Unmask the backers of the social media censorship regime and you find racketeering under the guise of hate speech.

It's not mass incompetence, far from it, it's malice.

Now expand this to all mainstream media, higher education, politics, etc. and you'll have clown world figured out.

Dylan LeClair

dylan@b.tc

npub1pyp9...c0qq

I'm Dylan. I like math, markets, technology, and bitcoin.

As a percent of circulating supply, #bitcoin moved in the last 30 days is at an all time low of 5.4% (94.6% dormant), meanwhile spot volumes are at levels not seen since 2019.

Saying this market is thin currently is an understatement - remember inelasticity can cut both ways...

Going live with @ODELL in ~30 minutes at 2pm EST. https://www.youtube.com/@CitadelDispatch

Pump the token you printed from thin air with only a billion of derivative open interest; create tens of billions of value.

It's relatively easy too, you have proprietary info on the only liquid spot and derivatives market it trades on at the time. Futures collateralized with stablecoins and the token itself, pump it.

+4,000% in one year. $100+ billion in market cap. Your share, a mirage worth nearly $50b, materializes a mere four years after the ICO. A treasure and a trap, you enable your users to collateralize against it. Encourage this, and of course encourage them to also keep buying, this thing won't simply just support itself.

How do you capitalize? Well, first off, do NOT sell anything, that'd be too risky, as there are no natural buyers in size, you are the market. Instead, think of other ways to leverage your near immortal levels of newfound wealth, where you won't damage the exchange rate. Your own platform enables this, of course.

Access to billions of dollars of fiat flows, an international banking network, and a stablecoin issued in your name—which you even manage to rehypothecate by the billion—gives you plenty of tools at your disposal.

Your biggest competitor, who attempted to mirror your model, goes down in flames, their bluff called, with the world watching. A win at first, you shortly realize the move backfires. Regulators start circling, a precedent has been set.

Fiat rails and banking relationships get cut. Your stablecoin is ordered to wind down, and jurisdiction by jurisdiction your platform is ordered to cease. Volatility and volumes dwindle, further thinning the air.

Depleted of fiat, with most of your wealth tied to a 'Hotel California' asset that you can never sell hanging above multi-year support, you do and say anything to keep the confidence game alive.

THE LIQUIDATION OF GOVERNMENT DEBT

https://imf.org/external/np/seminars/eng/2011/res2/pdf/crbs.pdf

Disinflation is Here, What Could It Mean?

Long form post:

1) Disinflation is in motion. Sufficiently tight Fed policy is doing it's job, as evidenced by 1m & 3m annualized sticky CPI decelerating meaningfully. Focus from market participants should be shifted from inflation to the reality of the tightest monetary policy in fifteen years. (see chat #1)

2) High inflation, particularly in the core basket (ex. food & energy) masked the effects of the fastest tightening cycle in history - a tight labor market fueled the flames for higher wages, second half of the inflationary impulse wasn't energy driven, it was instead fueled by wages in a tight labor market.

3) Real yields (using both trailing 12m inflation and forward expectations) are the highest they have been in decades. This isn't the 1980s, debt levels don't allow for sufficiently positive real yields for long before things start to deteriorate. (chart #1)

4) Take a look at previous Fed tightening & cutting cycles. There is a reason that much of the pain in equity markets is felt after the Fed starts cutting. Is the Fed causing distress by lowering interest rates? Obviously not, they are merely attempting to ease the pain from the second and third order effects of sufficiently tight monetary policy.

Look at when 2y yields topped in previous cycles (2y yields are essentially a proxy for the blended average of the next two years of Fed Funds) - look at what follows for equity markets/the real economy historically (chart #2)

5) Disconnect between bond markets and equity markets is large and growing by the day. It's understandable that equity earnings would be in favor relative to bonds during an inflationary regime due to pricing power advantage of equities, but with disinflation now underway, the growing divergence between equity multiples & real yields can no longer be ignored. This can also be seen through the equity risk premium (equities yields - bond yields, chart #3).

6) In equity markets in particular, the FOMO is real, with the latest round of buyers being lots of long only funds caught offside sitting in cash and plenty of retail from what I can see. 2021 bubble favorites are so back.

