Today we look at what’s really in your paycheck?

The Net vs. Gross Salary Puzzle in Europe

Let’s talk money. Specifically, let’s talk about how much of your hard-earned cash actually ends up in your pocket after taxes, social security, and all those other deductions that seem to magically disappear from your paycheck. If you’ve ever stared at your payslip and wondered, “Where did it all go?”—you’re not alone. A recent dive into net vs. gross salaries across Europe by Euronews Business sheds some light on this universal frustration, and let me tell you, it’s a mixed bag.

First off, let’s break it down. Gross salary is what you earn before anything gets taken out. Net salary is what you actually take home after taxes, social security contributions, and, if you’re lucky, some family allowances. The difference between the two can be eye-watering, depending on where you live, your marital status, and whether you’ve got kids. Spoiler alert: having kids can actually work in your favor, tax-wise. Who knew?

Singles Without Kids: The Taxman’s Favorite?

If you’re single, child-free, and living in Europe, chances are you’re keeping less of your paycheck compared to your married-with-kids counterparts. According to Eurostat’s 2023 data, the average single person in the EU takes home about 68.8% of their gross salary. But here’s where it gets wild—Belgium is at the bottom of the pile, with singles keeping just 60.1% of their earnings. Ouch. On the flip side, Cyprus is the MVP, with singles taking home a whopping 85.9% of their gross salary. Switzerland, Estonia, and Czechia aren’t far behind, all hovering around the 80% mark.

Why the big difference? Well, in places like Switzerland, local tax competition keeps rates lower, which means more money in your pocket. Meanwhile, countries like Belgium, Germany, and Denmark are taking a bigger bite out of your paycheck. If you’re single and living in one of these countries, maybe it’s time to start dating—or at least adopt a pet for some emotional support.

Couples Without Kids: Not Much Better

If you’re part of a two-earner couple without kids, the numbers don’t change much. You’re still looking at a net-to-gross ratio of around 69% on average. Basically, you’re in the same boat as your single friends, just with someone to split the rent with. Not exactly a win, but hey, at least you’ve got company.

Couples With Kids: The Real Winners

Now, here’s where things get interesting. If you’re a one-earner couple with two kids, your take-home pay ratio jumps significantly. The EU average for this group is 82.7%, with some countries like Slovakia and Czechia going above and beyond. In Slovakia, net earnings actually exceed gross earnings thanks to something called a “negative income tax.” Yes, you read that right—some families are getting more money than they technically earned. Talk about a win!

Even in countries without such extreme policies, couples with kids generally fare better. For example, in Belgium, a single person without kids keeps just 60.1% of their gross salary, but a one-earner couple with two kids gets to keep 79.7%. That’s a difference of nearly 20 percentage points. So, if you’ve been on the fence about starting a family, maybe this is the nudge you needed. Kids: they’re expensive, but at least they come with tax benefits.

Two-Earner Couples With Kids: Still Better Off

For two-earner couples with two kids, the take-home ratio is slightly lower than for one-earner families but still higher than for singles or childless couples. The EU average here is 73.8%, meaning you’re keeping a decent chunk of your earnings. Again, countries like Slovakia, Poland, and Austria are leading the pack, offering more favorable conditions for families.

So, what’s the takeaway here? Well, if you’re single and child-free, you’re probably getting the short end of the stick when it comes to take-home pay. But if you’ve got a family, especially with kids, you’re likely benefiting from more favorable tax policies and family allowances. It’s clear that many European countries are trying to support families, which is great—but it does leave singles wondering where their break is.

At the end of the day, where you live plays a huge role in how much of your salary you actually get to keep. If you’re in Cyprus or Switzerland, life is good. If you’re in Belgium or Denmark, well, maybe it’s time to start lobbying for some tax reforms. Either way, it’s worth knowing where you stand so you can plan accordingly. After all, knowledge is power—and in this case, it might just help you keep a little more of your paycheck.

Today we look at what’s really in your paycheck?

The Net vs. Gross Salary Puzzle in Europe

Let’s talk money. Specifically, let’s talk about how much of your hard-earned cash actually ends up in your pocket after taxes, social security, and all those other deductions that seem to magically disappear from your paycheck. If you’ve ever stared at your payslip and wondered, “Where did it all go?”—you’re not alone. A recent dive into net vs. gross salaries across Europe by Euronews Business sheds some light on this universal frustration, and let me tell you, it’s a mixed bag.

First off, let’s break it down. Gross salary is what you earn before anything gets taken out. Net salary is what you actually take home after taxes, social security contributions, and, if you’re lucky, some family allowances. The difference between the two can be eye-watering, depending on where you live, your marital status, and whether you’ve got kids. Spoiler alert: having kids can actually work in your favor, tax-wise. Who knew?

Singles Without Kids: The Taxman’s Favorite?

If you’re single, child-free, and living in Europe, chances are you’re keeping less of your paycheck compared to your married-with-kids counterparts. According to Eurostat’s 2023 data, the average single person in the EU takes home about 68.8% of their gross salary. But here’s where it gets wild—Belgium is at the bottom of the pile, with singles keeping just 60.1% of their earnings. Ouch. On the flip side, Cyprus is the MVP, with singles taking home a whopping 85.9% of their gross salary. Switzerland, Estonia, and Czechia aren’t far behind, all hovering around the 80% mark.

Why the big difference? Well, in places like Switzerland, local tax competition keeps rates lower, which means more money in your pocket. Meanwhile, countries like Belgium, Germany, and Denmark are taking a bigger bite out of your paycheck. If you’re single and living in one of these countries, maybe it’s time to start dating—or at least adopt a pet for some emotional support.

Couples Without Kids: Not Much Better

If you’re part of a two-earner couple without kids, the numbers don’t change much. You’re still looking at a net-to-gross ratio of around 69% on average. Basically, you’re in the same boat as your single friends, just with someone to split the rent with. Not exactly a win, but hey, at least you’ve got company.

Couples With Kids: The Real Winners

Now, here’s where things get interesting. If you’re a one-earner couple with two kids, your take-home pay ratio jumps significantly. The EU average for this group is 82.7%, with some countries like Slovakia and Czechia going above and beyond. In Slovakia, net earnings actually exceed gross earnings thanks to something called a “negative income tax.” Yes, you read that right—some families are getting more money than they technically earned. Talk about a win!

Even in countries without such extreme policies, couples with kids generally fare better. For example, in Belgium, a single person without kids keeps just 60.1% of their gross salary, but a one-earner couple with two kids gets to keep 79.7%. That’s a difference of nearly 20 percentage points. So, if you’ve been on the fence about starting a family, maybe this is the nudge you needed. Kids: they’re expensive, but at least they come with tax benefits.

Two-Earner Couples With Kids: Still Better Off

For two-earner couples with two kids, the take-home ratio is slightly lower than for one-earner families but still higher than for singles or childless couples. The EU average here is 73.8%, meaning you’re keeping a decent chunk of your earnings. Again, countries like Slovakia, Poland, and Austria are leading the pack, offering more favorable conditions for families.

So, what’s the takeaway here? Well, if you’re single and child-free, you’re probably getting the short end of the stick when it comes to take-home pay. But if you’ve got a family, especially with kids, you’re likely benefiting from more favorable tax policies and family allowances. It’s clear that many European countries are trying to support families, which is great—but it does leave singles wondering where their break is.

