fiat sucks use bitcoin

Lloyd Dunne

lloyddunne@getalby.com

npub1php4...ea7s

bc1q359cpjwdptwyajqj3rsagxpyh2k77hr0wz8rn2

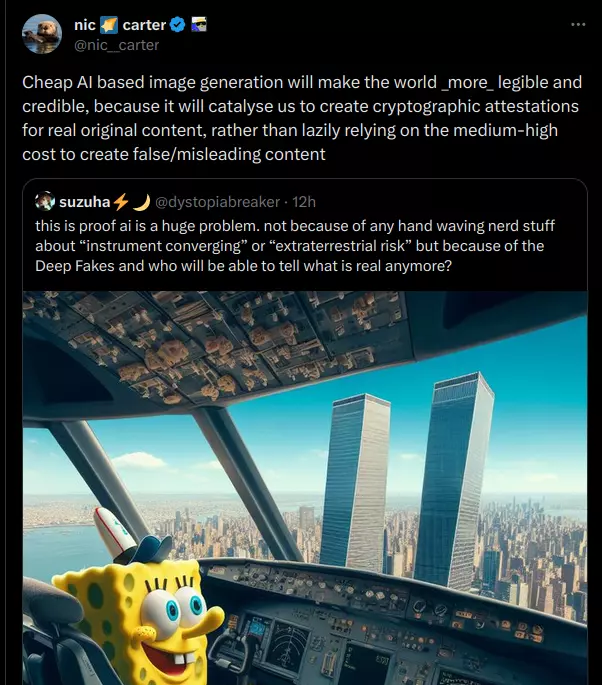

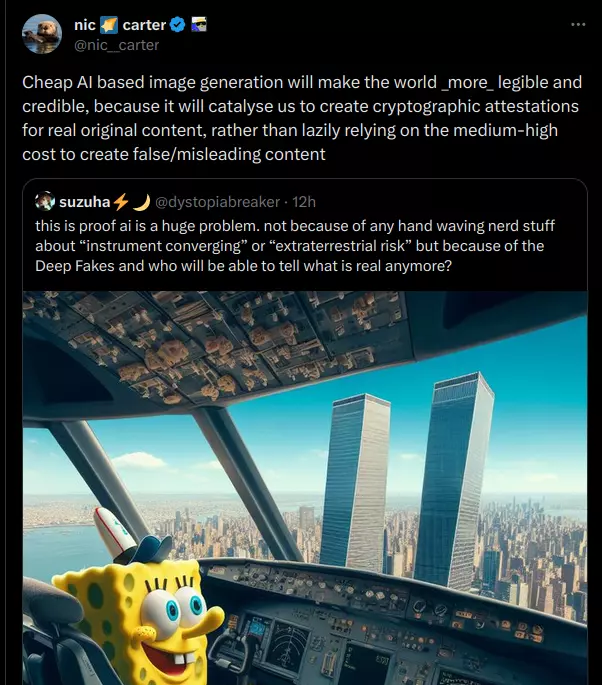

nostr marketing department need to get on this asap, before shitcoinery captures the narrative on 'blockchains can help regulate AI disinformation'

nostr or OpenTimestamps fixes this?

@Marty Bent @ODELL @Gigi

not sure a note i did got posted

The Great Taking (2023)

