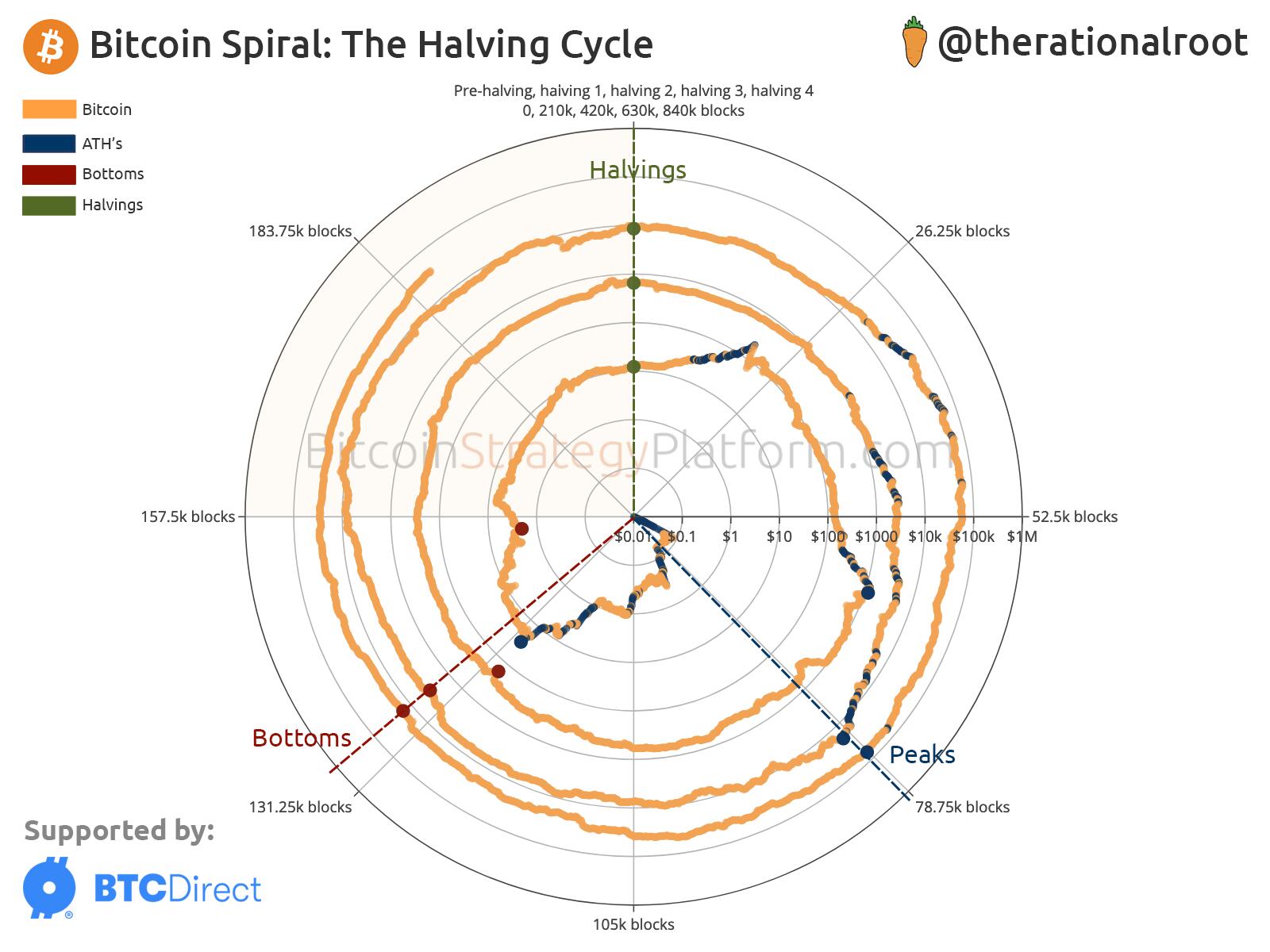

Ever wondered where and when people buy their Bitcoin?

