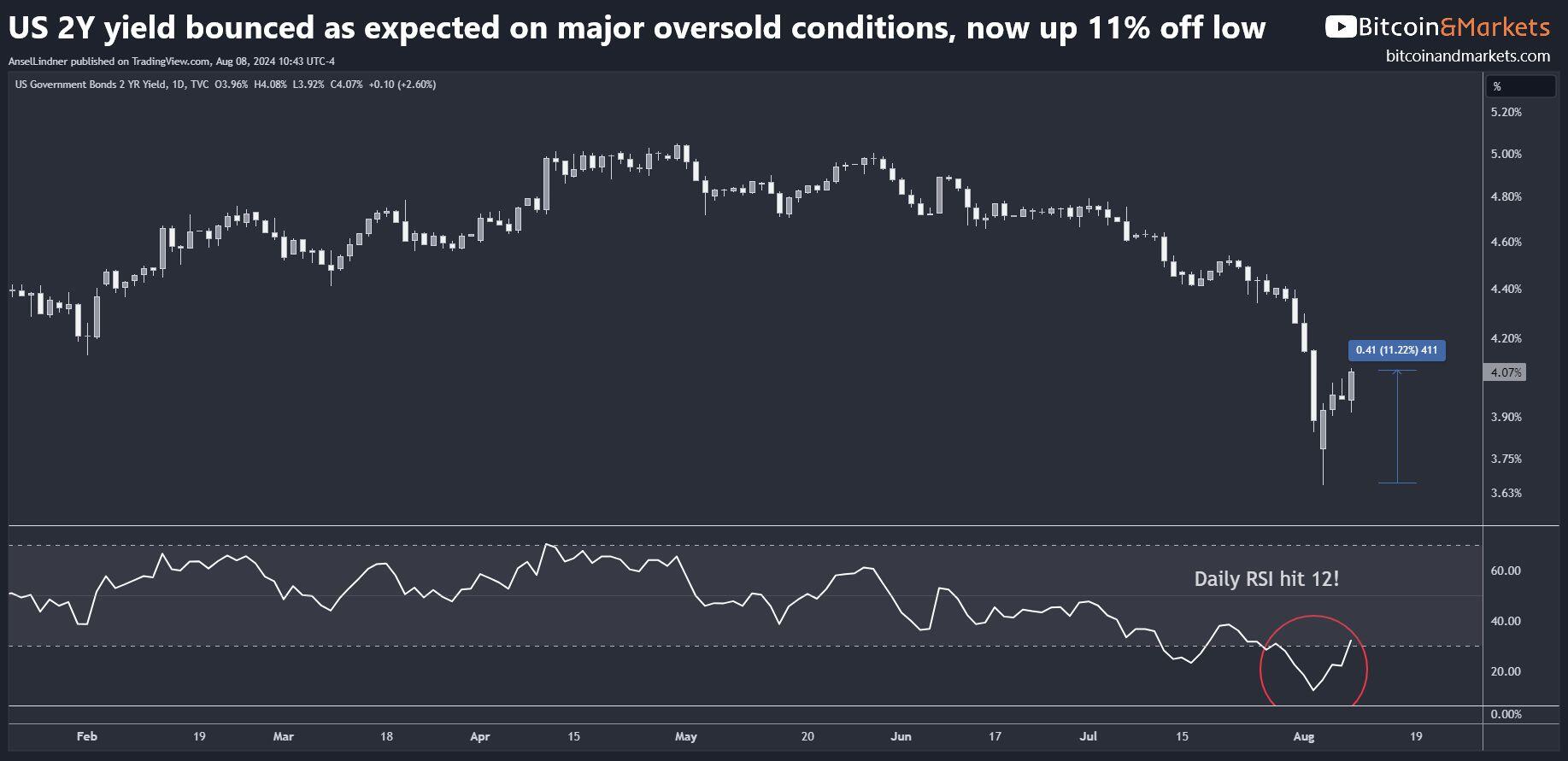

🚨 📊NEW Macro Minute: Predicted Stabilization in Markets, Decision Time

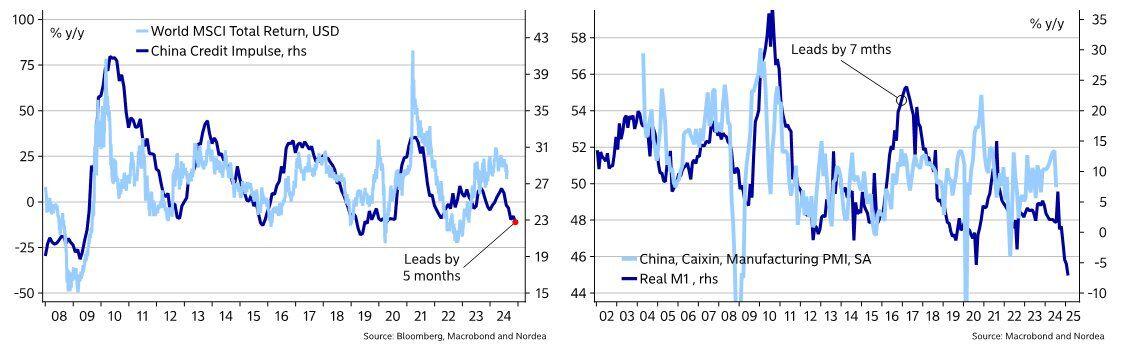

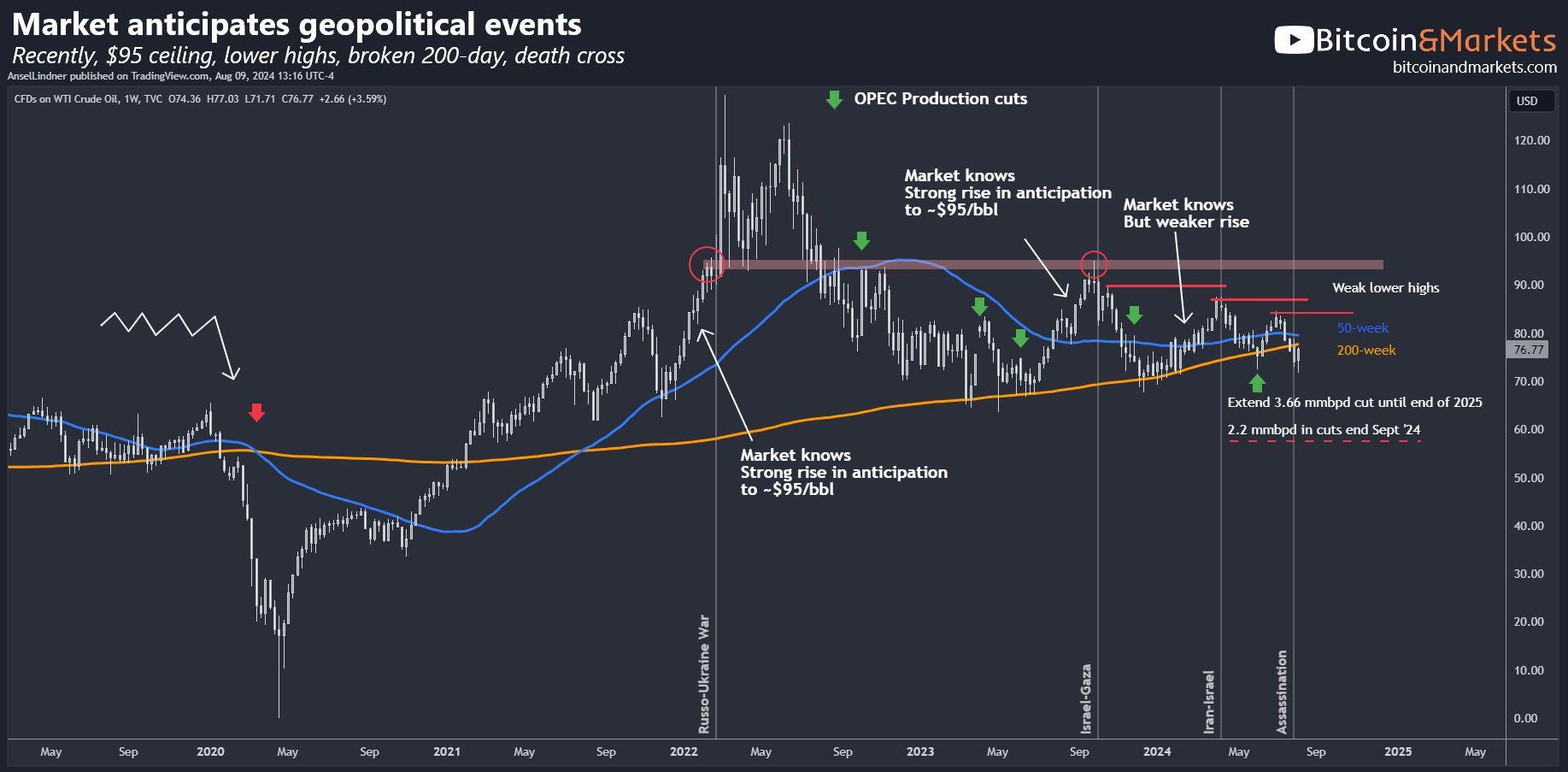

A debrief of last week's panic, stocks, Treasuries and Bitcoin's bounce-back, and the long-term macro time scales to help you understand market moves. 🔥

Bitcoin & Markets

Macro Minute: Predicted Stabilization in Markets, Decision Time

Understanding last week's panic, Bitcoin's rebound, and the time scales guiding long-term market trends.