🚨Trump is expected to sign an executive order that will officially allow the inclusion of Bitcoin in private retirement plans (401(k)s).

The second-order effects remain to be seen, but this could potentially be bigger than ETFs—and maybe even bigger than BTCTC.

The passive capital inflow from millions of people who have no idea what Bitcoin is could be massive.

401(k) funds hold over $7 TRILLION in financial assets. If just 10% of that capital rotates into BTC, we could see an estimated $3.6 TRILLION increase in Bitcoin’s market cap, assuming a 5x multiplier effect.

Now, extrapolate that figure across the $43 trillion in total assets across all U.S. retirement plans.

Bitman

bitman@nostrplebs.com

npub1z204...mxwn

Follow the money.

“#Bitcoin is too volatile and doesn’t protect you from inflation.”

As ironic as it may sound, #Bitcoin not only protects you from the Cantillon Effect — it also puts you on equal footing with the privileged few who receive freshly printed money first. In other words: #Bitcoin gives you the power to exploit the victims of the system.

In the fiat standard we live under, central bankers print trillions and funnel that money first to well-connected banks — those at the front of the monetary privilege line. The bitcoiner, however, does something more elegant: they use absolute scarcity as collateral to drain liquidity from the system.

As former President Obama once said (even if he didn’t grasp the full depth of what he meant): holding #Bitcoin is like carrying a Swiss bank in your pocket. And he wasn’t wrong.

Put simply: you don’t just escape monetary debasement — you can profit from it.

In practice, this means access to hard-money credit (dollars, euros, yen, etc.) at interest rates historically reserved for banks deemed “too big to fail” — the same ones that have already collapsed in the past and were bailed out by taxpayers.

Being a bitcoiner today is more privileged than being any Brazilian bank. After all, Brazilian banks are far from the Federal Reserve and still operate under the control of local politicians — a toxic combination of distance from new money and proximity to Brazilian risk.

While most people are trying to survive the Cantillon Effect, you can profit from it.

After all, access to 5% annual credit in dollars is something not even Itaú can get.

Study #Bitcoin now — before the rest catch on. Take advantage of the privilege of others’ ignorance.

By the time the masses understand, the gains will have already gone to the sharp ones — and the only thing left for the “system’s obedient” will be crumbs.

Jordan Peterson says, “#Bitcoin is steadily gaining recognition as a global monetary standard, much like gold.”

@James Lavish breaks down why U.S. Treasury Bonds make weak collateral for borrowing — his takeaway: ditch the bonds and buy #Bitcoin instead.

“Ultimately, we’re witnessing #Bitcoin evolve from a tech-driven asset linked to the Magnificent 7 or the Nasdaq into something that more closely resembles digital gold.”

I hope Bitcoin helps you build and grow your family.

I wish that your legacy is honored by worthy and wise heirs.

May your efforts to create value be rewarded with the happiness of a full table and the peace of mind knowing you made the right choices. 🙏

🚨The government of Bhutan just sent $14.8 million worth of Bitcoin to Binance.

This is the first deposit made to an exchange this year — could they be selling BTC?

The country is a major player in Bitcoin mining and still holds over $1.2 billion worth.

The discerning are few, and fools are plenty.

It's easier to find an idiot who accepts a (loss-bearing) stablecoin like USDT than someone willing to take on the unstable upside risk of BTC.

It takes longer for the dull masses to catch on.

Take advantage of the asymmetry before hyperinflation hits.

For decades, one of Israel’s greatest state secrets quietly crossed the desert: a pipeline built in partnership with… Iran.

That’s right. The country that now vows to “wipe Israel off the map” was, for years, its main oil supplier.

Israel faced a critical strategic challenge: how to ensure a steady oil supply in a hostile Middle East?

In the mid-1950s, Iran under Shah Mohammad Reza Pahlavi — who didn’t even officially recognize Israel — became its primary supplier, accounting for up to 90% of Israel’s oil imports.