At the end of the day, where you live plays a huge role in how much of your salary you actually get to keep. If you’re in Cyprus or Switzerland, life is good. If you’re in Belgium or Denmark, well, maybe it’s time to start lobbying for some tax reforms. Either way, it’s worth knowing where you stand so you can plan accordingly. After all, knowledge is power—and in this case, it might just help you keep a little more of your paycheck.

The Nomadic Goat

tng@plebs.place

npub1zk66...drsk

"Aut inveniam viam aut faciam"

Enthusiast on Economy, Markets, Investments and #Bitcoin

@TNG

@thenomadicgoat on Twitter

Today we look at what’s really in your paycheck?

The Net vs. Gross Salary Puzzle in Europe

Let’s talk money. Specifically, let’s talk about how much of your hard-earned cash actually ends up in your pocket after taxes, social security, and all those other deductions that seem to magically disappear from your paycheck. If you’ve ever stared at your payslip and wondered, “Where did it all go?”—you’re not alone. A recent dive into net vs. gross salaries across Europe by Euronews Business sheds some light on this universal frustration, and let me tell you, it’s a mixed bag.

First off, let’s break it down. Gross salary is what you earn before anything gets taken out. Net salary is what you actually take home after taxes, social security contributions, and, if you’re lucky, some family allowances. The difference between the two can be eye-watering, depending on where you live, your marital status, and whether you’ve got kids. Spoiler alert: having kids can actually work in your favor, tax-wise. Who knew?

Singles Without Kids: The Taxman’s Favorite?

If you’re single, child-free, and living in Europe, chances are you’re keeping less of your paycheck compared to your married-with-kids counterparts. According to Eurostat’s 2023 data, the average single person in the EU takes home about 68.8% of their gross salary. But here’s where it gets wild—Belgium is at the bottom of the pile, with singles keeping just 60.1% of their earnings. Ouch. On the flip side, Cyprus is the MVP, with singles taking home a whopping 85.9% of their gross salary. Switzerland, Estonia, and Czechia aren’t far behind, all hovering around the 80% mark.

Why the big difference? Well, in places like Switzerland, local tax competition keeps rates lower, which means more money in your pocket. Meanwhile, countries like Belgium, Germany, and Denmark are taking a bigger bite out of your paycheck. If you’re single and living in one of these countries, maybe it’s time to start dating—or at least adopt a pet for some emotional support.

Couples Without Kids: Not Much Better

If you’re part of a two-earner couple without kids, the numbers don’t change much. You’re still looking at a net-to-gross ratio of around 69% on average. Basically, you’re in the same boat as your single friends, just with someone to split the rent with. Not exactly a win, but hey, at least you’ve got company.

Couples With Kids: The Real Winners

Now, here’s where things get interesting. If you’re a one-earner couple with two kids, your take-home pay ratio jumps significantly. The EU average for this group is 82.7%, with some countries like Slovakia and Czechia going above and beyond. In Slovakia, net earnings actually exceed gross earnings thanks to something called a “negative income tax.” Yes, you read that right—some families are getting more money than they technically earned. Talk about a win!

Even in countries without such extreme policies, couples with kids generally fare better. For example, in Belgium, a single person without kids keeps just 60.1% of their gross salary, but a one-earner couple with two kids gets to keep 79.7%. That’s a difference of nearly 20 percentage points. So, if you’ve been on the fence about starting a family, maybe this is the nudge you needed. Kids: they’re expensive, but at least they come with tax benefits.

Two-Earner Couples With Kids: Still Better Off

For two-earner couples with two kids, the take-home ratio is slightly lower than for one-earner families but still higher than for singles or childless couples. The EU average here is 73.8%, meaning you’re keeping a decent chunk of your earnings. Again, countries like Slovakia, Poland, and Austria are leading the pack, offering more favorable conditions for families.

So, what’s the takeaway here? Well, if you’re single and child-free, you’re probably getting the short end of the stick when it comes to take-home pay. But if you’ve got a family, especially with kids, you’re likely benefiting from more favorable tax policies and family allowances. It’s clear that many European countries are trying to support families, which is great—but it does leave singles wondering where their break is.

At the end of the day, where you live plays a huge role in how much of your salary you actually get to keep. If you’re in Cyprus or Switzerland, life is good. If you’re in Belgium or Denmark, well, maybe it’s time to start lobbying for some tax reforms. Either way, it’s worth knowing where you stand so you can plan accordingly. After all, knowledge is power—and in this case, it might just help you keep a little more of your paycheck.

Today we look at what’s really in your paycheck?

The Net vs. Gross Salary Puzzle in Europe

Let’s talk money. Specifically, let’s talk about how much of your hard-earned cash actually ends up in your pocket after taxes, social security, and all those other deductions that seem to magically disappear from your paycheck. If you’ve ever stared at your payslip and wondered, “Where did it all go?”—you’re not alone. A recent dive into net vs. gross salaries across Europe by Euronews Business sheds some light on this universal frustration, and let me tell you, it’s a mixed bag.

First off, let’s break it down. Gross salary is what you earn before anything gets taken out. Net salary is what you actually take home after taxes, social security contributions, and, if you’re lucky, some family allowances. The difference between the two can be eye-watering, depending on where you live, your marital status, and whether you’ve got kids. Spoiler alert: having kids can actually work in your favor, tax-wise. Who knew?

Singles Without Kids: The Taxman’s Favorite?

If you’re single, child-free, and living in Europe, chances are you’re keeping less of your paycheck compared to your married-with-kids counterparts. According to Eurostat’s 2023 data, the average single person in the EU takes home about 68.8% of their gross salary. But here’s where it gets wild—Belgium is at the bottom of the pile, with singles keeping just 60.1% of their earnings. Ouch. On the flip side, Cyprus is the MVP, with singles taking home a whopping 85.9% of their gross salary. Switzerland, Estonia, and Czechia aren’t far behind, all hovering around the 80% mark.

Why the big difference? Well, in places like Switzerland, local tax competition keeps rates lower, which means more money in your pocket. Meanwhile, countries like Belgium, Germany, and Denmark are taking a bigger bite out of your paycheck. If you’re single and living in one of these countries, maybe it’s time to start dating—or at least adopt a pet for some emotional support.

Couples Without Kids: Not Much Better

If you’re part of a two-earner couple without kids, the numbers don’t change much. You’re still looking at a net-to-gross ratio of around 69% on average. Basically, you’re in the same boat as your single friends, just with someone to split the rent with. Not exactly a win, but hey, at least you’ve got company.

Couples With Kids: The Real Winners

Now, here’s where things get interesting. If you’re a one-earner couple with two kids, your take-home pay ratio jumps significantly. The EU average for this group is 82.7%, with some countries like Slovakia and Czechia going above and beyond. In Slovakia, net earnings actually exceed gross earnings thanks to something called a “negative income tax.” Yes, you read that right—some families are getting more money than they technically earned. Talk about a win!

Even in countries without such extreme policies, couples with kids generally fare better. For example, in Belgium, a single person without kids keeps just 60.1% of their gross salary, but a one-earner couple with two kids gets to keep 79.7%. That’s a difference of nearly 20 percentage points. So, if you’ve been on the fence about starting a family, maybe this is the nudge you needed. Kids: they’re expensive, but at least they come with tax benefits.

