The $1.2B hedge fund founder of 10T Holdings predicts that #Bitcoin is on its way to $180,000 🚀

Bitman

bitman@nostrplebs.com

npub1z204...mxwn

Follow the money.

“The government can’t print #Bitcoin—but it can print dollars, and they’re going to print a whole lot of them.”

— @Lawrence Lepard

Yesterday, net inflows into U.S. #Bitcoin ETFs surpassed nearly $1 billion.

Currently, around 450 BTC are mined daily, equivalent to approximately $500 million at the current price.

In other words, ETFs from just one country are already buying more #Bitcoin than the amount being produced each day — not even accounting for demand from retail investors, governments, or corporations holding BTC in their treasuries.

This is one of the main reasons why Bitcoin’s price has been reaching new all-time highs, even without signs of FOMO, euphoria, or a retail-driven surge. It’s also why many analysts argue that we may be witnessing the end of the traditional four-year correction cycles.

BlackRock’s CIO says that institutional investors are “primarily focused on #Bitcoin at the moment.”

@ODELL suggests that the U.S. should print as much money as necessary to accumulate #Bitcoin 🙌

The Treasury market is imploding;

A crisis of sovereign confidence is unfolding;

Clowns are taking over presidencies;

Fiat currencies are collapsing…

…and Bitcoin is hitting a new all-time high 🥁

Congratulations to everyone who saw the future and helped make it happen 🔥

The Dave Ramsey Show has shifted its position on #Bitcoin:

“Bitcoin is here to stay and deserves a place in a well-diversified investment strategy.”

@Lawrence Lepard says, "Owning a whole Bitcoin is going to be a huge deal in just a few years."

All roads lead to #Bitcoin

David Sacks: “#Bitcoin is scarce, it holds value, and that makes it a strategic asset for the U.S. to retain as a long-term reserve.”

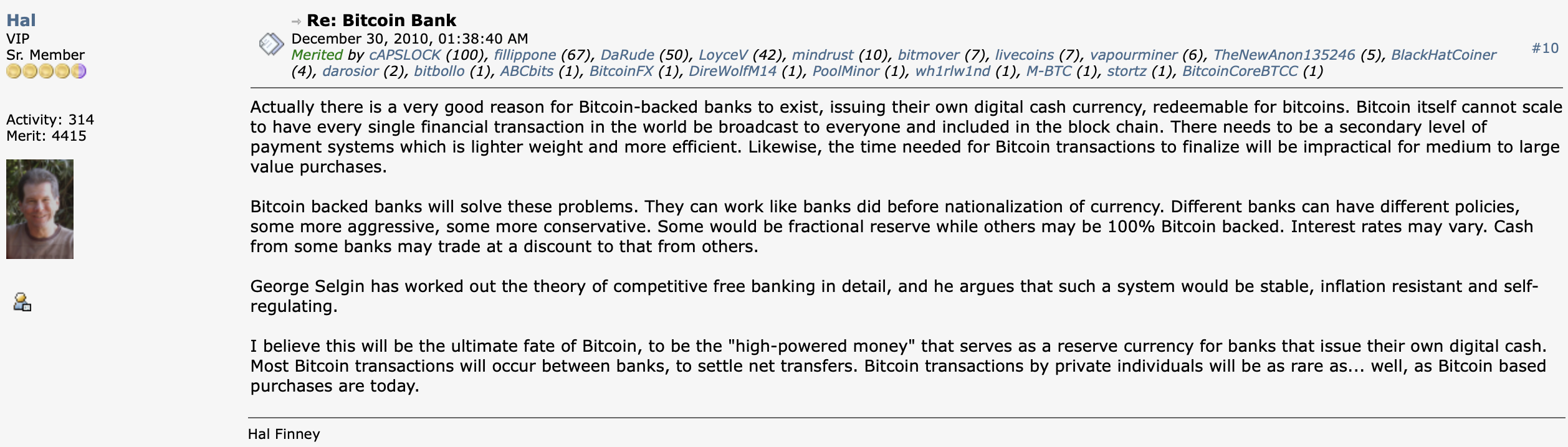

"The rules of #Bitcoin are extremely hard to change. Anyone can access the network directly without a trusted third party. Owning more bitcoin does not give you more control over the network so all participants are on equal footing.