00:00:00

In this section, the book "The Great Taking" by David Webb discusses the

concept of the taking of collateral, which refers to the end game of a

globally synchronized debt accumulation cycle. The author argues that a

small group of people, hidden from the public eye, control all major

institutions and are orchestrating a war against humanity. This war is

not fought with traditional weapons, but through deception and

manipulation. The book explores how this group plans to seize all

financial assets, including money, stocks, bonds, and property, in order

to concentrate wealth and power. The author also delves into the idea

of a digital currency controlled by central banks, which would result in

a loss of personal property and the potential for unprecedented

deprivation. The book draws parallels to previous periods in history,

such as the Great Wars and the Great Depression, to highlight the

potential for mass wealth transfer and control over humanity.00:05:00

In this section, the narrator discusses the relationship between money

supply velocity, GDP, and the decline in the velocity of money

throughout history. He mentions economist Milton Friedman and his

observation that the velocity of money sharply declined from 1880 to

World War I, coinciding with the collapse of various empires and

economies. The narrator argues that the decline in velocity was

intentional and used to consolidate power. He also points out that he

noticed the Federal Reserve's influence on financial markets during his

time managing hedge funds, as money creation was not leading to real

economic growth but instead driving a financial bubble. He concludes by

stating that crises are intentionally induced to consolidate power and

that the collapse in money velocity is a recurring phenomenon.00:10:00

In this section, the speaker discusses the collapse of the economy and

the confiscation of gold in 1933, the recovery during World War II, and

the subsequent collapse to a low point in 1946. They argue that the

current contraction of the economy is even worse than during the Great

Depression or World Wars, and that printing more money will not help.

The speaker suggests that the announcement of the great reset may not be

motivated by global warming or the fourth Industrial Revolution, but

rather by the collapse of the monetary system. They claim that

dematerialization of securities was a strategic move planned decades

ago, with the CIA playing a role in the project. The speaker also

mentions the formation of the Depository Trust Corporation (DTC) and the

transition from physical stock certificates to computerized entries.

They question whether the paperwork crisis was manufactured to push for

dematerialization and highlight the timeline of DTC's operations,

implying that functioning stock exchanges during that period contradict

the urgency of dematerialization.00:15:00

In this section, the excerpt explains how the concept of security

entitlement has replaced the ownership of tradable financial

instruments, such as securities. This legal concept allows certain

entities to treat these instruments as their own assets and use them as

collateral for borrowing money. The horror lies in the fact that these

securities, which were once considered personal property, can be seized

by secured creditors without judicial review in the event of insolvency.

