FTX has started reimbursing some clients who had funds on the exchange in 2022.

The payouts are being made in dollars, based on the price at that time.

In other words, anyone who held 1 BTC will receive only $18,000 😭

This is why maximalists always repeat the basics—because the basics work: “Not your keys, not your coins.”

Don’t fall for illusions. Until there is a truly decentralized platform like Aave running on the Bitcoin network, don’t risk your sats chasing yield.

Bitman

bitman@nostrplebs.com

npub1z204...mxwn

Follow the money.

This is Hayden Davis, advisor to Javier Milei, responsible for the memecoin $LIBRA scam.

He essentially admitted publicly to committing:

1. Insider Trading

2. Market Manipulation

3. Misappropriation of Funds (Potential Fraud)

4. Failure to Disclose Material Information

5. Theft or Unjust Enrichment

6. Conspiracy to Commit Financial Crimes

7. Regulatory Violations: Money Laundering and Securities Fraud

It is also possible that Hayden is involved in the $MELANIA memecoin, recently launched by the First Lady of the United States.

This is why MEMECOINS ARE A CANCER to this market.

If you want to avoid being scammed and robbed, buy Bitcoin and stay away from the easy-money narratives pushed by shitcoins.

This is why politicians, companies, and individuals should steer clear of “narratives” and focus on the ONLY decentralized currency—one with no insiders, no VCs, and no marketing team to deceive you.

Stay focused, stick to #Bitcoin.

Net inflows into #Bitcoin ETFs have dropped significantly in 2025, with both capital inflows and outflows flattening.

As volatility declined, traders distanced themselves from ETFs.

A shift in sentiment will be necessary to see new capital inflows.

GOOD MORNING NOSTR, STAY HUMBLE AND STACK SATS 🫡

🥃

We've reached the stage where a president is doing a rug pull on Twitter.

Peak attention for this market.

If you're still asking, "Where's retail?" you haven't realized it's already here.

You should check what the institutions are doing. Take a look at where their attention is.

“I’m interested in the internet having a native currency. The best manifestation, technology today is #Bitcoin.”

— @jack

#bullishbounty

GOOD MORNING NOSTR, STAY HUMBLE AND STACK SATS 🫡

Curious fact: In the last 30 days, nearly $27 BILLION has flowed out of ETH, while over $33.5 BILLION has moved into BTC on-chain.

Not sure if this is what many meant by “capital rotation,” but it certainly looks like the market structure is different from the last cycle.

Mayor of New York City says, “Remember y’all laughed at me when I first got my #Bitcoin?”

“Who’s laughing now?”