This is why bitcoin has value."

— @ODELL

Trump met with the Saudi prince and the three most powerful businessmen on Earth to design the new world order.

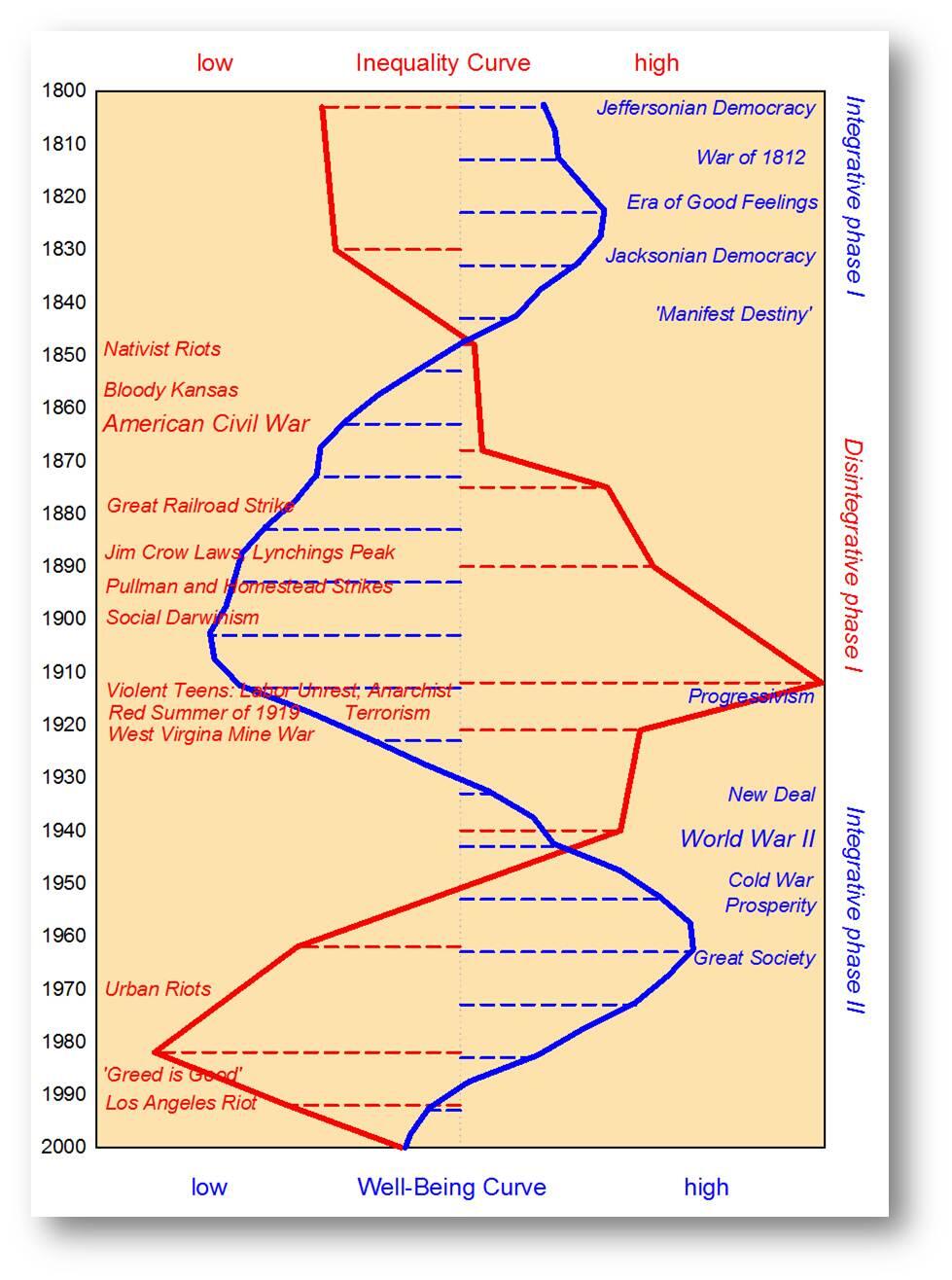

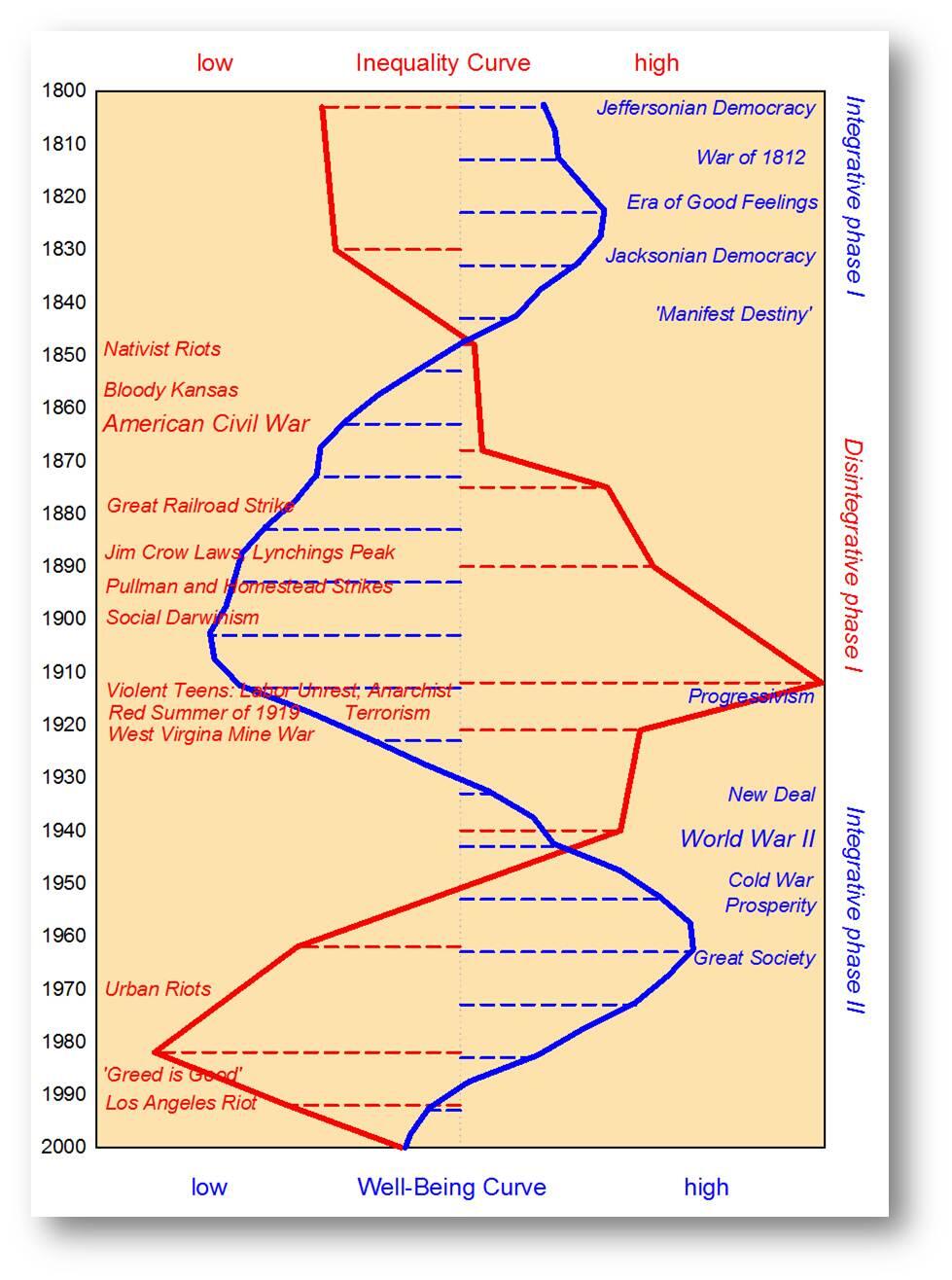

The “Pax Americana” has come to an end.