In 1965, Israeli Foreign Minister Golda Meir made a secret visit to Iran.

There, she proposed a bold plan to the Shah: build a pipeline linking the Red Sea to the Mediterranean, bypassing the Suez Canal — and secretly supplying oil to Israel.

The negotiations included representatives from Mossad and the Iranian state oil company NIOC — a testament to the initiative’s strategic importance.

Two years later, everything changed: the closure of the Suez Canal.

Following the Six-Day War, Egypt shut down the canal, and 75% of Iranian oil exports were left without a route.

The Shah saw the pipeline as a perfect opportunity: reduce dependence on Egypt and strengthen his leverage over Western oil companies.

It was the final push needed.

Thus was born Trans-Asiatic Oil Ltd., a 50/50 joint venture between Iran and Israel — registered in Switzerland, of course.

Officially, Iran said: “We don’t sell oil to Israel.”

In practice? They did — operating pipelines and even having Israeli naval escorts for Iranian tankers.

The 254-kilometer pipeline between Eilat and Ashkelon was completed in 1969.

In its first year, 10 million tons of oil passed through it. Israel kept 3 million; the rest was sold via Israel, with profits split between the secret partners.

A true geopolitical masterpiece.

While Israel secured its energy supply, the Shah’s Iran challenged Western oil giants and filled its coffers — all under the radar.

It was a win-win: oil, money, and influence for both sides. Hidden from the rest of the Arab world.

But everything changed in 1979 with the Islamic Revolution in Iran.

Israel nationalized the pipeline, ending the secret alliance.

The case ended up in court — and in 2016, an international tribunal ordered Israel to pay Iran over $1 billion for breach of contract.

Today, even mentioning such an alliance would sound like fiction.

But for over a decade, Israel’s greatest enemy was… its biggest ally behind the scenes.

The pipeline still exists. But the partnership is now a relic from an era when interests spoke louder than ideology.

The U.S. is evacuating embassies in the Middle East, and oil is up 5% today.

For now, it’s just speculation—pointing toward a possible strike on Iran. 👀

Chinese demographics in one image.

In 2000, there were 10 workers for every retiree. Today, there are only 5. The same issue will eventually be faced by aging-population countries, such as those in Europe.

A decline in consumption that will be countered with monetary debasement and stimulus…