Two-Earner Couples With Kids: Still Better Off

For two-earner couples with two kids, the take-home ratio is slightly lower than for one-earner families but still higher than for singles or childless couples. The EU average here is 73.8%, meaning you’re keeping a decent chunk of your earnings. Again, countries like Slovakia, Poland, and Austria are leading the pack, offering more favorable conditions for families.

So, what’s the takeaway here? Well, if you’re single and child-free, you’re probably getting the short end of the stick when it comes to take-home pay. But if you’ve got a family, especially with kids, you’re likely benefiting from more favorable tax policies and family allowances. It’s clear that many European countries are trying to support families, which is great—but it does leave singles wondering where their break is.

At the end of the day, where you live plays a huge role in how much of your salary you actually get to keep. If you’re in Cyprus or Switzerland, life is good. If you’re in Belgium or Denmark, well, maybe it’s time to start lobbying for some tax reforms. Either way, it’s worth knowing where you stand so you can plan accordingly. After all, knowledge is power—and in this case, it might just help you keep a little more of your paycheck. Today, we look at Trump’s Crypto Executive Order.

A Bold Step or Just Baby Steps?

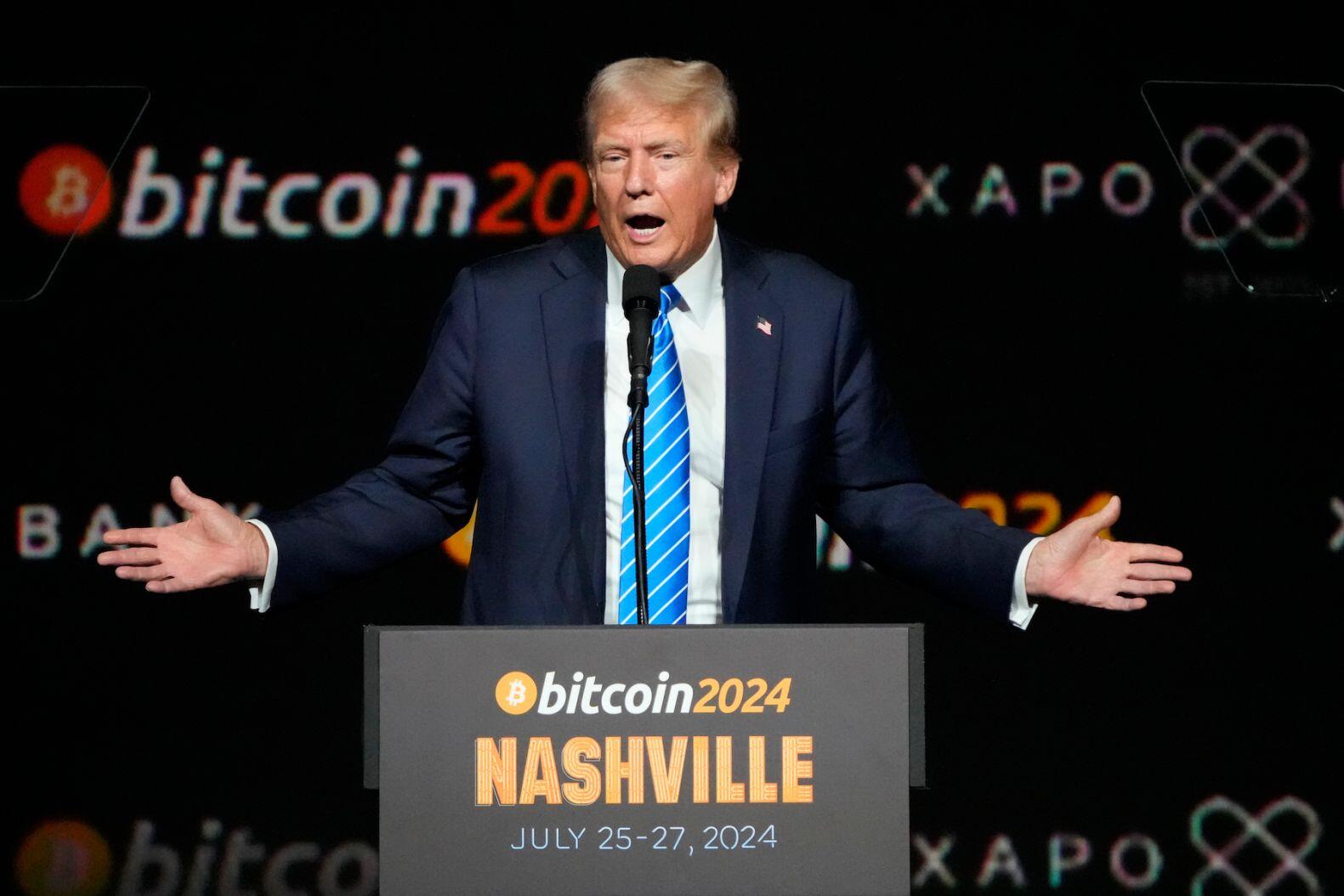

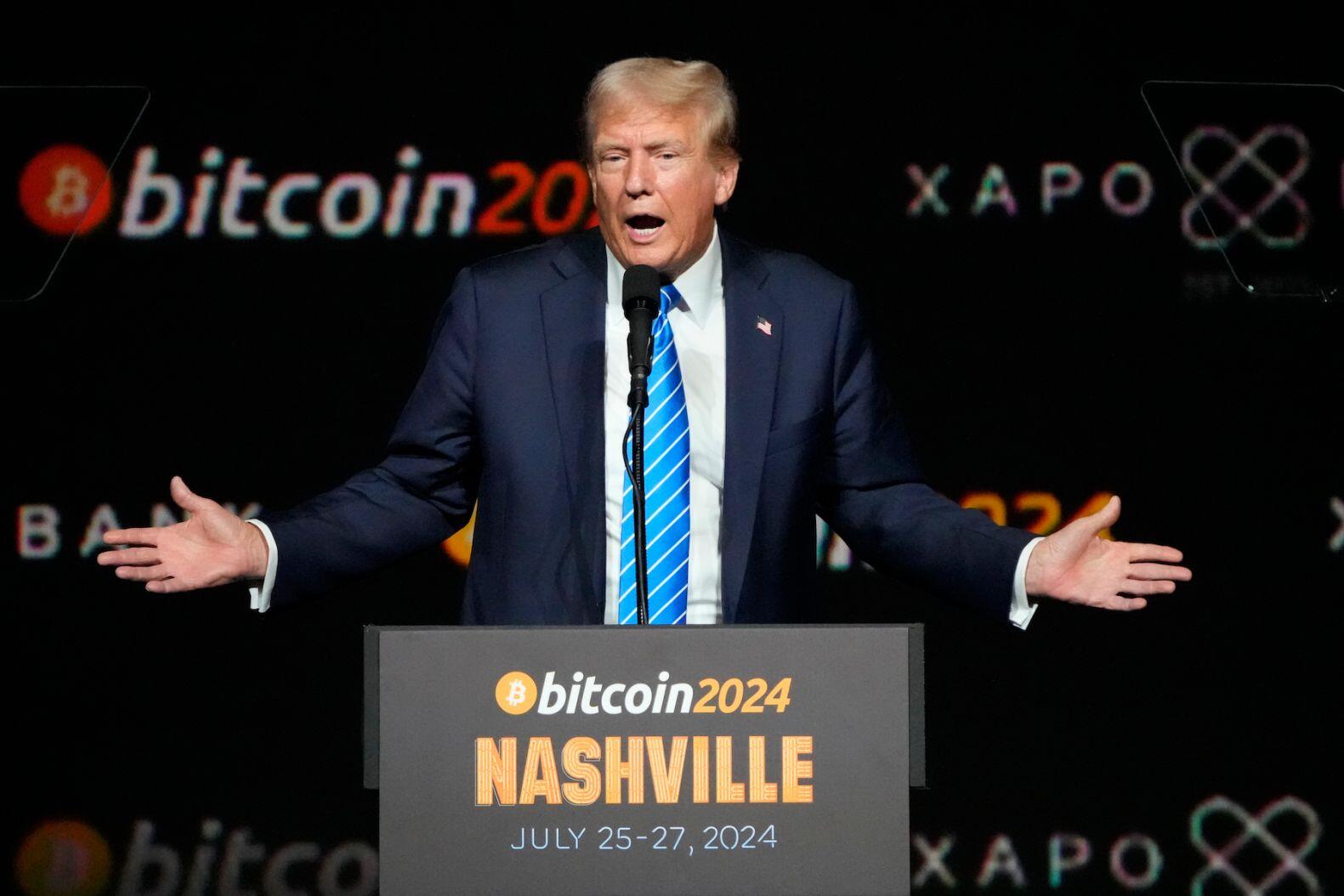

It’s official—Donald Trump’s new executive order is here, and it’s making waves in the crypto world. While it may not have delivered everything crypto enthusiasts hoped for, it did check off a couple of big promises: banning central bank digital currencies (CBDCs) and setting the stage for clearer regulation of digital assets.

First up, let’s talk CBDCs. By prohibiting their creation, Trump has drawn a line in the sand. Critics of CBDCs argue they could give governments excessive control over financial transactions, and this ban ensures the U.S. won’t go down that road—at least under his administration. It’s a strong nod to the crypto community, which has long championed financial freedom and decentralization.

The bigger piece of the order, though, is the establishment of a presidential working group to bring some much-needed clarity to the murky world of crypto regulations. Chaired by White House AI and crypto czar David Sacks, this group will include heavyweights like the Treasury Secretary and SEC Chair. Their mission? To figure out exactly how digital assets should be regulated, what rules are working (or not), and what legislative proposals might be necessary.

This isn’t just talk, either—the order sets clear deadlines. Within 30 days, the group must identify all existing regulations affecting crypto. Within 60 days, they’re expected to provide recommendations, and within 180 days, they’ll deliver a comprehensive report. That’s government efficiency we don’t usually see.

One intriguing piece of the order is the potential creation of a “national digital asset stockpile.” While this isn’t the same as Trump’s campaign promise of a strategic #Bitcoin reserve, it’s a step in that direction. The stockpile could include cryptocurrencies seized by the government, but there’s no word yet on whether Uncle Sam plans to start actively buying bitcoin.

And let’s not forget the other ripple effects already emerging. Just as this executive order dropped, the SEC rescinded guidance that had made it tough for banks to hold crypto for clients. Clearly, the administration’s stance is having a domino effect across regulatory bodies.

For crypto advocates, this is a big moment. While the executive order doesn’t give the green light to everything the community might want—like that bitcoin reserve—it shows the U.S. is taking crypto seriously. Trump’s vision of making the U.S. the “crypto capital of the planet” is starting to take shape.

The crypto world isn’t without its skeptics, though, and it’s fair to question whether this order is the bold move it appears to be or just the groundwork for what’s to come. Either way, it’s a fascinating chapter in the ongoing evolution of digital finance.

Today, we look at Trump’s Crypto Executive Order.

A Bold Step or Just Baby Steps?