These guys will make a lot of money with what comes next. You can too.

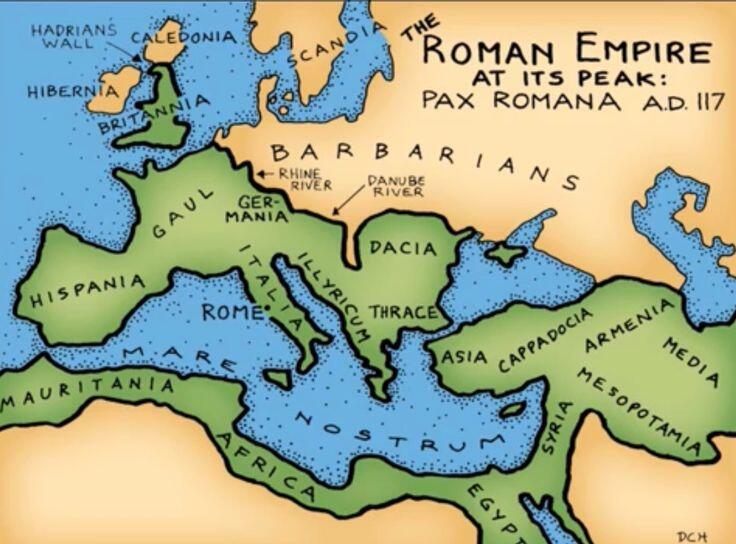

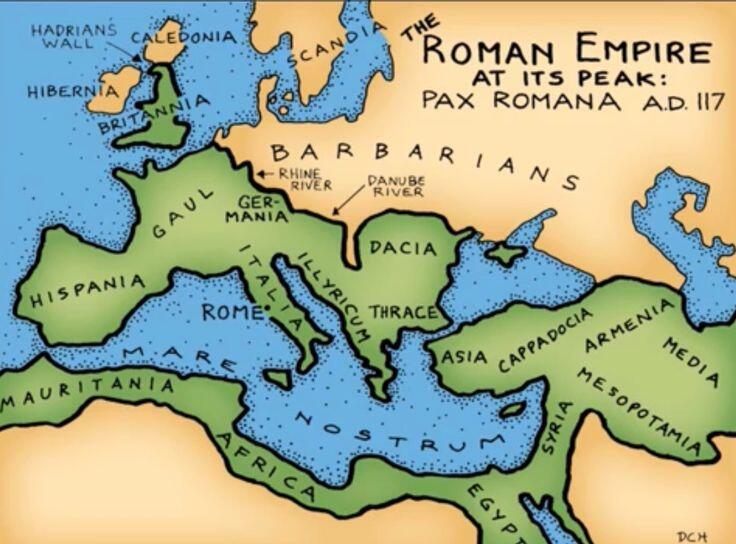

The Pax Romana was the period of political stability when Jesus was born.

70 million people lived under relative peace, from Northern Europe to Mesopotamia, because the Empire swiftly eliminated dissenters.