The system of hypothecation and rehypothecation further enables the

reuse of the same collateral multiple times, making the derivatives

complex much larger than the global economy itself. This deception has

been facilitated by amending the Uniform Commercial Code in the United

States, gradually subverting property rights and leaving even

sophisticated investors unprotected.00:20:00

In this section, it is explained that courts and account providers have

the legal authority to borrow pulled Securities without restrictions,

known as self-help. This concept aims to use all Securities as

collateral. The evidence for this is documented and undeniable. In 2004,

the European Commission proposed the establishment of a legal certainty

group to address legal uncertainty in clearing and settlement. In 2006,

the Deputy General Council for the Federal Reserve Bank of New York

provided detailed responses to the group, highlighting the use of US

commercial law in empowering secured creditors to take client assets in

the event of custodian failures. The excerpt demonstrates that legal

uncertainty can lead to potential vulnerabilities for investors and the

prioritization of secured creditors. It also touches on the handling of

shortfalls in practice.00:25:00

In this section, the excerpt discusses the concept of security

entitlements and the potential implications it has on ownership. It

explains that in the US and Canada, investors are viewed as owning

securities entitlements rather than securities themselves. This allows

for greater availability of assets as collateral but raises concerns

about the stability of the system. The use of omnibus account structures

also increases the risk of unauthorized use of client assets and the

potential for clients to become unsecured creditors in the event of a

default. The push for legal certainty and mobility of collateral

globally, driven by powerful creditors, raises questions about who truly

benefits from these changes and whether citizens have been betrayed by

their own governments. The excerpt suggests that financialization and

the pursuit of financial profits have been used to harm nations, and

that the global harmonization of legal certainty has been orchestrated

to serve the interests of certain secured creditors.00:30:00

In this section, the narrator discusses the Hague Securities Convention,

an international treaty aimed at providing legal certainty for

cross-border securities transactions. The convention introduced a

conflict of laws rule called the "place of the relevant intermediary

approach," which determined the applicable law for collateral

transactions. The drafting of the convention involved key individuals

like James S. Rogers and Professor Egan Gutman, who had expertise in

securities transfers and secured transactions. While the EU did not sign

the convention due to conflicts with European law, the objective of

providing legal certainty to creditors was recognized and accepted by EU

authorities. This is evidenced by Directive 2002/47/EC, which aimed to

improve the legal certainty of financial collateral arrangements.00:35:00

In this section, the transcript excerpt discusses the Euroclear system

and its recommendations for addressing legal barriers in cross-border

activity. Euroclear suggests the removal or modification of requirements

that hinder the implementation of major initiatives, including

recognizing the multi-layer holding structure and the rights of

nominees. Additionally, they recommend eliminating impediments to the

free use of collateral across borders. The excerpt also mentions the

appointment of Diego Devas as the General Counsel of the Bank for

International Settlements, his warning about the undermining of property

rights to securities, and the implementation of the Central Securities

Depository Regulation by the EU. However, despite raising awareness

about these issues, it seems that many professionals and clients were

indifferent or unaware of the implications.00:40:00

In this section, the transcript excerpt discusses how the European

Securities and Markets Authority (ESMA) plays a crucial role in

post-trade harmonization efforts in Europe through the Central

Securities Depositories Regulation (CSDR). The CSDR enables the transfer

of legal title to customer collateral and the use of customer

collateral through links between national and international Central

Security Depositories (CSDs). The excerpt also highlights the case of

Euroclear acquiring the Nordic Central Security Depository (NCSD),

leading to changes in property rights to securities in Sweden and

Finland. These changes resulted in the erosion of property rights,

transforming the countries from having the strongest property rights to

securities to having no property rights beyond an artificial appearance

of ownership, as dictated by the EU directive on CSDs.00:45:00

In this section, the transcript excerpt discusses a clause in Sweden's

law on Central Security depositories and accounting for financial

instruments that allows for the legal control of customer assets to be

passed to the International Central Securities Depository (ICSD) without

the account holder's knowledge or approval. This gives the local

Central Security depository (CSD) broad authority to use customer assets

as collateral. The implementation of this clause has made it impossible

for Swedish citizens to hold Swedish government bonds in Sweden without

exposure to the insolvency of the account provider, the local CSD, or

the ICSD. The excerpt also mentions how financial institutions like

Handlesbanken and SEB have changed their account structures, further

complicating the ownership of securities.00:50:00

In this section, the transcript discusses the concept of collateral

management and its connection to regulatory reforms and central clearing

of derivatives transactions. It suggests that the demand for collateral

assets is not driven by true market forces, but rather by regulatory

fiat. The report mentioned in the transcript indicates that while there

is no evidence of scarcity of collateral in global financial markets,

the demand for collateral assets is being artificially created and

intensified. The objective of collateral management systems is to

provide cross-border mobility of collateral, allowing the largest

secured creditors behind the derivatives complex to control collateral.

The transcript also mentions the implementation of a global custodial

platform that aims to provide a single view of available collateral

regardless of location. Overall, the transcript highlights the

intentional design and execution of strategies to move control of

collateral to certain entities within the financial system.00:55:00

In this section of the transcript, the author discusses the services

available at ICDS (International Central Securities Depositories) and

how participants in the ICD can hold securities in the ICDS via link

arrangements with local CSDs (Central Securities Depositories). The

report also explains the role of collateral givers and collateral

takers, where both parties provide information to the ICD for collateral

obligations. The ICD then runs an optimization process and may

automatically generate collateral allocation instructions. If the

collateral giver does not have sufficient securities in the ICD, they

can transfer securities from their own account at the link CSD to their

securities account in the ICD. The report then introduces the concept of

collateral transformation, which is the encumbrance of client assets

under swap contracts without their knowledge. This process serves no

beneficial purpose for the clients and is done in times of market

stress. The automation and standardization of collateral management may

enable market participants to manage complex and rapid collateral

demands. The ultimate objective is to utilize all securities as

collateral, creating comprehensive collateral management systems.01:00:00 - 02:00:00The