It’s official—Donald Trump’s new executive order is here, and it’s making waves in the crypto world. While it may not have delivered everything crypto enthusiasts hoped for, it did check off a couple of big promises: banning central bank digital currencies (CBDCs) and setting the stage for clearer regulation of digital assets.

First up, let’s talk CBDCs. By prohibiting their creation, Trump has drawn a line in the sand. Critics of CBDCs argue they could give governments excessive control over financial transactions, and this ban ensures the U.S. won’t go down that road—at least under his administration. It’s a strong nod to the crypto community, which has long championed financial freedom and decentralization.

The bigger piece of the order, though, is the establishment of a presidential working group to bring some much-needed clarity to the murky world of crypto regulations. Chaired by White House AI and crypto czar David Sacks, this group will include heavyweights like the Treasury Secretary and SEC Chair. Their mission? To figure out exactly how digital assets should be regulated, what rules are working (or not), and what legislative proposals might be necessary.

This isn’t just talk, either—the order sets clear deadlines. Within 30 days, the group must identify all existing regulations affecting crypto. Within 60 days, they’re expected to provide recommendations, and within 180 days, they’ll deliver a comprehensive report. That’s government efficiency we don’t usually see.

One intriguing piece of the order is the potential creation of a “national digital asset stockpile.” While this isn’t the same as Trump’s campaign promise of a strategic #Bitcoin reserve, it’s a step in that direction. The stockpile could include cryptocurrencies seized by the government, but there’s no word yet on whether Uncle Sam plans to start actively buying bitcoin.

And let’s not forget the other ripple effects already emerging. Just as this executive order dropped, the SEC rescinded guidance that had made it tough for banks to hold crypto for clients. Clearly, the administration’s stance is having a domino effect across regulatory bodies.

For crypto advocates, this is a big moment. While the executive order doesn’t give the green light to everything the community might want—like that bitcoin reserve—it shows the U.S. is taking crypto seriously. Trump’s vision of making the U.S. the “crypto capital of the planet” is starting to take shape.

The crypto world isn’t without its skeptics, though, and it’s fair to question whether this order is the bold move it appears to be or just the groundwork for what’s to come. Either way, it’s a fascinating chapter in the ongoing evolution of digital finance. GM.

A new executive order to shape up crypto?

Trump banned central bank digital currencies (CBDCs) and created a team to craft clear rules for digital assets.

Big promises, but no national #Bitcoin stockpile—yet.

This new task force will study the idea of a U.S. crypto reserve, potentially using assets seized in law enforcement actions.

Trump’s pro-crypto stance is making waves—he’s vowed to make the U.S. the global hub for AI and crypto.

With SEC reforms and big plans ahead, the industry’s watching closely. Is the U.S. about to become the “crypto capital of the planet”?

GM.

A new executive order to shape up crypto?

Trump banned central bank digital currencies (CBDCs) and created a team to craft clear rules for digital assets.

Big promises, but no national #Bitcoin stockpile—yet.

This new task force will study the idea of a U.S. crypto reserve, potentially using assets seized in law enforcement actions.

Trump’s pro-crypto stance is making waves—he’s vowed to make the U.S. the global hub for AI and crypto.

With SEC reforms and big plans ahead, the industry’s watching closely. Is the U.S. about to become the “crypto capital of the planet”? Crypto execs at Davos are optimistic about clear U.S. regulations this year under Trump.

Coinbase's CEO called it the "dawn of a new day" for crypto, as the SEC launches a task force to create comprehensive rules.

Big changes ahead for the industry!

Binance predicts a U.S. strategic #Bitcoin reserve could be on the horizon, with stablecoin laws also gaining traction.