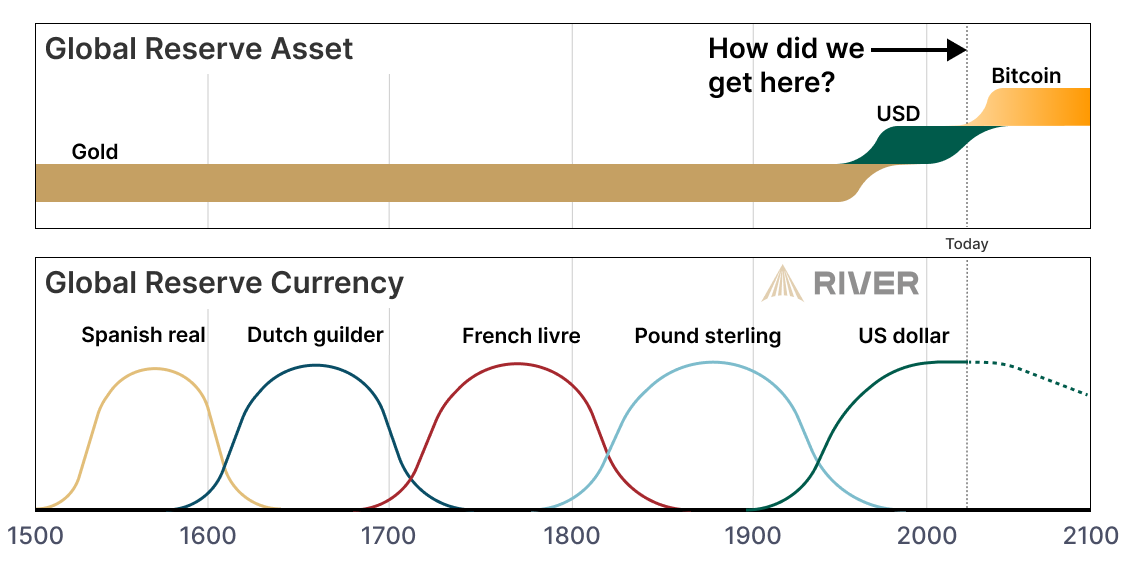

A similar dynamic defined other hegemonies over time...

An empire masters a new military technology and begins to expand. It subjugates provinces. It grows by “imposing peace” wherever it goes.

At some point, the cost of maintaining the empire exceeds the potential “revenue” from plundering new provinces.

Border territories are ceded. Resources dwindle. Living standards decline. Elites clash. And a new superpower rises.

Pax Ottomana: 16th and 17th centuries. The Ottomans were the first Western hegemony to master gunpowder.

Pax Britannica: 19th century. The British patrolled the seas… until the first great war broke out in Europe.

Pax Americana: from the end of World War II until today.

The last 100 years have been the most peaceful in history (unless you live in the Middle East), because the Pentagon can obliterate any capital before you finish watching a TikTok.

Allow me to introduce the USS Gerald R. Ford—the ultimate symbol of the guarantors of world peace:

Recent generations of Americans have enjoyed the highest quality of life ever seen, exporting inflation and importing cheap goods produced in the Third World.

But now it’s time for Uncle Sam to pass the baton.

