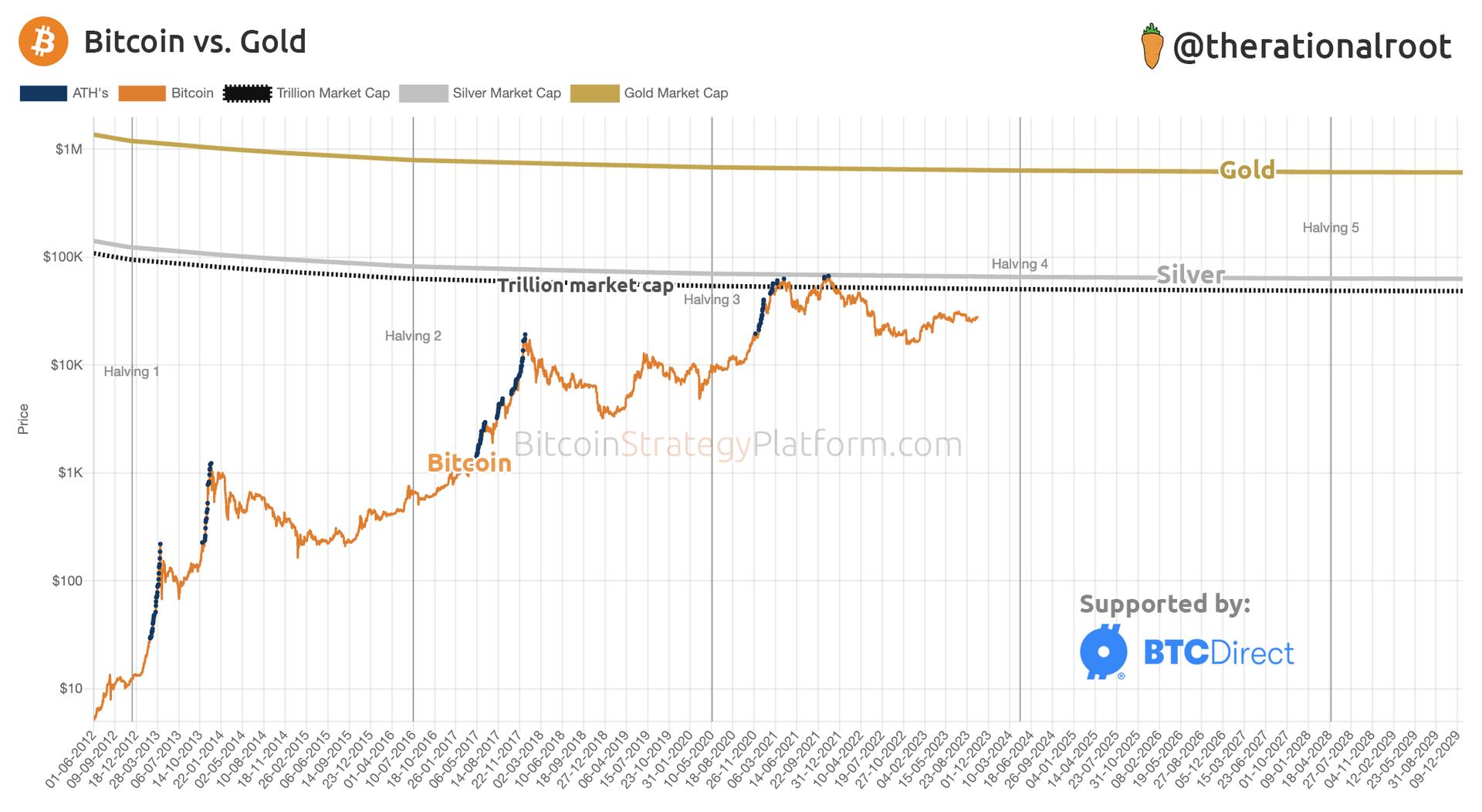

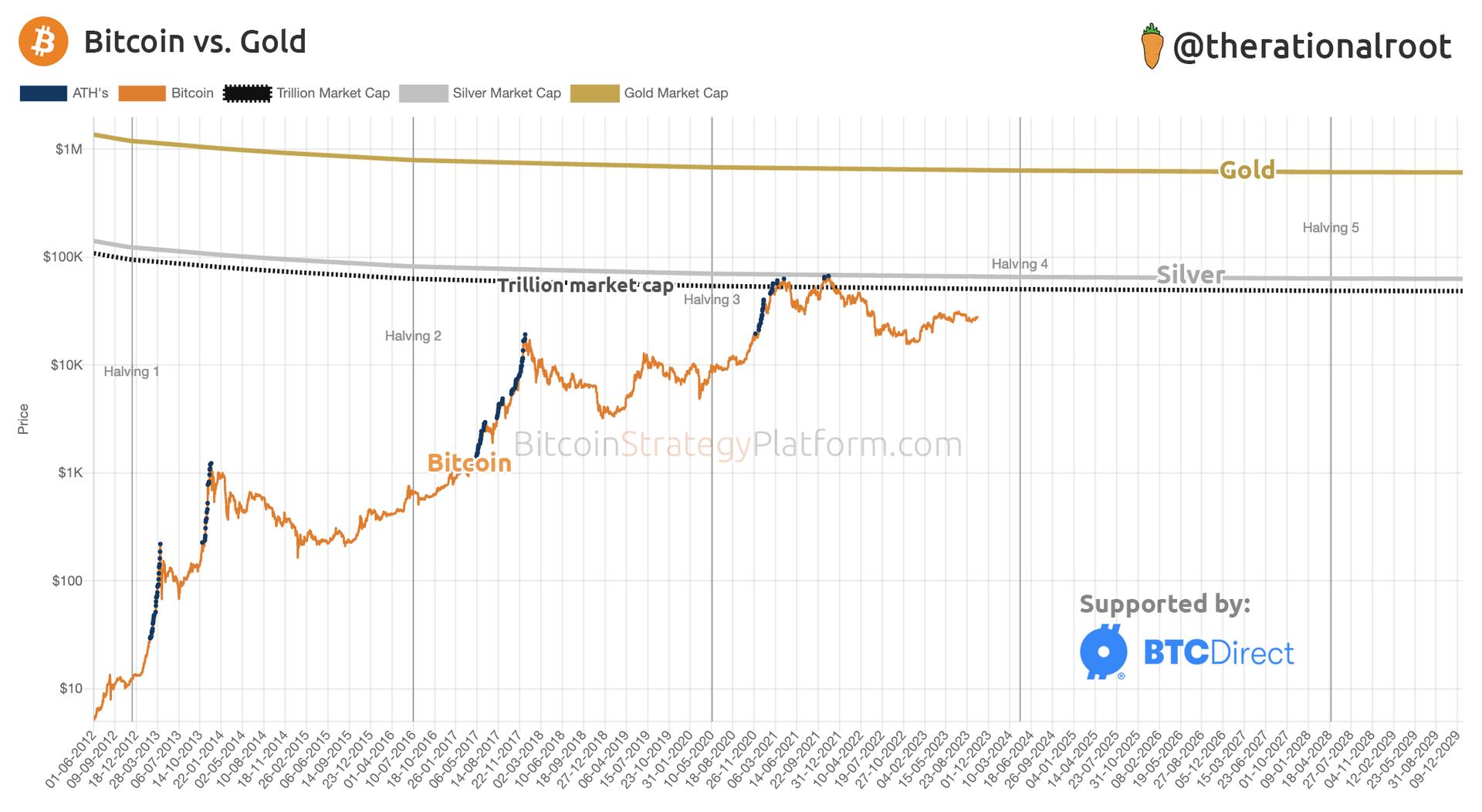

Bitcoin vs. Gold

In both gold and Bitcoin, the concept of paper or synthetic assets affecting the spot price is a concern. However, a critical distinction between the two lies in the area of verifiability. While both futures and spot ETFs for Bitcoin and gold share the common feature of often lacking an actual underlying asset, the two diverge significantly when it comes to the capability for transparent verification of those assets.

In the world of gold, the lack of easy verifiability tends to make spot ETFs more susceptible to becoming fractional reserves. That is, the real, physical gold that's supposed to back the paper might not fully exist, making the system less transparent and reliable.

Bitcoin, by contrast, offers the benefit of higher verifiability and proof of reserves, which substantially mitigates the risk of fractional reserve practices.