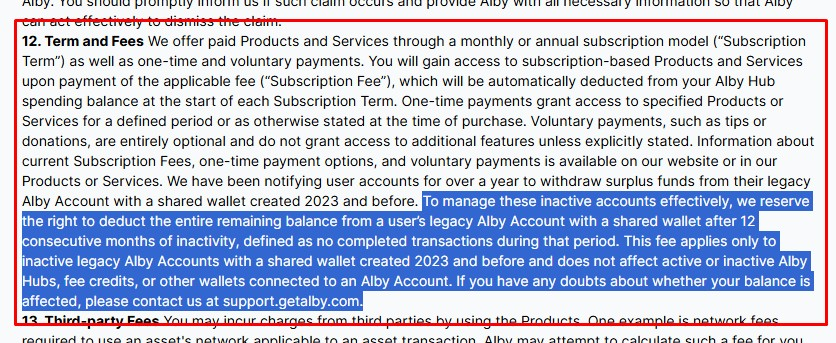

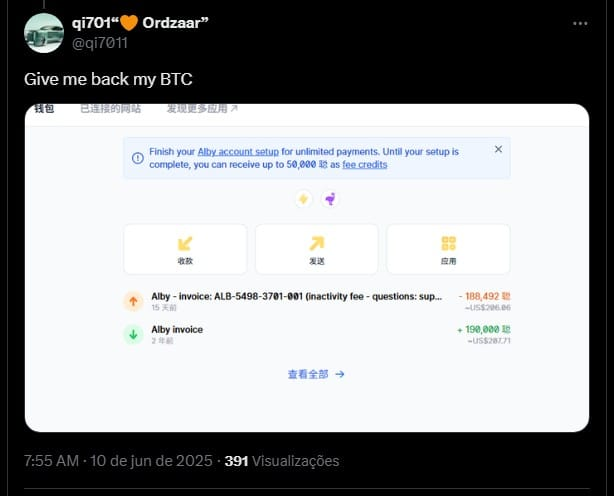

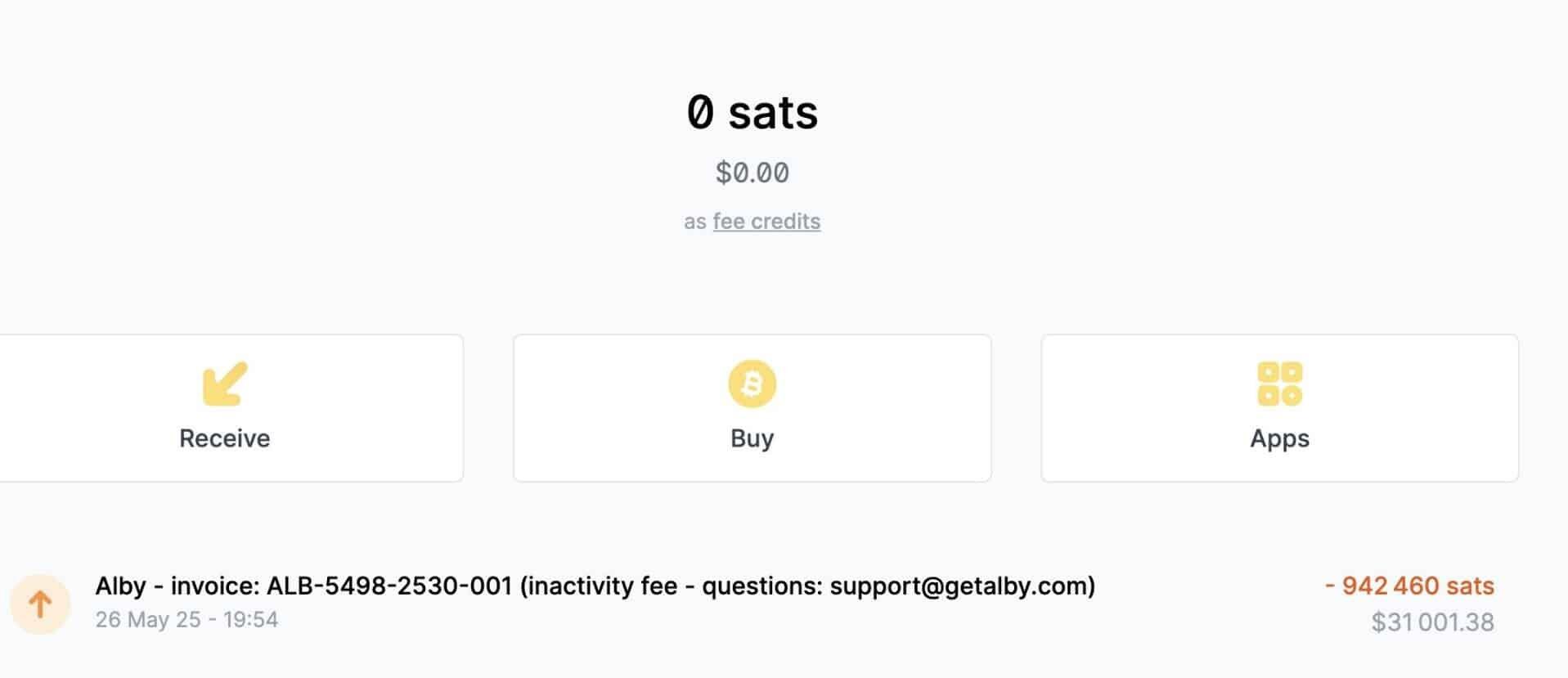

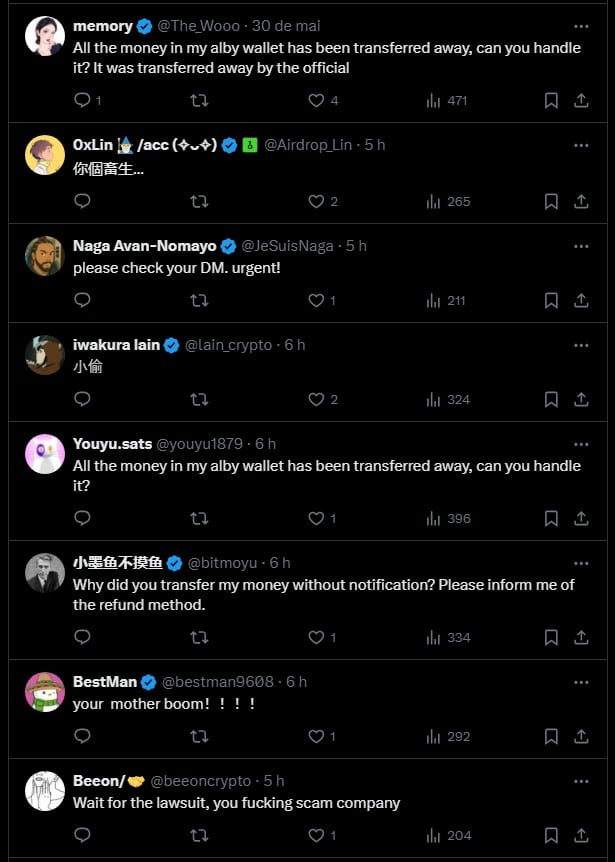