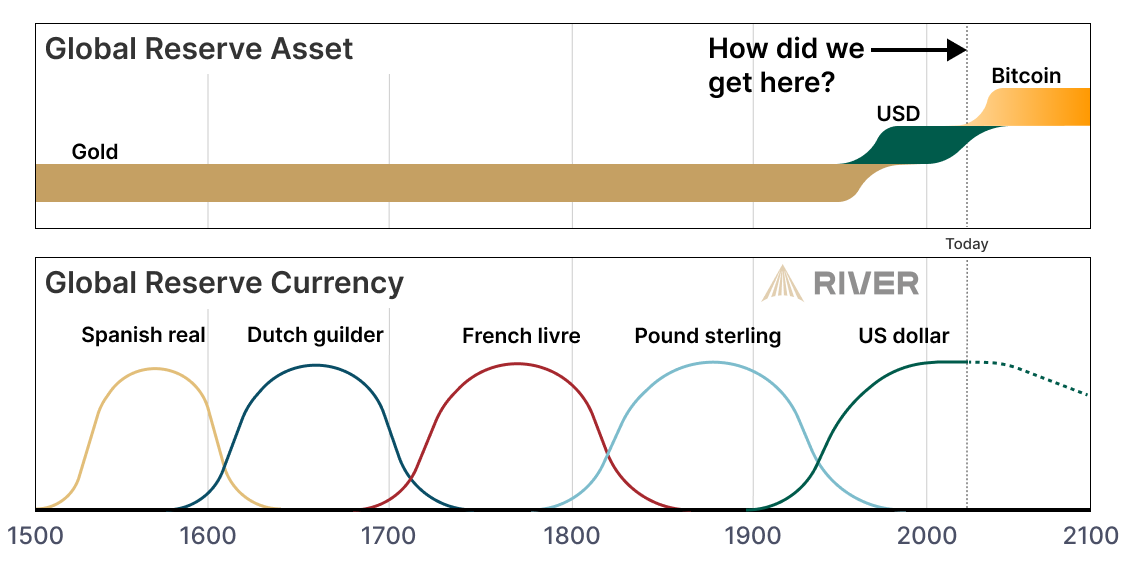

Trump is deliberately demoting the dollar from its role as the global reserve currency.

Ceding key “provinces” of the Empire: Taiwan to China, eastern Ukraine to Russia.

And intensifying the plunder of allies: Greenland, Ukrainian rare earths, Canada...

Central banks worldwide are dumping Treasuries.

China has offloaded 25% of its holdings since 2020.

The dollar’s share in foreign reserve assets won’t drop to zero overnight.

But if the current pace of divestment continues, it could hit zero in a century.

So far, three currencies have been considered “potential successors” to the dollar.

One is already out of the race: the Euro.

Two “contenders” remain:

China’s currency... and the Internet’s currency.

~15% of all #Bitcoin is held by governments, corporations, or ETFs. Not counting those on exchanges.