YouTube video titled "The Great Taking" by David Webb discusses various

aspects of the global financial system, highlighting how it benefits

financial firms at the expense of ordinary people. It delves into topics

such as the unequal distribution of wealth and power, the concentration

of risks in central counterparties, concerns about the resilience of

clearinghouses, and the potential abuse of safe harbor provisions by

large financial institutions. The video also explores the deliberate

actions taken during the Great Depression by the Federal Reserve and

banks to consolidate power and control over assets. It raises questions

about the motivations and effects of these actions, as well as the

ongoing efforts to seize and control assets through the banking system.

The transcript further delves into the role of derivatives, the shifting

collateral backing for the banking system, and the risks posed by

large-scale derivatives in deposit-taking subsidiaries. It highlights

concerns about the safety of deposits, adequacy of deposit protection,

and potential consequences of a widespread banking crisis. The video

concludes by discussing trilateral exercises and coordination between

global financial sector authorities, raising questions about the motives

behind central bank digital currency development and its potential role

in a global hybrid war. Overall, the video presents a critical analysis

of the financial system and its impacts on individuals and society.01:00:00

In this section, the transcript explains how the global financial system

is set up to benefit financial firms and secured creditors at the

expense of ordinary people. When a crash occurs and prices plummet,

collateral management systems will automatically sweep all collateral to

central clearing counterparties and central banks, leaving no pockets

of resilience in any country. The deliberate strategy of inflating the

global bubble, driven by financialization, will ultimately lead to

disastrous consequences for many. The revised Safe Harbor provisions in

the US bankruptcy code ensure that secured creditors can take client

assets without challenge, further exacerbating the unequal distribution

of wealth and power.01:05:00

In this section, the concept of protected contracts, particularly swap

agreements, and the safe harbor provisions in bankruptcy law are

discussed. The safe harbors were implemented to mitigate systemic risk

in the derivatives market by allowing for the closeout of derivative

positions during a bankruptcy. However, the rush to closeout positions

and demand collateral from distressed firms can have negative

consequences on the markets. The safe harbor regime was solidified in

case law during the bankruptcy of Lehman Brothers when JP Morgan, as

both a secured creditor and custodian, took client assets. This set a

precedent that protected class secured creditors have priority claims to

client assets. The safe harbor provisions, although intended to promote

stability, have raised concerns about the potential abuse of these

protections by large financial institutions.01:10:00

In this section, the transcript discusses the role of CCPs (central

counterparties) in managing counterparty risk and clearing and settling

trades in various financial instruments. It highlights the concerns

surrounding the concentration of risks in CCPs and the lack of alignment

in financial regulations across jurisdictions. The transcript also

mentions the tension between clearing houses, clearing banks, and asset

managers regarding who should bear the cost in the event of a CCP

collapse. Furthermore, it points out the potential risks associated with

the small capital base of CCPs and the need for scenario planning to

prevent future CCP crises.01:15:00

In this section, the excerpt highlights some limitations in the analysis

provided by the Financial Stability Board of the Bank for International

Settlements (BIS) regarding the potential impact of a global financial

crisis. The analysis did not consider underlying economic circumstances,

the likelihood of simultaneous defaults of clearing members, or second

and later order effects that could lead to wider market stress.