Bitcoin’s momentum is strong, trading at $104k.

The crypto world is buzzing with optimism for this "golden year" of regulation.

Circle's CEO sees bipartisan support in Congress for stablecoins like USDC, hinting at rapid progress under this administration.

With U.S. leaders backing crypto, the industry is ready to hit new highs.

Could 2025 be the year crypto truly goes mainstream?

Crypto execs at Davos are optimistic about clear U.S. regulations this year under Trump.

Coinbase's CEO called it the "dawn of a new day" for crypto, as the SEC launches a task force to create comprehensive rules.

Big changes ahead for the industry!

Binance predicts a U.S. strategic #Bitcoin reserve could be on the horizon, with stablecoin laws also gaining traction.

Bitcoin’s momentum is strong, trading at $104k.

The crypto world is buzzing with optimism for this "golden year" of regulation.

Circle's CEO sees bipartisan support in Congress for stablecoins like USDC, hinting at rapid progress under this administration.

With U.S. leaders backing crypto, the industry is ready to hit new highs.

Could 2025 be the year crypto truly goes mainstream? Today, we look at the Ups and Downs of European Venture Capital: Is the Glass Half Full or Half Empty?

When it comes to venture capital (VC), Europe often feels like the younger sibling in a room full of overachievers. Sure, it's got some promising start-ups, exciting sectors, and a growing sense of ambition. But compared to the US, the funding numbers and growth seem like a slow crawl rather than a sprint.

Let’s start with the good stuff. In 2024, AI was the star of the European VC show, soaking up billions in investments. Companies like the UK’s GreenScale and France’s Poolside led the charge, with deals worth €1.198 billion and €450 million, respectively. AI wasn’t just a rising trend; it was the trend, snagging 25% of the continent’s total deal value. Add some strong performances in life sciences, mobility tech, and foodtech, and you’ve got a decent highlight reel.

Now, the challenges. Venture capital investments across Europe dipped last year. Fewer deals, fewer funds raised, and a general vibe of caution hung over the market. Even sectors like cleantech and fintech, which are usually solid performers, saw noticeable declines. Why? Europe’s VC ecosystem still battles fragmentation, tight regulations, and a lack of big-ticket investors for later-stage funding rounds.

And then there’s the elephant in the room: the US. Europe has about 128 unicorns. Sounds impressive until you realize the US has over 640. While European funds show solid returns, the sheer volume of deals and funding in the States leaves Europe trailing far behind. The regulatory landscape here doesn’t help either. Complex laws, national-level restrictions, and an overall lack of unity make cross-border operations a headache for both start-ups and investors.

On the brighter side, 2024 was hailed as the “year of the exit comeback,” with IPOs and acquisitions picking up steam. That’s a good sign for the ecosystem, as successful exits mean more confidence—and cash—for future investments. Venture debt also had a moment, giving companies an alternative to equity-based funding.

Looking ahead, Europe’s venture capital scene has potential, but unlocking it will take work. Simplifying regulations, creating a more unified market, and addressing gaps in later-stage funding are just some of the steps needed.

So, is European VC thriving or just surviving? The answer lies somewhere in between. It’s growing, but whether it can catch up with its global counterparts depends on how quickly it can adapt to the challenges ahead.

Today, we look at the Ups and Downs of European Venture Capital: Is the Glass Half Full or Half Empty?

When it comes to venture capital (VC), Europe often feels like the younger sibling in a room full of overachievers. Sure, it's got some promising start-ups, exciting sectors, and a growing sense of ambition. But compared to the US, the funding numbers and growth seem like a slow crawl rather than a sprint.

Let’s start with the good stuff. In 2024, AI was the star of the European VC show, soaking up billions in investments. Companies like the UK’s GreenScale and France’s Poolside led the charge, with deals worth €1.198 billion and €450 million, respectively. AI wasn’t just a rising trend; it was the trend, snagging 25% of the continent’s total deal value. Add some strong performances in life sciences, mobility tech, and foodtech, and you’ve got a decent highlight reel.

Now, the challenges. Venture capital investments across Europe dipped last year. Fewer deals, fewer funds raised, and a general vibe of caution hung over the market. Even sectors like cleantech and fintech, which are usually solid performers, saw noticeable declines. Why? Europe’s VC ecosystem still battles fragmentation, tight regulations, and a lack of big-ticket investors for later-stage funding rounds.

And then there’s the elephant in the room: the US. Europe has about 128 unicorns. Sounds impressive until you realize the US has over 640. While European funds show solid returns, the sheer volume of deals and funding in the States leaves Europe trailing far behind. The regulatory landscape here doesn’t help either. Complex laws, national-level restrictions, and an overall lack of unity make cross-border operations a headache for both start-ups and investors.

On the brighter side, 2024 was hailed as the “year of the exit comeback,” with IPOs and acquisitions picking up steam. That’s a good sign for the ecosystem, as successful exits mean more confidence—and cash—for future investments. Venture debt also had a moment, giving companies an alternative to equity-based funding.

Looking ahead, Europe’s venture capital scene has potential, but unlocking it will take work. Simplifying regulations, creating a more unified market, and addressing gaps in later-stage funding are just some of the steps needed.

So, is European VC thriving or just surviving? The answer lies somewhere in between. It’s growing, but whether it can catch up with its global counterparts depends on how quickly it can adapt to the challenges ahead. Trump just granted a full pardon to Ross Ulbricht, founder of the Silk Road dark web marketplace.

Ulbricht had been serving a life sentence without parole since 2015 for charges including drug distribution and computer hacking.

Silk Road, which ran from 2011–2013, was a global drug bazaar fueled by Bitcoin, handling $200M+ in sales.

Trump called Ulbricht’s sentence “ridiculous” and credited the Libertarian Movement and crypto community for supporting the decision.

Ulbricht’s case has been a rallying point for the crypto world, with petitions and campaigns to “Free Ross.”

Trump’s move fulfills a campaign promise to the crypto community, further cementing his alliance with Bitcoin advocates.

Trump just granted a full pardon to Ross Ulbricht, founder of the Silk Road dark web marketplace.

Ulbricht had been serving a life sentence without parole since 2015 for charges including drug distribution and computer hacking.

Silk Road, which ran from 2011–2013, was a global drug bazaar fueled by Bitcoin, handling $200M+ in sales.

Trump called Ulbricht’s sentence “ridiculous” and credited the Libertarian Movement and crypto community for supporting the decision.

Ulbricht’s case has been a rallying point for the crypto world, with petitions and campaigns to “Free Ross.”

Trump’s move fulfills a campaign promise to the crypto community, further cementing his alliance with Bitcoin advocates. Today we look into Geo-blocking.

Still a Thorn in Europe’s Digital Shopping Experience.

Imagine this: you’re ready to binge-watch a new show or snag a great deal online, but instead of access, you’re met with a virtual “Sorry, not available in your region” sign. Annoying, right? That’s geo-blocking for you—a practice that was supposed to be tackled by EU regulations back in 2018 but, as a recent audit reveals, it’s still creating headaches for European consumers.

The European Court of Auditors (ECA) just dropped a report that pulls no punches. Sure, progress has been made, but there’s a glaring issue—enforcement across EU countries is wildly inconsistent. Some nations hand out laughable penalties of €26 for violations, while others threaten fines in the millions or even jail time. That’s like trying to stop a storm with a paper umbrella in some places while wielding a sledgehammer in others.