7) Looking at what's fueling strong earnings surprises and a resilient U.S. consumer, look partially to excess savings. COVID-era fiscal stimulus remains in the coffers of U.S. consumers, but the distribution of those excess saving is key to monitor. (chart #4)

“We estimate that the top income quintile currently holds just over 80% of excess savings. The 0-20% and 20-40% quintiles have already depleted their excess savings balances, while the 40-60% quintile will likely follow in the next month or so.” - BNP Paribas

With consumer savings running dry for all but the upper class, expect the resilient consumer of late to begin to feel some stress, with student debt obligations restarting at the same time as excess savings running dry, with possible/expected labor market weakness on the horizon as well.

8) Final Point:

I've admittedly been pleasantly surprised by the strength of the U.S. economy and the equity markets in particular so far in 2023.

The recent bull parade, especially following the cool CPI print this week, has been especially interesting to see. Meme stonks are back, Nvidia is the new Tesla, and shorting vol is once again a path to infinite riches, all is right in the world...

In the midst of it all however, I cannot escape the thought that some of the recent celebrations and fist pumping may be a bit premature.

If history is to serve as any sort of precedent, the cycle is far from over, as the fun doesn't even begin until the Fed starts to cut rates...

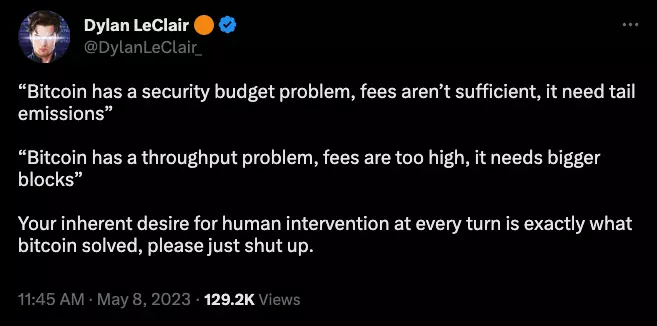

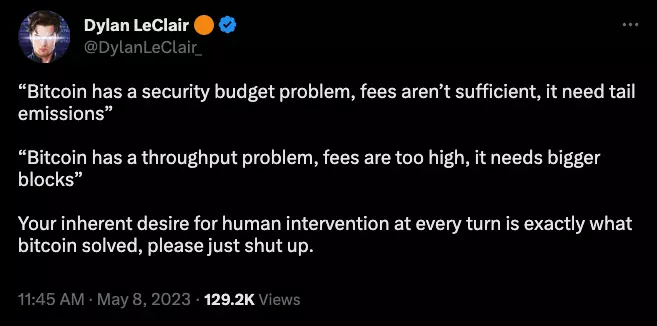

I lost braincells on crypto twitter today.

The amount of Stockholm syndrome displayed on the timeline today on Crypto twitter was truly a sight to behold.

The writing has BEEN on the wall. These people are clueless.

Twitter is an amazing tool. I've spent hundreds of hours learning from some of the brightest minds across subject matters, got my job over a DM after dropping out of school, have made countless friendships, developed business connections, and much more; it's wildly powerful.

With that being said, the fantasies of Elon being it's saving grace weren't based in reality. He's human and able to be captured, just like anyone else.

The theme of the next decade is the buildout and development of neutral open systems. There is no other way.

Enough.

It was a great honor to once again join my good friend @preston for the latest episode of The Investor's Network Podcast.

Watch:  Listen:

Listen:

LinkedIn

This link will take you to a page that’s not on LinkedIn

LinkedIn

This link will take you to a page that’s not on LinkedIn

I love when one post gets sent out four separate times 😅😅😅

This entire game is about energy preservation & appreciation of your purchasing power, over medium/long periods of time. Strip all of the economic & financial dogma away, and keep it simple:

Technology is more advanced than ever, yet prices keep going up, as more units of currency perpetuate the system; it never ends.

The idea of an absolutely scarce monetary asset with supply inelasticity relative to demand, tied directly to energy markets with an ever increasing marginal production cost, is so profound, that most dismiss it outright; are repulsed by it even. It breaks worldviews.

A majority of people are so comfortably dependent on the incumbent system, that they will decide defend a ticking time bomb.

A small minority understand the system as it exists from within, yet defend it for reasons of self interest and greed; dishonorable but understandable given the incentives.

