Ray Dalio has sounded the alarm: the global debt system is unsustainable, with the U.S., China, and other major economies drowning in liabilities. His advice? Abandon debt-based assets like bonds and move to hard money — specifically, gold and #Bitcoin.

Once a Bitcoin skeptic, Dalio now sees it as digital gold: finite, immutable, and beyond the control of governments and central banks. While gold has been a safe haven for millennia, Bitcoin takes it further — faster, more portable, and immune to seizure. As fiat currencies devalue and debt crises loom, gold and Bitcoin are hitting record highs, a clear signal of where the world is headed.

Dalio’s message echoes a timeless principle: own scarce assets, not promises. Fiat currencies and bonds can be printed and devalued at will, but Bitcoin and gold remain untouchable. The old financial system is cracking, and those who shift to hard money now will be the ones standing when it collapses.

Darren Easton

dazeaston@nostrcheck.me

npub1ze25...52k0

Advocate for health, wealth & property rights

https://x.com/dazeaston

Notes (20)

Mentors don’t have to be alive, yeah? They don’t even have to know you exist! One of mine is Ray Dalio — bloke’s got more wisdom than a fortune cookie factory. Now he’s got this AI thing, ‘Ask Ray’ — it’s like having him on speed dial without the awkward small talk. Check it out: principles.com/AIBeta-signup

Imagine thinking houses are expensive because people need somewhere to live. No, it’s because the rich treat them like Pokémon cards. If Bitcoin steals some of that ‘store of value’ demand, house prices might actually make sense again. Madness, I know.

MicroStrategy is exploiting a loophole in the Keynesian system: be the first to adopt a #Bitcoin treasury, issue shares to buy more Bitcoin, and repeat. A self-reinforcing cycle within a fiat-based financial framework.”

How to Look Like a Genius with MSTR Convertible Arbitrage:

1. Buy MSTR Convertible Bonds

• “Bonds with stock upside? Sure, I’ll take that interest too!”

2. Short MSTR Stock

• Hedge your bets. Short just enough stock so you’re not crying if it moves.

3. Profit from Arbitrage

• Get paid interest, watch prices realign, and casually call it “market inefficiency.”

Risks:

• Shorting fees might eat your lunch.

• Bonds can be harder to sell than your bad ideas at a pitch meeting.

• Hedge math isn’t for the faint-hearted.

But hey, if you pull it off, you just made money being both cautious and clever. Legend! nostr:note16gcmqpv38x263vldkz2d5hmsmqwzulrhf7vzn63zv2vk75cazu0qj4pfjd

Convertible Arbitrage: A Smart Play on #micostrategy $MSTR?

Here’s how you can exploit inefficiencies in MicroStrategy (MSTR) convertible bonds & stock:

1. Buy MSTR Convertible Bonds

• Earn interest & gain exposure to stock through the bond’s conversion option.

2. Short MSTR Stock

• Hedge stock risk by shorting shares equal to the bond’s “delta” (e.g., short 7 shares for a bond with delta = 0.7).

3. Profit from Arbitrage

• You collect bond interest & profit from pricing discrepancies between the bond and stock.

Risks:

• Borrowing costs for shorting.

• Illiquid bonds.

• Imperfect hedges from delta changes.

Done right, this strategy extracts a risk-adjusted premium from market inefficiencies. A classic convertible arbitrage move! nostr:note1mxwl33ec0shh287muansmlstw8sflw852sat8xulpadqlxxnzk9s6vtcgv

Right, here’s the deal. For the past 40 years, the global economy has been built on this giant pile of US Treasury bonds. It's like the foundation of a house that’s been rock solid—until now. It’s been the go-to place for people to park their money and watch it grow, right? But here’s the problem: inflation’s on the rise, and those bonds? They’re starting to crumble. Imagine if the house you’ve been living in suddenly starts to tilt to one side—everything built on it is going to crack and break.