Additionally, the analysis assumed that all non-defaulting participants

would continue to perform as committed. The article from the Depository

Trust and Clearing Corporation (DTCC) discusses efforts to update

recovery and wind-down plans for clearing corporations and the need to

be prepared for potential disruptions. The DTCC emphasizes the

importance of capitalization and resilience in clearinghouses, but the

total shareholders' equity of DTCC is around $3.5 billion, which may

raise concerns about whether it is sufficiently capitalized considering

its role in the US securities market and derivatives complex.01:20:00

In this section, the transcript excerpt highlights some key points from

the exchange between the legal certainty group and lawyers for the

Federal Reserve. It discusses the vulnerability of investors to the

insolvency of intermediaries and the priority of secured creditors over

entitlement holders. The collapse of clearing subsidiaries and the

taking of assets by secured creditors is seen as a deliberate and

planned event. The excerpt also mentions the opposition of DTCC to

prefunding the default loss waterfall and its support for prefunding

operating capital for a new CCP. The transcript emphasizes the

importance of the rule of law and the potential chaos if it is not

upheld. Additionally, it includes an excerpt from the Wikipedia article

on DTCC, explaining the structure of the organization. The section ends

with a quote from William Blake and a personal anecdote about the Great

Depression.01:25:00

In this section, the excerpt discusses the aftermath of the bank

reopening during the Great Depression. Only the Federal Reserve Banks

and the banks approved by the Federal Reserve were allowed to reopen,

causing many people with money in banks not selected to lose all of

their funds. Their debts were not cancelled and were taken over by the

chosen banks, leading to the loss of everything financed with debt,

including homes, cars, and businesses. Cleveland Trust Company, one of

the selected banks, consolidated debts and foreclosed upon thousands of

families' homes, offering them the opportunity to rent their former

houses. While some perceived the bank holiday and reopening as a

successful solution to the Panic, it ultimately benefited the banks and

consolidated their power. The excerpt questions the true intentions and

effects of the bank holiday during this time.01:30:00

In this section of the video, the narrator discusses the role of the

Federal Reserve in the transformation of the normal recession into the

Great Depression. The Federal Reserve's passive approach, such as not

lowering interest rates or injecting liquidity into the banking system,

allowed for large bank failures and widespread panic. Although the Fed

later admitted its mistakes and promised not to repeat them, the

narrator questions whether they can be trusted. The deliberate actions

of the Federal Reserve and the banks in taking property and assets

during the Great Depression are seen as evidence that their motivations

were not solely driven by greed or the desire to help, but rather part

of a larger plan.01:35:00

In this section, the focus is on the deliberate hurting of humanity

through strategies that aim to eliminate centers of resistance and

impose subjugation. The Federal Reserve Act of 1913 set the stage for

the Federal Reserve System to eventually confiscate the gold of the

public in times of crisis, under the justification that credit could not

be expanded otherwise. This was evident in the Executive Order 6102,

which aimed to remove the constraint on the Federal Reserve, allowing it

to increase the money supply during the Depression. The order

criminalized those who hoarded gold and confiscated all gold owned by

the public. This pattern of deprivation and control continued with

severe penalties for non-compliance. The purpose behind constructing the

largest bank vault in the world in Cleveland in 1923 becomes apparent,

as it served as a means to store the confiscated gold.01:40:00

In this section, the speaker discusses how the collateral backing for

the banking system has shifted from essential holdings like gold to

global securities and derivatives. This could potentially allow big

banks to suppress the price of gold and accumulate physical gold for

themselves while selling paper gold to the public. However, this doesn't