What’s more, many consumers don’t even know their rights or where to get help. Traders aren’t off the hook either—they’re struggling with unclear rules and dispute resolutions. It’s a mess, and it’s leaving people frustrated when their online shopping plans hit a wall simply because of where they live.

And then there’s the elephant in the room: streaming services and TV content. These are still exempt from the rules, thanks to complex copyright laws. If you’ve ever been blocked from watching your favorite series because it’s not available in your country, you know the pain. The ECA suggests it’s time to rethink these exemptions, and frankly, they’re right. In a globalized, interconnected world, why should location limit your options?

The European Commission seems to get it. They’ve welcomed the report and hinted at tightening enforcement and expanding regulations. But words are easy—action is what matters. Consumers deserve consistent protections, whether they’re buying a gadget, booking a service, or streaming a movie.

As the 2025 review of the Geo-blocking Regulation approaches, it’s clear that the EU needs to step up. Fair access to goods and services isn’t just a perk—it’s a right in the Single Market. Let’s hope policymakers take these findings seriously and give geo-blocking the boot once and for all. After all, no one should be locked out of the digital world based on their postcode.

Today we look into Geo-blocking.

Still a Thorn in Europe’s Digital Shopping Experience.

Imagine this: you’re ready to binge-watch a new show or snag a great deal online, but instead of access, you’re met with a virtual “Sorry, not available in your region” sign. Annoying, right? That’s geo-blocking for you—a practice that was supposed to be tackled by EU regulations back in 2018 but, as a recent audit reveals, it’s still creating headaches for European consumers.

The European Court of Auditors (ECA) just dropped a report that pulls no punches. Sure, progress has been made, but there’s a glaring issue—enforcement across EU countries is wildly inconsistent. Some nations hand out laughable penalties of €26 for violations, while others threaten fines in the millions or even jail time. That’s like trying to stop a storm with a paper umbrella in some places while wielding a sledgehammer in others.

What’s more, many consumers don’t even know their rights or where to get help. Traders aren’t off the hook either—they’re struggling with unclear rules and dispute resolutions. It’s a mess, and it’s leaving people frustrated when their online shopping plans hit a wall simply because of where they live.

And then there’s the elephant in the room: streaming services and TV content. These are still exempt from the rules, thanks to complex copyright laws. If you’ve ever been blocked from watching your favorite series because it’s not available in your country, you know the pain. The ECA suggests it’s time to rethink these exemptions, and frankly, they’re right. In a globalized, interconnected world, why should location limit your options?

The European Commission seems to get it. They’ve welcomed the report and hinted at tightening enforcement and expanding regulations. But words are easy—action is what matters. Consumers deserve consistent protections, whether they’re buying a gadget, booking a service, or streaming a movie.

As the 2025 review of the Geo-blocking Regulation approaches, it’s clear that the EU needs to step up. Fair access to goods and services isn’t just a perk—it’s a right in the Single Market. Let’s hope policymakers take these findings seriously and give geo-blocking the boot once and for all. After all, no one should be locked out of the digital world based on their postcode.GM.

Today's highlights??

Trump’s First-Day Blitz.

Well, Trump’s back, and he’s hitting the ground running—more like sprinting—with a flurry of executive orders. From energy to tariffs, TikTok to federal workforce control, it’s clear that his second term is going to be nothing short of eventful. But what does it all mean for investors? Let’s break it down.

Trump wasted no time declaring a national energy emergency, aiming to ramp up domestic production. He pulled the U.S. out of the Paris Climate Accords (again) and signed an order aptly titled “Unleashing American Energy,” which could open federal lands and waters for exploration. His message was clear: “Drill, baby, drill.”

For energy investors, this is a double-edged sword. Increased production could boost U.S. energy stocks, but over-supply risks and environmental pushback could dampen long-term prospects. And withdrawing from the Paris Accords? That’s a potential red flag for companies tied to green energy initiatives.

Trump, famously a fan of tariffs, hasn’t dropped the hammer just yet. While there’s talk of a 25% tariff on imports from Mexico and Canada and more duties on Chinese goods, investors got a temporary reprieve. Markets welcomed the delay, with S&P 500 futures rising.

But don’t get too comfortable. The tariffs are coming, and when they hit, they’ll likely rattle global trade. For businesses reliant on imports, it’s time to start looking at alternative supply chains or brace for higher costs.

In a surprising twist, Trump gave TikTok a brief reprieve from a looming ban. He’s not done playing hardball, though. Investors should tread carefully with any companies tied to TikTok, as legal and political uncertainties still loom large.

Regulatory Overhaul and Workforce Shake-Up

From freezing federal regulations to putting more control over the federal workforce, Trump’s aiming to shake up Washington. Businesses might find some regulatory relief in sectors like energy and finance, but the broader implications—like potential hiring freezes—could add layers of uncertainty.

For investors, the key takeaway is volatility. Trump’s plans to overhaul trade, energy, and federal policies signal massive shifts that could boost some sectors while shaking others to their core. Energy stocks, U.S.-based manufacturers, and companies with diversified supply chains might benefit, but others tied to global trade or renewable energy could face challenges.

As Trump himself said, “Now the work begins.” For investors, the same holds true: Stay vigilant, stay flexible, and prepare for a bumpy ride.

Trump’s First-Day Blitz.

Well, Trump’s back, and he’s hitting the ground running—more like sprinting—with a flurry of executive orders. From energy to tariffs, TikTok to federal workforce control, it’s clear that his second term is going to be nothing short of eventful. But what does it all mean for investors? Let’s break it down.

Trump wasted no time declaring a national energy emergency, aiming to ramp up domestic production. He pulled the U.S. out of the Paris Climate Accords (again) and signed an order aptly titled “Unleashing American Energy,” which could open federal lands and waters for exploration. His message was clear: “Drill, baby, drill.”

For energy investors, this is a double-edged sword. Increased production could boost U.S. energy stocks, but over-supply risks and environmental pushback could dampen long-term prospects. And withdrawing from the Paris Accords? That’s a potential red flag for companies tied to green energy initiatives.

Trump, famously a fan of tariffs, hasn’t dropped the hammer just yet. While there’s talk of a 25% tariff on imports from Mexico and Canada and more duties on Chinese goods, investors got a temporary reprieve. Markets welcomed the delay, with S&P 500 futures rising.

But don’t get too comfortable. The tariffs are coming, and when they hit, they’ll likely rattle global trade. For businesses reliant on imports, it’s time to start looking at alternative supply chains or brace for higher costs.

In a surprising twist, Trump gave TikTok a brief reprieve from a looming ban. He’s not done playing hardball, though. Investors should tread carefully with any companies tied to TikTok, as legal and political uncertainties still loom large.

Regulatory Overhaul and Workforce Shake-Up

From freezing federal regulations to putting more control over the federal workforce, Trump’s aiming to shake up Washington. Businesses might find some regulatory relief in sectors like energy and finance, but the broader implications—like potential hiring freezes—could add layers of uncertainty.

For investors, the key takeaway is volatility. Trump’s plans to overhaul trade, energy, and federal policies signal massive shifts that could boost some sectors while shaking others to their core. Energy stocks, U.S.-based manufacturers, and companies with diversified supply chains might benefit, but others tied to global trade or renewable energy could face challenges.