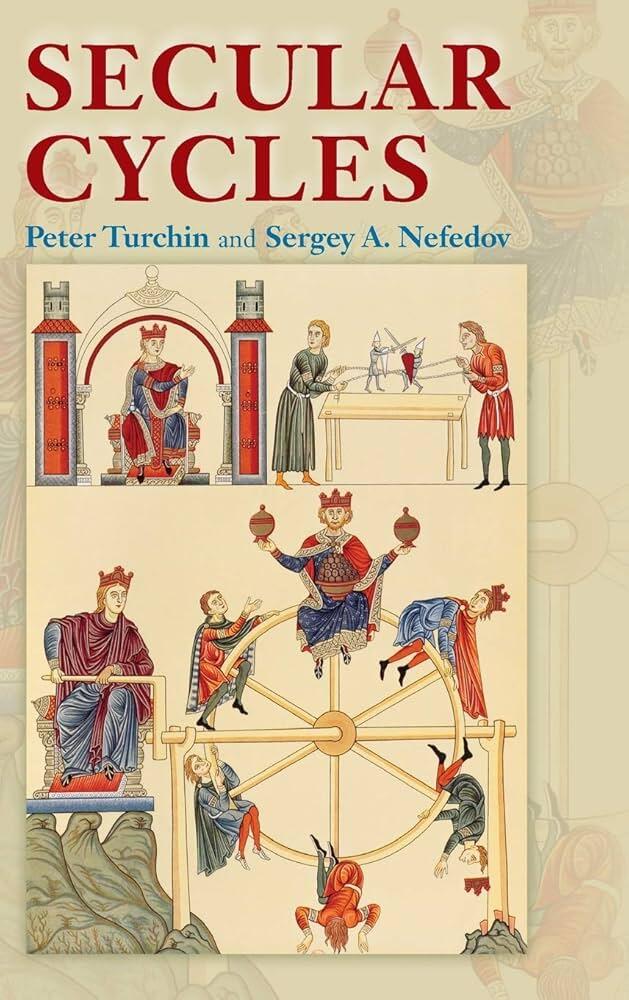

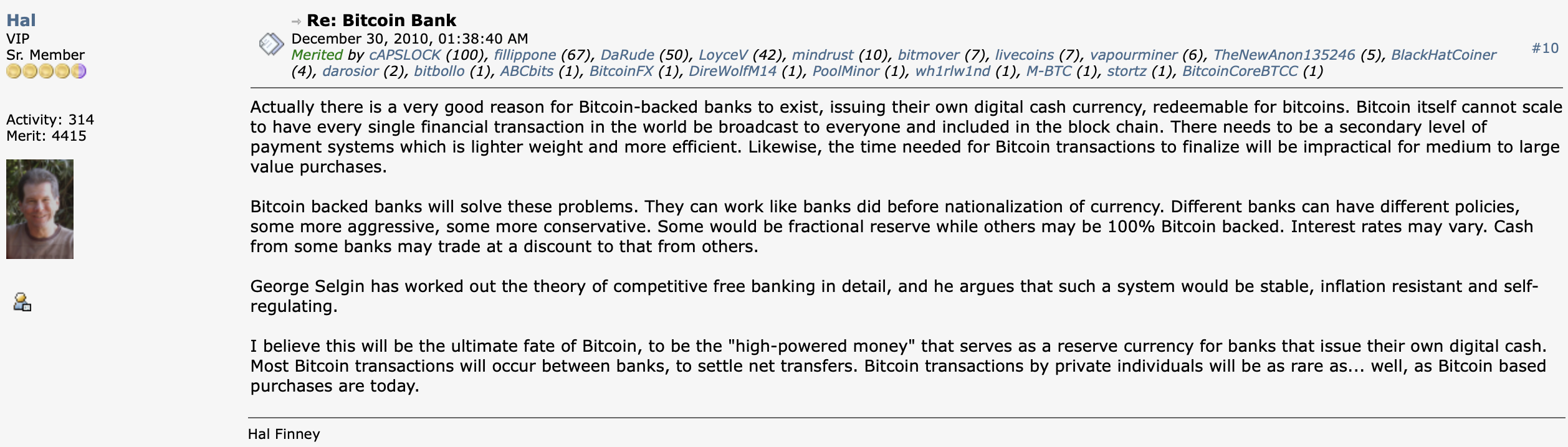

In the end, most satoshis will likely serve as backing—alongside other assets or not—for private stablecoins.

Financial institutions, social networks, and nation-states will have their own stablecoins 🤑

With different backings, reserve levels, and distribution strategies.

Just as every company became a “publisher” in the Internet era, every business can become a “bank” in the Bitcoin era.

The market will converge toward currencies backed by the supreme collateral, but there will be demand for other types of “commercial money.”

Both financial and human capital will become more liquid.

The average person won’t have money in 3 or 4 places anymore, but in dozens.

Capital controls will be less effective.

Wars will be much harder to finance.

The era of “Mutually Assured Destruction” (M.A.D.) gives way to “Mutually Assured Cooperation” (M.A.C.).

The primary deterrent to war is no longer just the nuclear threat, but the fact that funding military adventures is far more expensive in a Bitcoin standard.

And that’s what comes after Pax Americana.

A new order.

Feel free to call it “Pax Bitcoiniana.”

Heroes and villains will emerge in this transition. It doesn’t matter.

#Bitcoin was designed for people who don’t like or trust each other.

It’s “money for enemies” ⚔️

You don’t need to believe Bitcoin will save humanity. You just need to understand it will prevent humanity from destroying itself.

@Adam Back claims that “$100,000 is far too low” and predicts Bitcoin will reach between “$500,000 and $1 million in this cycle.”

Have you ever shuffled a deck of cards? If so, you’ve likely held a unique sequence—a combination of cards that’s never existed before in the universe’s history and probably never will again.

Let’s dive into entropy, improbability, and, naturally, #Bitcoin.

A standard 52-card deck can be arranged in 52! ways. That’s:

80,658,175,170,943,878,571,660,636,856,403,766,975,289,505,440,883,277,824,000,000,000,000

or roughly 8x10⁶⁷ possible shuffles. Hard to grasp?

Consider this:

⏱️ ~4.3x10¹⁷ seconds have elapsed since the Big Bang.

🧑🧑🧒🧒 ~100 billion humans have ever lived.

If every person shuffled a deck every second since the universe began, we’d still likely never see the same order twice.

Each thorough shuffle creates something entirely new. That’s the wonder of entropy.