guarantee that individuals will be able to keep their gold if the banks

continue on their current path. The Federal Reserve System has been

designed to survive and take over all assets and banking activities,

leaving cash holders in banks as unsecured creditors with no enforceable

claim to their money. The regime shift aims to nationalize all deposits

and assets, with the protected class of secured creditors taking

control. The big banks have organized themselves as holding companies

with subsidiaries to legally separate risks, allowing deposit-taking

subsidiaries to be separately bankrupted. The Federal Reserve has the

power to grant exemptions to move derivatives into these subsidiaries,

as seen in the case of Bank of America. Overall, the speaker warns that

the banking system is designed to ultimately seize all deposits and

assets, leaving individuals vulnerable, regardless of where they hold

their money.01:45:00

In this section, the transcript discusses the alarming scale of

potentially toxic obligations, known as derivatives, that major banks

house within their insured retail units. With the approval of the

Federal Reserve, banks like Merrill Lynch, Bank of America, and JP

Morgan Chase have moved massive amounts of derivatives into their

deposit-taking subsidiaries. The sheer size of these derivative

positions, which rival the entire global economy, raises concerns about

the safety of deposit-taking subsidiaries. The intention behind this

large-scale endeavor remains unclear, but it appears that the collapse

of these subsidiaries could lead to a comprehensive "Taking" of money,

including from depositors, while the protected class of bank holding

companies and their subsidiaries survive and thrive. This raises

questions about the adequacy of deposit protection, as the Deposit

Insurance Fund may only offer a fraction of insured deposits in the

event of a widespread banking crisis.01:50:00

In this section, the transcript discusses the objections of the Single

Resolution Board (SRB) to the super priority of legacy national deposit

guarantee schemes (DGS). The SRB argues that super priority claims

undermine the use of DGS funds in resolution processes and instead

supports adopting a general depositor preference. However, this

preference would place DGS funds behind secured creditors but ahead of

unsecured creditors, essentially wiping out the funds in the event of a

major failure. The SRB is also directing the largest banks to prepare

for a solvent wind-down, which hints at certain portions of these banks

remaining solvent while the bubble bursts. Excerpts from the SRB memo

indicate that banks are expected to work on solvent wind-down planning,

especially for their trading books. The SRB's 2023 work program

acknowledges the challenges posed by the pandemic, Russian aggression in

Ukraine, and rising energy costs. It emphasizes the need to finalize

banking resolvability and ensure that resolution plans and strategies

are implementable. The transcript suggests that the seriousness of the

powers that be indicates that an important turning point is approaching.01:55:00

In this section, it is revealed that the United States, the United

Kingdom, and the European banking Union are participating in a

trilateral exercise to enhance understanding and coordination on

cross-border resolution for global systemically important banks. This

exercise is part of a series of regular events and exchange among the

financial sector authorities. The significant attention given to this

exercise from the US side is highly unusual and suggests that something

serious is being planned. Additionally, the Atlantic Council, a military

strategy think tank, is focused on central bank digital currency

(CBDC), which is being developed by central banks around the world. The

focus on CBDC raises questions about the motives behind its development,

particularly in the context of a global hybrid war where the collapse

of banking and payment systems is seen as a war aim by those who control

central banks.02:00:00 - 02:20:00In

this YouTube video titled "The Great Taking (Audio Book) by David

Webb," the speaker discusses the concept of deflation and its historical

impact, highlighting how commodities, public companies, and real estate

prices have suffered from persistent deflation over several decades.