So, what’s causing this? Well, it's a few things. First, they’ve been printing money like it’s going out of style. That’s causing prices to shoot up. Second, supply chains are a mess—think of a storm wrecking everything on your island. Everyone needs the same stuff, so prices go through the roof. And then, there’s the third reason: dodgy policies. Politicians make all these decisions without thinking about what they’re NOT doing, and it leads to a system where nothing works properly.

Now, with everything falling apart, where do we go? Bitcoin. It’s like the new superhero of the financial world. No central bank, no government messing with it—it's decentralized. It’s got a fixed supply, so no one can just print more and inflate it like they’ve been doing with the dollar. That means your money’s safe, unlike all the other stuff that’s at risk of losing its value.

And the best part? It’s global. You don’t need to trust anyone. You don’t need to wait for some banker to blink three times and make the markets go mental. #Bitcoin’s borderless, frictionless, and it’s the only thing that could stand up to all this nonsense we’ve got going on.

So, here’s the choice: sit back, watch the world burn, and let other people get rich off Bitcoin, or get in now, understand the game, and start winning. Either way, you’re going to have to deal with it. And trust me, you want to be on the right side of this.

$MSTR pioneered innovative ways for institutions to access #Bitcoin. They issue zero-coupon, long-dated convertible bonds to fund BTC purchases giving fixed-income investors Bitcoin exposure without holding crypto directly. Their success evidences institutional demand for Bitcoin

Saylor’s Convertible Bond Strategy Explained Simply:

Saylor: Lend me $100.

Lender: What’s the interest rate?

Saylor: There isn’t one.

Lender: Why should I lend you money then?

Saylor: If MicroStrategy’s stock hits a specific price, I’ll repay you with MSTR shares. If the stock performs well, your $100 could turn into $200, $500, or even $1,000. The potential returns far exceed traditional bonds.

Lender: Has this strategy worked before?

Saylor: Yes. My convertible bonds have outperformed traditional bonds, stocks, and even Bitcoin over the last 4 years.

Lender: Sounds compelling.

#MSTR #bitcoin

MicroStrategy’s $MSTR strategy is a major boost for #Bitcoin and miners. Here’s why:

1. $MSTR buys BTC, reducing market supply → BTC price rises

2. Investors FOMO into $MSTR → share price climbs

3. Higher share price = Saylor issues more equity/convertible debt, accessing cheap capital

4. $MSTR uses that capital to buy more BTC

5. Repeat steps 1-4, creating a self-reinforcing cycle

6. Rising BTC boosts miner profits

7. No miners = no new BTC supply for $MSTR or anyone else to buy

It’s a win-win for the whole Bitcoin ecosystem!

