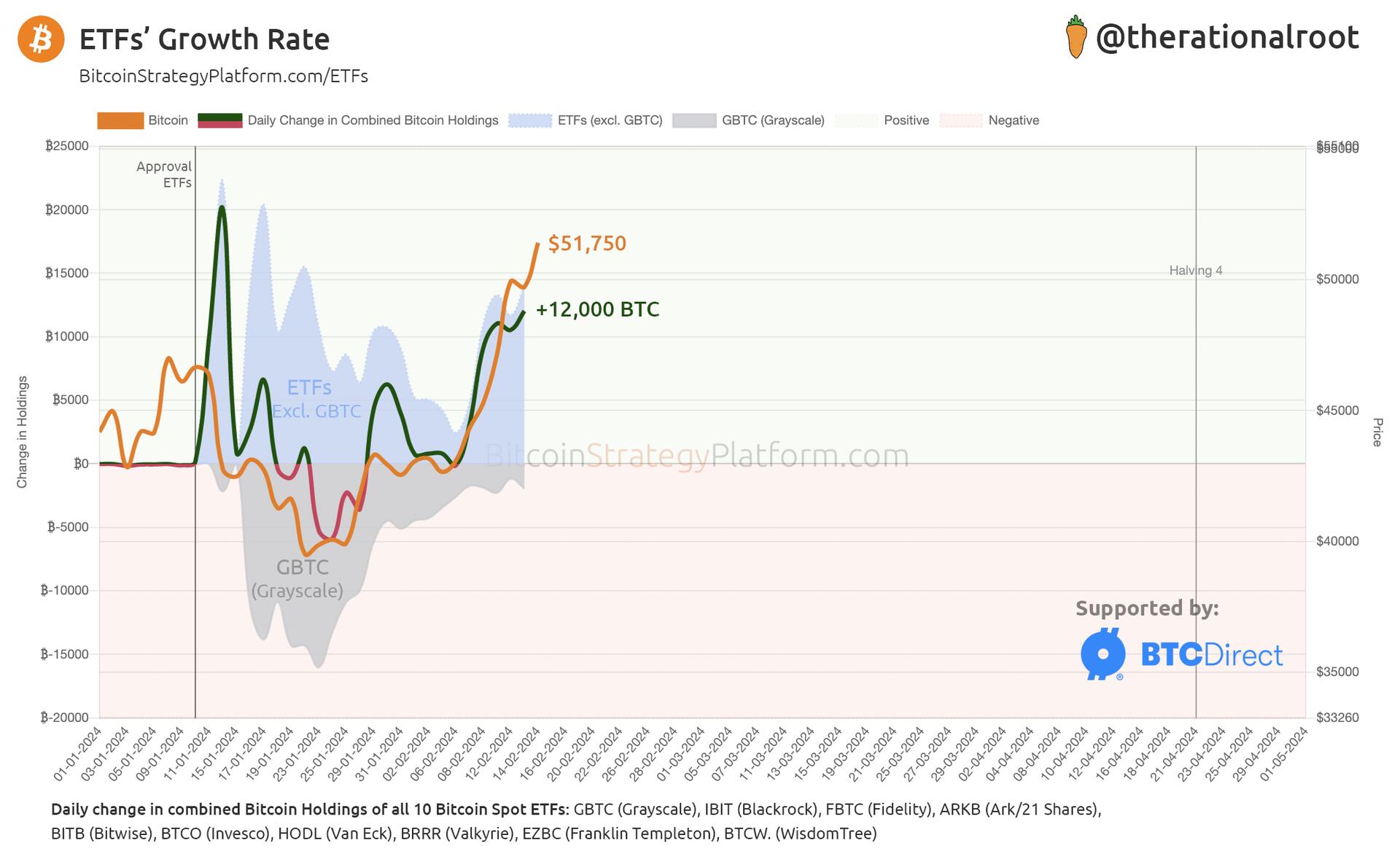

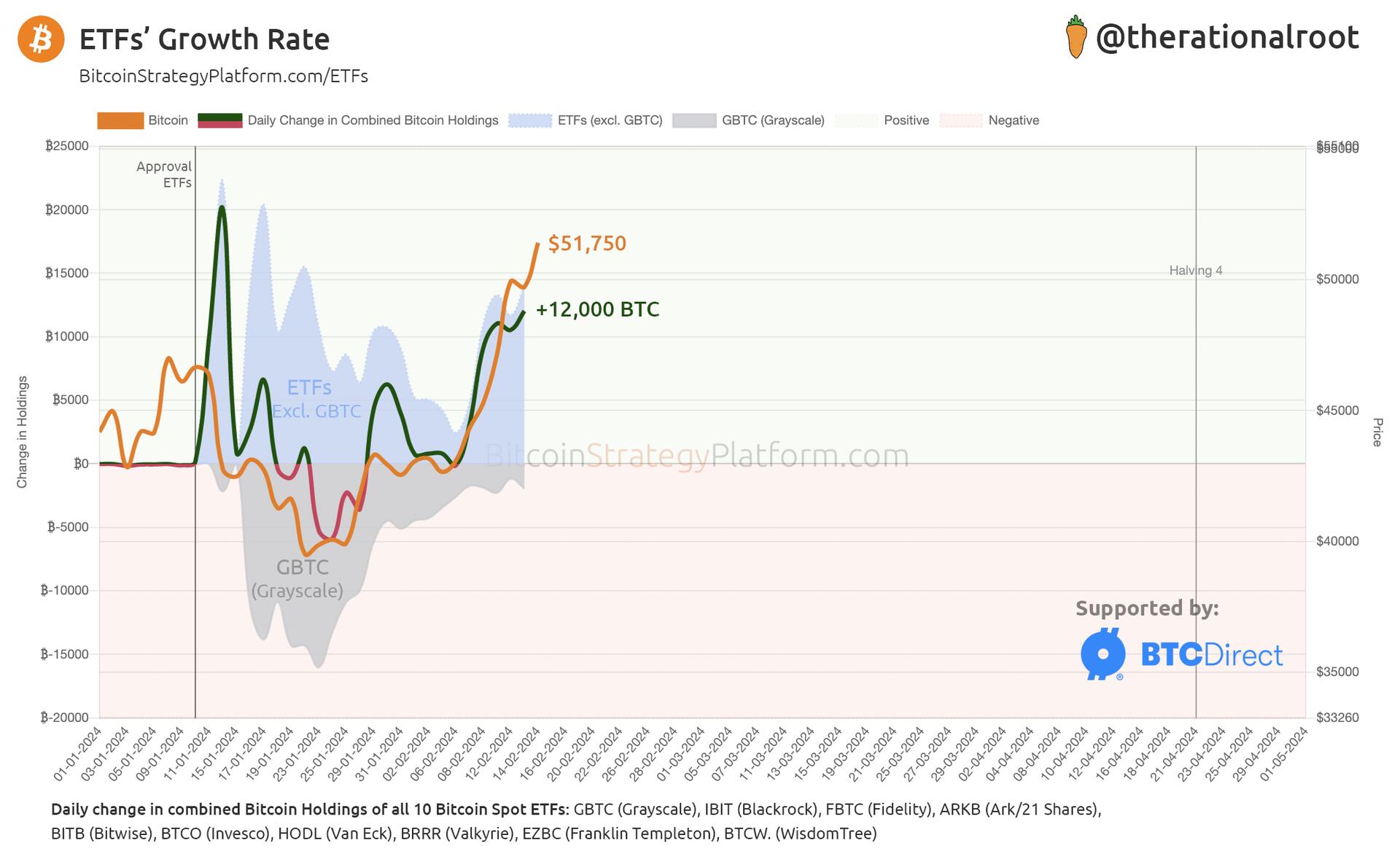