They argue that the current inflationary trends are a result of massive

devaluation of money and artificial scarcity, with the underlying

problem being deflation. The impact of interest rate changes on

financial instruments, the role of debt in dispossessing individuals,

and the need for a system that serves the people instead of perpetuating

deprivation and fear are also discussed. The video further emphasizes

the dangers of pseudoevents and the escalating hybrid war, media

control, censorship, and erosion of human rights. It concludes by

advocating for the non-violent dismantling of the power structure

through documenting actions and criminal prosecution.02:00:00

In this section, the speaker discusses the concept of deflation and

provides historical examples to support their argument. They highlight

how in the 1930s, during the Great Depression, commodities and public

companies experienced significant declines, with price levels taking

decades to recover. The speaker also shares personal anecdotes and

research on real estate prices, showing how properties suffered from

persistent deflation over several decades. They suggest that the current

inflationary trends are merely a result of massive devaluation of money

and artificial scarcity, while the underlying problem of our time is

deflation. Additionally, they point out that the lack of significant

demand drivers, coupled with advancements in technology that promote

automation and efficiency, further contribute to deflationary pressures.02:05:00

In this section, the speaker discusses the impact of interest rate

changes on the value of financial instruments, particularly

perpetuities. The Fed's decision to lower interest rates results in an

increase in the value of the perpetuity, while an increase in market

rates leads to a decline in its value. The speaker argues that the

global financial complex operates on the same principles, with the

prices of fixed income instruments, equity markets, and commercial real

estate all being influenced by interest rates. The Fed's actions in

creating the everything bubble by lowering rates during the global

financial crisis and subsequently increasing rates now are seen as

setting the stage for a massive decline in financial and real estate

markets, which will result in a deflationary depression. The speaker

suggests that the architects of this system are positioned to take

everything from the populace, leaving them enslaved and destroyed. With

deep debt and prolonged deflation, people will be unable to make debt

payments, leading to the loss of property and businesses. The speaker

emphasizes that debt is a construct designed to take real things, and

its historical function has been to dispossess and take away property

from individuals.02:10:00

In this section, the audio book highlights the importance of human

welfare and questions the purpose of societal constructs and

institutions. It criticizes the powers that be for prioritizing the

interests of private banks over the well-being of depositors and

emphasizes the need for a system that serves the people instead of

perpetuating deprivation and fear. The audio book argues that the

protectors in society often become the oppressors, causing harm to

innocent civilians. It urges individuals to be aware of the existence

and operation of evil and emphasizes the interconnectedness of all

things. The audio book concludes by stating that stopping the hybrid war

begins with changing one's mindset and being aware of the systematic

psychological manipulation that has been ongoing since the Great War.02:15:00

In this section, the excerpt discusses the danger of pseudo events and

how they can redefine reality by the parameters set by their creators.

The people behind wars and control of central banks are described as

lying, thieving killers who have deliberately caused deaths, and their

criminality has reached an unprecedented scale with the aim of

subjugating the entire globe. The binding power of shared guilt among

the perpetrators is suggested as a reason for how they are held

together. The excerpt also highlights the escalating hybrid war, media

control, censorship, lockdowns, and the erosion of fundamental human

rights that have taken place under the guise of preventing the spread of

infectious diseases. It is asserted that this is not about increasing

control, but rather a response to the collapsing power of

deception-based control systems.02:20:00

In this section, the excerpt discusses the desperation of those who hold

all the assets and have caused immense damage to humanity. Despite

promoting the belief that they are all-powerful, they have only been

able to exert control through the power to print money. However, this

system of benefiting a few at the expense of many is inherently unstable

and unsustainable. The excerpt argues that physical control requires

enormous energy and cannot be sustained while destroying economies and

abusing people. Furthermore, it highlights that war is not the natural

state of humanity and that survival is based on cooperation and not

killing one another. The people orchestrating chaos in countries are

seen as criminals, while those following their orders are not heroes but

criminals as well. The section concludes with the assertion that the

power structure of these individuals and organizations must be

dismantled non-violently by documenting their actions and subjecting

them to criminal prosecution.

the new phoenix update for iOS let me down receiving a payment bigger than my inbound liquidity. would normally seamlessly open a new channel.

@bumi getalby there to save the day!

can anybody loan me 20k sats so i can post bond to robosats for a trade?

need that kyc free

#asknostr

Currency Wars (2016)

00:00:00 In this section, the speaker talks about the impact of currency wars on Bitcoin and its potential for cross-border transactions. They mention that while they previously believed Bitcoin would mainly be used for foreign remittances, recent developments in global currency wars have changed this perspective. The speaker highlights that Bitcoin exists in a competitive world of international finance, and that the currency war currently taking place globally will change the trajectory of Bitcoin adoption. They mention several countries that are currently embroiled in currency wars, emphasizing that the people in these countries are the hostages of these conflicts. The speaker also mentions a recent example in India where a significant amount of cash was removed from circulation, further highlighting the impact of currency wars on everyday individuals.