#bitcoin

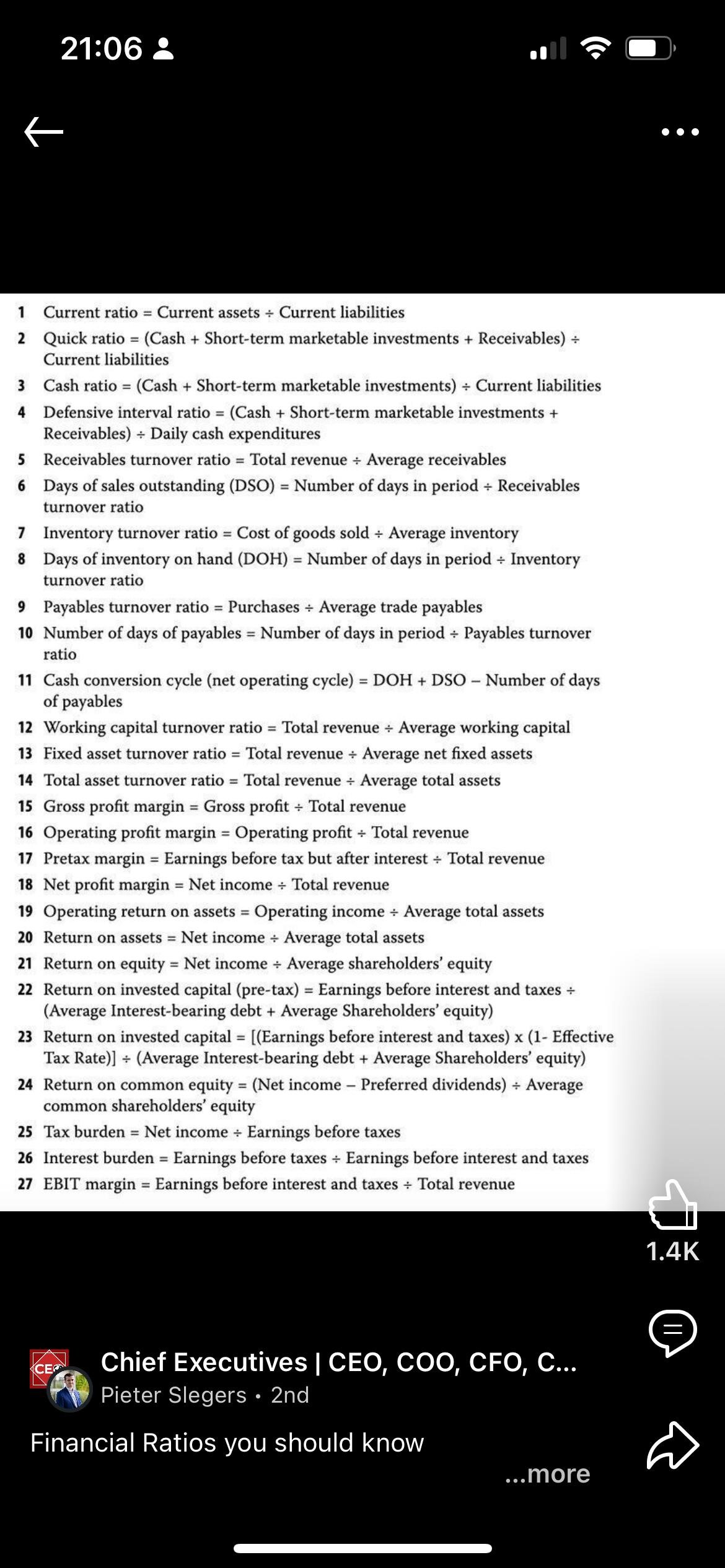

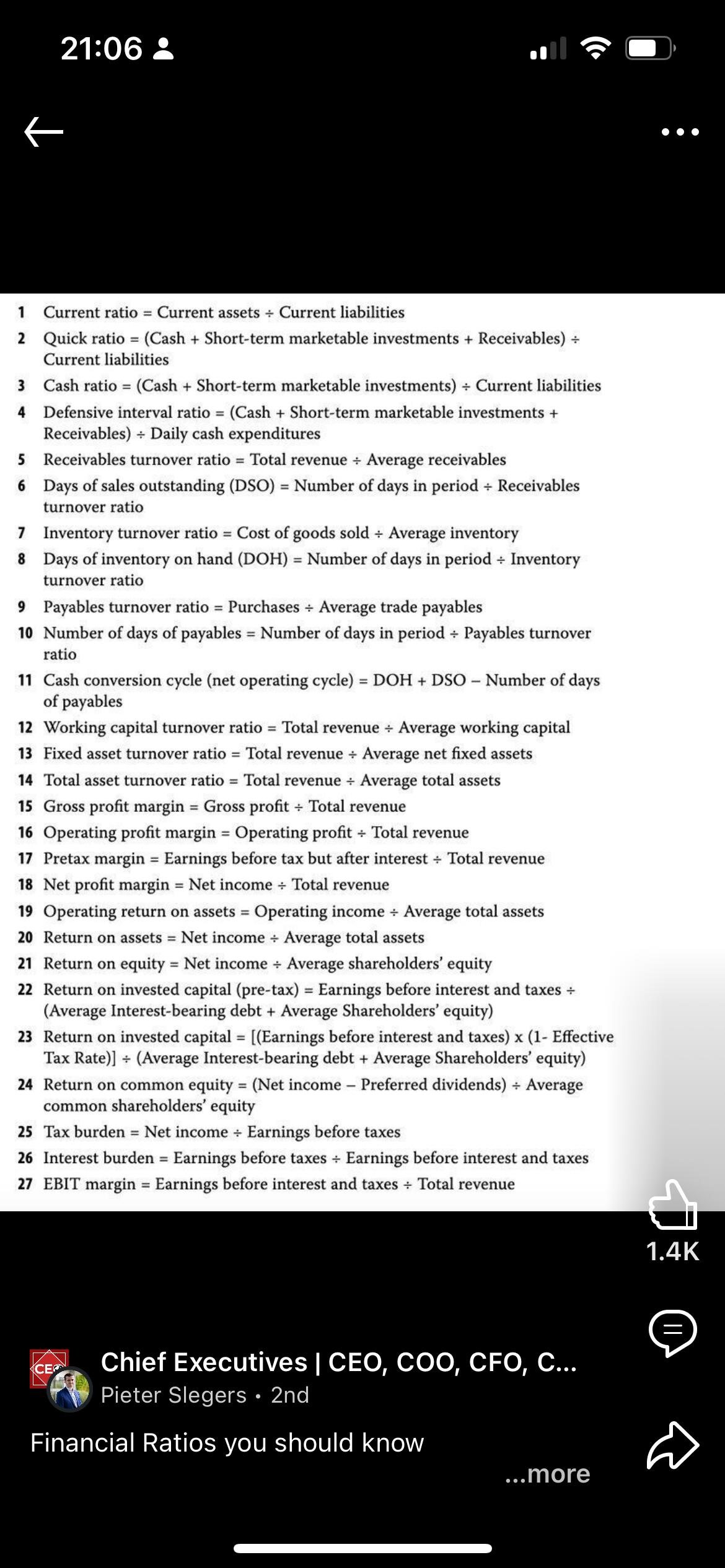

Financial Ratios you should know #investing #wealth

#Bitcoin fixes this

Rehearsing for the $100,000 Bitcoin party 🎉💃 with none other than Michael Saylor. 🚀💎 #Bitcoin100K @Saylor #BTC #Bitcoin https://video.nostr.build/1f4c0f825a1bc3a9761c9091d05d5ded7b22b3e726d88d87c1990b4005112158.mp4

When I wrote this article 4 yrs ago #Bitcoin was $9,700 - now it's trading at $97,000 & becoming a mainstream digital asset held by institutions & countries.

#Bitcoin is helping millions around the world including the unbanked to preserve their wealth

https://www.logicinvestments.co.uk/logic-market-views/should-you-buy-bitcoin/

Friday night vibes after a fantastic week for #Bitcoin and #MicroStrategy https://video.nostr.build/bd2a16fba9d816ad8e494c6b4ca5eb065cede07962d478139b10347d29c9a82e.mp4

Semler Scientific $SMLR is following the #MicroStrategy $MSTR playbook by deciding to convert its cash holdings to #Bitcoin. The company has invested $60m in Bitcoin and plans to buy more pending SEC approval for a capital raise. The shares are currently trading at $46.66

Position sizing is key during a market rally to help manage risk while maximising returns. I use a strategy of scaling in & out: gradually adjusting my position in an asset rather than making large moves all at once. It’s all about managing risk & staying flexible. #SPX #Bitcoin

Microsoft buying Bitcoin?

The results of the #Microsoft shareholders meeting yesterday regarding the proposal to invest in #Bitcoin have not been announced yet.

Could this be the next huge development that pushes Bitcoin way over $100k?

The people are taking back control from the establishment!

Individual Bitcoiners front-ran the big institutions, driving momentum behind an anti-establishment president.

It’s a powerful reminder: true power belongs to the people, not the elite. #Bitcoin