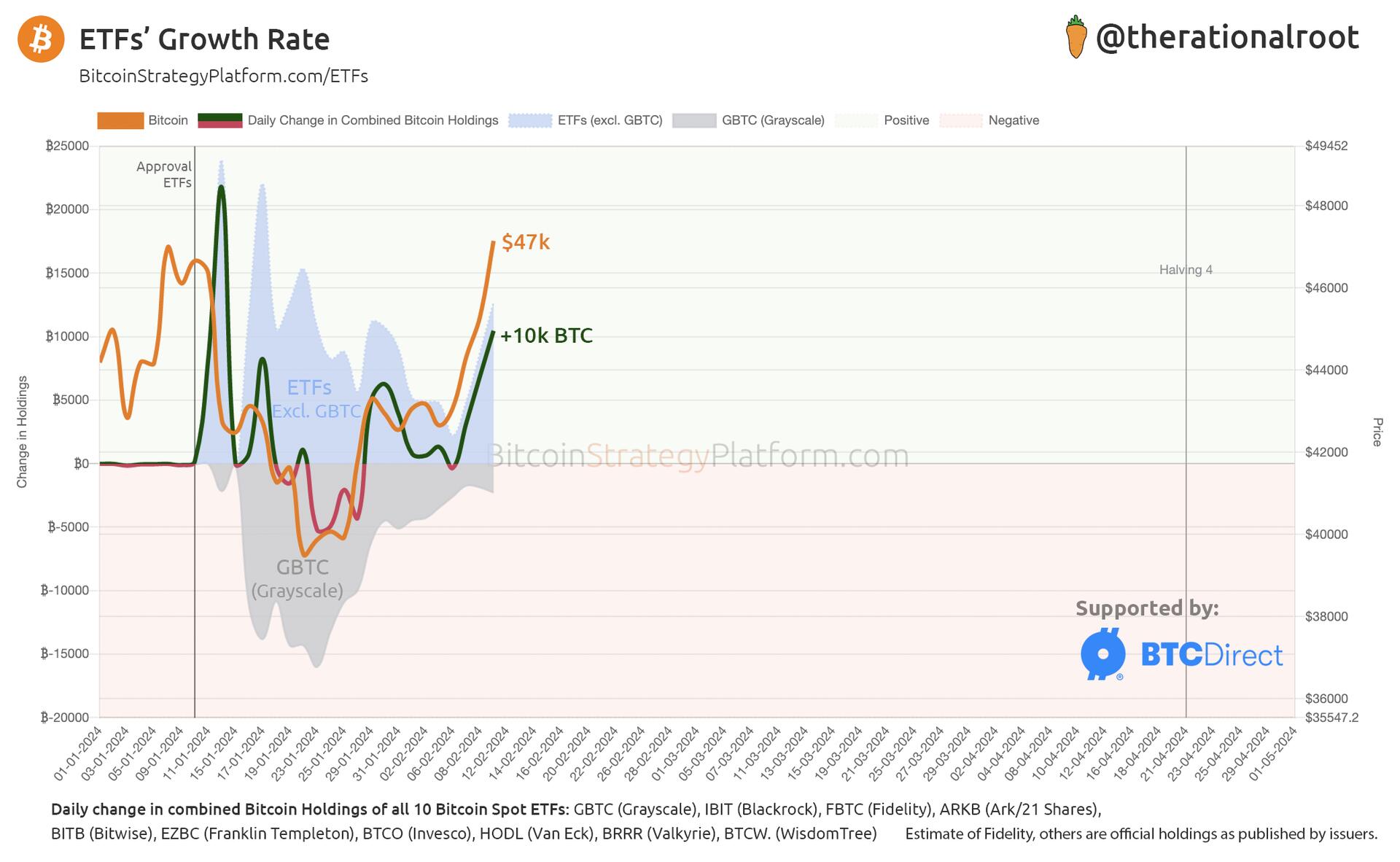

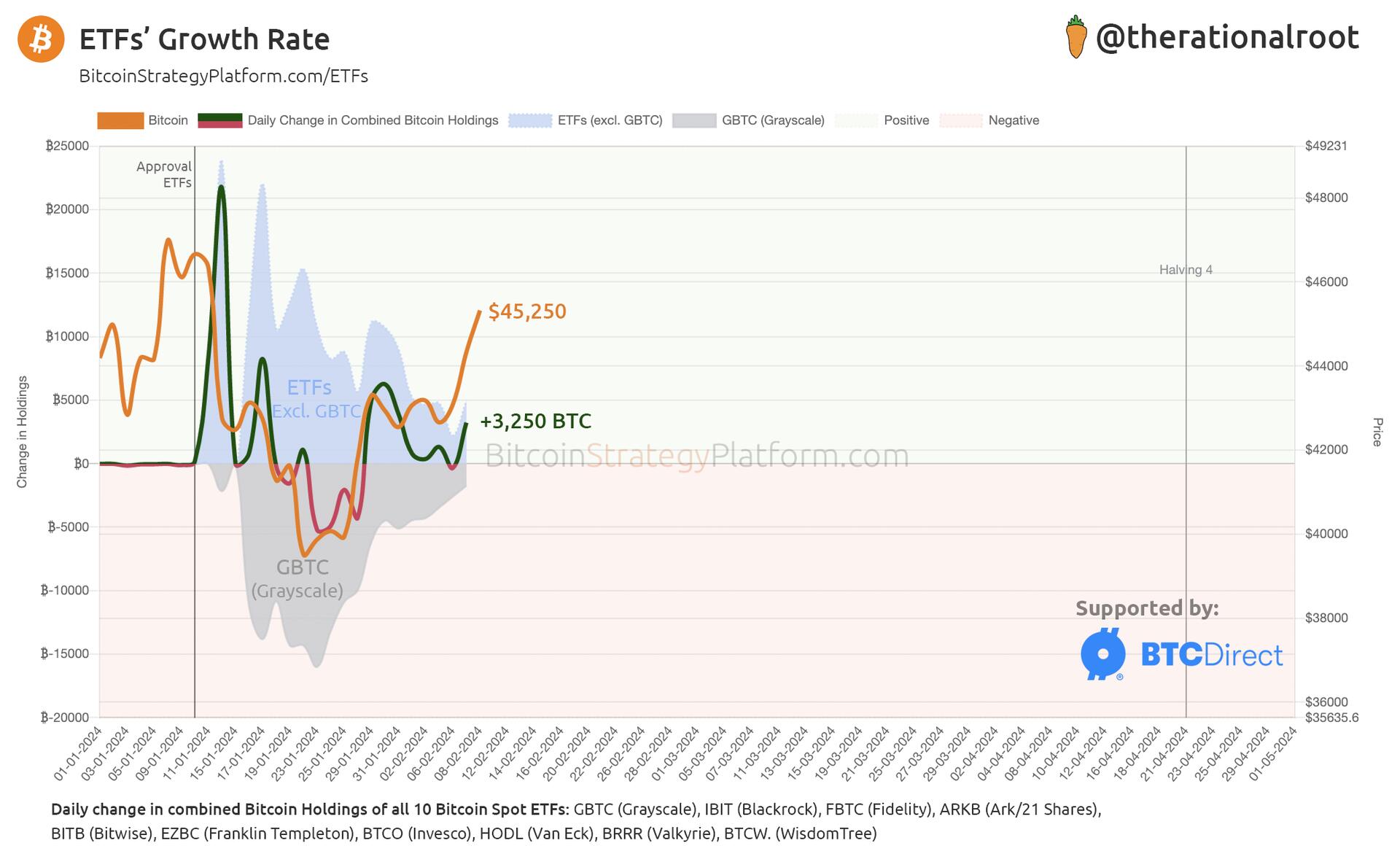