The rest are useful idiots, defending the system while being exploited by its very existence. This cohort is definitively in the blast radius, due to their own sheer ignorance and/or incompetence.

On the other side, there exists an intransigent and uncompromising minority of people who have come to understand the ultimate reality of both systems. Economic game theory and a desire for a different rules based order leads them to simply just leave to start playing a different game entirely.

This entire game is about energy preservation & appreciation of your purchasing power, over medium/long periods of time. Strip all of the economic & financial dogma away, and keep it simple:

Technology is more advanced than ever, yet prices keep going up, as more units of currency perpetuate the system; it never ends.

The idea of an absolutely scarce monetary asset with supply inelasticity relative to demand, tied directly to energy markets with an ever increasing marginal production cost, is so profound, that most dismiss it outright; are repulsed by it even. It breaks worldviews.

A majority of people are so comfortably dependent on the incumbent system, that they will decide defend a ticking time bomb.

A small minority understand the system as it exists from within, yet defend it for reasons of self interest and greed; dishonorable but understandable given the incentives.

The rest are useful idiots, defending the system while being exploited by its very existence. This cohort is definitively in the blast radius, due to their own sheer ignorance and/or incompetence.

On the other side, there exists an intransigent and uncompromising minority of people who have come to understand the ultimate reality of both systems. Economic game theory and a desire for a different rules based order leads them to simply just leave to start playing a different game entirely.

This entire game is about energy preservation & appreciation of your purchasing power, over medium/long periods of time. Strip all of the economic & financial dogma away, and keep it simple:

Technology is more advanced than ever, yet prices keep going up, as more units of currency perpetuate the system; it never ends.

The idea of an absolutely scarce monetary asset with supply inelasticity relative to demand, tied directly to energy markets with an ever increasing marginal production cost, is so profound, that most dismiss it outright; are repulsed by it even. It breaks worldviews.

A majority of people are so comfortably dependent on the incumbent system, that they will decide defend a ticking time bomb.

A small minority understand the system as it exists from within, yet defend it for reasons of self interest and greed; dishonorable but understandable given the incentives.

The rest are useful idiots, defending the system while being exploited by its very existence. This cohort is definitively in the blast radius, due to their own sheer ignorance and/or incompetence.

On the other side, there exists an intransigent and uncompromising minority of people who have come to understand the ultimate reality of both systems. Economic game theory and a desire for a different rules based order leads them to simply just leave to start playing a different game entirely.

This entire game is about energy preservation & appreciation of your purchasing power, over medium/long periods of time. Strip all of the economic & financial dogma away, and keep it simple:

Technology is more advanced than ever, yet prices keep going up, as more units of currency perpetuate the system; it never ends.

The idea of an absolutely scarce monetary asset with supply inelasticity relative to demand, tied directly to energy markets with an ever increasing marginal production cost, is so profound, that most dismiss it outright; are repulsed by it even. It breaks worldviews.

A majority of people are so comfortably dependent on the incumbent system, that they will decide defend a ticking time bomb.

A small minority understand the system as it exists from within, yet defend it for reasons of self interest and greed; dishonorable but understandable given the incentives.

The rest are useful idiots, defending the system while being exploited by its very existence. This cohort is definitively in the blast radius, due to their own sheer ignorance and/or incompetence.

On the other side, there exists an intransigent and uncompromising minority of people who have come to understand the ultimate reality of both systems. Economic game theory and a desire for a different rules based order leads them to simply just leave to start playing a different game entirely.

Just stumbled upon LNCal(.)com. Awesome implementation. Just carved out a small slot daily on it.

Anything on the table:

Book me on LNCal.com

Payments in Bitcoin only

The median fee rate for transfers over the Lightning Network is anywhere from 60,000% to 140,000% more efficient than what is currently being charged by legacy credit card processors.

0.003% median fee rate compared to 1.5% to 3.5%.

An increasing amount of people in the West feel disenfranchised by the current state of political affairs. A fraction of these people have a stance other than "vote harder".

Only after one understands that the system is too far gone to be saved from within can you begin to see where we are headed.

Testing out the zaps feature, can someone zap over some sats.

Plz don’t send a lot, just want to see if I got it set up correctly 🤝