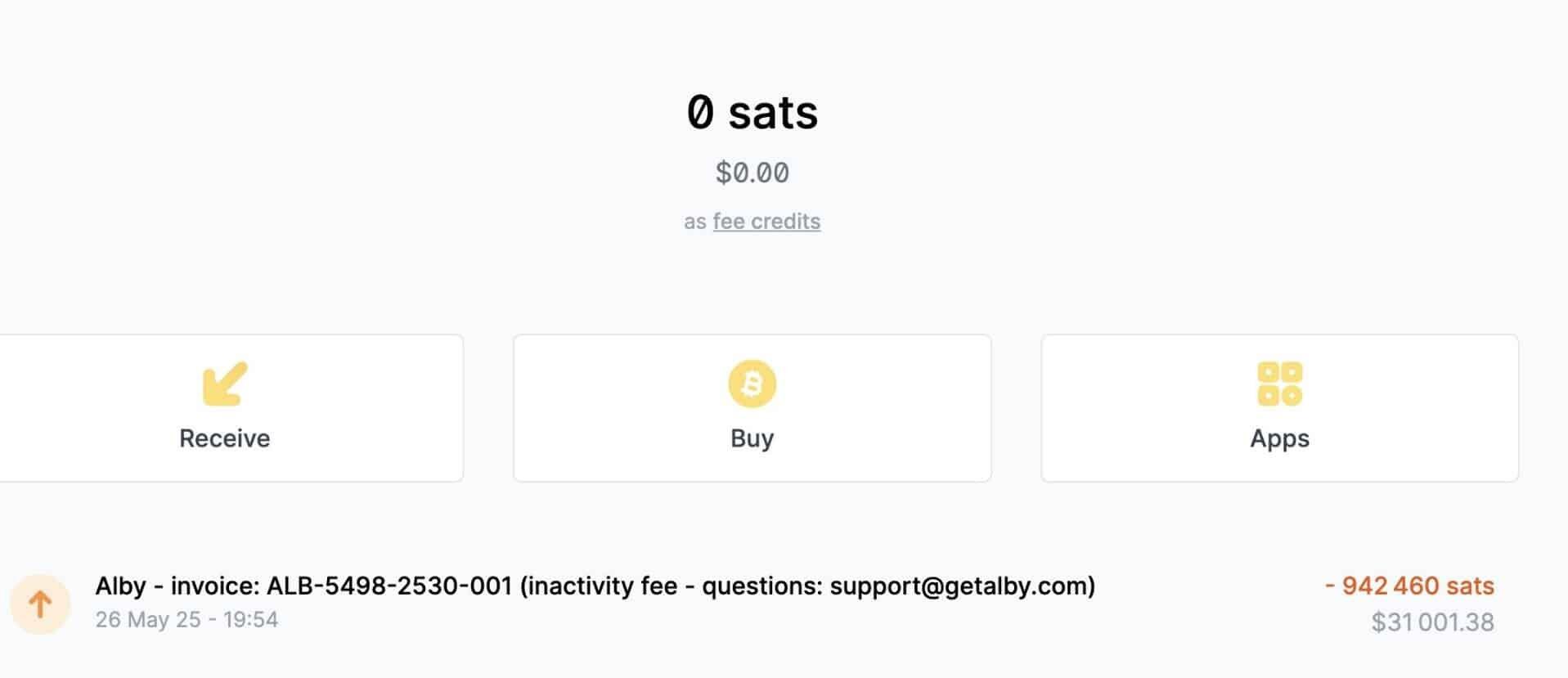

Bitcoin Wallet Begins Charging ‘Inactivity Fee’ to Users; Amounts Reach Up to $30,000

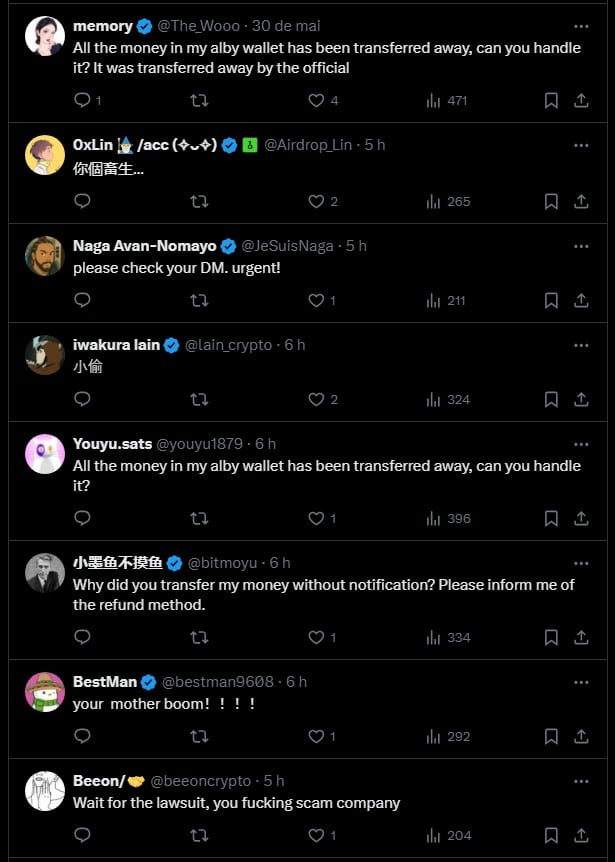

Users of a Bitcoin wallet are accusing its developers of moving their coins without permission. Numerous reports about the issue can be found on social media.