As Trump himself said, “Now the work begins.” For investors, the same holds true: Stay vigilant, stay flexible, and prepare for a bumpy ride. Today, we look into Tariff Wars.

Will it Tip Europe’s Supply Chains Over the Edge?

Picture this: a tangled web of politics, trade policies, and global rivalries, all threatening to trip up Europe’s intricate supply chains. Sounds like a plot twist in an economic drama, right? But this isn’t fiction—it’s the very real possibility of a global tariff war looming on the horizon. With key players like the EU, US, and China locking horns, Europe could find itself caught in the crossfire.

The sparks first flew when the EU slapped increased tariffs on Chinese electric vehicles, citing concerns over government subsidies tilting the playing field. China didn’t take it lying down, launching investigations into EU brandy, pork, and dairy imports. Meanwhile, the US isn’t exactly staying neutral. Incoming President Donald Trump has hinted at tariffs of up to 20% on EU imports, ranging from cars to cheese. Toss in the already strained US-China trade ties, and the stage is set for a tariff war that could have Europe scrambling.

What does all this mean for Europe’s supply chains? Kevin O’Marah, supply chain guru from Zero100, paints a grim picture. Think pandemic-era chaos, but potentially worse: shipping delays, skyrocketing costs, and a mad dash for alternative suppliers. Critical industries—electric vehicles, semiconductors, and even solar power—could see disruptions, with costs spiraling as companies scramble to secure reliable materials.

But here’s the twist: some isolated players, like the UK, might find a silver lining. Overcapacity in places like China could lead to cheap materials flooding smaller markets, offering short-term gains for industries dependent on those resources.

Oddly enough, Trump’s tariffs might just nudge companies toward long-overdue changes. The push to regionalize supply chains could foster resilience and sustainability. Instead of shipping components halfway around the world, businesses might focus on local suppliers, reducing their carbon footprint and insulating themselves from geopolitical storms.

The good news? Companies aren’t walking into this unprepared. Lessons learned from COVID-19 disruptions have spurred investments in AI, robotics, and predictive analysis. Many are diversifying away from China, fine-tuning supply chain models, and building agile teams to respond to crises in real time.

As O’Marah says, “Most global companies are actually quite prepared to deal with a volatile tariff environment.” It’s a fight-or-flight moment for Europe’s supply chains, but with innovation and adaptability in their corner, survival seems likely—though not without a few bumps along the way.

Today, we look into Tariff Wars.

Will it Tip Europe’s Supply Chains Over the Edge?

Picture this: a tangled web of politics, trade policies, and global rivalries, all threatening to trip up Europe’s intricate supply chains. Sounds like a plot twist in an economic drama, right? But this isn’t fiction—it’s the very real possibility of a global tariff war looming on the horizon. With key players like the EU, US, and China locking horns, Europe could find itself caught in the crossfire.

The sparks first flew when the EU slapped increased tariffs on Chinese electric vehicles, citing concerns over government subsidies tilting the playing field. China didn’t take it lying down, launching investigations into EU brandy, pork, and dairy imports. Meanwhile, the US isn’t exactly staying neutral. Incoming President Donald Trump has hinted at tariffs of up to 20% on EU imports, ranging from cars to cheese. Toss in the already strained US-China trade ties, and the stage is set for a tariff war that could have Europe scrambling.

What does all this mean for Europe’s supply chains? Kevin O’Marah, supply chain guru from Zero100, paints a grim picture. Think pandemic-era chaos, but potentially worse: shipping delays, skyrocketing costs, and a mad dash for alternative suppliers. Critical industries—electric vehicles, semiconductors, and even solar power—could see disruptions, with costs spiraling as companies scramble to secure reliable materials.

But here’s the twist: some isolated players, like the UK, might find a silver lining. Overcapacity in places like China could lead to cheap materials flooding smaller markets, offering short-term gains for industries dependent on those resources.

Oddly enough, Trump’s tariffs might just nudge companies toward long-overdue changes. The push to regionalize supply chains could foster resilience and sustainability. Instead of shipping components halfway around the world, businesses might focus on local suppliers, reducing their carbon footprint and insulating themselves from geopolitical storms.

The good news? Companies aren’t walking into this unprepared. Lessons learned from COVID-19 disruptions have spurred investments in AI, robotics, and predictive analysis. Many are diversifying away from China, fine-tuning supply chain models, and building agile teams to respond to crises in real time.

As O’Marah says, “Most global companies are actually quite prepared to deal with a volatile tariff environment.” It’s a fight-or-flight moment for Europe’s supply chains, but with innovation and adaptability in their corner, survival seems likely—though not without a few bumps along the way. Today, let's look into the current Crypto Frenzy.

ETF Filings Flood SEC as Gensler Bids Farewell.

Well, it didn’t take long for the crypto industry to seize the moment, did it? As SEC Chair Gary Gensler packs up his office, the cryptocurrency world is buzzing with excitement—and a stack of ETF proposals. Over ten applications landed on the SEC’s doorstep just days before Gensler's departure on January 20, signaling a strategic push to get ahead of what many expect to be a more crypto-friendly era under the incoming Trump administration.

ProShares, a major player in the ETF game, is making bold moves. They’ve filed for a Solana Futures ETF, which could give investors exposure to Solana’s native token, SOL, through futures contracts. While Solana futures aren’t exactly a hot commodity yet, this could pave the way for significant market interest. However, ETF analyst James Seyffart remains skeptical about seeing Solana ETFs in the U.S. before 2026.

And ProShares isn’t stopping there. They’ve also thrown their hat in the ring with proposals for leveraged, inverse, and futures ETFs tied to XRP. Other firms like CoinShares, Bitwise, 21Shares, and WisdomTree are also jockeying for position with spot XRP ETFs and other innovative funds.

Meanwhile, VanEck is doubling down on the broader crypto ecosystem. Their "Onchain Economy" ETF aims to back companies like software developers, miners, and payment providers—essentially covering the whole crypto shebang.

Timing, as they say, is everything. Gensler’s tenure as SEC chair was nothing short of a crypto crackdown. From lawsuits against Coinbase to hammering unregistered securities, his time at the helm was marked by tension with the digital assets world.

But with his exit—and the arrival of a Trump administration that’s signaling a warmer attitude toward crypto—the industry is betting on a regulatory reset. This ETF filing frenzy feels like a collective “let’s get in while the getting’s good.”

The incoming administration seems poised to loosen the reins, which could open the door for wider adoption and innovation in the crypto space. Eric Balchunas, senior ETF analyst, summed it up perfectly: “Gensler wasn’t even out of the building for five minutes, and the ETF industry unloaded a massive crypto filing frenzy.”

Whether this marks the dawn of a golden age for crypto ETFs or just another chapter in the ongoing regulatory tug-of-war, one thing’s for sure: the crypto industry isn’t wasting any time staking its claim. Hold onto your hats—2025 is shaping up to be a wild ride for digital assets.

Today, let's look into the current Crypto Frenzy.

ETF Filings Flood SEC as Gensler Bids Farewell.

Well, it didn’t take long for the crypto industry to seize the moment, did it? As SEC Chair Gary Gensler packs up his office, the cryptocurrency world is buzzing with excitement—and a stack of ETF proposals. Over ten applications landed on the SEC’s doorstep just days before Gensler's departure on January 20, signaling a strategic push to get ahead of what many expect to be a more crypto-friendly era under the incoming Trump administration.