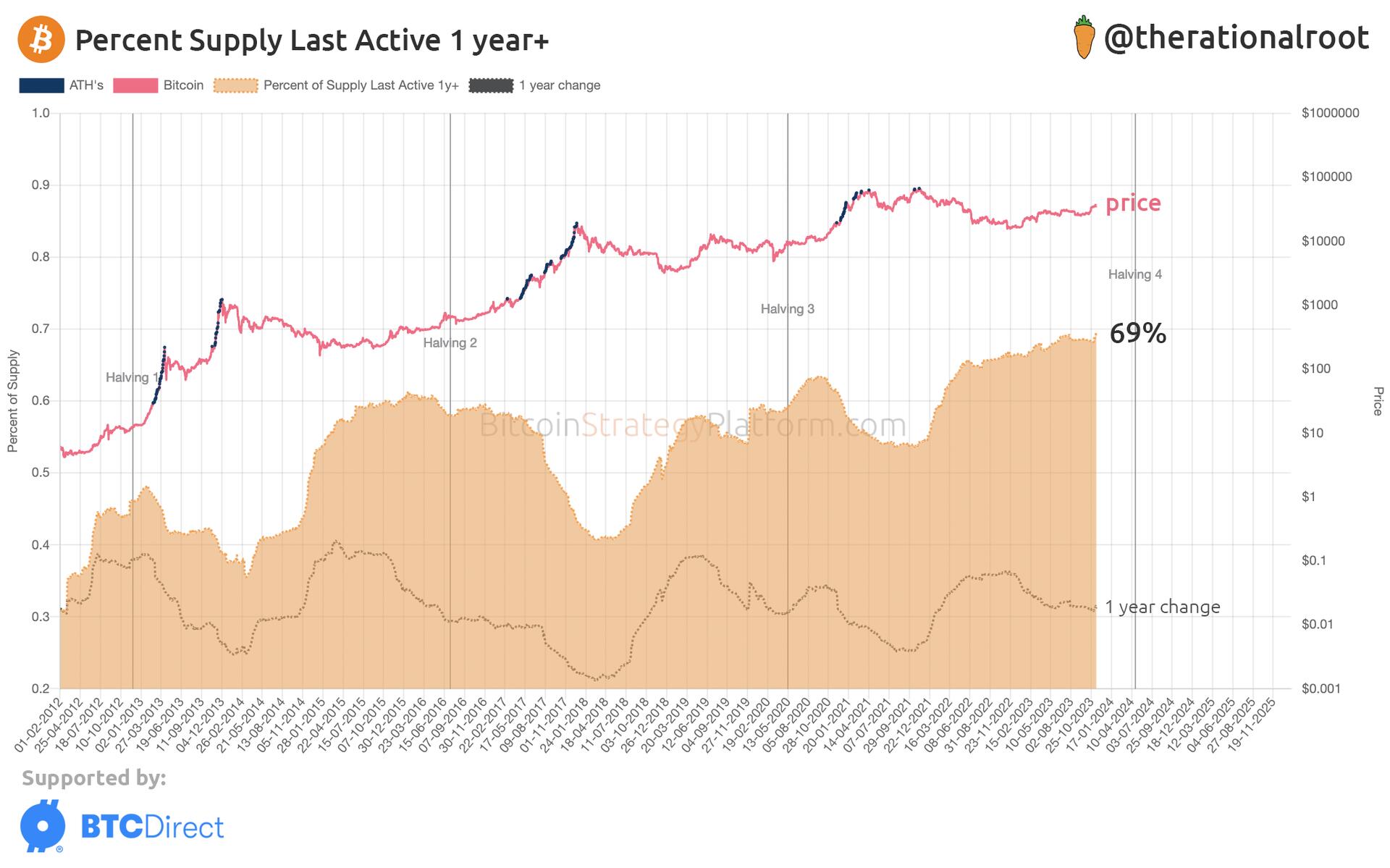

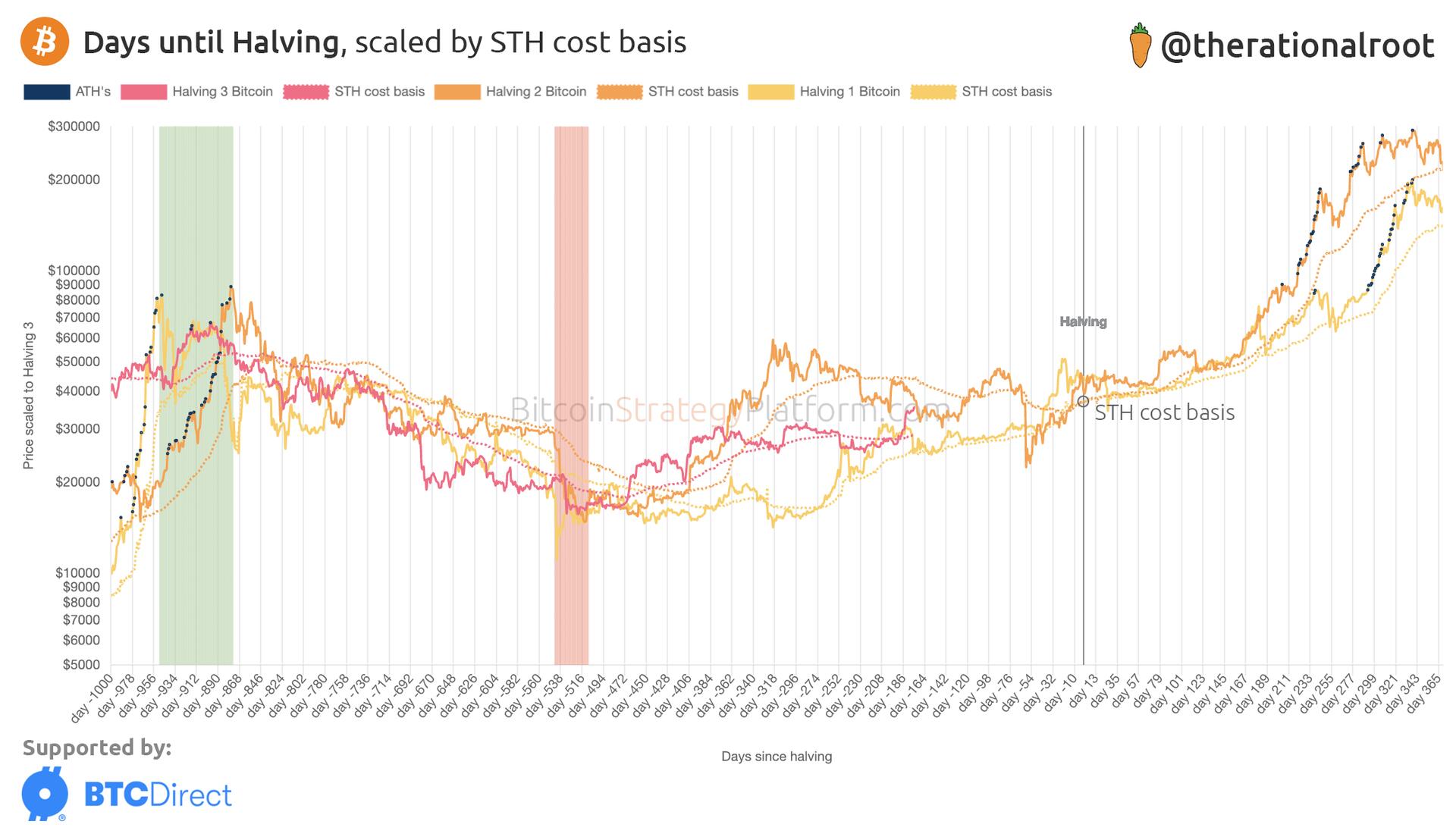

Around 24% of Bitcoin’s supply has been traded proximate to current price levels.