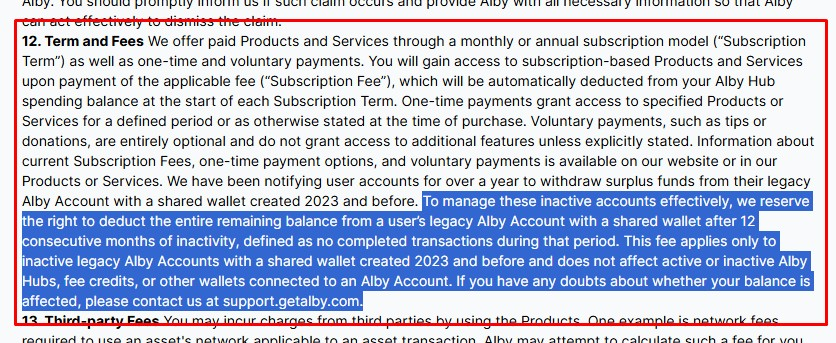

The transfers are reportedly an “inactivity fee” charged by the wallet, which operates on both the native Bitcoin network and the Lightning Network. The fee is outlined in its terms of service.

Unlike other well-known wallets, such as Electrum or Ledger, this wallet offers a shared custody solution. As a result, the developers also have access to the funds.

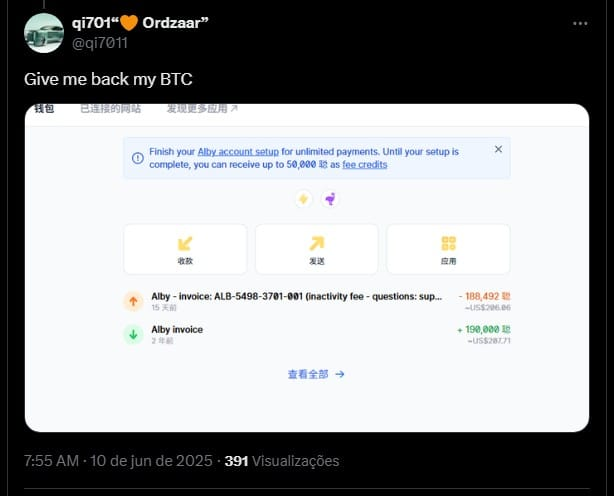

As an example, a user shared a screenshot showing that the developers deducted $200 in Bitcoin from their wallet. The invoice cites an “inactivity fee” as the justification.

In another post, several similar comments can be found. While some question the motivations behind these transfers, others threaten to sue the company.

“All the money in my @Alby was transferred, can you fix this? It was transferred by the official.”

“You bastard”

“Thief”

“All the money in my @Alby was transferred, can you fix this?”

“Why did you transfer my money without warning? Please provide the refund method.”

“Get ready for a lawsuit, you damn fraudulent company.”

Other screenshots show deducted amounts of $42, $117, $1047, and even $30000. In other words, it is not a fixed-value fee.

“The Alby wallet redefines the meaning of: ‘Your money is my money.’ My goodness, a new way to steal money!”

“The main reason is that, according to @Alby terms of service updated in March 2025: to more efficiently manage accounts inactive for long periods, the platform withdraws the entire remaining balance from accounts that have had no transactions for 12 consecutive months,” wrote the user KuiGas.

Someone is still using the original Bitcoin software and just never upgraded.

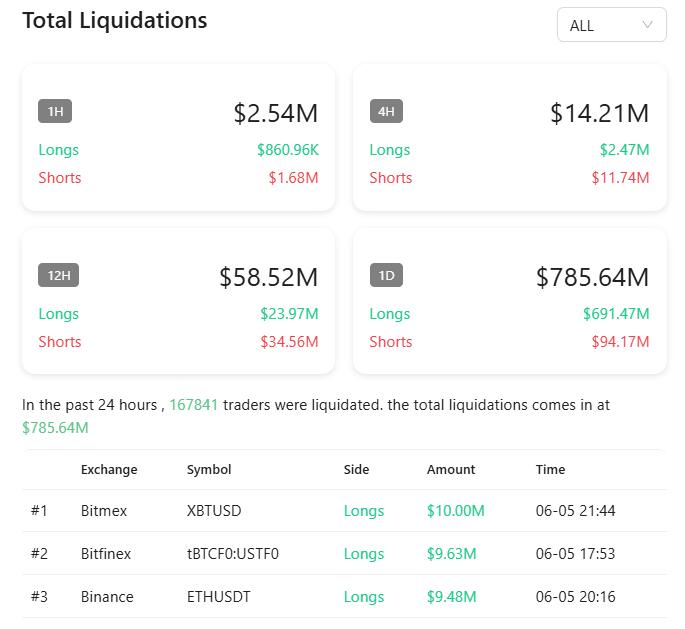

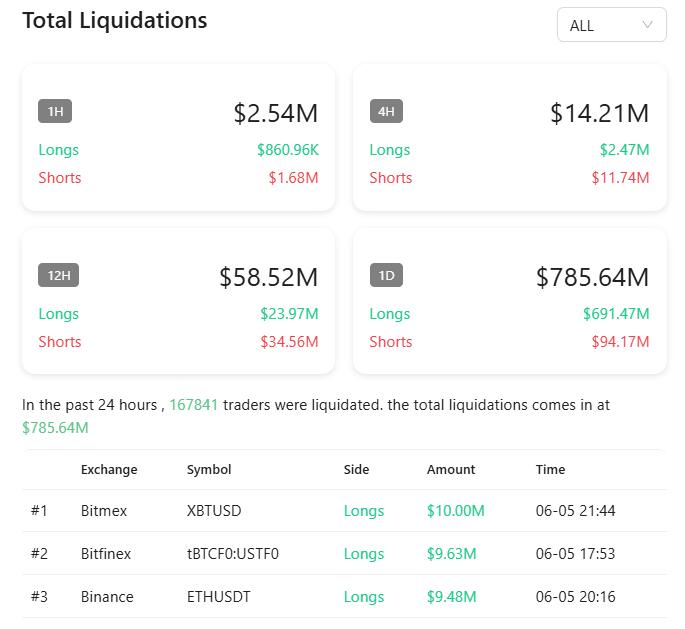

Nearly \$800 million was liquidated yesterday in the futures market. 🔥

Bitcoin accounted for about \$267 million of the total liquidations.

A X spat triggered one of the biggest liquidations of 2025.

Another Bitcoin Treasury Company is born. 🔥

Know Labs, Inc. (\$KNW), a U.S.-based medical materials company, has announced a Bitcoin Treasury Strategy with an initial purchase of 1,000 BTC following its acquisition by Greg Kidd.

It’s becoming routine at this point, isn’t it?

The U.S. Treasury has just repurchased $10 billion of its own debt. 🚨

Just to be clear: this is the largest debt buyback operation in history.

Probably nothing. Brrr 🖨️

Few people really know this, but as of today, there are already 223 entities — including 124 publicly traded companies — that have declared Bitcoin on their balance sheets. 🤯

In just the past month, 19 new companies have joined this group.

But how are they custodying these BTCs?

Most large companies use institutional custodians.

In other words, they delegate the custody of their BTC to third parties, much like they would with a bank vault.

But this solution comes with high costs and concentrated risks. After all, whoever holds the key… holds the Bitcoin.

And we’re not talking about just a few bitcoins.

If we combine private companies and publicly traded ones, we’re talking about more than 1.1 million coins.

In total, institutional and corporate adoption of Bitcoin already holds over 3.39 million BTC in circulation.

Several custodians are used, such as BitGo (Galaxy Digital, Fidelity Digital Assets, Anchorage Digital, and NYDIG).

But Coinbase Custody is currently the largest, having reported $114 billion in assets under custody in 2024.

For example, MicroStrategy uses Coinbase.

++ CIRCLE SURGES +186% AT THE OPENING OF ITS IPO. 🔥

Wall Street is starting to realize the power that stablecoins hold, but the most incredible thing is that a large part of the market is still asleep.

Just imagine the volume of capital that will flow in through synthetic dollars…

First they attack and reject it, then they adopt it.

JPMorgan will offer loans collateralized with Bitcoin ETFs to its clients.

#Bitcoin is the ultimate collateral, and this is just the beginning of this trend.