Today, June 4th, 2025, marks the 21st anniversary of the KILLDOZER — one of the most infamous acts of rebellion and defiance against government authorities.

Marvin Heemeyer owned a small muffler shop in his town. The local government approved the construction of a concrete plant directly in front of his business, effectively blocking access and causing severe financial harm. Marvin repeatedly sought solutions through legal means, appealing to the city council to halt construction or allow partial access. Every request was denied.

At one point, Marvin even offered to build an alternative access road at his own expense — he had purchased the necessary materials and machinery. Still, the city refused.

To make matters worse, the concrete plant disconnected Marvin's shop from the town’s sewage system. Instead of helping, the city fined him for having improper sewage. 🤡

With his business failing and his personal life in ruins, Marvin meticulously planned his revenge. Over the course of 1.5 years, he secretly modified a bulldozer he had originally purchased for the road project. He fortified it with steel armor, installed bulletproof glass, and equipped it with a sophisticated camera system — state-of-the-art for the time.

On June 4th, 2004, Marvin locked himself inside the armored bulldozer and began his mission, first demolishing the concrete plant that had devastated his livelihood. Over the next few hours, he drove through town, systematically destroying government buildings and the homes of public officials he held responsible for his plight.

The SWAT team was deployed, but their weapons, including rifles and explosives, proved useless against the heavily armored KILLDOZER.

Nothing seemed capable of stopping Marvin’s fury against the system — until the machine became trapped in the debris of one of the buildings he was demolishing. Surrounded and with no way out, Marvin took his own life — the only casualty of that day.

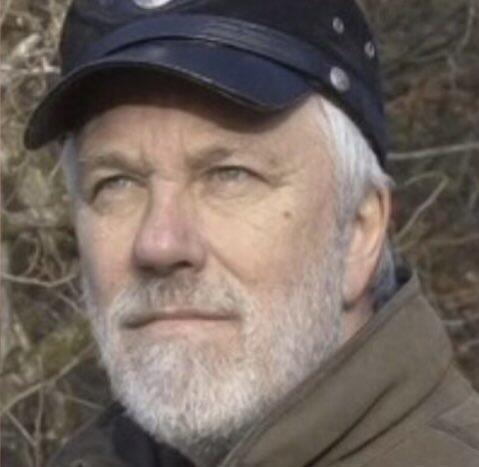

Today, we remember the day of the KILLDOZER and Marvin Heemeyer — the last great American anti-hero. A simple man who decided to fight back after his life was destroyed by an indifferent government.

Among his notes, one quote stood out:

“I was always a reasonable person until I had to be unreasonable. Sometimes reasonable men must do unreasonable things.”

🫡