So, how does this connect to Bitcoin?

This same improbability is what makes #Bitcoin secure.

When you create a Bitcoin wallet with a 24-word seed phrase, you’re selecting one out of:

115,792,089,237,316,195,423,570,985,008,687,907,853,269,984,665,640,564,039,457,584,007,913,129,639,936

possibilities, or ~1.1579x10⁷⁷. That’s exponentially larger than the deck’s shuffles.

To crack your wallet, someone would need to guess that exact sequence.

💪 Brute force? Useless.

🖥️ Supercomputers? Nope.

⏳ Time? Not enough.

It’s like picking one specific grain of sand from the entire universe… twice.

Bitcoin’s security doesn’t come from secrecy—it’s protected by being one choice among near-infinite possibilities.

Isn’t that elegant?

And get this: you can generate that level of security with something as simple as a six-sided die or, yes, a deck of cards.

If this doesn’t spark awe for the math behind #Bitcoin and its brilliant design, reread it. You’ll probably want to stack more satoshis.

Happy Sunday! 👋

Did Coinbase buy Deribit? If anyone has details, let me know.

Two VERY important events for #Bitcoin coming up:

The next block

The next halving

Everything else is just noise.

Good night, Nostr! 😴

Website that gave 5 bitcoins to each visitor will be revived by investor.

Charlie Shrem, founder of the #Bitcoin Foundation, announced this Sunday (4) that he will be reviving the first Bitcoin “faucet” in history. Originally created by Gavin Andresen, the site gave 5 bitcoins to each visitor back in 2010.

@James Lavish explains how US Treasury Bonds are not strong collateral for borrowing against.

Sell Bonds. Buy #Bitcoin

GOOD MORNING NOSTR, STAY HUMBLE AND STACK SATS 🫡

The OP_RETURN drama just shows how MANY people don’t understand the basics of how #Bitcoin works.

Spoiler: you can’t stop arbitrary data storage on the timechain. Trying to do so might even make things worse.

Some people are saying it's possible to "filter" spam in the mempool.

Wrong. That’s unfeasible. Anyone saying that is either misinformed or acting in bad faith.

The mempool is just local policy. Who really decides what goes into a block are the miners.

Many blindly believe influencers without understanding the fundamentals:

#Bitcoin is a decentralized database designed to store data.

Financial transactions are one type of data — not the only one.

"But shouldn’t we prioritize financial transactions?"

Yes.

"But can we stop arbitrary data from going into the timechain?"

No.

"Are there good reasons to store arbitrary data on #Bitcoin?"

Absolutely.

L2s and scalability solutions depend on on-chain proofs.

That’s just data storage.

It doesn’t matter what your node accepts or not — miners are incentivized to include these transactions and profit from them.

Financial incentives are what drive the system. Period.

If you try to become a “Bitcoin™ Defender” by running software with crazy filters...

Guess what?

The transactions go straight to the miners (with extra fees)

Small miners get left behind

Mining centralizes

People will hide the data using steganography (and you won’t even notice)

Even worse: it discourages developers.

Few people work full-time on #Bitcoin already.

Imagine having to deal with drama and FUD just to propose a basic PR?

Fewer devs = slower progress = more risk = weaker #Bitcoin.

"But what about spam?"

#Bitcoin already has a built-in antispam: fees.

Don’t want to see JPEGs or zk-proofs?

Use real #Bitcoin: spend, self-custody, join the circular economy.

You know why “spam” increased so much?

Because most people stopped using #Bitcoin on-chain.

Today it’s all custodians: Strike, Wallet of Satoshi, Liquid…

Less usage = more free space = more arbitrary data on the timechain.

Want to fix it?

More real usage → more demand for block space → higher fees → less incentive to use Bitcoin as storage.

Simple. And effective.

Want to “save #Bitcoin”?

It’s not through filtering, censorship, or hysteria.

It’s through real usage, open source, economic incentives, and freedom.

#Bitcoin is neutral. And that’s a good thing.