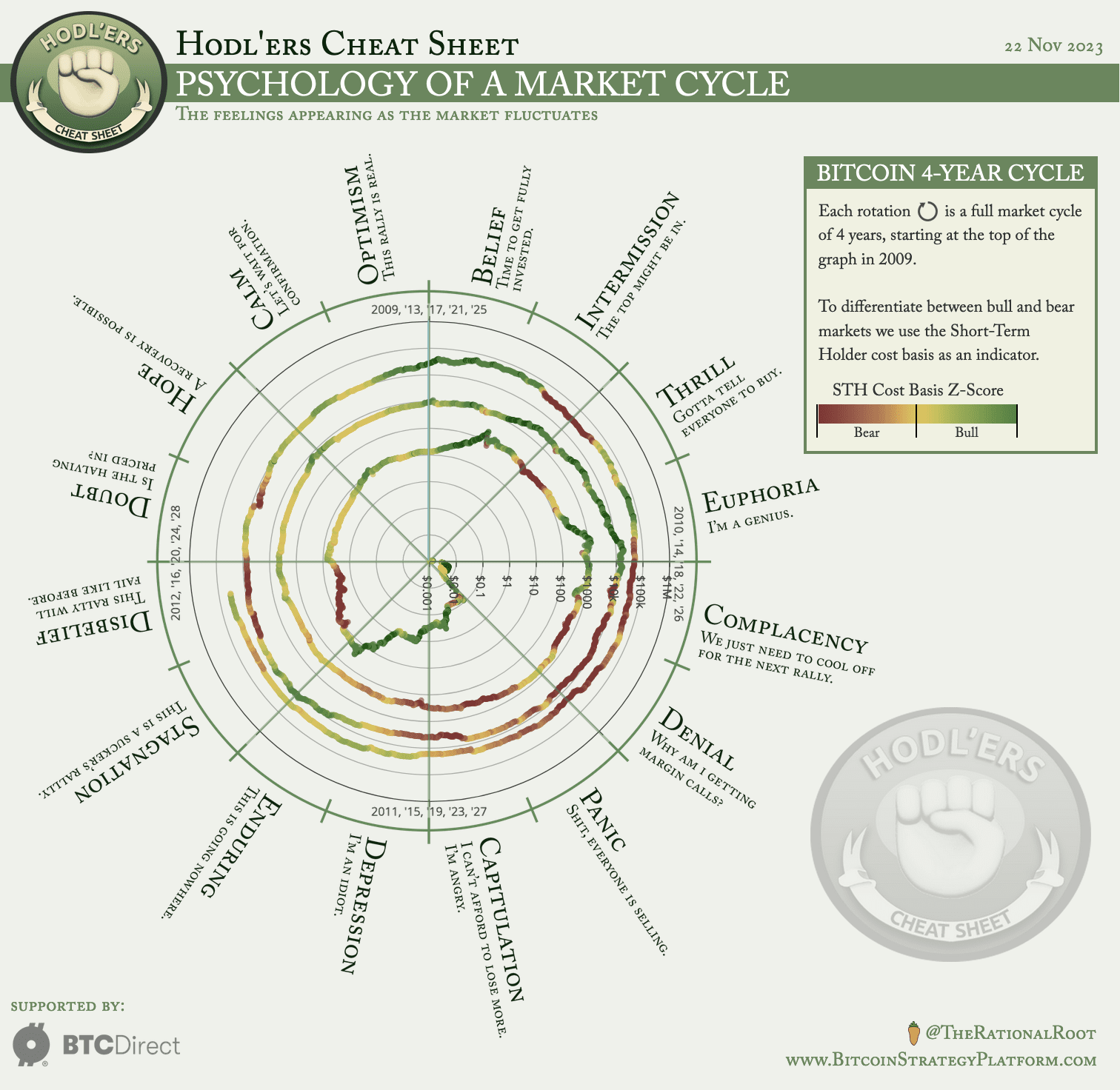

Predominant psychological intervals are apparent at approximately 10k steps: 17k, 27k, 38k, 47k, and 57k. Those seem like key milestones for a lot of buyers.

Read more in this week's report.