ProShares, a major player in the ETF game, is making bold moves. They’ve filed for a Solana Futures ETF, which could give investors exposure to Solana’s native token, SOL, through futures contracts. While Solana futures aren’t exactly a hot commodity yet, this could pave the way for significant market interest. However, ETF analyst James Seyffart remains skeptical about seeing Solana ETFs in the U.S. before 2026.

And ProShares isn’t stopping there. They’ve also thrown their hat in the ring with proposals for leveraged, inverse, and futures ETFs tied to XRP. Other firms like CoinShares, Bitwise, 21Shares, and WisdomTree are also jockeying for position with spot XRP ETFs and other innovative funds.

Meanwhile, VanEck is doubling down on the broader crypto ecosystem. Their "Onchain Economy" ETF aims to back companies like software developers, miners, and payment providers—essentially covering the whole crypto shebang.

Timing, as they say, is everything. Gensler’s tenure as SEC chair was nothing short of a crypto crackdown. From lawsuits against Coinbase to hammering unregistered securities, his time at the helm was marked by tension with the digital assets world.

But with his exit—and the arrival of a Trump administration that’s signaling a warmer attitude toward crypto—the industry is betting on a regulatory reset. This ETF filing frenzy feels like a collective “let’s get in while the getting’s good.”

The incoming administration seems poised to loosen the reins, which could open the door for wider adoption and innovation in the crypto space. Eric Balchunas, senior ETF analyst, summed it up perfectly: “Gensler wasn’t even out of the building for five minutes, and the ETF industry unloaded a massive crypto filing frenzy.”

Whether this marks the dawn of a golden age for crypto ETFs or just another chapter in the ongoing regulatory tug-of-war, one thing’s for sure: the crypto industry isn’t wasting any time staking its claim. Hold onto your hats—2025 is shaping up to be a wild ride for digital assets.GM. It is weekend, so hear me out.

This is a conspiracy theory from me, but in the world we live in, why not?

So... what if the large Financial Corporations who launch the BitcoinETF are purposely dumping the BTC price and thus not letting it grow in value?

If you are a company who beside BitcoinETF also owns several other assets and ETFs of regular stocks to offer your customers, you can clear see a unbalance of returns when comparing Bitcoin with anything else.

So... how do you solve this problem of unbalanced returns? By holding back the returns of your best performance asset, not to devaluate the others and keep a stable interest from customers to all your products.

If these companies sees a mass flux of customers moving to BitcoinETF in detriment of their other products, this would be bad for them.

A possible high devaluation of stocks and loss of company's MarketCap would break the stock market and the whole ecosystem we have.

The answer to that is not letting Bitcoin grow out-of-control. It's by controlling the market using the thousands of BTC these companies have accumulated in the past years to fund these BitcoinETFs.

By not letting Bitcoin grow exponentially as it would and could, these companies keeps all their products relevant to their customers.

It is just my opinion. But if indeed comes out to be true, you heard here first.

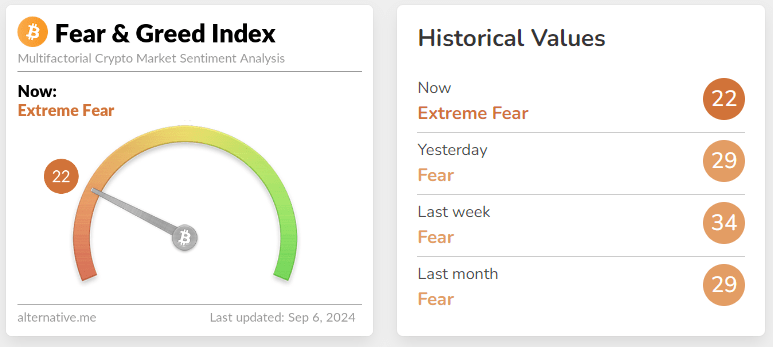

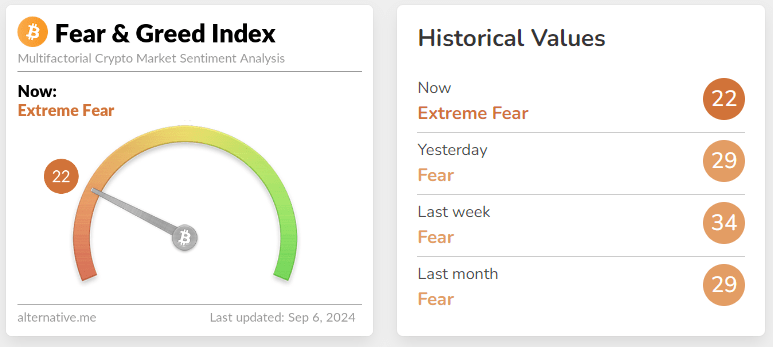

Big outflows hit Bitcoin ETFs again! Spot Bitcoin ETFs saw a total net outflow of $211M on Sept 5, with Grayscale's GBTC losing $23M, and Fidelity's FBTC seeing a huge $149M exit. BlackRock's IBIT stayed flat. Institutional investors still staying cautious.Total net asset value of Bitcoin spot ETFs hovers at $50B, but growth has stalled. The bearish sentiment continues to affect the crypto market’s momentum. Are we in for more turbulence?

GM...

C'mon guys... it is time to be brave.

Editorial time!!

🚨 Bitcoin's breaking into politics! Even Trump is jumping on the bandwagon after once calling it a scam. Why? Votes, sure—but also because if the U.S. doesn't adopt Bitcoin, someone else will. It's all about staying ahead in the global game. The U.S. is falling behind in Bitcoin adoption thanks to red tape. Some senators are now pushing to add Bitcoin to the national reserve! It’s not just about buzzwords—it’s about securing the future economic edge. 💰 Think of it as a new arms race, but with Bitcoin. Countries are scrambling to stock up on BTC before fiat currencies lose their power. It’s a "Bitcoin global hash war," and everyone wants a piece of the action. 🔥 🌊 The fiat world is sinking like the Titanic, and Bitcoin's the lifeboat. As traditional currencies lose value, the race to accumulate BTC is heating up. Time to "bend the knee" to Bitcoin, just like everyone else. 🚢 #FiatCollapse 🚀 So, what’s the move? Trump and the U.S. need to make Bitcoin legal tender and start hoarding it in the Treasury. The clock’s ticking, and the stakes have never been higher. Is the U.S. ready for "World War Bitcoin"? 🕰️

GM. Some good news out of El Salvador.

Remembers... it used to be one of the most dangerous countries in the world.

GM. On the news, this morning... The hacker behind India's biggest crypto heist just started laundering the $234M stolen from WazirX. They moved 2,500 Ether ($6.3M) to Tornado Cash right after the exchange's briefing on recovery efforts. Over 4M users affected, and the attacker remains unknown.WazirX's founder hints at a possible North Korean link, but full details are still missing. Only about 57% of stolen funds might be recovered. With WazirX restructuring and ongoing Binance disputes, users are left in limbo.

For my Brazilian followers... if any.

I have the e-book of George Orwell's 1984 available at my e-book Library and it is FREE to download.

https://tipybit.com/tng/products/1984-by-george-orwell

The similarities are uncanny. Worth a read.

GM... so, this happen:

And what have we learned, boys and girls??

Do anybody remember Mick Jagger in the World Cup of 1998?? Same vibe...