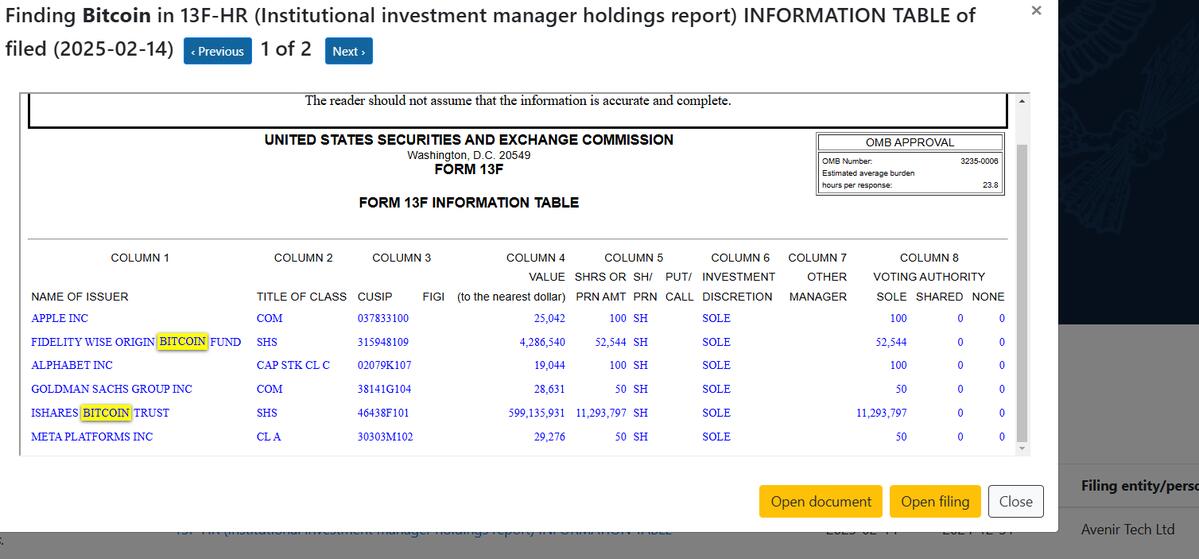

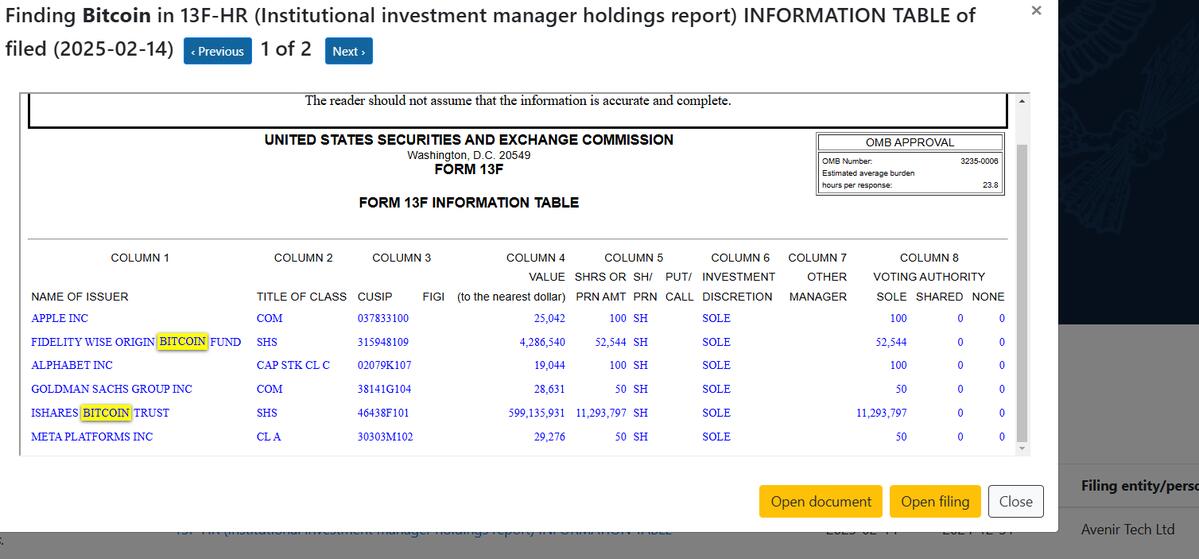

Avenir, a Hong Kong-based investment firm, reported this morning that it held $599 million in IBIT (11,293,797 shares) as of December 31.

Corporate demand is accelerating fast.