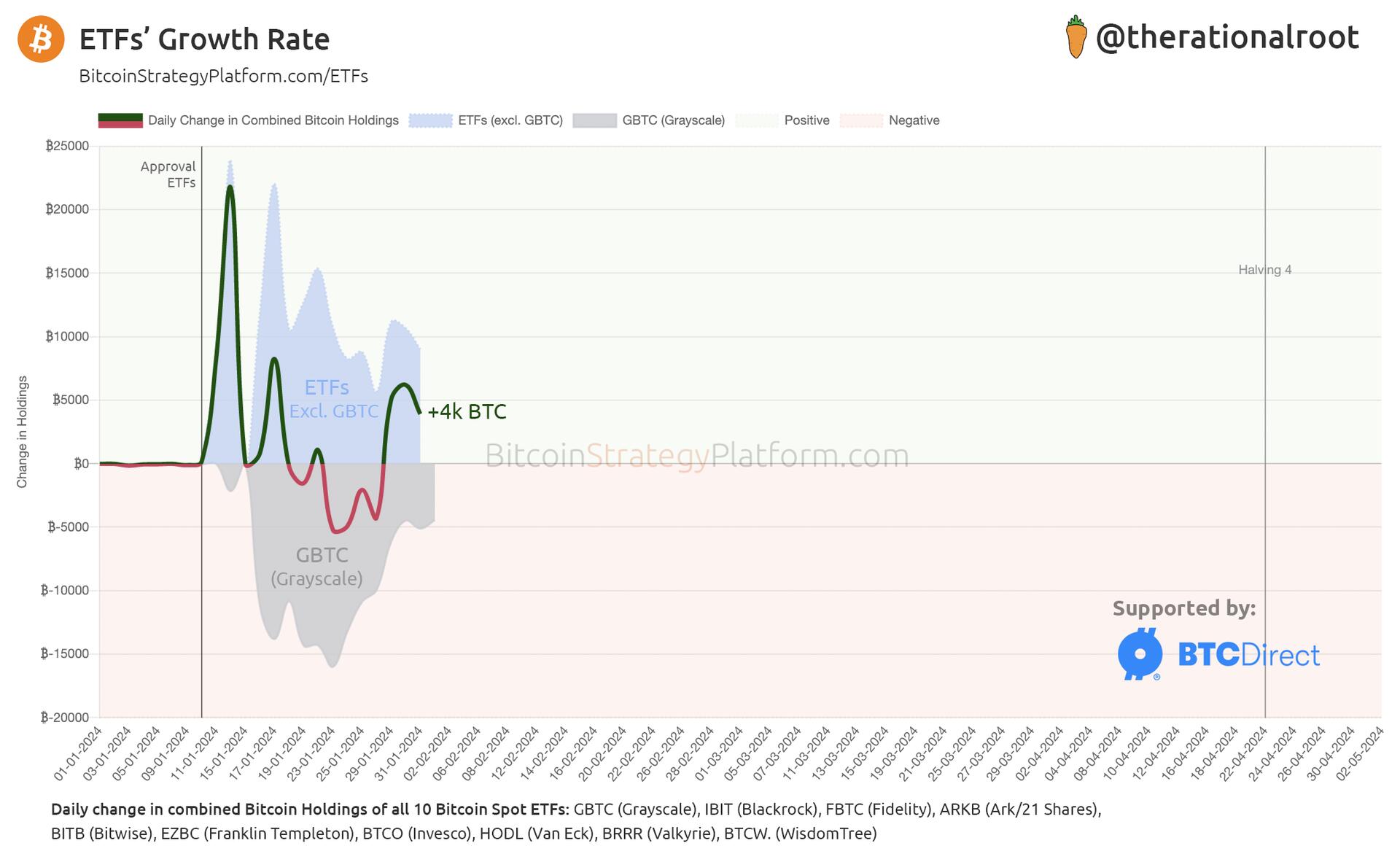

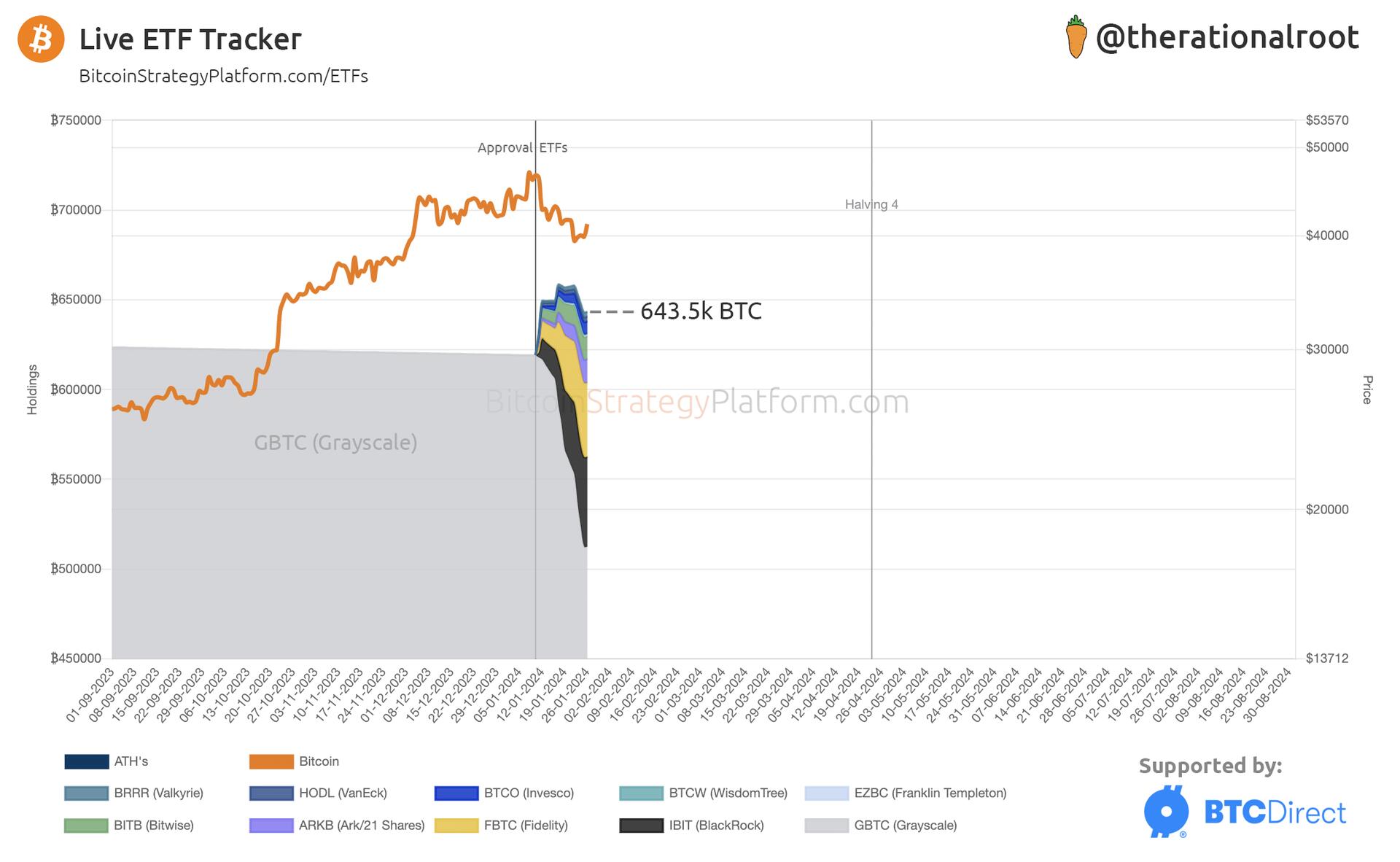

Enormous ETF inflows, net +12k #BTC were added yesterday.

- BlackRock alone saw a 10k btc inflow, and now surpassed 100k btc in holdings 🤯.

- Biggest outflows were from Grayscale (1.9k) and Invesco (~500 btc).

- Three consecutive days over +10k net inflows.

Follow me for more ETF news 👊

cc:

cc: