Bitcoin Wallet Begins Charging ‘Inactivity Fee’ to Users; Amounts Reach Up to $30,000

Users of a Bitcoin wallet are accusing its developers of moving their coins without permission. Numerous reports about the issue can be found on social media.

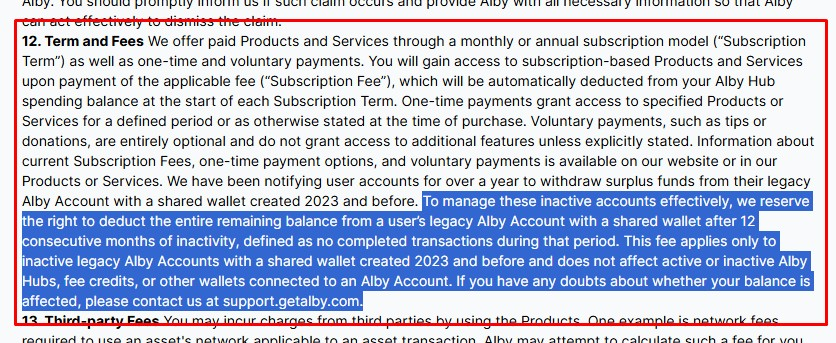

The transfers are reportedly an “inactivity fee” charged by the wallet, which operates on both the native Bitcoin network and the Lightning Network. The fee is outlined in its terms of service.

Unlike other well-known wallets, such as Electrum or Ledger, this wallet offers a shared custody solution. As a result, the developers also have access to the funds.

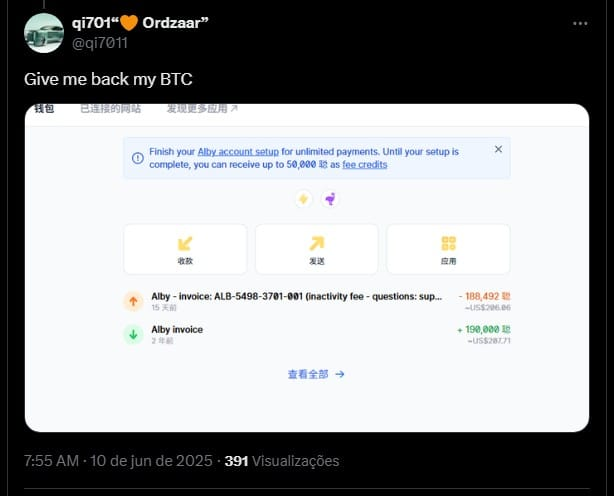

As an example, a user shared a screenshot showing that the developers deducted $200 in Bitcoin from their wallet. The invoice cites an “inactivity fee” as the justification.

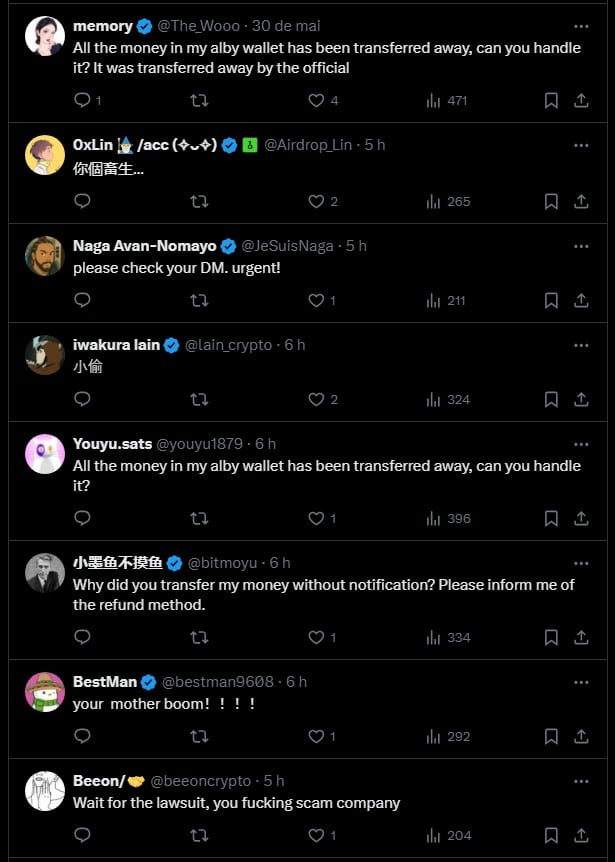

In another post, several similar comments can be found. While some question the motivations behind these transfers, others threaten to sue the company.

“All the money in my

@Alby was transferred, can you fix this? It was transferred by the official.”

“You bastard”

“Thief”

“All the money in my

@Alby was transferred, can you fix this?”

“Why did you transfer my money without warning? Please provide the refund method.”

“Get ready for a lawsuit, you damn fraudulent company.”

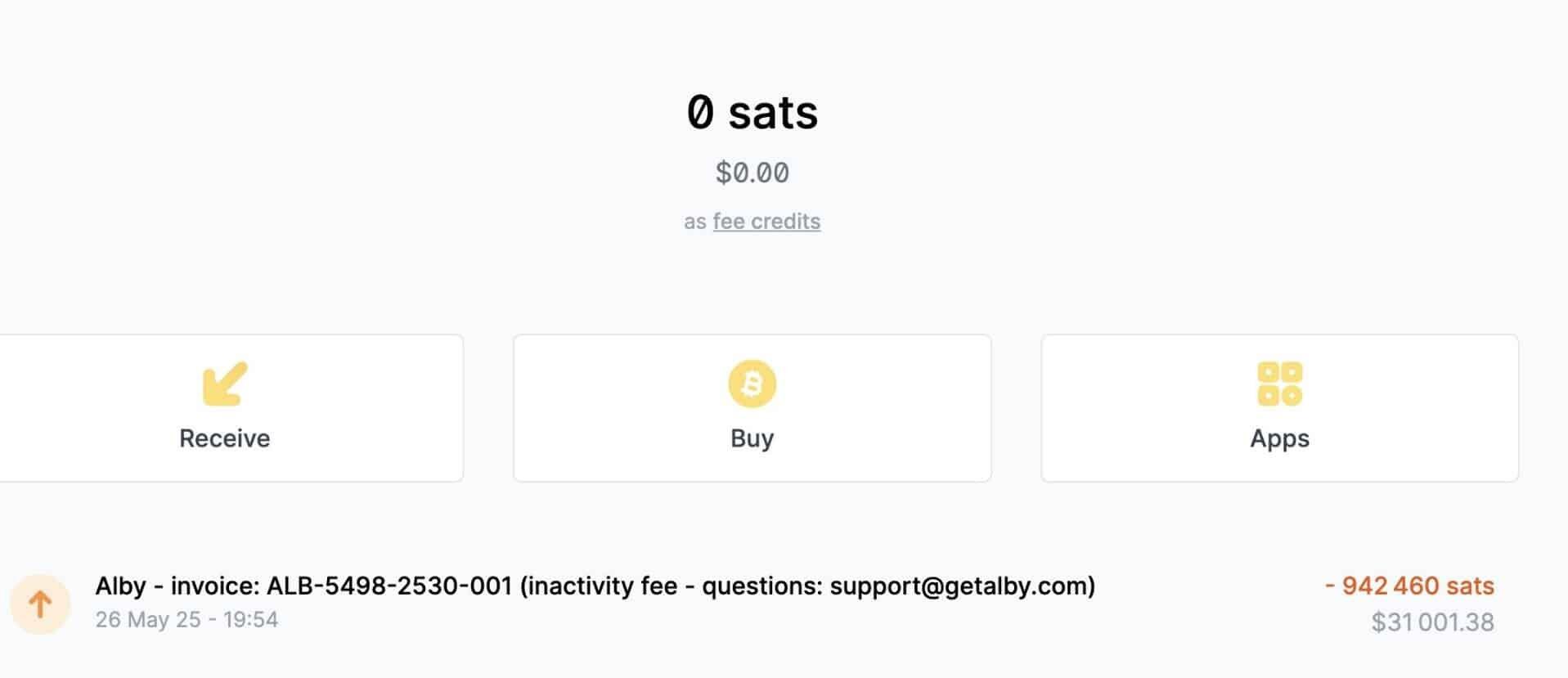

Other screenshots show deducted amounts of $42, $117, $1047, and even $30000. In other words, it is not a fixed-value fee.

“The Alby wallet redefines the meaning of: ‘Your money is my money.’ My goodness, a new way to steal money!”

“The main reason is that, according to

@Alby terms of service updated in March 2025: to more efficiently manage accounts inactive for long periods, the platform withdraws the entire remaining balance from accounts that have had no transactions for 12 consecutive months,” wrote the user KuiGas.