00:05:00 In this section, the speaker discusses the impact of India's demonetization policy, stating that it has resulted in a humanitarian disaster with a significant loss in GDP. The consequences have caused entire industries to halt, with people unable to buy essentials or transact. The speaker warns that this experiment with 15% of humanity as involuntary experimental subjects may be repeated if the government's aims are achieved. Furthermore, the speaker highlights the global war on cash, where governments aim to eradicate physical currency in favor of digital forms of money that allow for surveillance, control, and negative interest rates. Lastly, the speaker notes the use of national currency as a trade war instrument and criticizes governments for choosing to confiscate savings and impose inflation as a means to relieve debt.

00:10:00 In this section of the video, the speaker discusses the current state of currency wars and how Bitcoin provides a neutral and safe haven for individuals to opt out of these nationalist experiments. The speaker highlights how governments try to force their citizens to support their policies, using patriotism and fear tactics. However, Bitcoin allows people to see through these nationalist ideals and opt out of the system. This challenges the power of sovereigns, who may respond with force. The speaker also mentions the changing equilibrium between currencies and the increased demand for Bitcoin in countries like India and China, where people are willing to pay a premium for the opportunity to exit the current financial system.

00:15:00 In this section, the speaker discusses the consequences of currency wars and the negative impact they have on ordinary people. He compares these wars to a game of SimCity, where raising income tax can lead to a decline in population. The speaker argues that currency wars waged by governments against their own people have devastating effects, causing death and suffering. He also addresses the criticism that those who advocate for Bitcoin are labeled as criminals and terrorists, emphasizing that opportunities to build an alternative system should be embraced.

00:20:00 In this section, the speaker discusses the consequences of currency wars and the impact on people and economies. They highlight how the banks benefit from such wars, while corruption and economic crises rise in countries like India, Cyprus, Greece, Venezuela, Argentina, and Ukraine. The speaker also explains the concept of Gresham's Law, which states that bad money drives out good money in an economy. They provide examples of people hoarding and hiding "good" money like bitcoin, US dollars, or stable currencies, while spending the "bad" money, resulting in the disappearance of good money from circulation. The speaker predicts that cash will be eliminated globally, and bitcoin will play a major role in this change.

00:25:00 In this section, the speaker discusses how Bitcoin will oppose the currency wars while being funded by them. As the currency wars escalate, investment in Bitcoin will grow, resulting in infrastructure improvements. This will create an exit from the currency wars, initially accessible to the richest and most privileged individuals. However, over time, more people will benefit from this exit. The speaker emphasizes that despite being labeled as criminals for providing an alternative, they are simply pointing out the economic crisis and offering a solution. Eventually, the narrative may twist to blame Bitcoin for starting the fire, but it is crucial to remember that Bitcoin is not the cause and that it provides a way out for everybody.

How bout we try get these ark and enigma things working without any soft forks. A good craftsmen never blames his tools!

CTV/Enigma… whatever to call it, shouldn’t be implemented for atleast 10 years. There is no way to know how a change like this would impact bitcoin and the game theory etc

The most frustrating, stressful day trying to sell my car 😤

How do I #zap ze board

We need to normalize not generating your seed through a hardware wallet, no matter which hardware device it is!!

Once you know there is a potential vulnerability, you can’t rest easy. Generate it offline on a computer that doesn’t use internet using an easy python script or something like border wallets 🤙

You will sleep like a baby

#bitcoin

#[0] wen Enigma Network podcast deep dive

Cars are set up so strange. To get rid of the service oil warning I’ve had forever, all I gotta do is push the brake, switch on the electrics and then press the gas at the same time for a short while and it’ll fix it!

I gave installing C-Lightning a go but have given up after a couple of attempts 🤣

May try to return to it at a later date but perfectly happy with Phoenix Wallet rn

#[0] can I login to Damus with getalby yet on mobile? Currently have my private keys on the app

Who is this polyd_ guy making everyone’s brain hurt? 🤯

clightning wizards what could I be doing wrong after trying to run lightningd and this comes up -

rest-port=3001: unrecognized option

#lightning #bitcoin

Fedi sounds abit meh