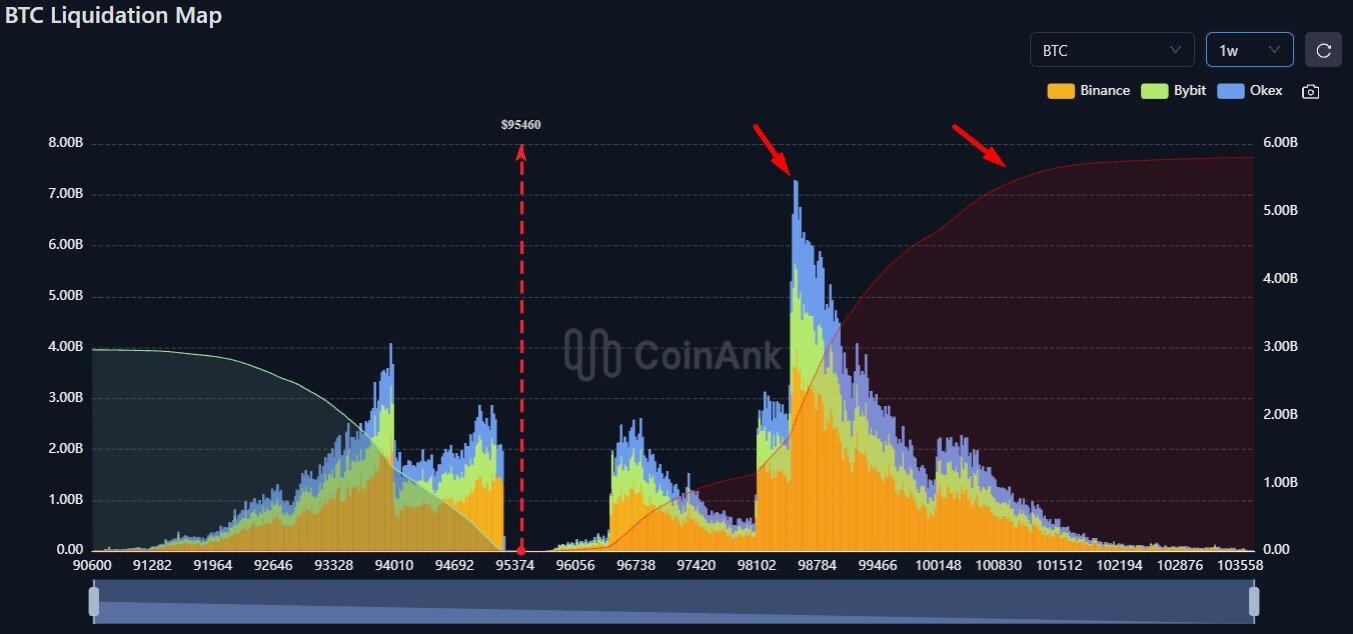

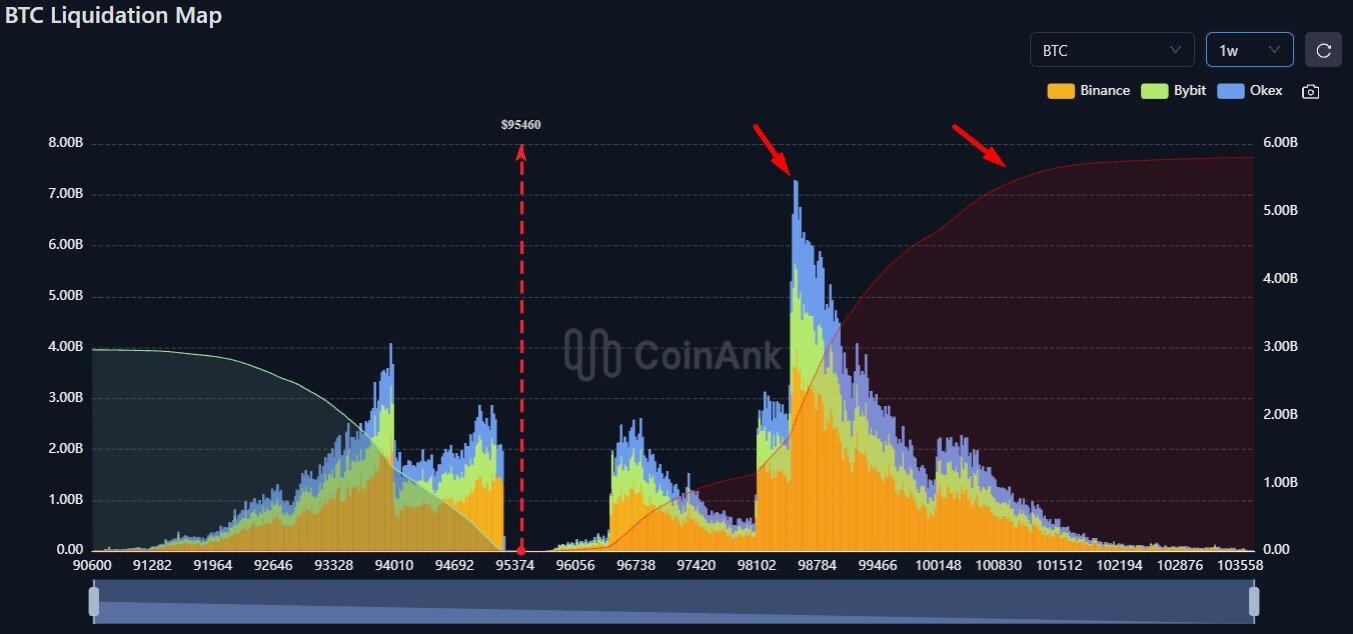

Shorts continue to dominate the potential liquidity supply in the short term, with over $5 billion in liquidations above $100K.

At some point, that liquidity may be targeted.

Grab the popcorn. 🍿

GOOD MORNING NOSTR, STAY HUMBLE AND STACK SATS 🫡

Buying groceries in Costa Rica using #Bitcoin

President Trump’s Commerce Secretary Howard Lutnick says, “I have hundreds and hundreds of millions of dollars exposure to #Bitcoin and it will be billions. Every time bitcoin dips, I’m buying.” 🙌

MSNBC guest says, “If you think MAGA is a strong political movement, just wait until you see bitcoiners” 👀

Most of the Federal Reserve’s current quantitative tightening has been offset by increased liquidity through TGA and RRP.

If your thesis is based solely on “When does QE return?”, you’re likely seeing only part of the puzzle.

Liquidity is a set of tools, not just the Fed’s balance sheet.

🚨 Tether may sell $8 billion in #Bitcoin to comply with new U.S. stablecoin regulations, according to JP Morgan.

Currently, only 66% of its reserves meet compliance standards, while Tether holds approximately 83,758 BTC.

The STABLE Act imposes stricter reserve requirements and allows state-level regulation, while the GENIUS Act mandates federal oversight for major issuers and permits a broader range of reserve assets.

If either bill passes, Tether may need to restructure its reserves, likely increasing its holdings of U.S. Treasury securities.

#Bitcoin miners are having their machines seized due to rising import tariffs in China.

Bitmain, the leading ASIC manufacturer, is struggling to fulfill deliveries, which could result in U.S. miners losing market share.

Producer Price Inflation (PPI) rises to 3.5%, exceeding the expected 3.2%.

Core PPI came in at 3.6%, above the projected 3.3%.

Price inflation continues to rise in the U.S., suggesting interest rates may remain high for longer.